(ETF.com) In the land of ETFs, thematic investing is a burgeoning trend. Among the many themes you can access today in an ETF wrapper, morality is one of them, through ETFs focusing specifically on virtue and vice.

Does investing based on the Bible or in the darker world of guns, marijuana and alcohol, impact your results—for better or worse? Ultimately, it all hinges on what’s inside these ETFs. You’d expect their underlying holdings to be vastly different, and their returns to reflect that contrast. But is that the case?

For example, consider these two ETFs: the virtuous Inspire 100 ETF (BIBL) and the “sin stock”-stuffed AdvisorShares Vice ETF (ACT).

ACT is an actively managed fund that invests in U.S. companies involved in alcohol-, cannabis-, or tobacco-related activities, thus the “ACT” ticker. Launched in December 2017, the fund has $14 million in assets under management (AUM) and carries a 0.75% expense ratio.

BIBL tracks a market-cap-weighted index of large cap U.S. stocks, selected based on the firm’s proprietary definition of biblical values. Launched shortly before ACT, at the end of October 2017, the fund has $61 million in AUM and an expense ratio of 0.35%—less than half the price of ACT.

Inside these ETFs, the holdings are indeed vastly different, as are the methodologies behind them. ACT is actively managed, while BIBL uses a traditional market-cap-weighting index.

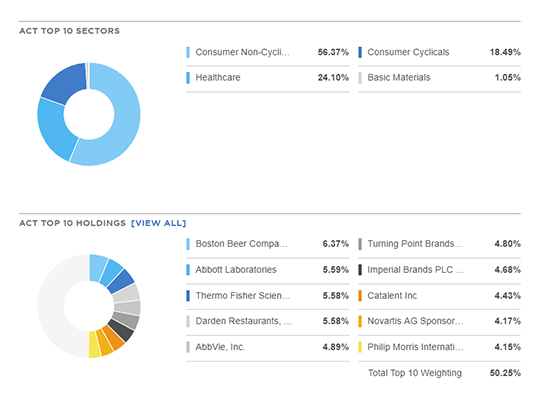

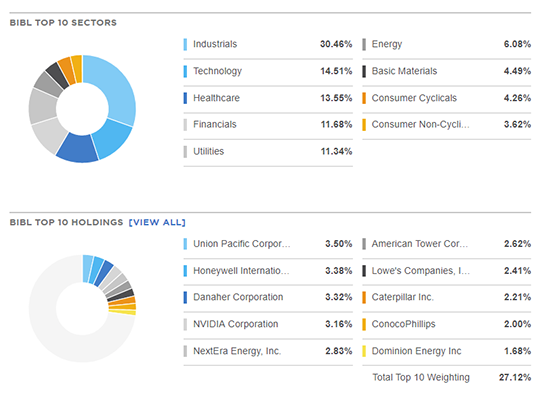

Here’s what sector allocations and underlying securities for each fund look like:

No Overlap, But Similar Sized Stocks

No Overlap, But Similar Sized Stocks

Unsurprisingly, there is no overlap in underlying holdings between these two funds’ biggest allocations. There are some similarities between the two, however.

First, both ETFs have a sizable allocation to health care names. ACT tilts more heavily into health care, and it may be because many health care companies are DEA-certified to use cannabis for research. But BIBL, too, owns a lot of health stocks.

They are also both basically large cap funds. They swim in different pools of equities based on the products and services delivered, but they’d both fit within your large cap equity sleeve. They both have similarly weighted market cap averages; ACT’s is $60 billion, BIBL’s is $52 billion.

Trading execution, as measured by average trading spreads, is also similar on both ETFs—they’re pretty wide. ACT trades with an average spread of 0.32%, BIBL has a spread of 0.27%. The also both have the same ESG (environmental, social and governance) ranking of “A,” according to MSCI.

All Comes Down To Performance

But ultimately, investors want to know about performance, and year to date, they’re side by side. Investing in virtue through BIBL has delivered returns of 18.5%, while investing in vice through ACT has returned 18%. Both thematic ETFs have underperformed the broad market as represented by SPY’s (SPDR S&P 500 ETF Trust) 21.4% returns this year.

Since inception in late 2017, however, BIBL has significantly outperformed ACT, returning 14.4% versus 2.20%—both still underperforming SPY in the same period.

Looking at the past 12 months for yet another picture of performance, BIBL is up 4% versus ACT’s loss of 2.41% during that time.

We have seen similar performance between ACT and BIBL this year after a pattern of underperformance by ACT, and both of them against the broad market. Slicing up the broad market into vice and virtue portfolios in these instances is lagging in returns.