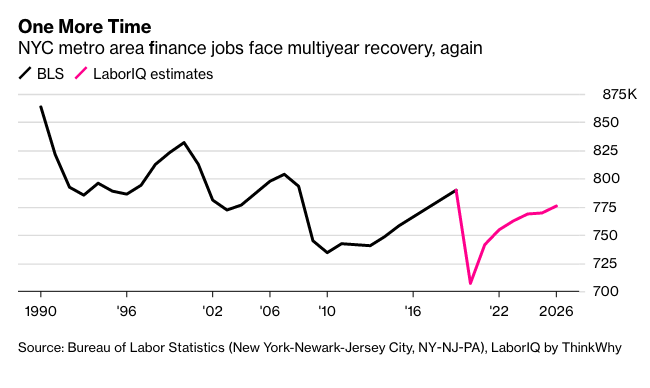

New York City’s finance industry won’t recover from the devastation wrought by Covid-19 until 2026, according to an analysis by software firm LaborIQ by ThinkWhy that ranks U.S. employment markets.

The NYC region lost about 8% of its finance jobs this year, down from its peak of more than 800,000 last August. Coronavirus, which has killed at least 21,000 New Yorkers so far, isn’t the culprit in all of those cuts. But the lockdown stemming from the illness caused a domino effect on everything from rents to mortgage payments.

The finance sector spans industries ranging from banking and securities to real estate and insurance. Most Wall Street firms pledged not to cut staff during the pandemic, but Bloomberg reported last month that Cantor Fitzgerald was planning to lay off hundreds of workers due to the virus.

LaborIQ, based in Dallas, Texas, uses 10 key economic indicators to rank U.S. employment markets -- including job and wage growth, demographics and educational attainment. New York ranks No. 1 in population but doesn’t fare as well in other metrics such as wage increases (No. 47) and job growth (No. 143).

New York was rated the world’s leading financial market by the Global Financial Centres Index by Z/Yen Partners in collaboration with the China Development Institute and according to a survey from Duff & Phelps.

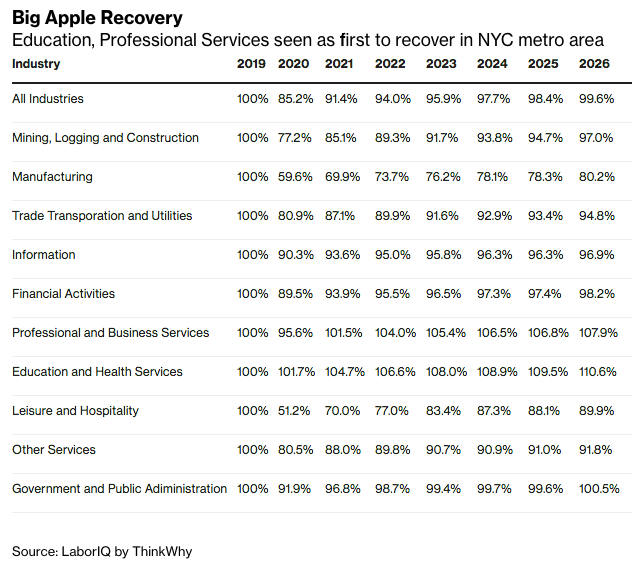

The city that never sleeps has shown its resiliency multiple times in the last 20 years, including from the Great Recession. LaborIQ predicts that the employment level will be almost back to 2019 levels in six years.

Most industries will take years to recoup. Employment in the leisure and hospitality arena, for instance, is expected to reach only about 90% of its 2019 level by 2026, the latest year in the forecast.

This article originally appeared on Bloomberg.