(Forbes) With the first jobs release of 2020 being published tomorrow, investors will be paying more attention than usual. Last October, Claudia Sahm, a former Federal Reserve economist, developed a new, and remarkably simple, measure of recession risk based on the unemployment rate.

Until now, one of the most enduring recession indicators was the slope of the yield curve. When the spread between the 3-month and 10-year rate turns negative, or inverts (as it did last year) recessions typically follow within 5-17 months. While helpful, it is not that precise. In a previous article, we recommended combining this yield curve indicators with two others. When all three flash red, a recession typically arrives within six months.

It’s understandable that investors try to anticipate recessions. History shows that recessions and bear markets are typically linked. But to succeed, investors need to get two calls right: they need to time the initial market exit well, and subsequently get the reentry point right.

Can Sahm’s new rule not only help identify recessions, but give investors an edge in making these two calls? We’ve simulated what this might look like.

An Early Recession Alert

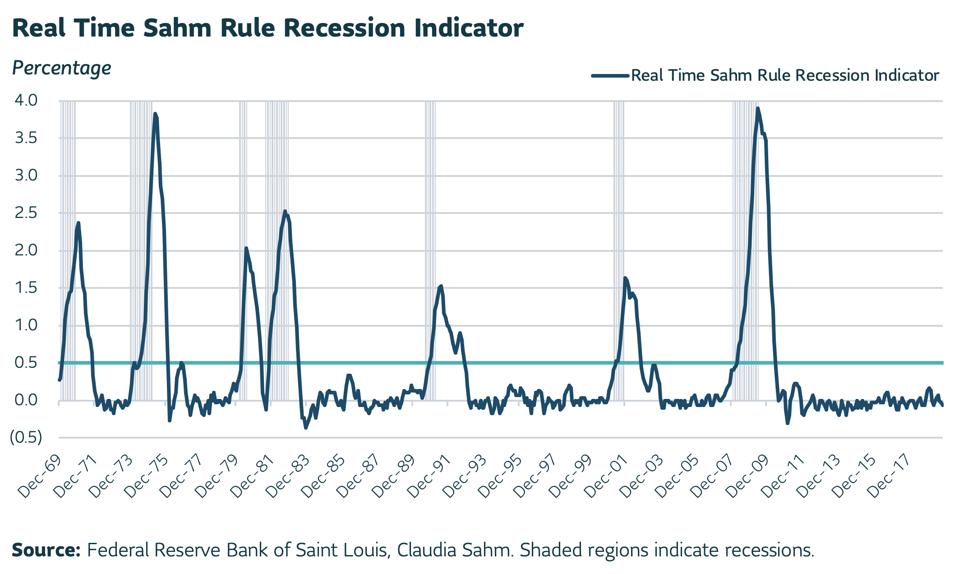

Sahm discovered that if the unemployment rate’s three-month moving average exceeded the minimum from the last 12 months by at least 0.5%, then a recession was in play.

This Sahm Rule Recession Indicator (SRRI) has an impressive track record. It detected each of the last seven recessions approximately three months after they started. That’s a significant improvement over traditional measures.

For example, the official arbiter of recessions is the National Bureau of Economic Research (NBER), which has needed anywhere between six and 21 months to determine previous recessions. Another rule of thumb is to declare a recession after six months of negative growth.

Could This Measure Help Improve Investment Performance?

