(Hive) - HIVE Digital Technologies Ltd. (TSX.V: HIVE) (Nasdaq: HIVE) (FSE: YO0) (BVC: HIVECO) (referred to as the “Company” or “HIVE”), a global leader in sustainable data center infrastructure, announced its results for the third quarter ended December 31, 2025 (all amounts in US dollars, unless otherwise indicated).

HIVE delivered record quarterly revenue of $93.1 million, representing 219% year-over-year growth and 7% quarter over quarter growth, and Adjusted EBITDA of $5.7 million. Gross operating margin expanded significantly to $32.1 million (34.5%), up more than sixfold compared to $5.3 million in the prior year period.

This quarter marks the strongest “dual-engine” growth in HIVE’s history, driven by the rapid scale-out of its Bitcoin hashrate fleet to an installed base of 25 Exahash per Second (“EH/s”) by period end December 31, 2025 and accelerating demand for BUZZ HPC platforms.

Q3 FY2026 Financial Highlights:

- Total Revenue: $93.1 million, a 219% increase from $29.2 million in Q3 FY2025 and a 7% increase over last quarter.

Gross operating margin was $32.1 million or 35%3, up from 18% in fiscal Q3 FY2025. See the calculation of direct costs and mining margin included below in this press release.

- Digital Currency Hashrate Revenue: $88.2 million, up 8% from Q2 FY2026, reflecting a 41% quarter-over-quarter increase in average hashrate to 22.9 EH/s, partially offset by approximately 10% lower Bitcoin prices and 15% higher network difficulty. This hashrate revenue was achieved at a direct cost of $57.8 million, of which approximately 90% is energy costs. See the calculation of direct costs included below in this press release.

- Bitcoin Output: Generated 885 Bitcoin, representing a 23% quarter over quarter increase, despite a 15% rise in network difficulty.

- HPC Revenue: BUZZ HPC revenue was $4.9 million during the quarter. This revenue was achieved against direct costs of $2.3 million.

- G&A: $8.4 million, up from $7.8 million in Q2 2026, primarily as a result of increased staff to support HIVE’s global expansion, including Paraguay, and the BUZZ HPC business. Notably, while gross operating margin increased more than 6x year-over-year, corporate G&A grew only 1.8x over the same period, demonstrating operating leverage and disciplined scaling.

- Net Loss: GAAP net loss of $91.3 million was primarily driven by $57.4 million in accelerated depreciation related to the Paraguay expansion and non‑cash revaluation adjustments. The loss reflects HIVE’s decision to depreciate the next‑generation ASIC fleet over a two‑year cycle, rather than the typical four‑year schedule, to reflect the faster pace of efficiency improvements and shorter economic lives of new ASICs—a conservative approach aligned with our strong growth in Paraguay and focus on operating income.

- Adjusted EBITDA1: $5.7 million.

OPERATING PERFORMANCE: SCALE WITH DISCIPLINE

Infrastructure Expansion

- Completed Paraguay Buildout and Achieved 25 EH/s: Operating 440 megawatts (“MW”) of global, hydro-powered capacity with 25 EH/s installed and 22.9 EH/s average operational hashrate, while reaching 17.5 Joules per Terahash (“J/TH”) fleet efficiency; record completion of 300 MW of green-energy Tier-I infrastructure brought online in 6 months (from May 2025 to November 2025).

- Land & Power: The company signed an additional 100 MW PPA in Yguazú and bought 10 hectares of land, with energization targeted for Q4 2026. This maintains our growth in Paraguay by an additional 10 EH/s. Subsequent to the quarter end, the Company has purchased an additional 63 hectares of land.

Positioning for AI and HPC Growth: Future Capacity & Growth Outlook

- Accelerating AI Revenue: In February 2026, the Company signed a 2-year, $30 million contract for 504 Nvidia B200 GPUs. Expected deployments to be live in calendar Q1 2026 at Bell’s Tier-III facility; adds ~$15 million of ARR and lifts HPC annualized revenue ~75% (from $20 million to $35 million). Targeting $140 million ARR by Q4 2026 for GPU AI Cloud with 11,000 GPUs, subject to market conditions and successful infrastructure deployment.

