With such paltry yields available in global fixed income markets, and with governments trying to pump up the world economy by running massive fiscal deficits, it is understandable why investors are turning to the commodities markets as a store of wealth.

Over the last few months, gold has made a new all-time high, oil appears to have bottomed, and a restart of the global economy could lead to a more robust demand for industrial metals like copper. Commodities often do better when investors experience or anticipate rising inflation. It may indeed be time to own commodities, but investors need to pay attention to how they get their exposure. An allocation to a generic commodity index can be very costly in terms of negative carry.

Unless you have a home with a vault to store gold or silver, a concrete silo in the backyard that can store thousands of bushels of wheat, or a basement that hold dozens of barrels of oil, you are probably going to get your commodity exposure from a mutual fund or ETF. These funds, in turn, will likely own futures contracts, not physical commodities. Futures can be an effective way to play the asset class, but trading futures comes with a cost. It’s called the “roll cost.” Investors who buy futures do not want to take physical delivery, so they roll them from one contract to the next before they expire. The fact that the oil traded a price of negative $37 per barrel in April highlights the difficulty in taking delivery and storing commodities like oil. It also demonstrates how extreme the roll cost can get.

The economic drag of rolling futures depends on a variety of factors, one of which is the cost of storage. Operating a grain silo to hold your wheat, for example, can be expensive. Such charges are built into the futures roll. Another factor is the price of money. Short-term interest rates are relevant because futures offer substantial leverage, minimizing the outlay of cash. Finally, supply and demand imbalances also determine the difference between current and forward prices along the futures curve. The table below shows the percentage difference in price between current commodity prices and the price in one year:

As you can see, today’s prices for all the major commodities are much lower than forward prices. Lean Hogs are almost 50% more expensive if you buy them twelve months forward compared to just one month forward. In other words, you would need the current price of Lean Hogs to rise by 50% just to break even. The upward-sloping shape of prices, or contango, is not as extreme in other commodity markets as it is in Lean Hogs. Yet it is still present in the major commodities that dominate most passive indices. Oil, gas, and even gold are all in contango. These roll costs are real and will impact returns.

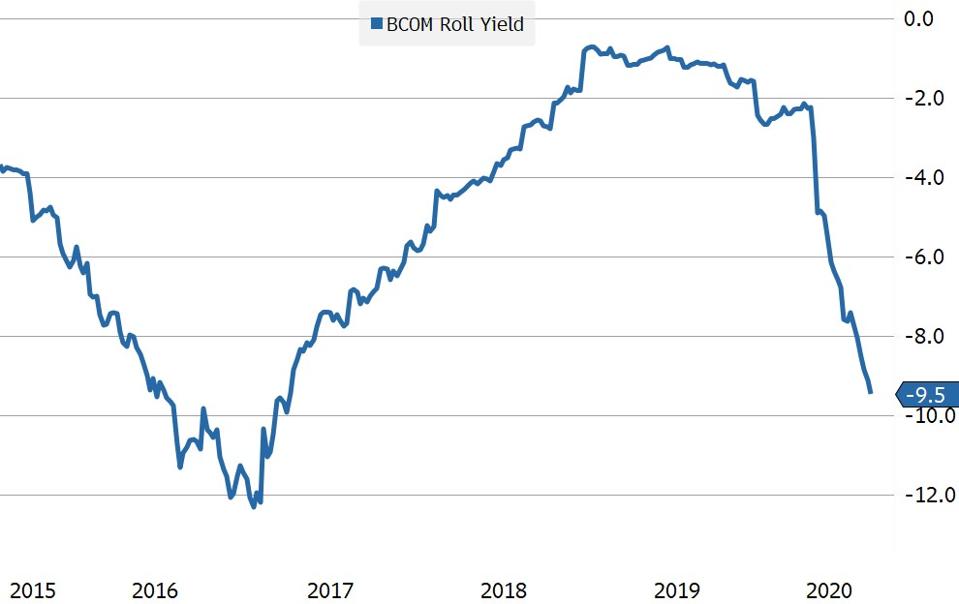

The chart below shows the difference between the one-year trailing return of the Bloomberg Commodity Total Return Index and the Bloomberg Commodity Spot Index. The total return index incorporates the cost of rolling futures contracts, whereas the spot index looks at the change in spot prices over one year. Over the last twelve months, the total return index has under-performed the spot index by 9.5%. That is the roll cost.

Commodities may be a good investment, and spot prices may move higher as the economy recovers and investors seek shelter from the rise in public debt and the rapid “money printing” that is taking place around the world. A movement in the price today does not necessarily translate to a profit when you are trading futures. You need forward prices to move higher to make money, and most of the time, those prices are already much higher.

There are dozens of commodity-based mutual funds and ETFs, all deploying various strategies to minimize the futures roll cost. Some purchase a combination of near and deferred contracts, and some use sophisticated models to optimize the most efficient point on the curve to minimize the negative roll. These trading tactics may reduce the impact of rolling futures rolls, but rarely eliminate the cost.

One reason investors are flocking to the commodities markets is that there is almost no yield left in traditional fixed income markets. Ten-year nominal bond yields at 0.5% don’t cut it for investors looking to earn a decent inflation-adjusted return. The carry in most commodities, though, is significantly more negative. The hidden cost of holding a position can be high, requiring significant moves in spot prices to offset the higher forward values embedded in the futures market. Be careful.

This article originally appeared on Forbes.