(ETF.com) “This isn't the time in the cycle to take excessive risk. The easy money has already been made.”

These were the words of ETF strategist John Davi, from Astoria Advisors, earlier this year. Now, with the first Federal Reserve rate cut in nearly a decade behind us, global growth still slowing down, a trade war with China still raging on and Brexit unresolved, these words seem to ring as true now as they originally did in February.

Mitigating risk in a portfolio can take many forms. One of the forms Davi has been a big proponent of this year is investing in high quality equity ETFs.

A Better Play Than Low Vol

Some, such as 3D Asset’s Ben Lavine, now say that high quality may even be a better way to play defense than low volatility due to “high valuation, low profitability and interest rate sensitivity” of low vol portfolios. (We’ve seen massive demand this year for low vol funds such as the iShares Edge MSCI Min Vol U.S.A. ETF (USMV).)

The quality factor has indeed been one of the best-performing factors this year. Quality ETFs abound, but each captures this risk premium in a different way.

Consider some of the largest quality ETFs:

- iShares Edge MSCI U.S.A. Quality Factor ETF (QUAL), $10.6 billion in total assets; 0.15% expense ratio

- WisdomTree US Quality Dividend Growth Fund (DGRW), $2.7 billion in total assets; 0.28% expense ratio

- Invesco S&P 500 Quality ETF (SPHQ), $1.4 billion in total assets; 0.15% expense ratio

QUAL, the largest and most popular quality ETF, is also the one that’s taken the lion’s share of net creations in this space—nearly $2.7 billion year to date. By comparison, DGRW has seen $88 million in net inflows, while SPHQ has attracted a modest $22 million so far this year.

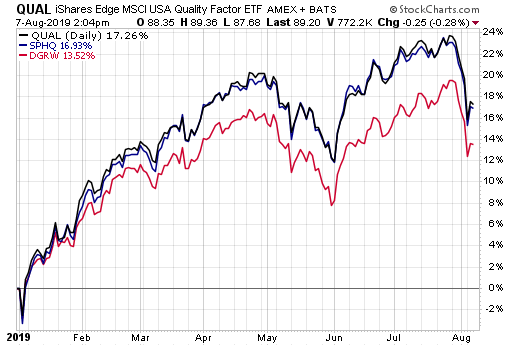

Of these three quality ETFs, QUAL is also the best performing in 2019, delivering roughly 2% more than the S&P 500:

Quality Is Pricey

But owning quality right now is expensive from a valuation perspective, and QUAL is at the top, with a weighted price to earnings ratio (P/E) of about 20.4 (trailing earnings).

That’s cheaper than, say, owning the SPDR S&P 500 ETF Trust (SPY), with weighted P/E of 22, or the super popular iShares Edge MSCI Min Vol U.S.A. ETF (USMV), with a current weighted P/E of 26.5. But it’s loftier than DGRW, with a weighted P/E of 17 (SPHQ has a P/E of 20).

If you are looking to own quality in an ETF, but you are a value investor, chances are QUAL isn’t the best ETF choice for you. The fund’s honed-in focus on quality stocks comes at a hefty price in the form of high valuations.

