Albert Edwards, the provocative London-based strategist at French bank Société Générale, has been for decades predicting the U.S. and Western Europe would follow Japan into an era of deflation and ultralow bond yields, what he calls the “Ice Age.”

He has been pretty much on the mark about that, even if some of his warnings about the stock market have gone awry. But Edwards has accepted that if bond yields are low, growth stocks should do well.

“In the Ice Age, quality, growth and earnings certainty will be and should be, rerated to extreme highs. But woe betide any stock (or sector, as in 2001) that profit-warns, making the market realize it has been fooled, having wrongly valued it as a growth stock,” he says.

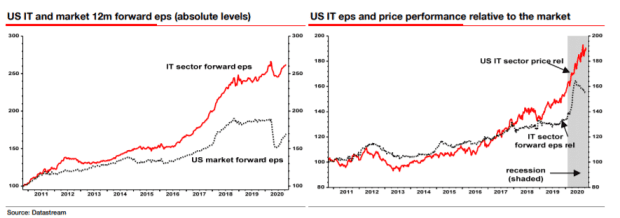

Edwards points out that for the U.S. information technology sector, its price relative to the market has continued to improve but earnings per share expectations relative to the market have started to deteriorate.

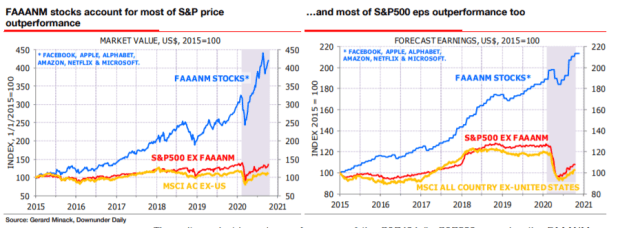

Forget antitrust or bond yield concerns — any hint, he says, of cyclicality could lead to a 2001-style valuation collapse. Including Microsoft to the traditional FAANG stocks of Facebook, Amazon, Apple, Netflix and Google owner Alphabet, he points out the rest of the S&P 500 has more or less performed in line with the rest of the world.

“The Ice Age thesis supports K-style valuation polarization within the equity market. Growth and quality stocks should be expensive relative to value and cyclicality. But if you have donned the Caesar-like valuation laurels that a growth stock wears, and then reveal yourself as a cyclical impostor when you are sitting at these nosebleed valuations, expect a Brutus-like denouement,” he says.

This article originally appeared on MarketWatch.