Investors call it “the single best trade of all time.”

In late February, billionaire investor Bill Ackman bet that Covid would crash the stock market and loaded up on credit default swaps. The contracts—which work as insurance against bond defaults—didn’t come cheap though.

They bound his fund to a hefty $27 million in monthly fees. But luckily for Ackman, the trade didn’t take long.

Soon after his bet, the virus spread and the world shut down. Stocks went into freefall. The price for “credit insurance” exploded. And within 30 days, the famed investor sold out his contracts for $2.6 billion—pocketing a near 10,000%.

Last week, Bill Ackman said he is pulling an identical trade. He thinks investors eased up too much on a coming wave of bankruptcies.

As I’ll show, cold hard numbers tell me he might be right—even with a vaccine. And the first domino could fall in the riskiest corner of the market.

Yes, the Fed gave a lifeline, but not for all junk

The Fed dangled many carrots to lure investors back into the market during Covid. One such incentive was its pledge to splash up to $750 billion onto corporate debt—including speculative-grade bonds called “junk bonds.”

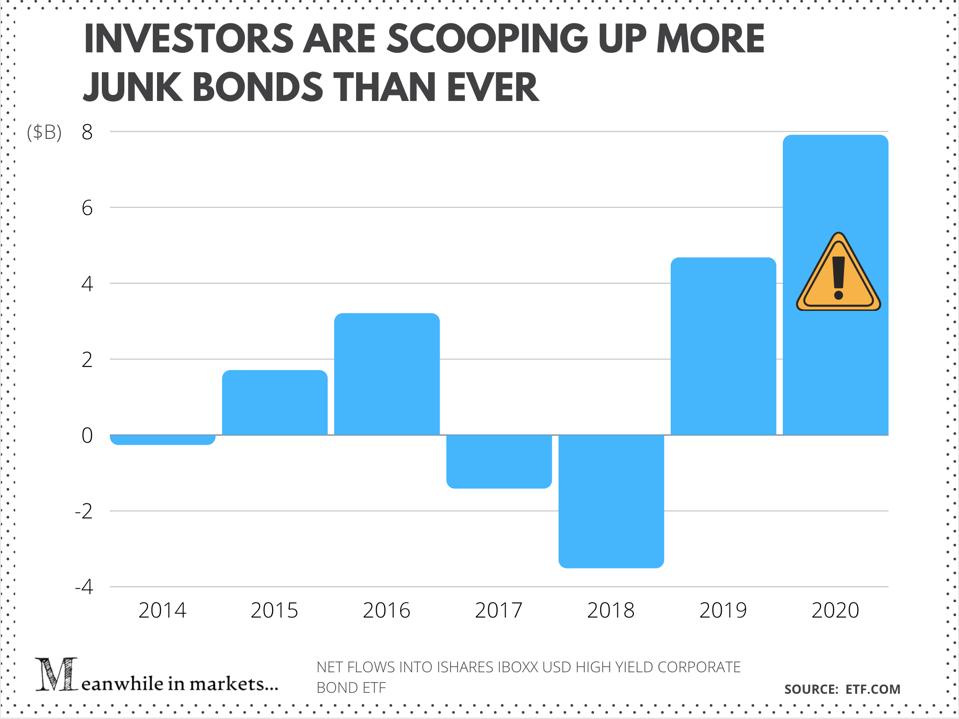

Investors took the Fed’s vow as a money-back guarantee stamp on most corporate bonds. They swiftly threw caution to the wind and scooped up more junk bonds than at any other time in history.

Take a look at this chart. It shows how much money flowed this year into the world’s largest ETF that holds speculative-grade debt:

Net flows into iShares iBoxx USD High Yield Corporate Bond ETF

MEANWHILE IN MARKETDuring one of history’s worst recessions, the fund’s inflows hit an all-time record. And it’s on track to pull in nearly 2X more money than last year.

But the thing is, the Fed didn't promise to buy that much in speculative bonds. Nor does the Fed’s shopping cart hint at much appetite for junk. For example, in August just 1.1% of the Fed’s bond purchases were junk bonds.

