(ETF Trends) -- More than ever before, investors are faced with a plethora of options when it comes to the bond market, especially with the advent of fixed income ETFs.

As investors are well aware after last year, volatility makes for a challenging environment in the equities market, but a safe-haven move to the fixed income market also poses its own challenges.

With the fixed income market going through its own growing pains, investors need to know where the growth lies and how to position their portfolios to capitalize on these forthcoming changes outlined in the latest “In The Know” update.

Douglas Yones, Head of Exchange Traded Products at the New York Stock Exchange, is a firsthand witness to the ever-changing fixed income ETF market and is keen on where the space is heading in 2019 as well as beyond.

“One of the biggest areas of growth really has been around fixed income,” said Yones.

“Advisors are using ETF solutions for their fixed income bucket in a portfolio more than we’ve really seen ever before, and as a result, product developers are now putting more and unique strategies in an ETF wrapper that maybe historically you could only get via mutual funds.”

The Liquidity Advantage of Fixed Income ETFs

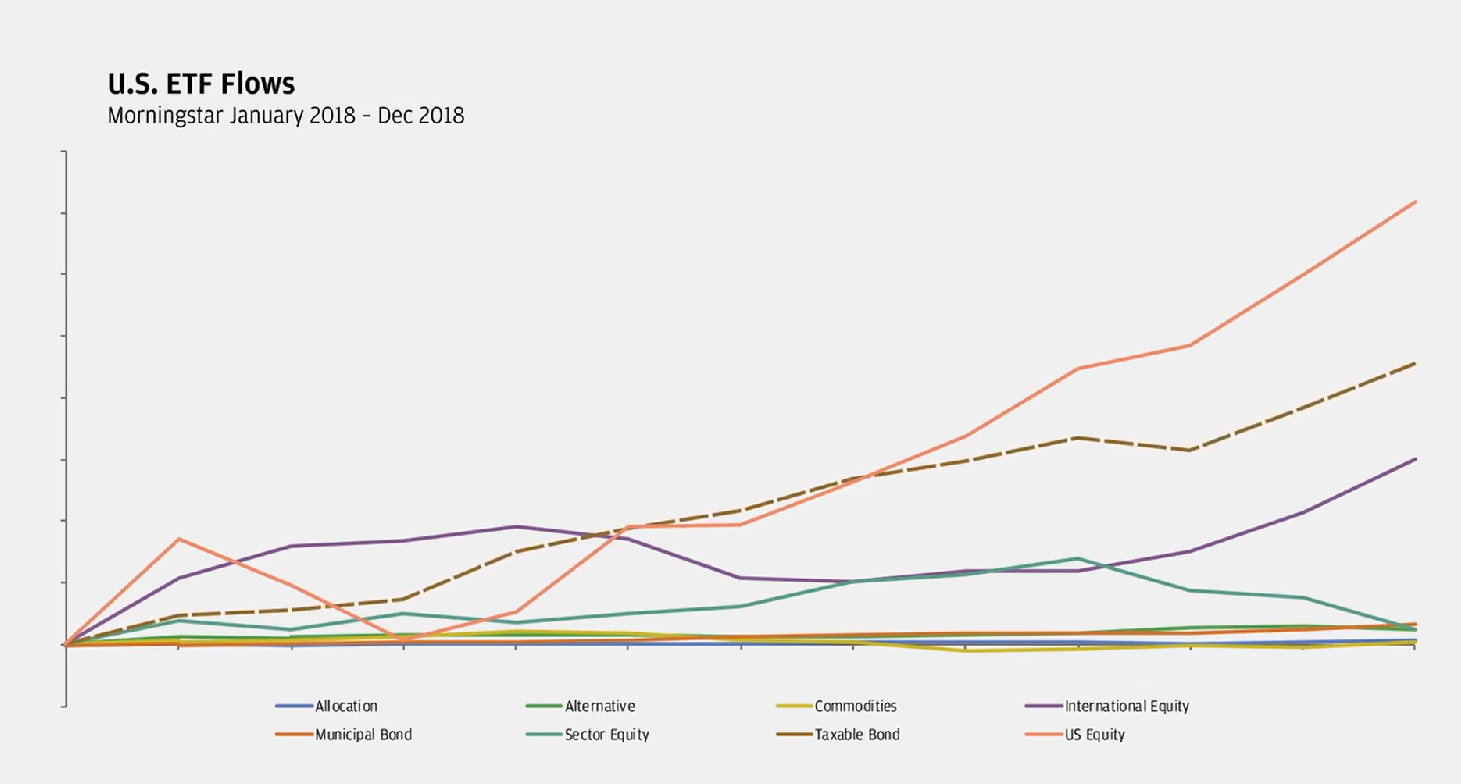

The move to bonds, particularly of the short duration variety, in 2018 was seen as a defensive move to hedge further rate risk after four increases in the federal funds rate by the central bank.

