The hazard with a three-week vacation is that it gives your office mates time to adapt. By the time you get back they’ve figured out they don’t need you on the payroll.

Covid-19 could deliver analogous misfortunes to certain segments of the economy.

At some point life will get back to normal. But it won’t be the same as before. Some of the temporary adaptations will become permanent. People will prefer them to the old ways of doing business.

Ordered to telecommute, workers will get better technology for home use and get better at using it. When the danger passes, they will wonder why they used to spend so much time and money going to an office. Some will get permission to stay put.

Panicked into cancelling conferences, trade organizations and sales forces will acquire more proficiency in running virtual gatherings. By the time travel restrictions abate, the companies who pay the bills will be having second thoughts. Do we really need to shell out for hotels and air fares?

Shying away from crowded theaters, audiences will invest in 82-inch TV screens. The coronavirus will fade. The QLED 8K from Samsung won’t. It will make a $12 movie ticket into a waste of money.

The short-term effects of the epidemic, like $110 billion in missing airline revenue, are pretty obvious. The long-term effects are more speculative, but still worth thinking about. Here, we’ll look at six elements of the economy where the coronavirus could create lasting winners and losers.

The workplace

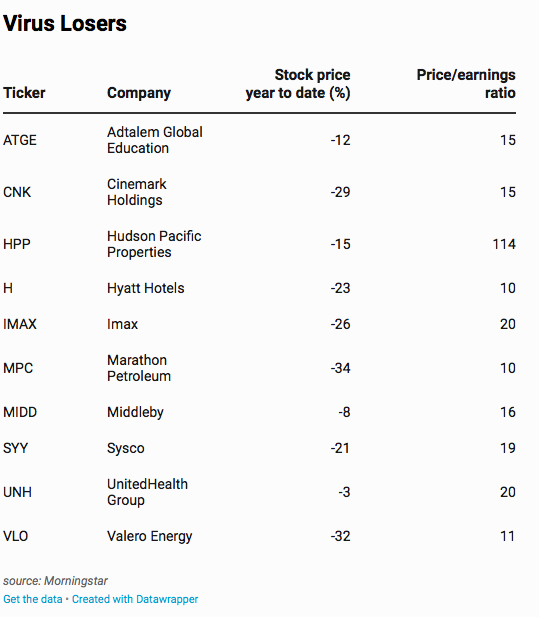

If Amazon or Microsoft can tell employees to work from home, so can a thousand other companies. Telecommuting, if it becomes endemic, would damage real estate investment companies that own office buildings. Hudson Pacific Properties, with a West Coast flavor, is one to avoid.

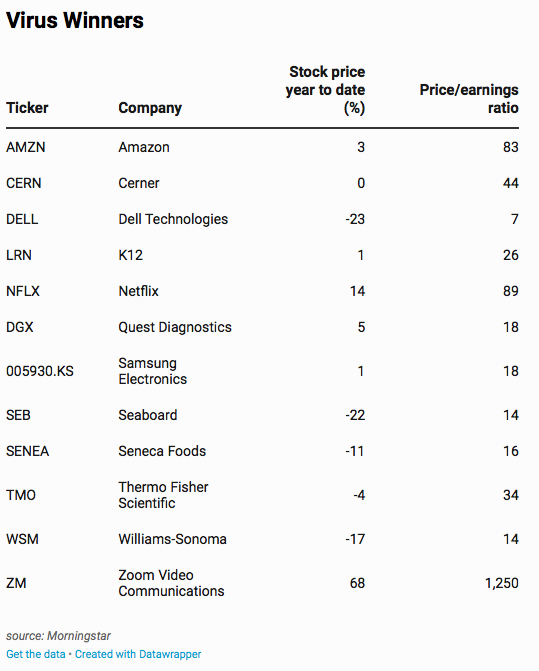

Teleconferencing is an obvious winner, perhaps too obvious to be capitalized on; Zoom Video Communications is already trading at 1,250 times earnings. A more affordable stock: Dell Technologies. It will benefit when employers upgrade the laptops used by remote workers.

Oil, whose price has crashed, will presumably recover as world demand resumes with expanding middle class consumption in India and China. But telecommuting will permanently damage U.S. demand for gasoline. Valero Energy Corp. and Marathon Petroleum Corp. have diminished growth prospects.

Travel

A press release from Hyatt Hotels Corp. says that it is “recognized for catering to business travelers” and offers “superb meeting facilities.” Not good if the post-corona business world decides it’s spending too much on meetings.

Medicine

Epidemiologists will emerge in a post-panic world with more power and more demands for data. Laboratory tests in hospitals and doctor offices will get more elaborate. This will probably be good for American health, and it will definitely be good for lab companies like Quest Diagnostics. Quest will begin Covid testing next week; the company’s long-term payoff will be from broader monitoring for infectious diseases.

As medicine, and medical paperwork, get more complicated, medical software firm Cerner Corp.will benefit.

The epidemic will put enormous financial pressure on hospitals and taxpayers. Apart from any immediate effect via higher claims in 2020, the insurance industry is likely to suffer long-term damage in the form of price controls. Not quite Medicare for All, but a step in that direction and bad for UnitedHealth Group.

The post-Covid 19 world is one with a high level of investment in medical testing equipment and reagents. Thermo Fisher Scientific is a player in this segment.

Food

Sysco Corp. sells food and supplies to restaurants and other gathering places. Its long-term growth trajectory has been bent downward. So has that of Middleby Corp., supplier of food service equipment. But the curve has turned up for Williams-Sonoma, retailer of food preparation gear for the home.

Seaboard Corp. sells food commodities and owns half of the Butterball turkey operation. It should fare well in a world with diminished growth in away-from-home food. So should Seneca Foods Corp., producer of frozen and canned foods.

Entertainment

A year of germophobes shunning crowded places could create a permanent shift in spending away from movie theaters and toward home theaters. That shift was taking place anyway, but the coronavirus will make it bigger. Bad for Imax and Cinemark Holdings. Good for Samsung Electronics, Netflix and Amazon.

Education

When schools close, people get better at creating and using online learning systems. Winner: K12, which delivers software-based educational services. Loser: Adtalem Global Education (formerly DeVry), which has campuses.

This article originally appeared on Forbes.