(ZeroHedge.com) - Japan offers one of the best global inflation hedges, with its stock-market superbly placed to weather the worst of the increasingly entrenched price rises building around the world.

This week sees Kazuo Ueda’s first BOJ meeting as governor, the latest in a long line of chiefs of the central bank who have over the last three decades yearned to reanimate inflation. But Japan should be careful what it wishes for.

Prices there are now rising faster than they have done for decades, and there are increasing signs – as in many other countries – that the rises are becoming entrenched. The inflation kindling has been lit, and in Japan the ensuing bonfire risks becoming a conflagration.

This could prompt an epochal portfolio shift from bonds to equities in the domestic market. Currency-hedged positions in Japanese stocks are therefore starting to look hugely attractive to foreign investors looking to protect themselves from increasingly embedded inflation pressures in their home countries.

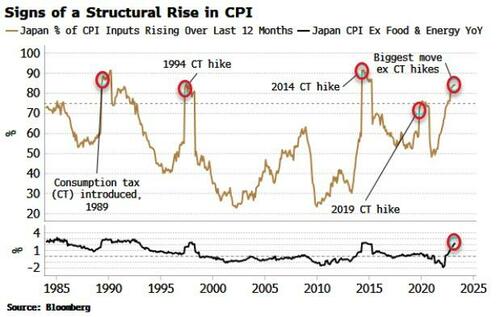

Japan has perennially struggled to get sustainable inflation of 2%. But it has faced the same unprecedented post-pandemic global supply-and-demand problems, leading to headline CPI hitting a near 40-year high of 3.2%. It has since fallen slightly, but as in the US, Europe and elsewhere, the stickiness shows that the problem is here to stay.

Structural inflation in Japan, i.e. that which is likely to prove more durable and harder to bring down, has only been higher in the past at times of hikes to the tax on consumption.

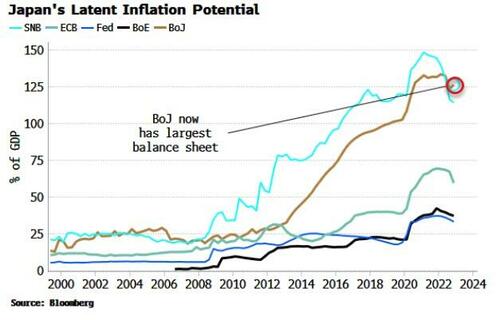

Japan’s low inflation over the last few decades masks the fact that, under the surface, it has been sailing very close to the inflationary wind. In Monetary Regimes and Inflation , the author Peter Bernholz, professor of economics at the University of Basel in Switzerland, showed that all of the major high and hyper-inflationary episodes of the 20th century were preceded by monetization of budget deficits beyond certain thresholds.

Japan came very close to these thresholds in the 2010s, but crucially, did not breach them. The country never saw huge central-bank monetization and significant government spending at the same time.

But in the wake of the pandemic, Japan is sticking to its monetary-easing path (with Ueda unlikely to tighten policy at this week’s BOJ meeting), while the government’s deficit is rising. A new willingness in a post-Covid world to use fiscal policy in concert with monetary policy raises the risk that Japan could tip over the edge into large-scale monetization of fiscal deficits, catalyzing considerably higher inflation.

To see the inflation potential we need only look at BOJ’s balance sheet, now the largest in the world in GDP terms.

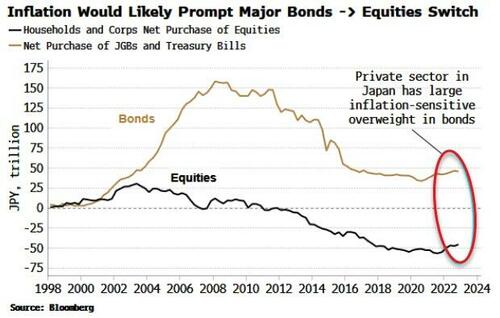

You might ask why should an investor gravitate toward where inflation could prove hugely problematic? The answer lies in the huge overweight in domestic bonds in the private sector, and the concomitant underweight in domestic equities.

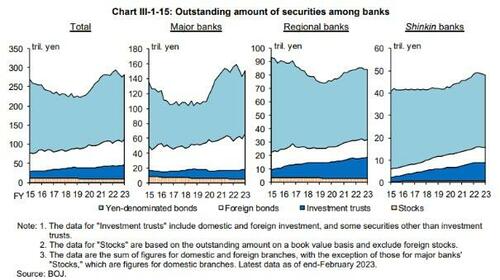

This is underlined in the holdings of Japanese banks, which are heavily exposed to yen-denominated bonds, with their ownership rising over the last few years (light-blue shading in chart below).

Source: BOJ

A rapid rise in inflation could be the trigger for a large shift out of bonds and into equities as investors perceive them to be a better inflation hedge.

The reality is more nuanced, but the perception would be enough to generate a self-fulfilling rise in stock prices.

Foreigners who invested in Japanese equities would thus own an asset which has the potential to outperform most developed-market bond and equity markets also battling inflation.

Hedging the currency is essential as the yen would weaken if inflation in Japan were to flare up.

Equities overall, however, are not necessarily the best inflation hedge. But we can do better.

Small-caps in the US proved their worth in the 1970s, with such stocks outperforming all other major sectors and factors, as well as bonds, commodities and gold, over the period 1972-1983.

Japanese small-caps are therefore a promising proposition to repeat this feat if inflation becomes a major domestic problem. The case becomes more compelling when you consider Japanese small-caps are cheaper on a valuation basis than large caps, and their small-cap versus large-cap price-to-book discount is bigger than in the US, Europe and the UK.

Moreover they are low duration, and they are very underowned, with almost three-quarters of Japanese small-caps covered by three or fewer analysts, according to Jefferies. That’s in contrast to the US and Europe where that proportion is only about half.

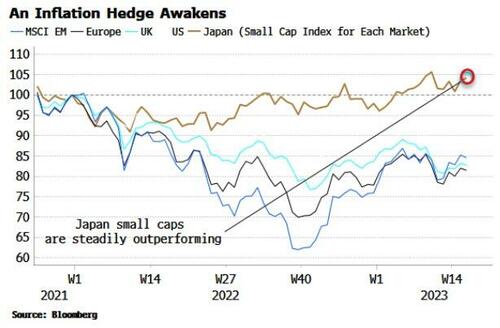

But the proof of the pudding is in the price. Perhaps in a sign of a growing longer-term trend reflecting a global investment environment going through profound change, Japanese small-caps have been steadily, and quietly, outperforming their peers.

By Tyler Durden

Authored by Simon White, Bloomberg macro strategist

April 27, 2023