By now you’ve all heard the news. Joe Biden, the Democrats’ presumptive nominee for president, has selected as his running mate Kamala Harris, junior senator from California and the state’s former attorney general.

If elected, she would be not only the first woman vice president in U.S. history but also the first Black American and first Indian American.

Biden’s announcement is as good an occasion as any for investors to start thinking about the upcoming election, less than three months away. Although Biden’s proposals aren’t nearly as radical as, say, Bernie Sanders’ or Elizabeth Warren’s, his administration could very well bring about significant policy changes that may impact your investments—especially if the Democrats maintain the House and take control of the Senate.

But first, what are markets telling us about the election? As legendary value investor Benjamin Graham once said, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

Pay Attention to the Three Months Before the Election

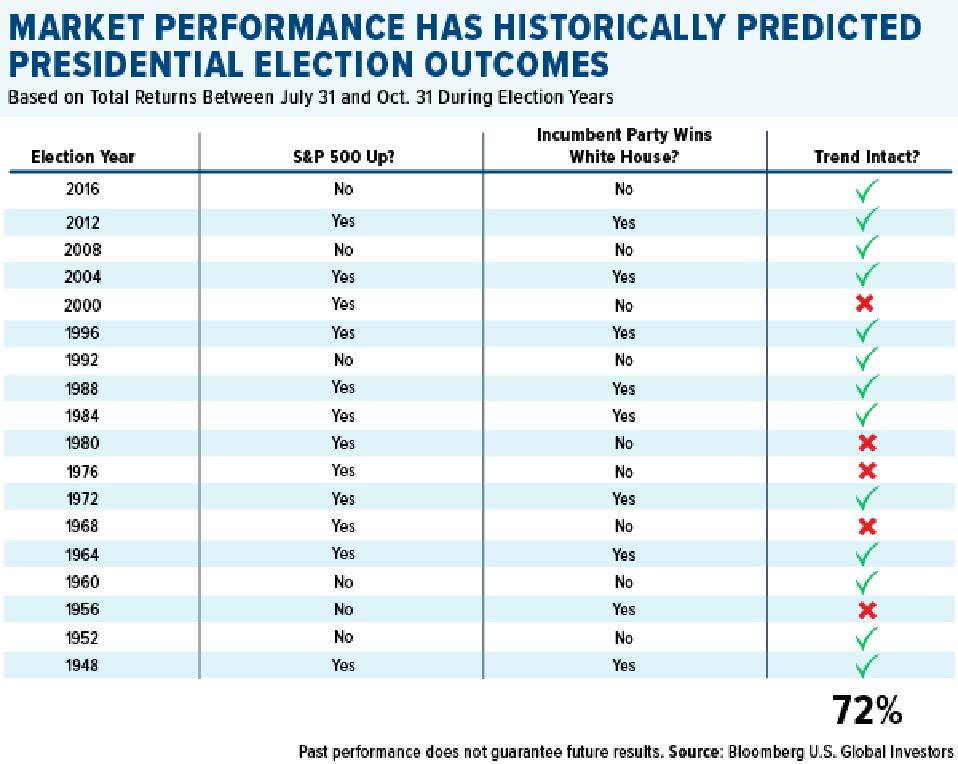

The three months preceding the election are a crucial time. According to the presidential election cycle theory, when the market rose from July 31 to October 31, the incumbent party has tended to win the presidency. And when the market slumped, it’s the challenging party that’s been victorious.

Look at the 2016 election as an example. Polls strongly favored Hillary Clinton, the incumbent party’s nominee, but Mr. Market had other ideas. The S&P 500 fell 1.7 percent in the three months leading up to Election Day, and the challenging party’s nominee, Donald Trump, won the White House.

Since World War II, this trend has had a 72 percent win rate. Put another way, investors have accurately “voted” for the winning candidate roughly three out of every four times. And if we exclude the 2000 election, the win rate increases to 78 percent, or one-in-five.