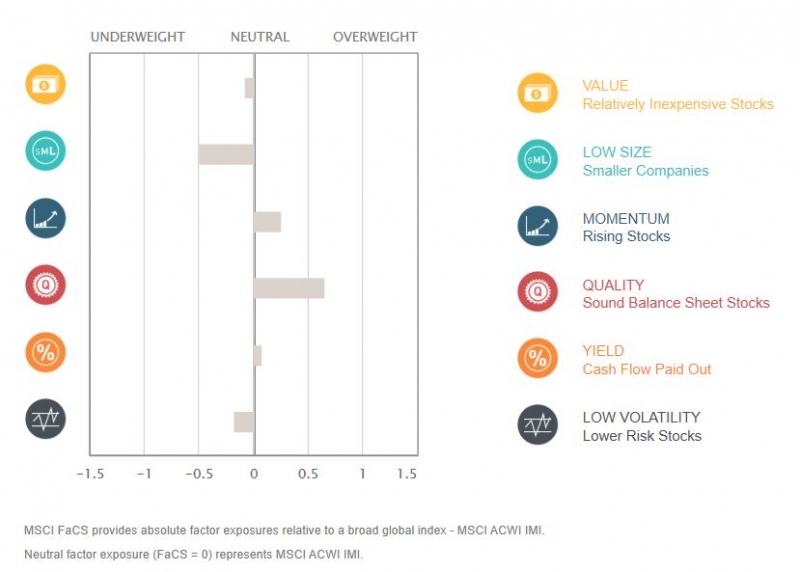

“These quality ETFs are perfect examples of why investors need to look under the hood when examining ETFs,” said Style Analytics’ Managing Director Tom Idzal. “While all three ETFs fall into the ‘quality’ category, when you scratch a bit deeper, they all exhibit very different factor profiles. Investors should know what they are getting along with their quality.”

QUAL: ‘Purest Play’

According to Idzal, QUAL is the “purest quality play” in an ETF wrapper. “You are getting the most quality exposure for your buck,” he said, even if you may be paying top dollar in high valuations for it.

QUAL also has the benefit of being sector neutral, he noted: “Investors aren't getting quality by over- or underweighting specific sector exposures, which may be attractive.”

This ETF looks for higher quality stocks within Global Industry Classification Standard sectors, but doesn’t make active bets in the form of sector tilts or biases. QUAL tracks the MSCI USA Sector Neutral Quality Index.

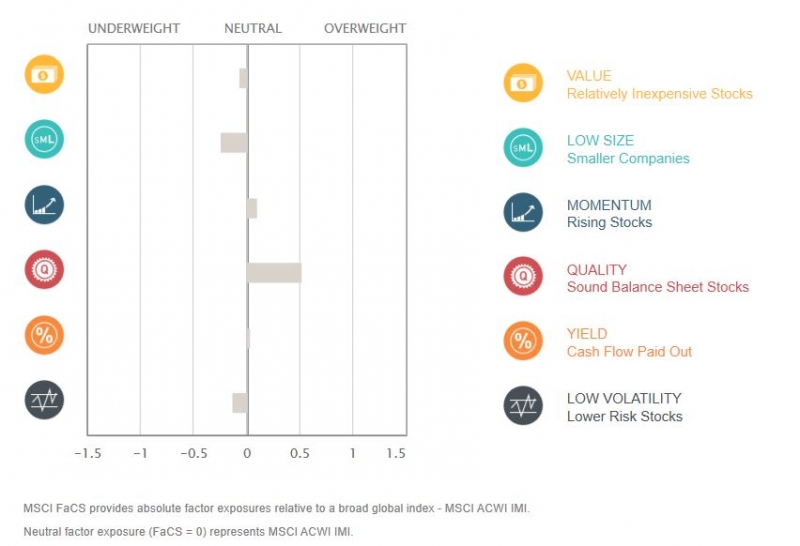

The fund does, however, tilt toward pricier stocks as well as companies of larger market capitalization compared to the MSCI ACWI index. The table below shows factor loading in QUAL relative to the broader index.

QUAL Factor Tilts

DGRW Offers Quality With Dividend Growth Focus

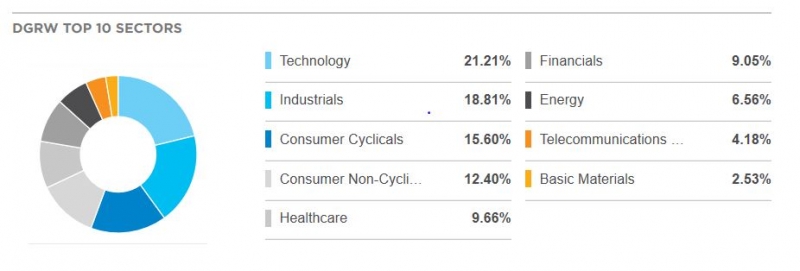

Competing DGRW is a different beast. It too captures quality through metrics such as return on equity (ROE) as well as historical data, but with a focus on dividend growth stocks.