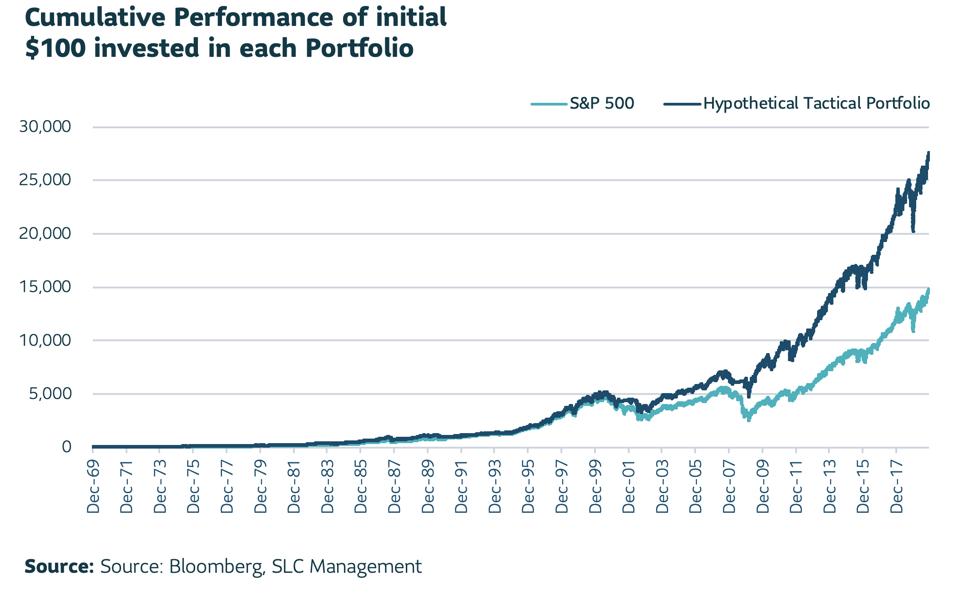

To test whether the SRRI could give investors a leg-up on a recession, we constructed a portfolio that tactically shifts between cash and equities (S&P 500 index) by relying on SRRI signals.

A strategy of lightening up on equities and hiding out in cash as a recession takes hold should improve performance. But that’s only the first leg of the trade. Investors also need to gauge when best to switch back from cash to equities. As the recession fades and growth perks up, beaten up equities should recover.

Constructing the tactical portfolio was relatively straightforward. It was driven by three simple rules:

- The default portfolio position is to be 100% invested in equities

- When the SRRI hits 0.5% or above, assume a recession in underway. Sell all equities and switch to cash

- When the SRRI hits 2.0 or above, or has peaked at a lower level, assume a recovery is underway. Switch from cash to all equities

Over the last 50 years, the tactical portfolio delivered a performance edge over an all equity (S&P 500) portfolio. It exceeded the annual return on the S&P 500 by 1.4%.

Over this period there were seven recessions. The tactical portfolio performed well during five but lagged during the 1980 and 1990-91 recessions. In both those episodes, unemployment remained high even as the respective recessions abated.

For example, the 1980 recession was short. While the tactical portfolio switched to cash in the second half of the year as unemployment rose, equities remained resilient.

Meanwhile, the 1990-91 recession was dubbed the jobless recovery. Again, the tactical portfolio was in cash for most of the recession, as unemployment continued to rise, yet equities had a strong run.

SLC MANAGEMENT

SLC MANAGEMENT

Overall, the SRRI has been effective at signaling recession starts. And efforts to interpret it as an investment timing tool shows promise as recessions, rising unemployment and equity bear markets tend to be correlated.

Where the tactical positioning does poorly, equity markets remain resilient even as growth and unemployment struggle. Nevertheless, the SRRI, with some simple tactical positioning rules, has shown an edge over a longer period. More research is needed, but the results so far are encouraging.

Government Taking Action

The effectiveness of SRRI in predicting recessions has also intrigued some policymakers, as they search for more timely indicators to avert some of the more serious fallout from recessions.

Using her SRRI measure, Sahm recommends that when it hits 0.5%, the government should spend around 0.7% of GDP on direct lump sum payments to individuals, regardless of income level. Subsequent annual payments should only be made if there is a deep recession where the cumulative unemployment rate increases by at least 2%.

Sahm and co-authors found that early lump sum payments to individuals were more effective than doling out the same benefits in installments. During the 2001 and 2008 downturns, consumer spending on durables jumped after checks arrived. Having a mechanism to execute payments as early as possible should amplify these effects.

She concludes that an immediate and vigorous response like this would help limit economic damage. Having a reliable quantitative measure for invoking this support should make it easier to get congressional approval in advance, and therefore act quickly when the downturn arrives.

In the future, this may create a more stable investment environment, where recessions are mitigated by swift and effective government policy to stymie the economic losses.