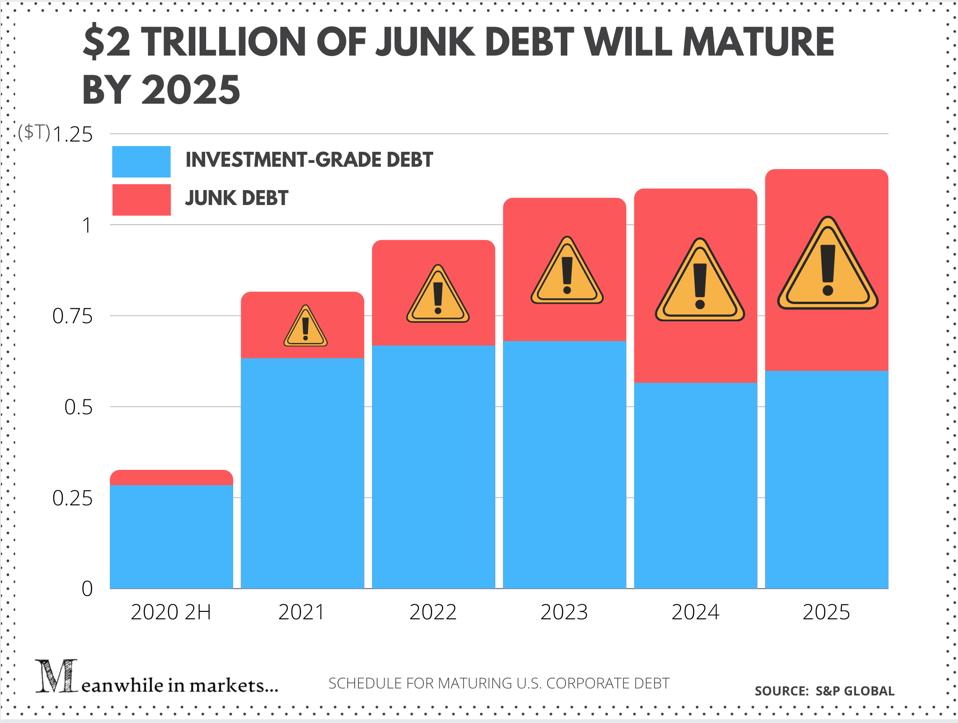

Meanwhile, $2 trillion in junk debt has to be refinanced by 2025

As you may know, bonds mature. When they do, most companies have to find a new investor and refinance the debt ( “roll over” in financial lingo). And that raises a couple of risks.

One, they might not afford it. For example, their debt could be downgraded meaning they would have to pay more in interest. Or a dip in the market could prompt investors to demand a higher interest rate in exchange for the risk they are taking.

Second, liquidity. Will investors be there to buy all that debt? There are many fewer investors for junk bonds than there are for investment-grade bonds due to regulations and risk. And they tend to be more skittish if the markets go south.

For example, when Covid swept across the world, investment-grade debt issuance came to a complete halt for a week. By contrast, speculative-grade bonds froze during much of March, according to S&P Global.

In the meantime, a record number of junk bonds is maturing by 2025, as you can see here:

Schedule for maturing U.S. corporate debt

MEANWHILE IN MARKETSDebt-laden companies will have to roll over up to $2 trillion in junk bonds in the coming years. But, as I’ve shown, the Fed has little interest in this debt. And who knows how investors will shop for junk if defaults blow up?

Defaults are picking up steam. Is the risk worth it?

