(Morningstar) - Over time, most investments overcome inflation’s headwind. Stocks eventually prosper as businesses recoup their higher costs by increasing the prices that they charge their customers. The prices of tangible assets, such as real estate or gold, rise. Even bonds recover, as their yields adjust to the new reality.

The transition, however, tends to be painful. When inflation first appears, investment prices suffer. That precept has very much held during 2022. Entering this year, the Federal Reserve forecast that Personal Consumption Expenditures would grow by 2.6%. Oops! Through July, that index had advanced by an annualized rate of 6.4%. The Fed responded by hiking interest rates on four occasions, and portfolio values tumbled.

This column will assess which portfolio holdings have dodged inflation’s initial damage. I have divided the investment candidates into three groups: 1) tangible assets, 2) debt obligations, and 3) alternative strategies. Each category contains but a single winner. Every other contender has lost money, through August.

Tangible Assets

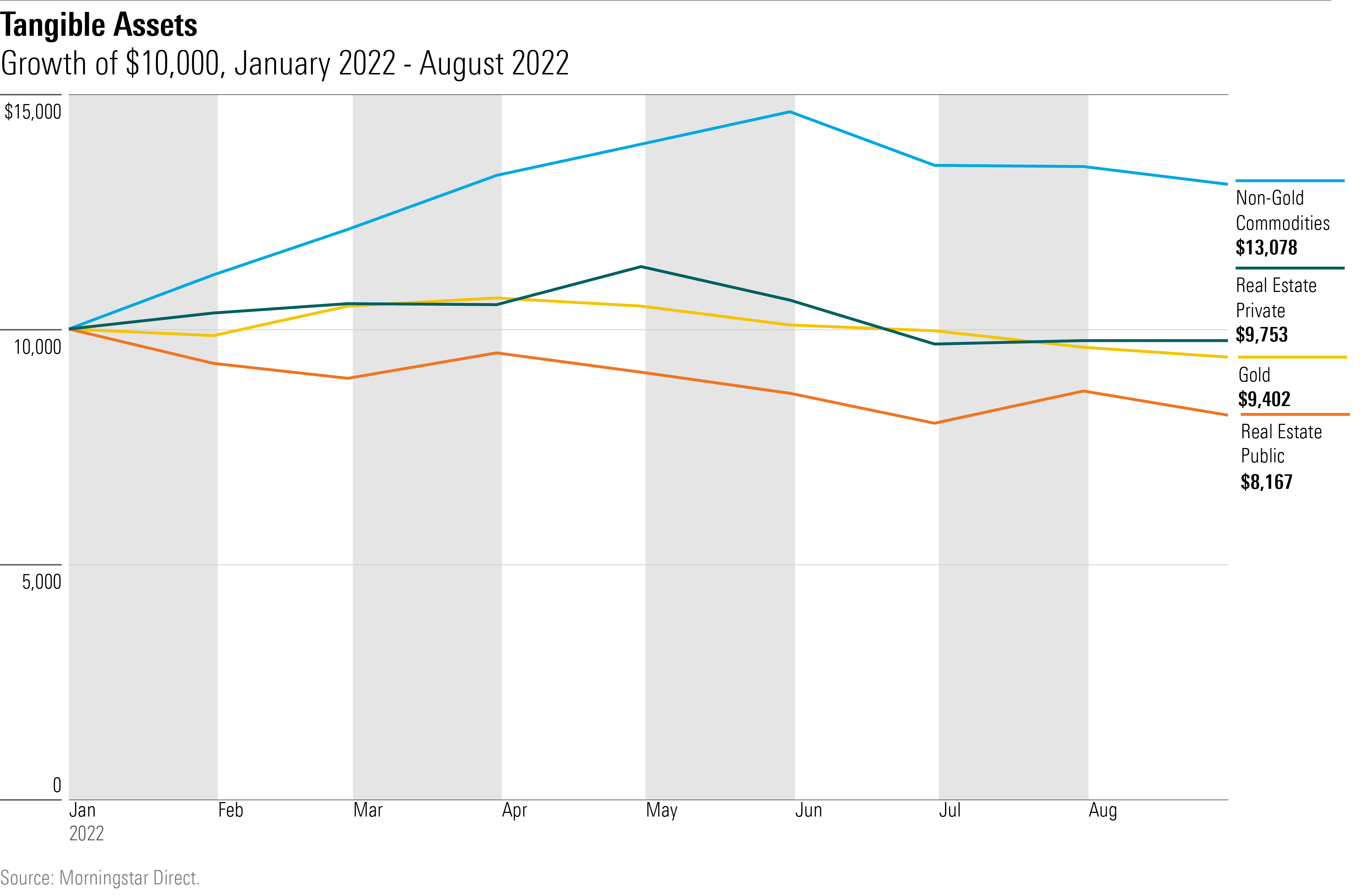

The tangible assets are: 1) gold, 2) nongold commodities, 3) privately held real estate, and 4) publicly traded real estate. (The appendix that concludes this article details the indexes that were used to measure each investment’s performance.) Their results appear below.

