Investments in mutual funds and number of investors investing in mutual funds (MF) are increasing unabatedly in India. It is hoped that investors are informed enough to identify performing schemes.

Regulatory prescription requiring disclosure of reference point to measure performance (benchmark) is helpful in selecting schemes. Here we examine if a scheme would perform better if it receives continuous attention of the fund manager (actively managed) or when it just mimics the bench mark (passively managed).

In actively managed funds, the portfolio is reviewed and rebalanced frequently in an attempt to improve performance and make it at least equal to the benchmark. For example, if a ‘large cap fund’ is benchmarked against the ‘Nifty 50’, the returns is expected to be comparable/outperform Nifty 50 returns.

In passively managed funds, the fund manager does not exercise discretion but simply follows the portfolio composition of the benchmark. In a passively managed fund the role of the fund manager is only to replicate the portfolio of the benchmark.

The question of whether an investor should invest in an ‘actively managed fund’ or a ‘passively managed fund’ is the most divisive one in the mutual fund environment across the world.

Investors in the United States appear to support passively managed funds. Over the past couple of decades in the US, the assets under management (AUM) of passively managed mutual funds have surpassed the AUM’s of actively managed mutual funds. By August 2019, the AUM of passive funds had grown to $4.271 trillion, as against the $4.246 trillion of AUM for active funds. This shows that investors in the US have recognised the underperformance of actively managed funds vis-a-vis passively managed funds.

In India actively managed funds have been underperforming their respective benchmark (see table below). The average net AUM (March 2021) of mutual funds stands at Rs. 32,17,194.64 crore, out of which actively managed growth/equity oriented schemes constitute Rs 9,82,567.45 crore, whereas the AUM of index funds (passive funds) stands at a meagre Rs 17,912.41 crore (as on March 31, 2021).

In terms of numbers, there are 344 growth/equity oriented actively managed funds as against 44 index funds (passive funds). While Indian investors have had the opportunity to invest in index funds for over two decades, it appears that the underperformance of actively managed funds against passively managed funds has not caught the attention of investors. The AUM of index funds is a little less than 2 percent of actively managed funds.

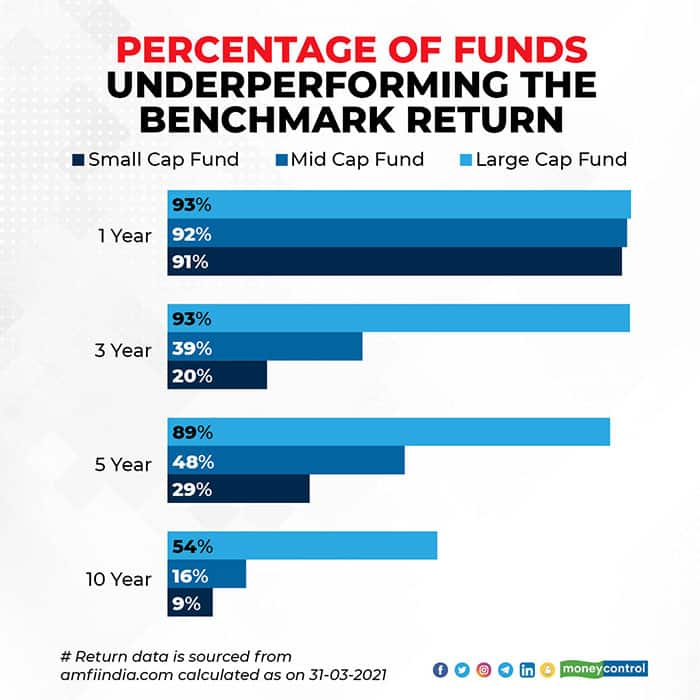

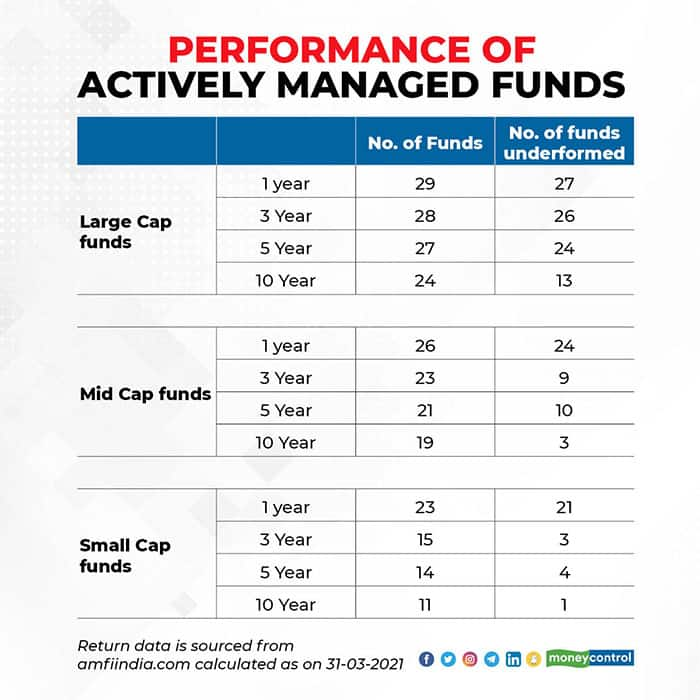

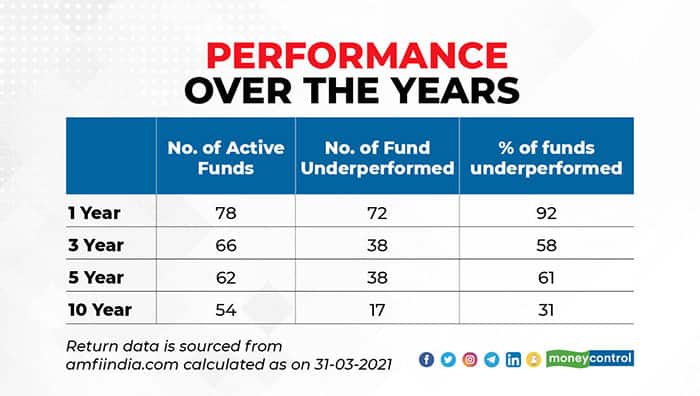

The graph and tables below show the vast majority of actively managed funds are underperforming the benchmarks.

As can be observed in the above table, active mutual funds across the three capitalisation categories have underperformed the benchmark returns. Out of 78 funds, 72 funds have underperformed the benchmark for a period of one year, that is a whopping 92 percent, and over a 10 year period 31 percent have underperformed (see table below).

As against the under-performance of actively managed funds, index funds (passive funds) would have generated a return close to the benchmark as that is what they are designed for.

Clearly, market sense reflected by index behaviour is better than fund manager sense when it comes to the question of rewarding investors. Therefore, investors need to check whether the fund selected for investing is performing in accordance with their expectations; else they are better off following the benchmarks by investing in index funds.

This article originally appeared on Money Control.