The coronavirus pandemic is already being predicted to be responsible for 20 million US job losses and, with trillions wiped off global stocks resulting in more than 35 percent market declines, it is getting hard to stay positive.

But remember: everything comes in cycles, and when things get tough and the beacons of hope seem few and far between, there are always a few great leaders out there we can trust, and they don’t get much better than Warren Buffett.

Mr. Buffett, who is 90 in August, has seen more than the majority of investors, and that’s why The Edge (who source under-performing companies for activist involvement, Special Situations and Spinoffs) believes investors should take a leaf out of Warren’s playbook: keep calm and find value from the wreckage.

Mr. Buffett has survived World War II, 9/11, bear markets in the 1970s, 1980s and 1990s, the dot com bubble, and the 2008 crash, and is not worth $70.5 billion by accident.

The Edge has chosen three great stocks the firm believes Mr. Buffett is considering as they are set to see a turnaround of at least 50% after the crisis is over.

All of these stocks are solid businesses with good management, little-to-no debt, and strong free cash flow, and their stock prices became casualties for no good reason. They are likely to outperform the S&P 500 Index following this current economic sell-off.

P

P

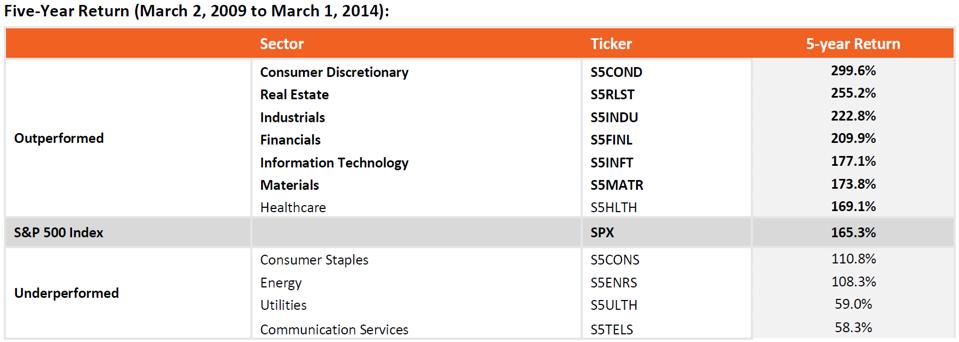

The 2008 crisis primarily affected the financial and the real estate sectors, and as shown above these sectors had the biggest rebound and consistently outperformed for the following five years post-crisis.

However, the Consumer Discretionary sector was the most resilient and provided the most long-term returns (as shown below), so that’s where The Edge began to look for opportunities as the global 2020 COVID-19 crisis continues.

Marriott International, Inc. (MAR)

Opportunity to Capitalize on Asset-Light Business Transformation

- Down ~60% YTD Vs. S&P 500 Index return of ~-26%

- Down ~50% in the last year Vs. S&P 500 Index return of ~-15%

Hotelier Marriott International, Inc. (MAR) has 53% of its rooms in either luxury or upper-upscale hotels, with high-end exposure exceeding that of Hilton Worldwide Holdings, Inc. (HLT) at 35% and Hyatt Hotels Corp. (H) at 23%.

This one was flying before the crisis and had transitioned itself to an asset-light model. Now investors are panicking with the belief that people are never going to go into a hotel again. The stock went from $151 down to $85 in one shot in a significant pullback.

Marriott has 5x more luxury hotels under development than HLT and has more high-end rooms under construction than HLT and H combined. This luxury and upper-upscale position works in MAR’s favor as this segment enjoys limited competition and is not exposed to online accommodation aggregators like AirBnB, which has a larger economy position competing against Wyndham Hotels & Resorts, Inc. (WH) and Choice Hotels International, Inc. (CHH).

Additionally, MAR is transforming itself into an asset-light business as fee-generating managed and franchised hotels account for a growing proportion of its revenue. In FY19, base management and franchise fees made up 59% of MAR’s adjusted revenue transition to an asset-light business, which is similar to rival Intercontinental Hotels Group (IHG). While saving profitability, MAR has undertaken such steps by reducing administrative costs by 15%, slashing executive compensation and shedding staff, in response to an expected FY20E lower than expected occupancy levels.

Although luxury hotels are vulnerable to an economic downturn, The Edge believes there is a value opportunity in the anticipation of expanding global wealth as seen following the 2008 crisis.

MAR also has prior experience with creating significant value for shareholders in Spinoffs, as it separated Marriott Vacations Worldwide Corp. (VAC) on November 22, 2011. From the Spinoff date to March 20, MAR returned +160% and VAC returned +189%, compared to the S&P 500 Index’s return of +94%.

With the prior recovery starting in March 2009, MAR saw a +326% return in the following five years compared to its peers H’s +100% return, IHG’s +224% return and the S&P 500 Index’s +142% return, indicating MAR may prove to be the key beneficiary of an improving economic outlook once again.