The growth of $10,000 from January 2022 through August 2022 for gold, nongold commodities, privately held real estate, and publicly traded real estate

Nongold commodities have soared, thanks to spiking energy prices. This surge owes partially to the chance occurrence of the Russia-Ukraine war and partially to the demand squeeze caused by economic growth. The latter should come as no surprise, as oil prices rose in 2007, 2010, and 2017, when global gross domestic product growth was also on the upswing. Whether energy protects against all forms of inflation is unclear, but it certainly hedges against inflation that comes from rising demand.

Gold does not. Although many have likened current economic conditions to those of the 1970s, citing the impending onset of stagflation, gold fails that comparison. When inflation exploded in 1973, exceeding the 6% barrier, gold had already rallied, doubling during the previous three years. In contrast, gold bullion has lost value this year and is down 15% from its August 2020 peak.

As with equities, real estate fends off inflation over the long term but not in the short run. Publicly traded real estate (meaning REITs) pretty much always loses, because it behaves more like a small-company stock than a distinct asset class. The value of privately held real estate, of course, is difficult to assess, but at least on this occasion, it also does not appear to have overcome inflation’s shock.

Interest Payments

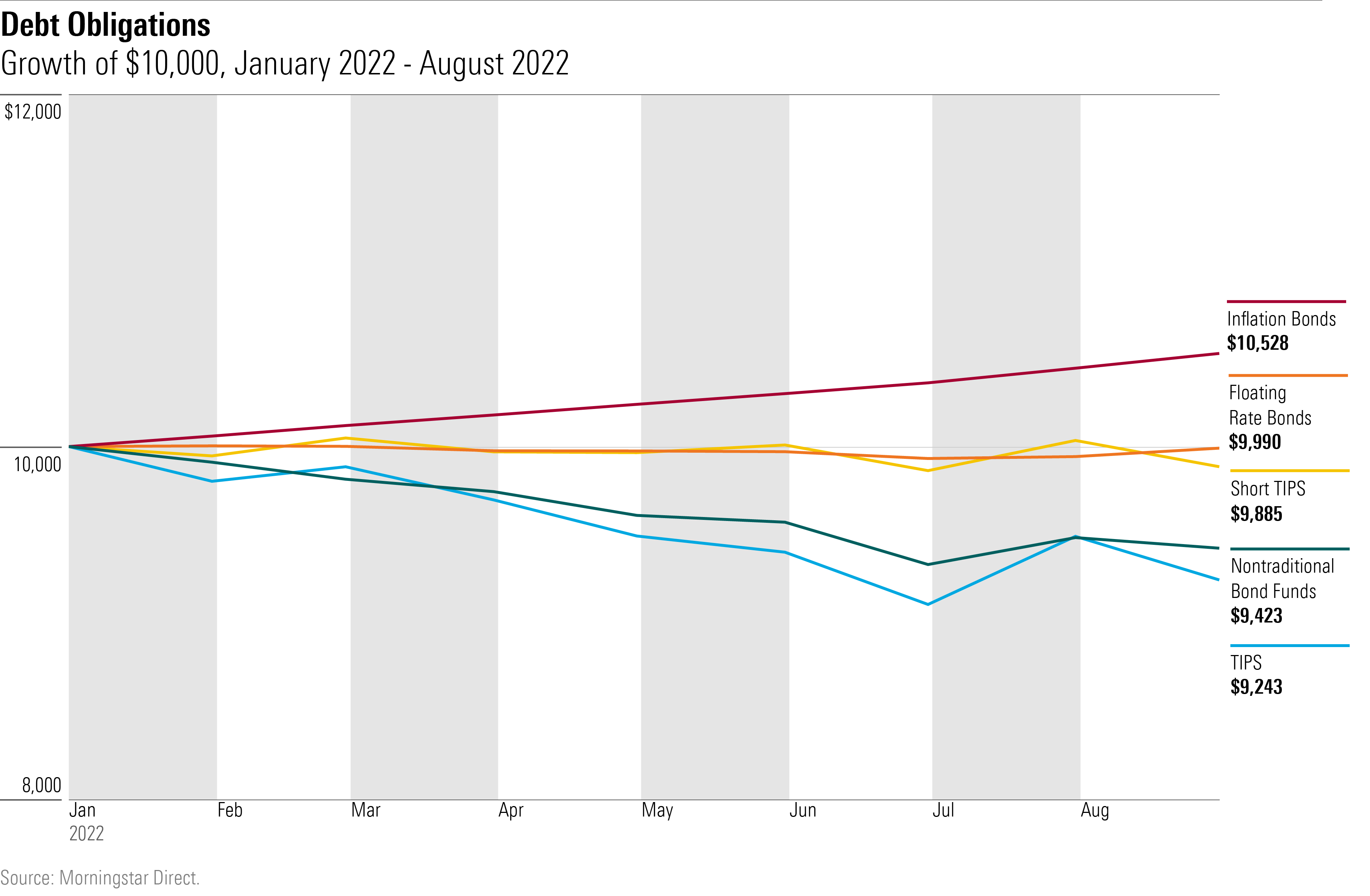

Next come debt obligations. (An awkward name, but I cannot call them "bonds" because some of these securities have short maturity dates, I cannot call them "notes" because some possess long dates, and I cannot use the generic term of "fixed-income investments," because most of their yields are variable.)

The growth of $10,000 from January 2022 through August 2022 for several varieties of US notes and bonds

In February, a reader sent me an email outlining his thoughts about which assets would guard against inflation. He was largely correct, as he pooh-poohed gold, cryptocurrencies (which have frequently been touted as inflation hedges and which have performed miserably so far this year), and long Treasury Inflation-Protected Securities, all of which have struggled. So, however, have shorter TIPS, which he did recommend.

In fact, the only debt obligation to profit through August has been Series I Savings Bonds, which by definition cannot lose money. True, floating-rate notes have almost landed in the black, and nontraditional bond funds have lost much less than their conventional rivals, but neither investment can truly be said to have been successful.

Which brings me to a hobbyhorse: cash as an inflation hedge. The asset is underrated. Over history, cash has not outgained inflation—but neither has it trailed. In aggregate, the interest payments on Treasury bills have matched inflation’s long-term growth. And when short-term inflation shocks arrive, as with this year, cash possesses the virtue (as with I Bonds) of not losing money. You could do a lot worse by owning other "inflation hedges."

