(Yahoo) As the coronavirus continues to spread, there is no question the U.S. economy is taking a major hit.

Economists at Goldman Sachs warn GDP will collapse at a 24% rate, a far cry from the “4, 5, and even 6%” growth scenario presented by President Trump just over two years ago.

“We are in a global recession,” Allianz’s Mohamed El-Erian said on Yahoo Finance’s On The Move. “We're in a global recession because of what economic sudden stops do.”

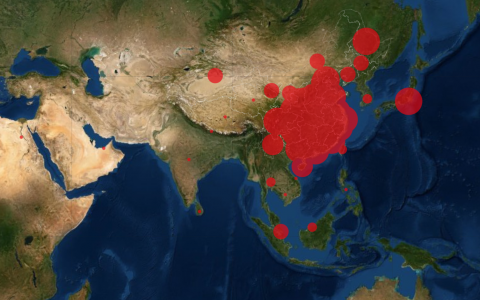

Economic contractions often happen gradually, not suddenly, giving policymakers and business leaders some time to adjust so that growth may resume. The coronavirus pandemic, however, has forced economic activity to grind to a halt (i.e. sudden stop) as social distancing has effectively shutdown the massive global discretionary services industry, while also disrupting the massive global manufactured goods supply chain.

“[Sudden stops] are normally experienced by fragile states or by a community hit by a natural disaster, where everything comes to a stop,” El-Erian added. “They've never been felt at a level of a country as systemically important as China or the U.S., or Europe. And they've certainly never been felt at the level of global economy. So this is unprecedented.”

Because of the unprecedented nature and scale of what the world is facing, economists have struggled to model how badly things are getting.

“There is no blueprint for the current shock, and uncertainty about the extent of contagion and the economic consequences is overwhelming,” Credit Suisse economist James Sweeney said.

Last Monday, however, Pantheon Macroeconomics’ Ian Shepherdson made a splash by taking a “guess.”

“We now guesstimate that second quarter GDP will drop at a 10% annualized rate, after a 2% fall in Q1,” Shepherdson said. “We are pencilling in a 20% plunge in discretionary consumers' spending in the second quarter, enough alone to subtract some eight percentage points from GDP growth.“

The calculus involved in making such forecasts is further complicated by the fact the policy response (both monetary and fiscal) continues to be a work in progress. And so the form, timing and ultimate impact of the response remains impossible to know. Though, most agree that the response will fuel a surge in activity once health officials tell us the coronavirus is under control.

Shepherdson’s note was followed by a slew of incredibly grim forecasts for the second quarter, coming from economists forced to use unconventional methods. Those economists were also encourage by the prospect of stimulus. All warned clients that every estimate came with a huge margin of error.

For a bank-by-bank review of the forecasts, head back to Yahoo Finance.