The path to financial independence is paved with income-producing assets.

And not just the kind you can buy on Robinhood.

“Most investors rarely venture past stocks and bonds when creating an investment portfolio. And I don’t blame them. These two asset classes are quite popular and are great candidates for building wealth,” Nick Maggiulli, COO for Ritholtz Wealth Management LLC, wrote.

But, of course, those are “just the tip of the investment iceberg,” and Maggiulli, in a post on his “Of Dollars and Data” blog, said that getting serious about growing wealth means casting a wider net.

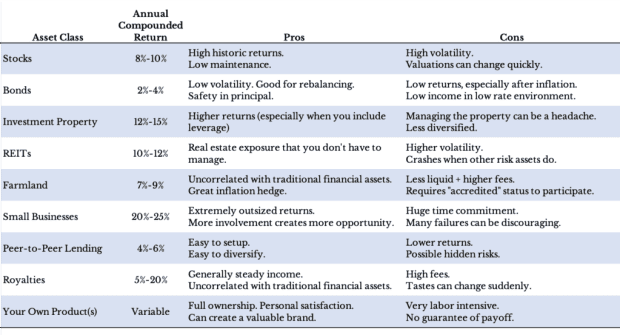

In that spirit, he came up with seven picks, in addition to stocks and bonds, for the best income-producing assets available to everyone. Here’s a summary of his list:

Some of those are easier to dip into than others, obviously. And as you can see, stocks – simple and historically strong performing – still top his list.

“If I had to pick one asset class to rule them all, stocks would definitely be it,” Maggiulli wrote in his post on Tuesday. ” Of course, is it possible that the 20th Century was a fluke and future equity returns are doomed? Yes, but I wouldn’t bet on it.”

In this climate, investing heavily in stocks is not for weak hands. He explained investors should expect the market to take a 50%+ hit a couple times per century, with 30% drops every few years.

Hence, dabbling in farmland, vacation properties and/or franchises can give offer investors some protection in a market that many expect will deliver wild swings in the coming months.

Check out Maggiulli’s detailed blueprint for more info on how to play these investments.

This article originally appeared on MarketWatch.