Alternative Investments

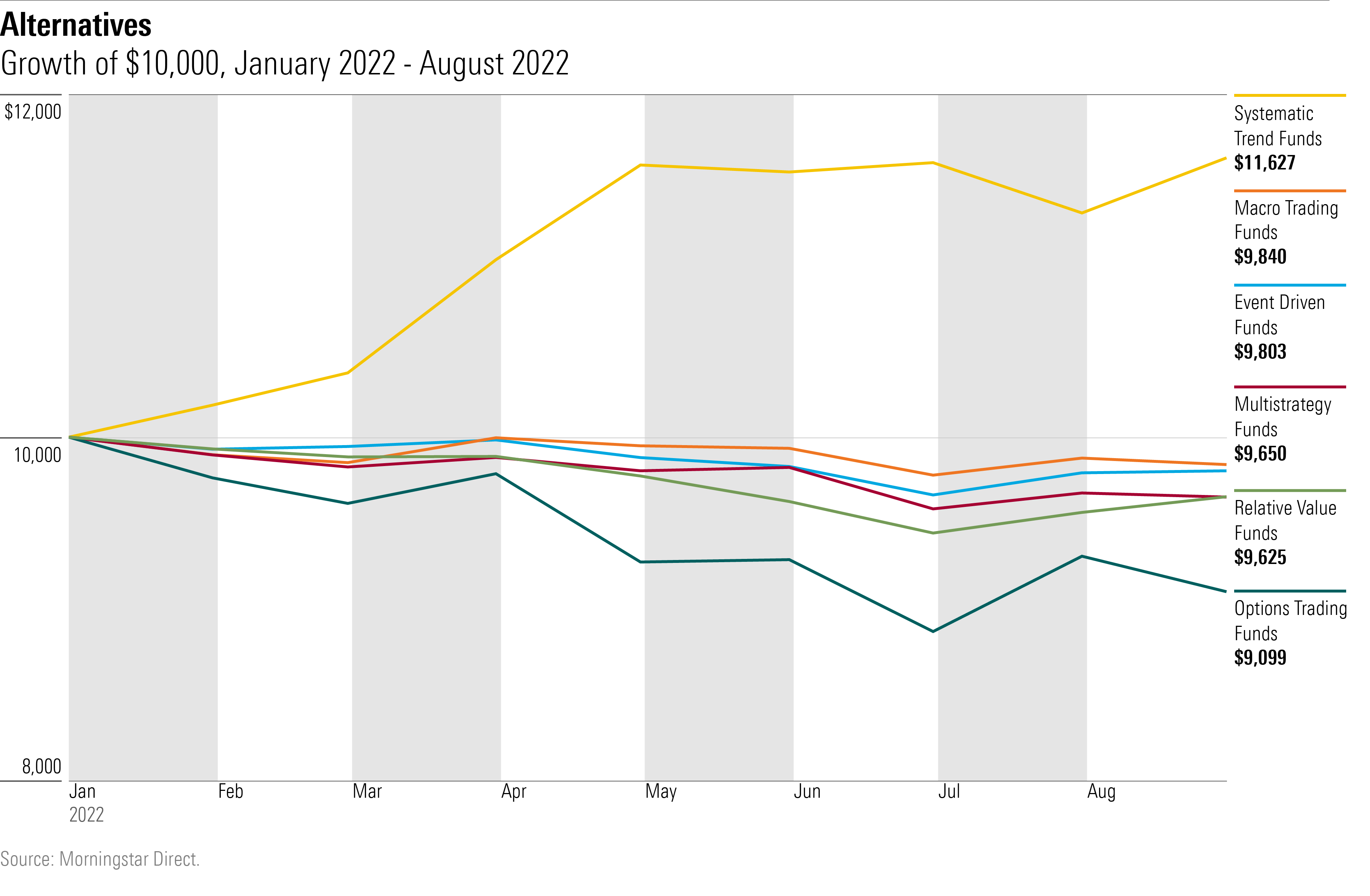

The final candidates consist of alternative investment strategies, which, in fairness to the truth, promise to diversify conventional portfolios, not specifically to protect against inflation. But of course, hedging against inflation is one form of diversification, so the test remains. One would hope that several alternative investment strategies have managed to turn a profit.

Hope in vain. Only systematic trend funds—a polyglot collection that consists mostly of managed-futures funds, which have participated in the commodities rally—have posted gains. The other alternative strategies have fared acceptably, avoiding the steep losses recorded by the major stock and bond market indexes. But as with all other potential inflation hedges, save for nongold commodities and I Bonds, such investments have nevertheless failed to deliver outright gains.

The growth of $10,000 from January 2022 through August 2022 for several categories of alternative investment funds

Wrapping Up

Investing for deflation is simple: Own long Treasury bonds. They inevitably profit from deflation. Not only do declining prices increase their real yields, but long Treasuries almost always supplement their distributions by recording capital gains. Moreover, their relative performances are stronger yet, because as long Treasuries prosper, the prices of rival investments (such as equities) tend to fall.

