(AssetMark) Whether you’re an employee at a wirehouse or a registered representative of an independent broker-dealer (IBD), you’ve decided that it’s time for the next stage in your career: You’re going to transition into a registered investment advisor.

It’s a big step, but for advisors that value independence, it can be the right move. Let’s dive into the whys and hows of this transition.

Why Advisors Are Going Independent

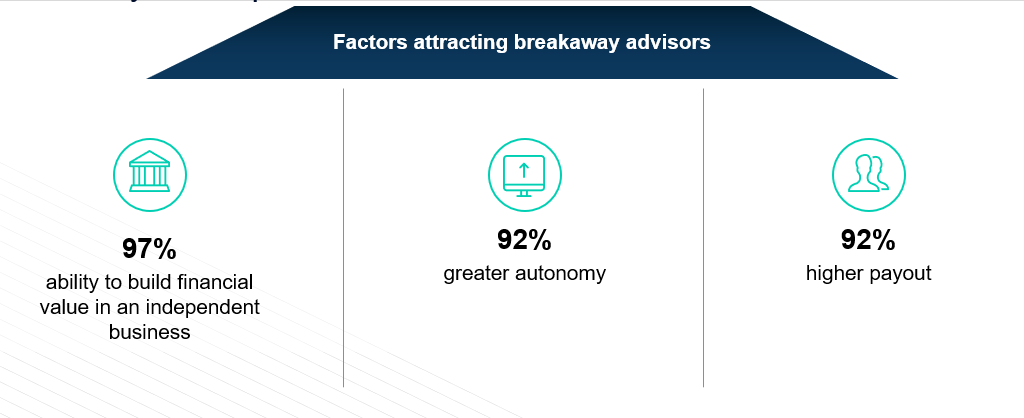

According to a Cerulli Associates study, three factors are attracting advisors to independence and away from their broker-dealers.

92 percent of advisors reported they were interested in transitioning in order to increase their earnings. This finding should come as no surprise—so long as an advisor’s broker-dealer takes a fee, some advisors are going to wonder whether that missing 10 or 15 percent is truly justified, or if they could do more with that percentage at their own business.

Another 92 percent reported they were interested in learning how to become a registered investment advisor for greater autonomy. While working at a wirehouse as an employee obviously restricts the kinds of service an advisor can provide, even IBD-registered representatives are limited to using the technology and platform provided by their IBD. In either case, advisors might wonder whether they could do more for their clients if they had the freedom to dictate how they deliver value.

Lastly, 97 percent of advisors reported that they wanted to build financial value in an independent business. While this statistic reflects the recurring theme that advisors looking to go independent do so for the economic benefits, it also reflects a deeper, more entrepreneurial desire.

For many advisors, the process of building up one’s own business and seeing it succeed can be deeply satisfying. Importantly, this desire is the one thing a wirehouse or IBD can’t fully solve for—broker-dealers can increase salaries, reduce their fees, help attract and assign more clients, all of which would increase a wirehouse- or IBD-affiliated advisor’s income. But they can’t give advisors the satisfaction of running a successful business venture.

The Fears Rarely Materialize

Source: Fidelity Institutional Insights 2020 Advisor Movement Study

As attractive as the economic benefits and autonomy of independence are, the majority of pre-transition advisors feel hindered by the anxiety of the unknown.

According to a Fidelity Institutional Insights 2020 Advisor Movement Study, over a quarter of breakaway advisors felt that none of their initial concerns ended up being an issue. From the data above, we can also gather that the severity of the concerns was greatly diminished after taking the leap. Compared to the 49% of people. For 89% of post-transition advisors, transition cost concerns and risk simply did not materialize.

How to Become a Registered Investment Advisor: Key Factors to Keep in Mind

The exact process of exiting from your broker-dealer will depend on whether you’re working for a wirehouse or a registered advisor with an IBD. However, there are some common concerns you’ll want to keep in mind no matter where you are in your advisor journey.

Unsure which of The Six RIA Essentials to prioritize? Click here to receive a free custom-built report for you and your needs.

Compliance Must Be Top of Mind

Before you take any steps towards independence, it is essential that you review your contract with your broker-dealer, their protocol, and all other legal documents related to your relationship with them. Don’t do this yourself, either; get in touch with a law firm with experience in supporting advisors during their transition.

