When it comes to retirement, there are two parts. Investors understand the first part quite well: that’s savings. It’s easy to understand that we all need to save for retirement, sock away money, invest in a portfolio of assets, etc. And while building a portfolio can be a complex undertaking, most people know they need to do it to retire.

The second part of retirement is a bit trickier. That’s turning your savings into a stream of income that will last throughout your Golden Years. The problem is most investors have no idea what kind of income their savings will generate or if they are even saving enough to hit a certain ‘income’ level.

Luckily, the Department of Labor has your back.

Thanks to new rules, investors will now start seeing revised income projections on a host of their investment accounts. Those new projections and governing rules could finally solve the income puzzle for many savers.

The SECURE Act

It’s no secret that Americans are facing a retirement dilemma. With this as their impetus, a bipartisan group of House members introduced new legislation designed to improve retirement outcomes for many Americans. After sitting in limbo, Congress enacted the Setting Every Community Up for Retirement Enhancement (SECURE) Act. Back in December, President Trump signed the bill into law.

The SECURE Act features a wide range of new policies and rules governing everything from required minimum distributions to the adoption of annuities into workplace retirement plans. But one of the new pieces of the SECURE Act includes rules on income projections for savers.

After a period of public comments, the Department of Labor’s Employee Benefits Security Administration (EBSA) announced the final rules that will require defined contribution retirement plans to provide two lifetime income illustrations on participants’ statements at least once every 12 months. Basically, you’ll get your 401k or 403b statement and see just how much income your balance could generate.

Some account providers have already started to do this ahead of the DOL’s new rules. However, the methodology is varied under plan sponsors. Depending on the type of models used, interest rate assumptions, and other factors, these estimates can and do vary widely from sponsor to sponsor. Under the Labor Department’s guidelines, a set of standards is created that translates across investment plans.

And just what are those standards?

The DOL’s rules use a few major assumptions. First, the rules now create a set commencement date and an assumed age. Plan administrators must calculate monthly payment illustrations as if the payments begin on the last day of the benefit statement period. Secondly, plan administrators must assume that participants start the income assumptions at age 67, which is the full current retirement age according to Social Security.

Third, plan participants provide two income assumptions. This includes a single life assumption for just the saver as well as Qualified Joint and 100% Survivor assumption. This shows what a portfolio would generate in the case of married participants. This income illustration shows what a portfolio could generate monthly for both partners. Key to these assumptions is that plan sponsors must use a gender-neutral mortality table to determine life expectancy.

Perhaps the most significant feature of the new rules comes down to interest rate determination. Where income projections tend to function widely is that many plan sponsors use different rates to create a baseline for growth and income potential. Under the DOL’s rules, sponsors must use the 10-year constant maturity Treasury rate (10-year CMT) as of the first business day of the last month of the statement period to calculate the monthly payments. This creates a standard for all participants.

Great News for Savers

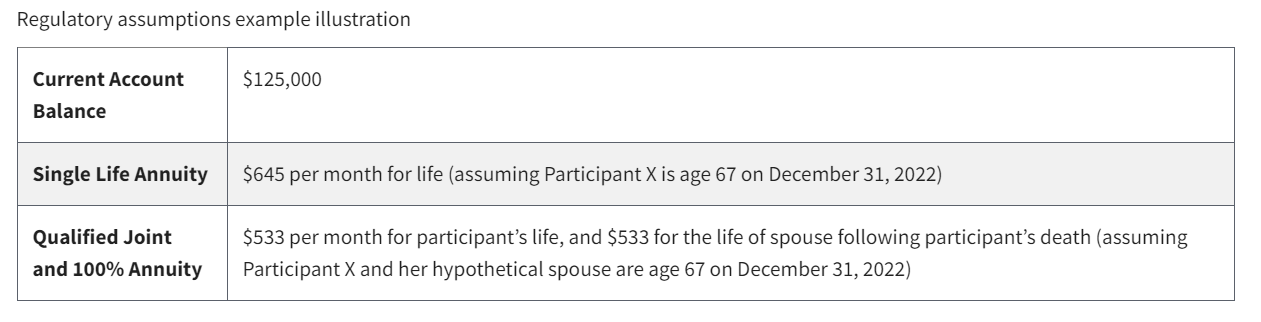

The Department of Labor provides an example as to what this may look like on a statement for a hypothetical saver. A 40-year-old single woman with a $125,000 balance at the end of 2022 would see this on her statement. This is with a 10-year CMT rate of 1.83%.

Source: Department of Labor

Creating the standard and forcing plan sponsors into showing investors this information can be considered a godsend for savers and help in the planning stages.

Having a standard number to work with, investors can now see if they are on track with their 401k/retirement savings. Based on current balance, investors now have an idea of what they can generate using what they already have saved at retirement age. If that number is too low, they can save more, change investments/rebalance their portfolios or stay the course if the number is satisfactory.

It also can be used in a variety of other financial planning scenarios. This number can be critical when looking at outside investments, risk tolerance, and the need to supplement with other accounts. All in all, the projection can give investors and financial planners much needed and standardized info to build a complete plan to reach the income needed during the future.

Perhaps the best part is that these projections are dynamic. As balances grow/shrink and the CMT changes with market conditions, investors can get a real-time picture on what they need to potentially do. This creates a much more active approach to income planning rather than just using assumptions.

The Bottom Line

With the passage of the SECURE Act, investors received some welcome news with regard to the Department of Labor’s new lifetime income rules. The rules now set a standard that all plan sponsors must use and the projections can be vital in various stages of retirement planning. In the end, the projections can help savers see the light on one of the hardest pieces of retirement planning — generating income in retirement.

This article originally appeared on Dividend.com.