As this year’s results have demonstrated, preparing for inflation is another matter altogether. What succeeded before may not succeed again. I Bonds will always thrive. Nongold commodities will probably also be profitable, along with the related investment of systematic trend funds, but it is certainly possible that inflation could arrive without higher energy prices. (For example, aggregate global demand might increase labor costs, while accompanied by a temporary oil glut.) And all other potential inflation hedges, as we have seen, cannot be relied upon.

In short, losses from inflationary shocks seem to be inevitable. Barring a portfolio that holds a very high percentage of I Bonds—a strategy that would be both extreme and, for many investors, also impractical, given the purchase limitations that the US Treasury places on I Bonds—there is no such thing as an inflation-proof portfolio. Inflation-cushioned, to be sure, but not inflation-proofed.

Appendix

Here are the sources for the performances cited in this column:

Nongold commodities—iShares S&P GSCI Commodity-Indexed Trust (GSG)

Gold—SPDR Gold Shares (GLD)

Real estate: private—Winans Real Estate Index

Real estate: public—Morningstar Category average, U.S. real estate funds

I Bonds—Author’s calculation, based on U.S. Treasury data

Floating-rate bonds—iShares Floating Rate Bond ETF (FLOT)

Short TIPS—iShares 0-5 Year TIPS Bond ETF (STIP)

Nontraditional bond funds—Morningstar category average

TIPS—iShares TIPS Bond ETF (TIP)

Systematic trading funds—Morningstar Category average

Macro trading funds—Morningstar Category average

Event-driven funds—Morningstar Category average

Multistrategy funds—Morningstar Category average

Relative value funds—Morningstar Category average

Options-trading funds—Morningstar Category average

By John Rekenthaler

September 14, 2022