- BUZZ’s Growth Plan: Targeting $225 million ARR for total HPC revenue (HPC Tier-III colocation at HIVE’s New Brunswick 70 MW Tier-I data center to be converted to 50 MW of IT Load for Tier-III hyperscaler colocation, estimated to generate $85 million ARR in addition to the GPU AI Cloud revenue) by end of calendar 2026 or early 2027 as GPU cloud and colocation capacity expands.

- Strengthened Runway for Scalable Compute: By year-end, HIVE expects to operate a 540 MW energy footprint (440 MW currently operating, plus the additional 100 MW PPA contracted). Existing and incremental megawatts will be evaluated to preserve flexibility for highest-value deployments – toward expanding EH/s or supporting future AI and high-performance computing workloads.

Management Insights

Frank Holmes, HIVE’s Executive Chairman, stated, “This quarter marked an inflection point for HIVE. We delivered record revenue, scaled our renewable-powered Tier-I hashrate platform to 25 EH/s and accelerated our AI strategy. These milestones reflect disciplined execution across both engines of our business – Bitcoin hashrate services as the cash generator and BUZZ as our high-growth HPC platform, positioning HIVE for diversified, recurring revenue growth. Demand for AI compute continues to rise, and HIVE is leveraging its long track record in high-performance compute infrastructure and deep technical expertise in AI cloud services and data center operations to capture that opportunity.

Notably, we are also positioning Paraguay to be a leader in HPC for Latin America. With abundant and stable green energy, and a government that is strongly-aligned with the United States, we believe Tier-III data centers are the future in Paraguay. Our future deployments in Paraguay will have the architecture and infrastructure footprint for Tier III future deployments as we build out our powered land. Our team has ordered the substation for the additional 100 MW at Yguazú, which we expect to come online in calendar Q3 2026.

Moreover, the Company has a strategic alignment with Paraguay’s largest Tier III telecom datacenter operator, where we are sending a cluster of high-performance GPUs which will operate on the BUZZ AI Cloud out of Asuncion. Thus, by laying the foundation for long-term and rapid scale HPC Tier III Data Center deployment with our next 100 MW in Yguazú, and curating HIVE’s first Latin America GPU AI cloud proof-of-concept this quarter from Asuncion, our vision is to be a first mover in Latin America, powering the AI industrial revolution with renewable energy from Paraguay.

HIVE will be a key economic driver for Paraguay, as we anticipate materially contributing to the GDP growth of the country through our data center construction expenditures and stable and long-term consumption of power from the Itaipu Dam, which will strengthen Paraguay’s domestic energy market and drive revenue for ANDE and the government. President Santiago Pena has demonstrated great leadership, along with Marcos Riquelme and Ruben Ramirez Lezcano, which gives us the confidence to advance our investments into Paraguay.”

Moreover, the Company has a strategic alignment with Paraguay’s largest Tier III telecom datacenter operator, where we are sending a cluster of high-performance GPUs which will operate on the BUZZ AI Cloud out of Asuncion. Thus, by laying the foundation for long-term and rapid scale HPC Tier III Data Center deployment with our next 100 MW in Yguazú, and curating HIVE’s first Latin America GPU AI cloud proof-of-concept this quarter from Asuncion, our vision is to be a first mover in Latin America, powering the AI industrial revolution with renewable energy from Paraguay.

HIVE will be a key economic driver for Paraguay, as we anticipate materially contributing to the GDP growth of the country through our data center construction expenditures and stable and long-term consumption of power from the Itaipu Dam, which will strengthen Paraguay’s domestic energy market and drive revenue for ANDE and the government. President Santiago Pena has demonstrated great leadership, along with Marcos Riquelme and Ruben Ramirez Lezcano, which gives us the confidence to advance our investments into Paraguay.”