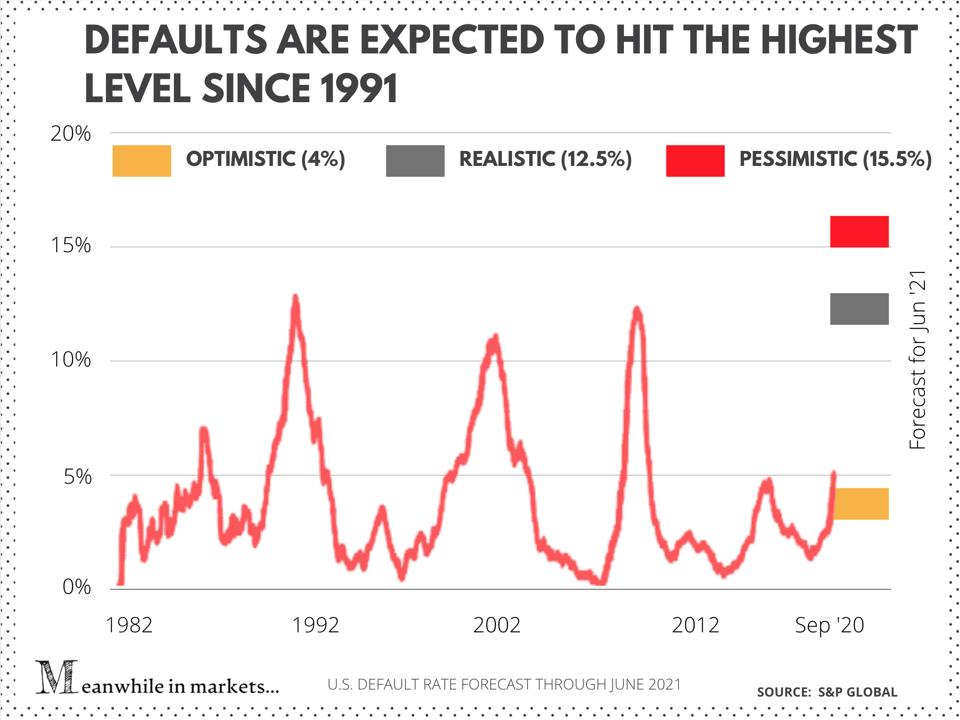

A recent Bloomberg analysis showed a sixth of American stocks aren't making enough money to cover their interest payments. That’s 57% more than before the pandemic. And while defaults have already ticked up this year, analysts expect the worst is still to come.

Last month, bond rating agency S&P released a report putting a pin on default rates next year. Even with a vaccine, the firm expects defaults to double by the summer and hit the highest level since 1991, as you can see here:

U.S default rare forecast through June 2021 by S&P Global

MEANWHILE IN MARKETSThat’s a lot of risk, and investors should be rewarded handsomely for taking it. Truth is, they are not.

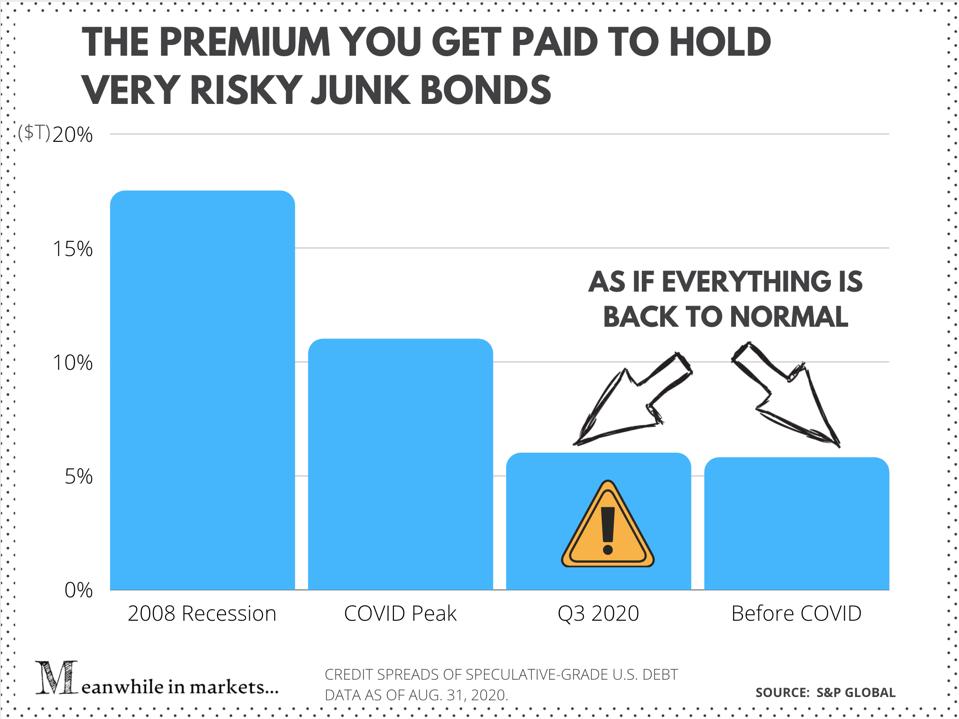

Here’s a chart that compares so-called credit spreads before the pandemic and now. In short, it shows the premium you get paid to hold risky junk debt over risk-free Treasury bonds.

Credit spreads of speculative-grade U.S. debt as of August 31, 2020

MEANWHILE IN MARKETSEven though defaults are on track to hit 2008 levels next year, junk bonds are priced as if everything is back to normal. Might as well call it the cost of the faith in the Fed.

Don’t get too tempted

Recent vaccine wins give hope, but businesses are still a long way from recovery. Hundreds of stocks are teetering on a high wire. Some will inevitably tumble before they get a chance to recover.

(To play devil's advocate, junk could hold up just fine because record low rates are forcing return-starved investors to take on more risk. And demand for junk bonds may not fade away anytime soon. Also, lower rates makes refinancing cheaper.)

In all, I’d tread lightly with junk bonds—or get way more selective. For example, you could look into Covid’s “fallen angels.” These are bonds that got downgraded to junk during Covid and are now getting special attention from the Fed.

This article originally appeared on Forbes.