(Seeking Alpha) 2019 began as one of the best years for IPO's. Chewy and Beyond Meat have an incredible performance on or just after their IPO earlier this year while recent IPO's have been complete flops. Quite frankly, I think the problem is simple. Many extremely overvalued and poorly run unicorn companies that were able to find overexuberant (i.e Vision Fund-type) investors in the private market are forced to face a harsher (and more reasonable) reality in public markets.

As a whole, major recent IPO's have been negative cash flow yielding and very highly valued companies from a price-to-sales perspective. Even more, quite a few come saddled with debt and don't even have the revenue growth to back up their valuation (UBER).

There is an ETF full of recent IPO's that could be a good thematic target. The ETF is aptly named (IPO) and is run by the IPO investment advisory firm Renaissance Capital. One could short the fund (though the availability of shares is not stellar right now). Or, they could use it simply to gauge the IPO market. If the cost of shorting the fund falls (currently 6%), it could be a great opportunity.

While the fund has generally been a strong performer in a rising stock market, it is starting to underperform and experience higher volatility. Quite frankly, it may be one of the best risk-reward short equity bets on the market today.

The Renaissance Capital IPO Fund

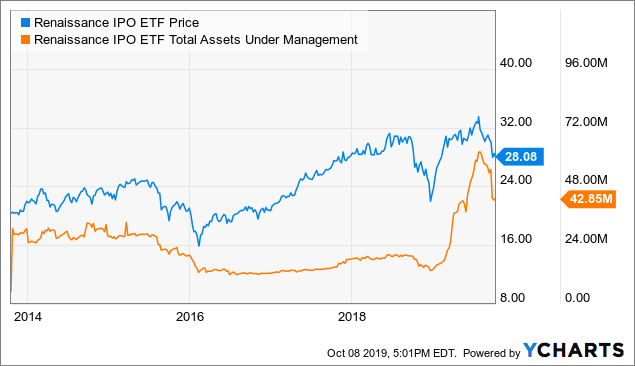

Before I dig into my short-thesis on the fund, let's go over the basics. The fund invests in large IPO's promptly after its launch and holds them for the following two years. The fund has been trading since 2013 and has delivered subpar risk-adjusted returns since then. Although it has seen tremendous inflows this year, it does have some closure risk as the ETF only has $42M in AUM. Take a look at the fund's performance vs. AUM since inception:

Data by YCharts

Data by YChartsAs you can see, the fund tends to rise more than the market in a bull market (i.e 2017) and fall much more than the market during a correction (i.e 2016 and 2018).

Importantly, the fund saw a huge increase in inflows this year. This may be due to the increasing interest in IPO's. It may also be due to simple trend-following algorithms that bought due to its strong performance early this year.

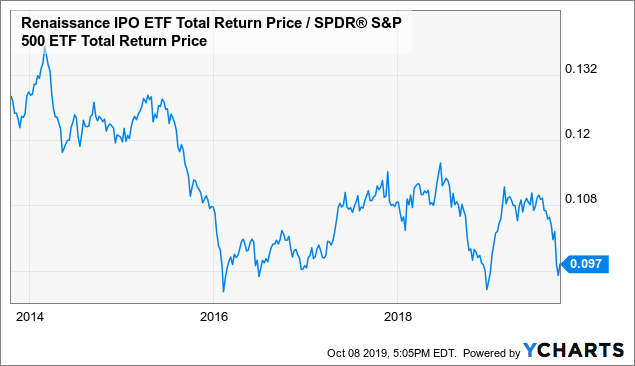

To get a better idea of its performance, take a look at the total return price of the fund (which includes dividends) divided by that of the S&P 500 ETF (SPY).

While this may seem strange, this lets us see precisely how much the fund is out or underperforming the general market. If you had a long IPO short SPY pairs trade, the total return ratio tells you exactly how you would have performed had you rebalance daily (i.e a 10% drop indicates SPY outperformed IPO by 10%):

Data by YCharts

Data by YChartsAs you can see, the ETF has generally underperformed the S&P 500 despite its higher volatility. In 2015, when the global economy was nearly in a recession, it underperformed by a staggering 25%. Similar results were seen in 2018 and over the past few months. I suspect that, if this ratio breaks below the 0.09-0.10 range, it may have much further to fall.

To try to gauge "how far" better, let's take a look at the fund's fundamentals.

Not Enough Growth For Valuation

Of course, it is much more difficult to financially value recent IPO's and high growth companies in general. They typically have negative, so earnings-based valuations are largely useless. That said, when you aggregate the data of many recent IPO's, the results are much more clear.