Why 2000? For one, even though I label the S&P as being up for the three-month period, it was in reality essentially flat at 0.18 percent. And two, the election was highly contentious, as you no doubt remember well, with George W. Bush losing the popular vote and winning the Electoral College vote with one of the slimmest margins in U.S. history (and only after the Supreme Court ruled that Florida must end its recount).

So how is Trump’s reelection bid looking so far, according to Mr. Market? As of August 12, the market was up more than 3 percent since July 31, close to its all-time high. It will be interesting to see if the trend remains intact.

Government Policy Is a Precursor to Change

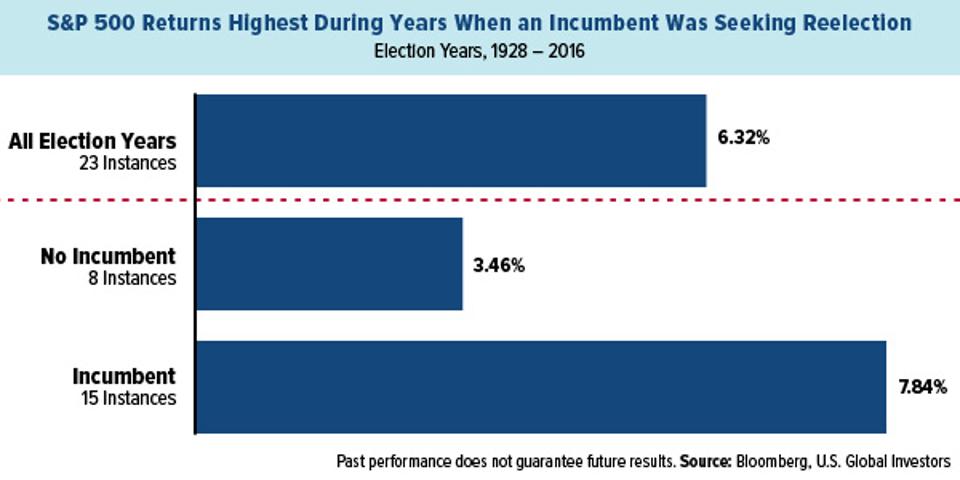

During election years, the market has historically done well, returning an average 6.23 percent, using data going back to 1928.

I’d like to break it down even further and look at how well the market performed depending on whether the incumbent president was running for a second term, or whether a new president would need to be elected. (To avoid confusion, I’m using “incumbent” here to describe the sitting president, not the party in power.)

As you can see, the S&P performed better in the years when an incumbent was seeking reelection, compared to the years when the next president would be someone completely different. Incumbent years ended with an average return of 7.84 percent, while non-incumbent years rose by less than half that on average.

This probably shouldn’t come as a surprise. When a president is seeking a second term, he is more likely to enact policies intended to boost economic growth, create jobs and drive the stock market. Consider President Trump’s most recent memorandums and executive orders, signed this past weekend. All of them are designed to assist households that have been economically impacted by the coronavirus, whether it’s extending weekly relief checks or minimizing evictions and foreclosures.

Where to Invest in a Biden Presidency

So what happens if the Biden-Harris ticket comes out on top? How should investors prepare?

As I’ve said many times before, we’re agnostic when it comes to party. It’s the policies that matter, and we believe there are always ways to make money, no matter which party controls the White House. A Biden presidency, working with a Democratically controlled Congress, could be good news for a number of industries, including renewable energy, mass transit and health care stocks.

Then again, a Trump presidency was supposed to favor fossil fuels, and yet energy has been the worst performing sector since his inauguration. The pandemic is not all to blame. Between January 2017 and January 2020, the S&P 500 Energy Index lost 26 percent, the only sector unable to deliver a positive gain.

It’s reasonable to expect, though, that taxes could rise and regulations could become more severe with a President Biden in the Oval Office. He supports lifting corporate profits to 28 percent from the current 21 percent, and doubling the capital-gains tax to an eyebrow-raising 39.6 percent from 20 percent on income of more than $1 million a year. One strategy many wealthy investors may have is to sell their shares now and pay the current rate instead of selling later and paying nearly 40 percent.

This article originally appeared on Forbes.