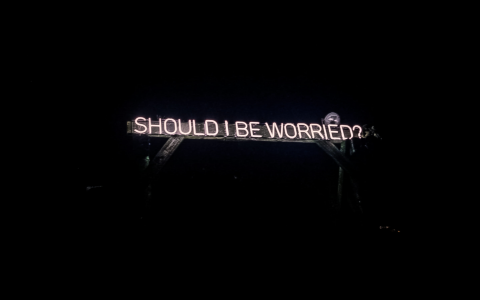

(401K Specialist) - Inflation, recession and healthcare costs continue to keep Americans age 50+ up at night when it comes to their retirement, new F&G survey finds.

Four out of five Americans age 50+ say they are worried about inflation in retirement, according to a new survey from F&G.

This feeling is even more acute among pre-retirees (84%) vs. 76% of retirees. The survey also revealed 71% of Americans are worried about a recession and 66% are worried about rising healthcare costs.

The survey also found that Americans age 50+ are considering various approaches to mitigate their retirement worries likely due to the current economic climate. Sixty-two percent of retirees are changing how they budget due to inflation, and more than half (55%) of pre-retirees expect to work part-time in retirement to cover day-to-day expenses. In addition, one third (31%) of pre-retirees say it’s unrealistic for them to retire without working at least part time.

“The threat of inflation continues to be top of mind for Americans both approaching and already in retirement. In this economic environment, it’s more important than ever to revisit your retirement plan with an advisor and consider a more holistic set of products that can guarantee income, help protect against market volatility and inflation. This approach can help shift the focus to a more predictable retirement with a lifestyle of your choosing,” said Chris Blunt, CEO of F&G.

When asked about why they plan to keep working into their 70s in retirement, 40% of respondents said they need the money while 39% said they would like to have more financial options and a larger safety net. While some respondents are currently or plan to work in retirement out of financial necessity, 43% enjoy the social aspect of working.

Unexpected healthcare costs in retirement

Des Moines, Iowa-based annuity and life insurance provider F&G’s survey found 66% of Americans age 50+ are very or somewhat worried about healthcare/long-term care costs for themselves or their spouse/partner in retirement.

Of these respondents, pre-retirees are more likely than retirees to be concerned about healthcare costs (74% vs. 58% respectively). However, nearly half (47%) of pre-retirees have not planned for unexpected healthcare costs in retirement. This can be especially concerning for those with underlying or chronic health issues.

Studies illustrate how increasing medical expenses can add up. If healthcare costs grow, for example, at 2% above consumer inflation for the next two years, a healthy 55-year-old couple could face $267,000 in additional medical costs when they retire at age 65, according to an analysis by HealthView Services.

“Unexpected expenses, especially health care costs, are clearly on Americans minds but many don’t have a plan to cover these costs in retirement,” said Blunt.

By Brian Anderson

July 12, 2022