The Federal Reserve is announcing its latest interest-rate decision on Wednesday, and expectations aren’t for a big shift at this meeting. More on that later.

Still the big issue in the world of central banking is last month’s official pivot to average inflation targeting. That is, the Fed is saying inflation will be allowed to run over 2% if — as it has — price growth has been under that target for a significant period.

Now the Fed didn’t really explain how it would implement this new strategy in practice. Tim Duy, the University of Oregon professor who writes the Fed Watch blog, says the benefit of that new shift comes when the economy is running faster than expected. “It’s particularly important in the context of a recovery that appears more rapid than anticipated. Along with the more rapid recovery is a faster pace of inflation,” he says.

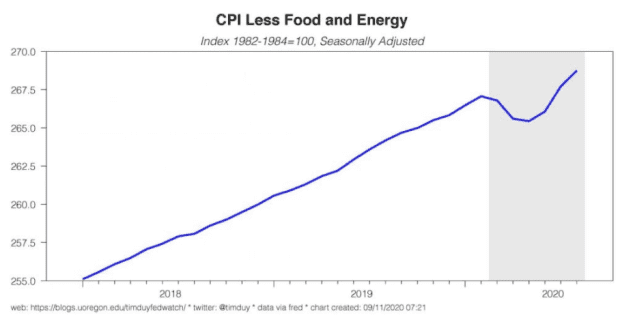

Already, the price level is looking to be returning to its pre-COVID trend. But the market, thanks to the Fed’s new guidance, isn’t shifting its expectations on interest rates.

“Now we are thinking that there is nothing in the data to prompt a more hawkish reaction from the Fed,” says Duy. “The Fed is content to allow real interest rates to continue to drop and presumably content to allow them to fall even a notch further than the last cycle.”

There is a risk in this strategy. “The Fed is committed to fighting the last battle, the long, slow recovery experienced in the wake of the Great Recession [2007-09 recession]. The Fed is absolutely unprepared for any outcomes on the right-hand side of the distribution. That opens up the risk that the Fed finds itself pivoting in 12 months or sooner,” says Duy.

Another risk is the increased importance put on financial stability in the strategy change. Like the average inflation targeting, the Fed didn’t say how it would put that emphasis into practice. “You kind of have to wonder what happens if the Fed’s commitment to maintaining deeply negative interest rates keeps the heat up under risk assets as you might expect it to,” says Duy.

This article originally appeared on MarketWatch.