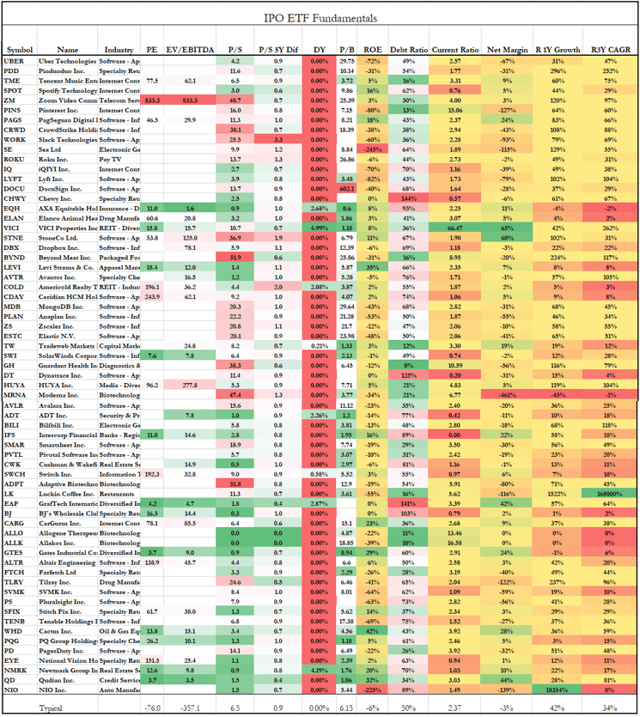

Here is a table of the select fundamental statistics for all of the ETF's holdings:

(Data Source - Unclestock)

As you can see, the vast majority of companies do not make a profit. In fact, only a third of the companies in the ETF make a profit margin above 3% (a level of stability).

While that may be ok, these companies have a very high median debt ratio at 50% for companies with negative cash flow. While the 35-45% typical revenue growth levels are strong, these companies may get trapped by their creditor obligations if they cannot maintain such a growth rate. Even more, they trade at such a high median price to sales ratio of 6.5X that they are likely significantly overvalued.

For example, say these companies generate a net margin of 5% if they cut growth spending. They would still have a harmonic mean "P/E" ratio of 130X. Even if they managed to double their revenue and maintain such a margin, they would have a typical "P/E" valuation of 65X which is still far above the market historical average of 15X.

Given that 5% margin expectation (which is typical for most companies) these stocks would need to grow revenue 866% to get to a fair low-growth PE of 15X. If you assume a higher 10% margin, that figure is still 433%. Quite frankly, I don't see the revenue of most of these companies growing over 2-3X. Not everyone can be a Facebook (FB).

Given a high long-run revenue growth expectation of 250%, the stocks would have a typical "P/E" of 37X with a fair 7% profit margin. This makes the typical company in the ETF currently overvalued by 60% (given a long-run post-growth "P/E" of 15X). Thus, I'll give IPO a fair price target of $11.35 (60% lower) to better reflect the true value of their growth potential.

A Last-Minute Race to Public Markets?

In my opinion, the most opportune time to invest in IPO's is right in the middle of an economic cycle. In the middle of the cycle, valuations expand and growth companies like this often see incredible returns. Even more, at a time like that the markets are still judgmental toward negative cash flow companies, so the ones that make the IPO cut are typical of very high quality.

On the other hand, in a late-cycle period like we have today, in my opinion, it is often companies of much lower quality that are racing to the market. Take 1999 for an extreme example. I frankly see almost no material difference between Pets.com (which sold pet supplies and lasted about a year before liquidation) and Chewy.com (CHWY). Both companies have awful fundamentals, don't do anything particularly unique, and generated far more investor hype than reasonable.

It is simple, while it is hard to time the market specifically, most companies and people have an intuitive sense of the economy's current phase. When they feel that stock valuations are likely to decline, the lowest quality names rush to IPO while the market will still accept them. If they wait too long and markets crash, nobody will want to invest in a company that loses money.

Today, we seem to be at the final stages of a bull market. This is the time when IPO valuations often collapse and many IPO's are met with poor subscription.

The Bottom Line

Overall, I find (IPO) to be a very interesting ETF. I like the fund in principal and I hope it survives a likely crash so I can invest in it at a better time. It seems to be well-run and offers unique exposure to an equity group that typically beats the market during the middle to late stages of an economic cycle.

Perhaps it will be a great opportunity years from now when we are once again in such an environment. That said, it is perhaps one of the riskiest and least rewarding equity funds available today. While there are a few possibly good picks in it like the insurance firm AXA holdings (EQH), the vast majority have poor fundamentals and unreasonable valuations.

While they have strong growth potential, they have generally poor balance sheets (for growth companies) and such extreme valuations that it seems nearly impossible for them to grow into the giant shoes investors have given them.

I know many will disagree, but these companies also seem generally less innovative than IPO's years ago. Online retailing (CHWY)(PDD) and music streaming (SPOT)(TME) have been around for decades. Other top holdings such as DocuSign (DOCU), Roku (ROKU), and Uber (UBER) offer useful products but have no moat to maintain profits in a competitive landscape.

Overall, (IPO) seems like a clear sell and I expect to see at least 50% or more in losses in the event of a recession or drop in equities. I'd give the fund a fair value of $11 to reflect revenue growth rates and current valuations, though I would not buy unless the fund crossed below $8.