Despite the Fed taking on a more dovish tone as it preaches more patience with respect to interest rate policy in 2019, investors are still opting for more exposure to fixed income.

As such, this has resulted in more positive flows for the fixed income ETF space.

However, neophyte fixed income investors must be aware of the nuances before entering into this unique space with plentiful opportunities. One preconceived notion to dismiss is that fixed-income ETFs are similar top-to-bottom compared to equity ETFs.

One might think all ETFs are created equal, but that simply isn’t the case.

“The short answer is no–an ETF is an ETF and when I say it I mean it’s an exchange-traded fund,” said Yones.

“These are funds, right? And like a mutual fund, they got these unique benefits that we’ve always talked about–the wrapper, the creation, the redemption, but what people forget is that ETFs have this nice layer of liquidity.”

One of the inherent benefits of an ETF is its ability to be bought and sold quickly like individual stocks.

With more capital flowing into ETFs, this just creates more liquidity and adds to the investment vehicle’s flexibility for all types of investors–whether they are of the long-term, buy-and-hold variety or the short-term trader.

Depending on the liquidity of the ETF, traders can enter and exit ETF positions quickly. Mutual funds simply can’t be traded at the requisite speed of ETFs that short-term traders desire–especially when trading fixed income.

“Shares are created. Yes, bonds are moved during the creation process, but then they’re out in the market, and there’s this extra layer that’s now been added. You and I can trade with each other,” Yones said.

Furthermore, in addition to the extra layer liquidity, ETFs will also have tax advantages built in.

The ETF is often praised for their tax efficiency since they use an in-kind exchange with an authorized participant, which means an ETF manager uses an exchange to sell the basket of stocks in a fund.

This allows the authorized participant to shoulder the impact of capital gains taxes while a mutual fund must sell stocks in order to cover redemptions.

This creates a scenario where the fund pays capital gains taxes that are passed on to the investor.

“We’ve already talked about the fact that a fixed income as adds an extra layer of liquidity. They add a nice tax efficiency where the creation redemptions can help to remove some tax ability on the fund structure,” Yones added.

More Price Transparency Via ETFs

Just like it’s important for a stock investor to know a company’s fundamentals, such as its revenue, earnings and expenses, an ETF investor wants to know what holdings that particular fund comprises.

Key regulations that govern mutual funds–the Investment Act of 1940, the Securities Act of 1933 and the Securities Act of 1934–require mutual funds to disclose their holdings on a quarterly or monthly basis.

In between those reporting periods, the roster of companies the mutual funds invests in could have changed dramatically given the current market conditions and goals of the fund.

Compare this to ETFs, which provide daily disclosure so the investor knows which holdings the fund has, giving it an added layer of transparency over mutual funds. This also applies to prices where ETF investors can simply obtain accurate pricing from the exchange where the ETF trades.

“They (ETFs) provide intraday pricing,” said Yones. “You know one of the things we don’t always talk about anymore with ETFs is when the markets are volatile like we saw in the 4th quarter and people do want to express the ability to get into or out of the markets intraday, when we’re seeing intraday swings, the ETF allows for that, versus a fixed income mutual fund where you’re really just buying a NAV at the end of the day.”

At the New York Stock Exchange, the focus is on more transparency and expediency, such as the publishing of closing prices.

The NYSE is using the help of mathematical algorithms so that investors and issuers alike know the exact price of an ETF at a specific time.

“Now we get an ETF and we’ve got a basket of bonds trading real time, pricing real time on our screen,” Yones said.

“We know exactly what it’s worth. So a lot of times in the industry we’ll say, ‘Boy, ETFs have actually created transparency in what was really an opaque market.'”