VF Corp. (VFC)

- High Margin, High Growth, Brand Value Play

- Down ~43% YTD Vs. S&P 500 Index return of ~ -26%

- Down ~33% in the last year Vs. S&P 500 Index return of ~-15%

VF Corp (VFC) is an apparel and footwear company that owns brands like The North Face, Timberland, Vans, Kipling, JanSport, Dickies, and Kodiak. This is another company that got hammered for no particular reason. It's a very, very good high- margin, high-growth stock with very valuable brands.

VFC is an apparel and footwear company with three segments: (i) Outdoor (brands like The North Face, Timberland, Altra, etc., FY18 revenue of $4.3bn) (ii) Active (brands like Vans, Kipling, JanSport, etc., FY18 revenue of $4.9bn) and (iii) Work (brands like Dickies, The Red Kap, Kodiak, etc., FY18 revenues of $1.8bn). Out of the three segments, the Outdoor and Active segments are the growth drivers, with an expected overall revenue growth of 5.1% in FY21E and 7.8% in FY22E. VFC also offers the highest EBITDA margin profile at 17% in FY21E compared to its peer average of 14.4% (Adidas: 14.7%, Nike: 15.4%, Puma: 11.4% and Columbia Sportswear: 16%). Despite having a higher growth and a higher margin profile, VFC is trading at a 10% discount at 11.5x compared to the peer average of 12.8x.

On March 16, 2020, VFC provided a COVID-19 update where the company said there was a limited impact on its supply chain. Also, the company has re-opened nearly 90% of their retail stores in Greater China as the situation steadily improves there. However, VFC’s North American and European stores have and will remain closed for now. Based on this acknowledgement and concluding that VFC’s digital sales are likely to continue its growth path, The Edge understands the COVID-19 impact is a “one-time” issue for VFC.

VFC has its flagship footwear brand Vans, which is comparable to Nike, Adidas and Puma and has a larger appeal in North America. Also, in the near-term, VFC’s $8bn ($4.5bn remaining) share buyback (1% return) and dividend (yield 3.3%) payment plan through 2021 remains a medium-term positive. After 20 years of holding a position in VFC since 1998, PNC Financial Services Group, Inc. (based out of Pittsburgh) continues to hold the largest institutional position to date. This also makes VFC PNC's second largest position in its portfolio of over 5,700 stocks, above names like AAPL, MSFT, JNJ and JPM.

Even with a higher growth, higher margin profile, VFC is trading at a 10% discount to peers due to its Work segment (revenue contribution of 16.4%). Therefore, The Edge believes VFC should sell or Spinoff its Work segment. Having already completing the Spinoff of Kontoor Brands (KTB) 10 months ago on May 23, 2019, the management may need to wait another 14 months to keep the KTB Spin as a tax-free transaction.

LafargeHolcim Ltd (LHN SW)

- Down ~44% YTD Vs. Euronext NV Index return of ~-19%

- Down ~40% in the last year Vs. Euronext NV Index return of ~+9%

LafargeHolcim Ltd (LHN SW) is a materials company with huge reach including cement, aggregates and concrete. There's good management, and it’s been consolidating its business and divesting non-core segments.

LHN enjoys a top-three position in 80% of its markets, with an asset base in more than 80 countries. It has four segments: (i) Cement (60% of FY19 net sales), (ii) Aggregates (14%), (iii) Ready-Mix Concrete (18%), and (iv) Solutions & Products (8%). Geographically, Europe is the largest net sales contributor (30% of 2019 net sales), followed by Asia Pacific (25%), North America (24%), Middle East Africa (11%), and Latin America (10%). With its peers HeidelbergCement AG (HEI GY), Compagnie de Saint Gobain SA (SGO FP) and CRH Plc (CRH LN) share prices plummeting in-line with LHN, The Edge thinks this provides an opportune time to capitalize on its size and diversified operations LHN has inherited as a result of the merger of Lafarge and Holcim in 2015 followed by bolt-on acquisitions.

Under its Strategic Plan 2022, LHN aims to grow net sales by 3%-5% and core EBITDA by at least 5% annually. The Edge expects this strategy will focus on selective markets and simplifying the business (divestments of the Indonesia and Malaysia businesses in FY19) to drive sales, which has started to bear fruit, evident by record cash flow of >CHF3bn, an increase of 79% Y-o-Y. Additionally, cost saving efforts can provide some cushion to increase EBITDA margins, apparent by CHF400m cost saved in FY19 and expected to continue until FY22E. LHN’s share price has been under pressure due to rising debt, which no longer seems to be a concern as the company succeeded in reducing its debt by CHF5bn, translating into a new financial strength level with net debt-to-EBITDA multiple of 1.5x compared to 2.2x in FY18.

The Edge also believes the recent COVID-19 outbreak presents near-term uncertainty, though by diversifying its footprint across the globe inorganically by means of acquisitions (8 new acquisitions in FY19 in Australia, Europe and North America), LHN will experience minimal impact from the virus’ spread. Additionally, with its financial health improving and global market under pressure, The Edge believes LHN will further consolidate its business by divesting low-growth non-core businesses and acquiring growth businesses in other countries, making for a mid-term re-rating catalyst.

This article originally appeared on Forbes.