If this step isn’t conducted thoroughly and correctly, you could find yourself in the situation where everything is in place for you to transition, only for your broker-dealer to send you a cease-and-desist letter. You won’t be able to bring your clients along with you, and the broker-dealer will simply reassign them to another advisor in their roster. Once the legal issues are ironed out, you might be able to ask some of those clients to come to your new practice, or you might not; in either case, you’ll have lost a fair chunk of your client base and will have to start at square one.

Building a Tech Stack Takes Time and Expertise

One of the biggest benefits that comes with working with a broker-dealer is that they provide all or most of the tech you need to get through the day-to-day as an advisor. There are planning systems, performance reporting systems, DocuSign software, investment management portals, and the dozens of other sophisticated tools that modern financial advisors depend upon to deliver their services.

If you’re trying to figure out how to become a registered investment advisor, this serves as a good example of how your role is going to expand beyond the provision of financial advice. Going independent means that you need to evaluate all of these different systems yourself, make sure that they work together yourself, and implement them yourself—or otherwise hire an expert to take care of that work for you.

What’s more, all of this needs to be in place and working before you launch your business. For the clients that you bring with you from your broker-dealer, it’s important that they have the same or better digital experience with you as a registered investment advisor.

Be prepared: your role is going to expand beyond the provision of financial advice.

Get an Early Start at Marketing and Branding

For advisors working as IBD-registered representatives, you’ll already have developed a brand of some sort, and your clients will recognize you as an independent entity. For advisors looking to move on from being an employee of a broker-dealer, however, you’ll need to start building your brand from the ground up. In either case, this transition is the best time to level up your branding.

Broker-dealer employees that are curious about how to become a registered investment advisor will need to construct a particularly robust brand presence. In effect, they’re asking clients of potentially a large and reputable wirehouse to leave and entrust their assets to another entity they’ve never heard of. If that entity has a polished website, social media presence, content addressing common investor concerns, and other brand-building collateral, then they’ll feel much better about making the switch.

Advisors thinking about leaving their IBD should also invest in elevating their brand. Not only is it just a good thing for any business owner to do with regularity, but they’re also putting their clients through a transition period.

Clients will recognize that their advisor’s platform has changed, and they may experience friction as you get used to independence. A stronger brand can go a long way to smoothing these bumps over—consider elevating your outreach and proactively talking about some of the changes clients can expect and why this transition is in their best interests. And if you do lose some clients during the switch, a stronger brand will make it easier for you to prospect for new clients.

Consider What You’ll Do With Your Commissionable Business

Whether you’re an employee or an IBD-registered representative, it’s likely that you’ll have some commission-based business in your portfolio. But if you’re deciding to become a pure registered investment advisor, then you’ll have to drop your FINRA license and will no longer be eligible to conduct commissions-based business.

There are a few different avenues you can take when deciding what to do with your commission-based business. You can:

- Sell that business to an advisor with a FINRA license

- Simply choose to leave it with the broker-dealer you’re exiting from

- Affiliate with a broker-dealer that’s friendly toward registered investment advisors and park those assets with them

There’s no right or wrong approach here, but deciding what to do with this legacy business is something you’ll need to consider before making the switch.

Find a Balance Between Being a Business Owner and a Financial Advisor

Some advisors that are curious about how to become a registered investment advisor merely think of it as transitioning into a new role rather than becoming a business owner.

The reality is that being a registered investment advisor requires a lot of work that falls outside of a financial advisors’ core skillset. Things like marketing or building a tech stack can be a challenge—for some advisors, it’s a welcome one; others merely want to provide financial advice in a manner of their choosing.

In this article, we talked about key factors to consider when making the transition to a registered investment advisor. Once you do make that transition, however, you need to be prepared to balance the concerns of your new business with those of your clients.

That’s why the team at AssetMark has put together their insights into the business of being a registered investment advisor in our new eBook. We’re calling it An RIA’s Guide to Business Growth: What’s Getting in the Way? Read through it when as you prepare to make your transition away from your broker-dealer, and you’ll hit the ground running in your new venture.