It’s a waiting game for investors early on Thursday.

The markets are patiently and somewhat nervously awaiting Federal Reserve Chairman Jerome Powell’s key speech at the Jackson Hole economic symposium later on Thursday. Powell is expected to suggest the central bank will adopt a new framework to allow inflation to run hotter than the present target after a period of missing that goal. U.S. stock futures pointed lower, implying a 100 point loss for the Dow Jones Industrial Average at the open. U.S. jobless claims data and second-quarter gross domestic product data will also catch the eye.

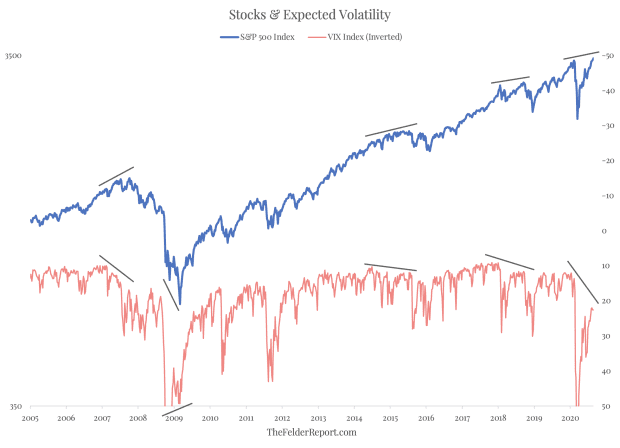

In our call of the day, Jesse Felder — author of the popular Felder Report financial blog — said the VIX index was “raising a red flag” for the stock market rally.

The former hedge-fund investor said that typically the stock market and expected volatility — indicated by the VIX index — should move in opposite directions. Any divergence from this, which Felder said has now appeared, can signal “an impending reversal.”

The 2007 stock market top and the 2009 market bottom were both identified by a divergence between the S&P 500 SPX, +1.02% index and the VIX, he said. “Since then we had several bearish non-confirmations that warned of significant corrections. Today, we have another bearish non-confirmation,” the Bear Stearns & Co alumnus said.

The 10-day correlation between the S&P 500 index and the VIX has risen into positive territory, which Felder said can serve as an effective short-term sell signal.

“Right now, this VIX warning signal is flashing again as it did earlier this year and prior to the corrections in the first and fourth quarter of 2018,” he said.

“In short, the options market is sending a message that volatility going forward is likely to be greater than the stock market currently implies. And history shows the options market is usually the only [that] wins this sort of argument,” he added.

This article originally appeared on MarketWatch.