Bridgewater Associates has laid off several dozen employees across the company this month, an unusually large cut at the world’s largest hedge-fund firm.

As of 2019, the company employed about 1,600 people.

The layoffs impacted Bridgewater’s research department and client-services team as well as among its recruiters. The cuts also affected the firm’s “audit groups” that assess the performance of employees in various departments, and its “core management team” — a management training program conceived by founder Ray Dalio. Bridgewater veterans of more than 15 years were among those laid off in Zoom meetings and given several days’ notice.

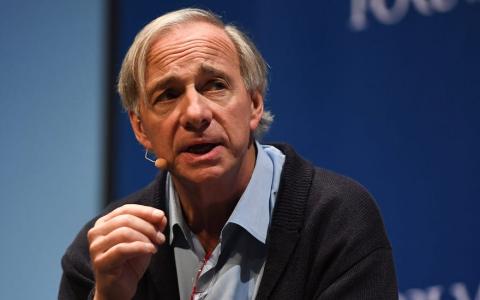

“There’s a trade war, there’s a technology war, there’s a geopolitical war and there could be a capital war — that’s the reality,” Dalio said on Fox’s “Sunday Morning Futures.”

“If you say by law, don’t invest in China or even possibly withholding the payment of bonds that the United States owes payment on in China, these things are possibilities and they have big implications, such as for the value of the dollar because premarket investors are not used to having those things dictated by the government,” he said.

The Bridgewater Associates founder added that these difficult questions had to be “well-addressed” and it was a challenge for the government to get the policy right. The hedge fund firm laid off several dozen employees across the company this month.

The U.S. dollar has slipped in recent months — the ICE U.S. Dollar Index, which measures the currency against a basket of six rivals, reached a 22-month low on Friday and fell lower again on Monday to two-year lows. On March 22, the index hit a more-than-three year intraday high.

When asked whether he was worried about the dollar, Dalio warned the U.S. was its “own worst enemy” and that he was concerned about the “soundness of our money.”

“You can’t continue to run deficits, sell debt or print money rather than be productive and sustain that over a period of time.

“If we don’t work together to do the sound things, to be productive, to earn more than we spend, to build the stability of our currency and build a good balance sheet, we are going to decline,” he added.

Dalio’s hedge-fund firm laid off several dozen employees across the company this month.