(Forbes) So far 2020 has been a pretty horrible year, with 150,000 deaths from COVID-19, massive unemployment in response to the Covid lockdown, protests in the streets against police brutality and a disheartening response from the federal government. The one place that hasn't been a complete disaster is the financial markets.

After losing 34% of its value in the beginning of the Covid crisis, the stock market's recovery has been one of the few good things to talk about this year. With half the year done, it's time for financial professionals to predict how they see the rest of the year going.

In a recent press conference over Zoom, a round table of industry leaders and asset managers discussed their mid-year outlooks.

Crit Thomas, global market strategist for Touchstone Investments, a Cincinnati, Ohio-based firm of mutual fund subadvisors, said he doesn't agree with the characterization that the market is ahead of, or ignoring, the fundamentals, especially with respect to the resurgence of COVID cases in the U.S.

"It seems that what is driving the market really are companies that would benefit from an extended period of social distancing," said Thomas.

A bet on the S&P 500 Index at this point is really a bet on a very small number of securities, said Mark Travis, co-founder of Intrepid Capital, a Jacksonville, Fla., asset manager.

At this point, evaluations of the S&P 500 are not a product of fundamentals, but rather monetary fiscal policy, and the idea that we're coming back to some normalcy, said Eddy Augsten, m anaging director at Concurrent, an advisor shop based in San Diego, Calif. "But, we're not looking out six months down the road. We're looking at real-time economic data on a daily basis. We're paying attention to the Coronavirus, what's happening every day, and the fact that we just hit a new record yesterday."

While it will becomes more about earnings and expectations after July," Augsten said looking forward it will be less on fundamentals and more a focus on the election, and what's going to happen in terms of vaccine. He asked, is it realistic to think it will come out in early 2021 or will it be postponed?

"Right now, the S&P is trading between 130% to 140% of the price-to-earnings based on its own history," said Saumen Chattopadhyay, chief investment officer at the Carson Group, a wealth manager in Omaha, Neb. "Now this pandemic appears to be all-consuming and there is a long-lasting lockdown, a ceiling on activity on the contact-intensive sectors, and a severe impact on the high unemployment with about 11.1% or 10 million people out of job and there is an expectation of stimulus."

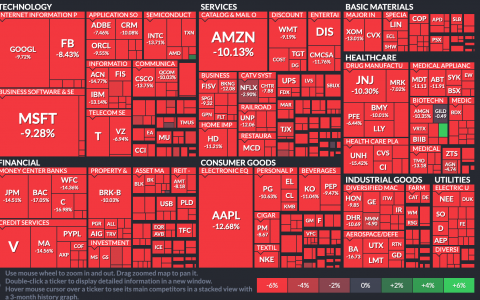

Chattopadhyay said the market is currently discounting hope. And even with a positive outlook on earnings, multiples are rising and creating a bubble in the equity market. He added that the there is a huge dispersion in the companies that have recovered. Technology and health care are up, while financials are still down.

"The companies which have a high-quality balance sheet, resilience to pandemic and high and strong cash flows are being priced in," said

Chattopadhyay. "From portfolio allocation, it is important to understand how much you can take of this appetite. There is definitely an imbalance at this location between where the economy is going and where the market is going, which poses the question, is this really sustainable? Is your portfolio allocation and your risk allocation aligned?" He added that people should start to think about hedging their portfolios.

With the opaque view of the near future, it's hard to predict valuations.

"It's probably wise to take some risk off the table in terms of your equities, especially if you've been participating with your full exposure on the equities and have a full beta to the equity market," said Augsten.

He said his firm has been taking profits from equities and looking at other markets to pick up equity beta, such as credit markets, specifically high-yield or preferred stocks.

"I think you could say that the S&P earnings could drop to as low as 120 for calendar year '20," said Travis. "You put a 15 multiple just because of masses zero in my head, and Saumen's 16.3 multiple and I get to 1800 on the S&P, which is pretty good ways from where we are right now."

"As tough as the equity picture looks right now, fixed income is even more difficult," said Thomas. "You have these low-interest rates that are just forcing a lot of investors to reconsider how to use fixed income in their asset allocation."