Aydin Kilic, President & CEO, stated, “This quarter demonstrated HIVE’s execution in both our Tier-I hashrate platform and GPU AI Cloud. Our business has scaled substantially over the last year. Notably, our gross operating margin has increased over 6x YoY, from $5.3 million period end December 31, 2024 to $32.1 million this current period end December 31, 2025. At HIVE, we pursue accretive growth with a high-performance work culture, and this exponential growth in gross operating margin relative to corporate G&A reflects our expertise to scale with our Tier-I hashrate platform. Furthermore, this growth in corporate G&A includes added key personnel and talent to our BUZZ HPC and GPU AI Cloud business. In this fiscal quarter, we announced the purchase of 504 next-generation AI-optimized GPUs, and last week, ahead of their installation in March 2026 in the BUZZ Canada West facility, we announced the entire cluster was leased on a two-year fixed term contract valued at $30 million. As we expand BUZZ, we are leveraging our proven infrastructure operating model and deep technical expertise in AI to deliver GPU cloud and colocation capacity quickly and reliably for enterprise customers. With Tier-III+ capacity across Canada, Sweden and a growing pipeline of multi-year GPU cloud and colocation demand, we believe HIVE is positioned to build a durable, high-margin, recurring revenue platform through 2026 and beyond. This dual engine strategy provides continued growth and sustained cashflow as we navigate the recent volatility in Bitcoin hashrate revenues.”

Darcy Daubaras, HIVE’s CFO, stated, “This quarter demonstrates strong revenue growth and operating margin expansion despite a more competitive hashrate environment. Accelerated depreciation impacted net income, but reflects conservative accounting and disciplined balance sheet management. We believe our cost structure and renewable power strategy position us to generate attractive operating margins as competition increases.”

Strategic Positioning

HIVE’s “dual-engine” strategy — Bitcoin infrastructure as cash generator and BUZZ AI Cloud as high-growth recurring revenue — provides diversification and capital allocation flexibility.

The Company remains focused on:

- Expanding gross operating margin

- Scaling recurring AI revenue

- Maintaining disciplined G&A growth

- Preserving balance sheet strength

With renewable-powered infrastructure across Canada, Sweden, and Paraguay, HIVE believes it is positioned to build a durable, margin-driven digital infrastructure platform through 2026 and beyond.

Conference Call Information

HIVE will hold its fiscal Q3 2026 earnings call on Tuesday, February 17 at 8:00 AM EST. To participate in this event, please log on or dial in approximately 5 minutes before the call.

Date: February 17, 2026

Time: 8:00 AM EST

Webcast: Registration link here

Dial-in: Provided after registration

Financial Statements and MD&A

The Company’s Consolidated Financial Statements and Management’s Discussion and Analysis (MD&A) thereon for the three months ended December 31, 2025 will be accessible on SEDAR+ at www.sedarplus.ca under HIVE’s profile and on the Company’s website at www.HIVEdigitaltechnologies.com.

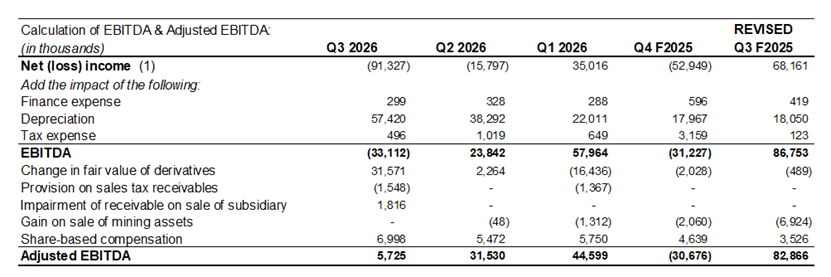

¹ The Company has presented certain non-GAAP measures in this report. The Company uses EBITDA and Adjusted EBITDA as a metric that is useful to management, the board and investors for assessing its operating performance on a cash basis before the impact of non-cash items and acquisition related activities. EBITDA is net income or loss from operations, as reported in profit and loss, before finance income and expense, tax and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for by removing other non-cash items, including share-based compensation, finance expense, depreciation and one-time transactions. The following table provides an illustration of the calculation of EBITDA and Adjusted EBITDA for the last five quarters:

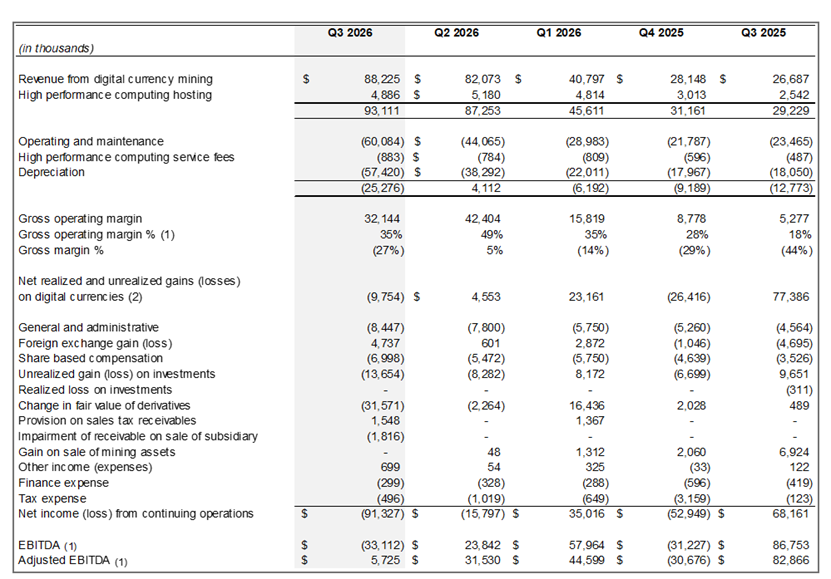

Net realized and unrealized gains (losses) on digital currencies is calculated as the change in fair value (gain or loss) on the coin inventory, and the gain (loss) on the sale of digital currencies which is the net difference between the proceeds and the carrying value of the digital currency.

Net realized and unrealized gains (losses) on digital currencies is calculated as the change in fair value (gain or loss) on the coin inventory, and the gain (loss) on the sale of digital currencies which is the net difference between the proceeds and the carrying value of the digital currency.

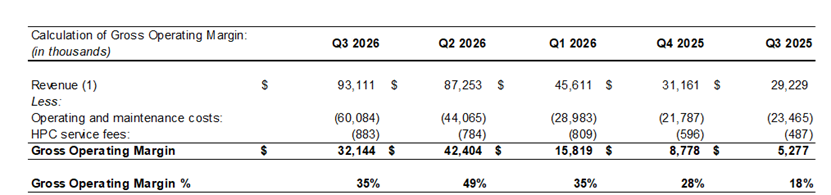

³ The following represents the Revenue and related costs that comprise the gross mining margin. We include connectivity, security, data center maintenance, and electrical equipment maintenance. Electrical costs may vary quarter over quarter.

*Average revenue per BTC is for hashrate services operations only and excludes HPC operations.

*Average revenue per BTC is for hashrate services operations only and excludes HPC operations.

References to annualized revenue and run-rate revenue are considered future-oriented financial information. Readers should be cautioned that this information is used by the Company only for the purpose of evaluating the merit of this line of its business operations and may not be appropriate for other purposes.

References to annualized revenue and run-rate revenue are considered future-oriented financial information. Readers should be cautioned that this information is used by the Company only for the purpose of evaluating the merit of this line of its business operations and may not be appropriate for other purposes.

Quarterly ATM Sales Report

For the three-month period ended December 31, 2025, the Company issued 4,925,948 common shares (the "November 2025 ATM Shares") pursuant to the at-the-market offering commenced in November 2025 (the "November 2025 ATM Equity Program") for gross proceeds of C$22.0 million ($15.8 million). The November 2025 ATM Shares were sold at prevailing market prices, for an average price per November 2025 ATM Share of C$4.47. Pursuant to the November 2025 ATM Equity program, a cash commission of $153 thousand on the aggregate gross proceeds raised was paid to the sales agents in connection with its services under the November 2025 ATM Equity Program.

About HIVE Digital Technologies Ltd.

Founded in 2017, HIVE Digital Technologies Ltd. is the first publicly listed company to mine digital assets powered by green energy. Today, HIVE builds and operates next-generation Tier-I and Tier-III data centers across Canada, Sweden, and Paraguay, serving both Bitcoin and high-performance computing clients. HIVE’s twin-turbo engine infrastructure-driven by hashrate services and GPU-accelerated AI computing-delivers scalable, environmentally responsible solutions for the digital economy.

For more information, visit hivedigitaltech.com, or connect with us on:

X: https://x.com/HIVEDigitalTech

YouTube: https://www.youtube.com/@HIVEDigitalTech

Instagram: https://www.instagram.com/hivedigitaltechnologies/

LinkedIn: https://linkedin.com/company/hiveblockchain

On Behalf of HIVE Digital Technologies Ltd.

“Frank Holmes”

Executive Chairman

For further information, please contact:

Nathan Fast, Director of Marketing and Branding

Frank Holmes, Executive Chairman

Aydin Kilic, President & CEO

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Hive Digital Technologies LTD

February 16, 2026