“Not surprisingly, this makes DGRW the most ‘value friendly’ of the three ETFs,” Idzal said.

This dividend focus leads the portfolio into companies of larger market capitalization, and into some notable sector tilts such as consumer stocks and industrials relative to the broader market.

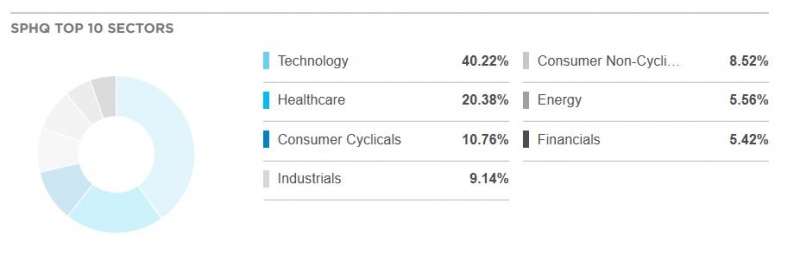

SPHQ’s Big Tech & Health Care Bets

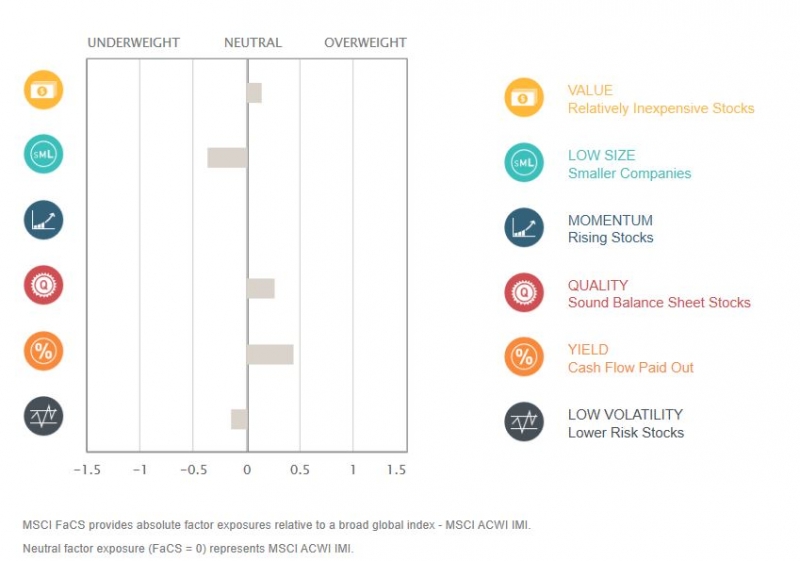

Finally, there’s SPHQ. The fund fishes for high quality names in the S&P 500 pond using three measures: profitability as measured by ROE, earnings quality as measured by lower accruals, and earnings stability as measured by financial leverage. Each stock is given a score based on these metrics, and SPHQ invests only in the top quintile.

Our fund report on SPHQ points out that the methodology could lead to “significant active risk/reward relative to the market,” especially because SPHQ only loosely limits sector weightings—each sector can represent as much as 40% of the portfolio.

The fund may have more easy-on-the-stomach valuations, but its sector tilts can be significant. Consider that 60% of the portfolio is currently tied to two sectors: technology and health care—the best and the second-worst-performing S&P 500 sectors this year, respectively.

In the end, each of these quality ETFs offers a different take on the quality factor. QUAL may be best for purer quality exposure, but it comes with hefty valuations. DGRW offers a strong growth angle at lower valuations, but it’s also the weakest performer of the three this year. And SPHQ brings relatively attractive value for high quality names, but with significant sector overweights. There’s no such thing as a one-size-fits-all quality ETF.

“No one orders just vanilla ice cream anymore,” Idzal said. “People order Madagascar Vanilla, or French Creme vanilla or salted vanilla ice cream. The same goes for quality ETFs—there’s so much more to understand than just quality.”