(Forbes) The U.S. Bureau of Labor Statistics reported today that the consumer price index (CPI) has increased by 0.1% for August, after rising 0.3% in July. Here’s what that means for taxpayers in 2020, together with a first look at predicted rates for the next year as calculated by Bloomberg Tax & Accounting.

The CPI measures the cost of goods and services—in other words, your cost of living. Under the Tax Cuts And Jobs Act (TCJA), the Internal Revenue Service (IRS) now figures cost-of-living adjustments using a “chained” CPI. The chained CPI measures consumer responses to higher prices rather than merely measuring the higher prices. What that means for taxpayers is that inflation adjustments will appear smaller: Most inflation-adjusted amounts, including the threshold dollar amounts for tax rate brackets, are projected to rise by less than 1.5% in 2020.

(You can find some examples of how the chained CPI works here.)

“We are projecting smaller increases for most inflation-adjusted amounts this year, as we expected, due in part to the use of the chained CPI to measure cost of living adjustments, and partly due to the slower rise in inflation overall,” said Annabelle Gibson, practice lead for U.S. income tax and IRS procedure, Bloomberg Tax & Accounting. “Our projections help taxpayers and tax planners get a jumpstart on the 2020 tax planning season in advance of the Internal Revenue Service’s publication of official 2020 inflation-adjusted amounts later this fall.”

Following are projected numbers for the tax year 2020, beginning January 1, 2020. These are not the tax rates and other numbers for 2019 (you'll find the official 2019 tax rates here).

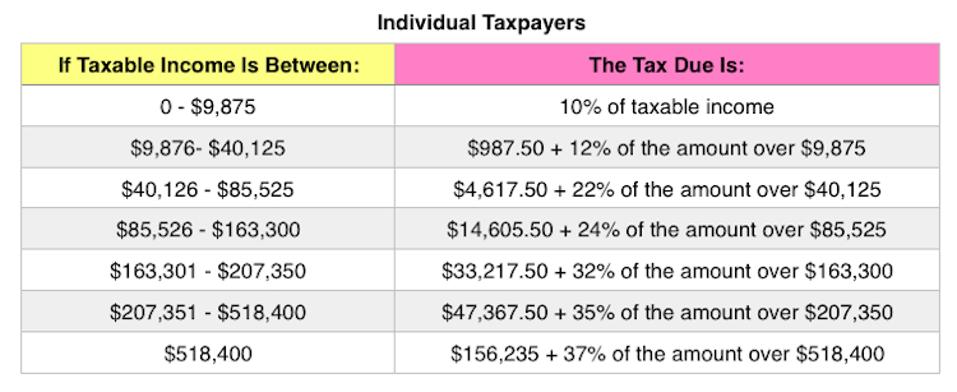

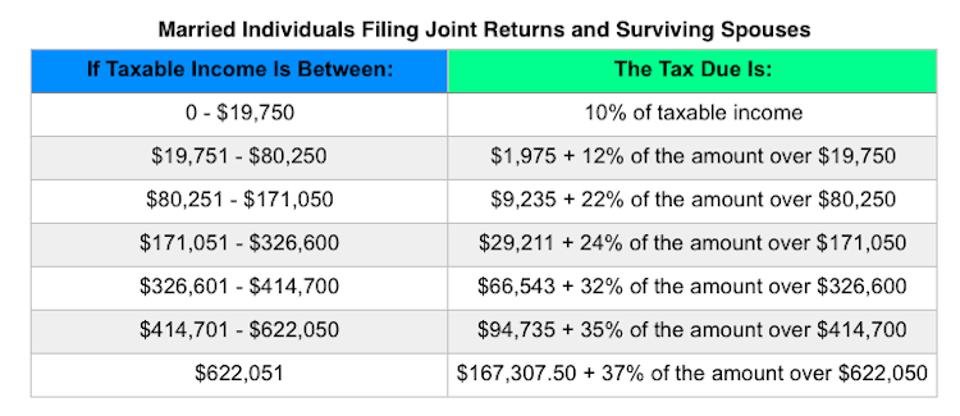

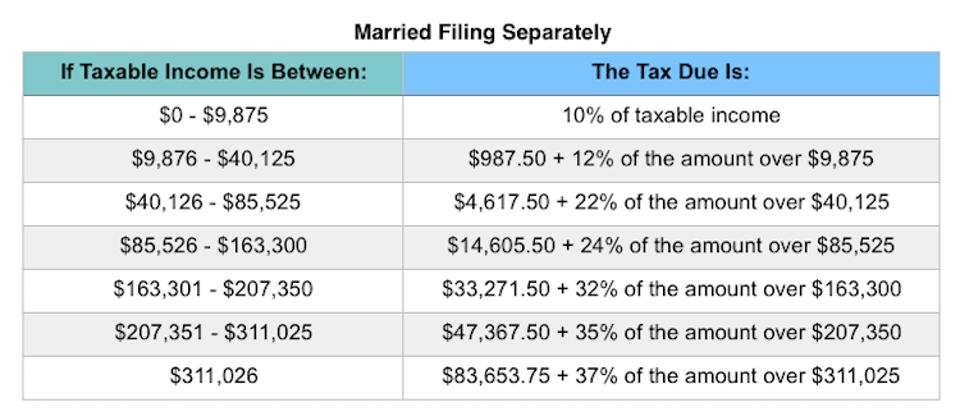

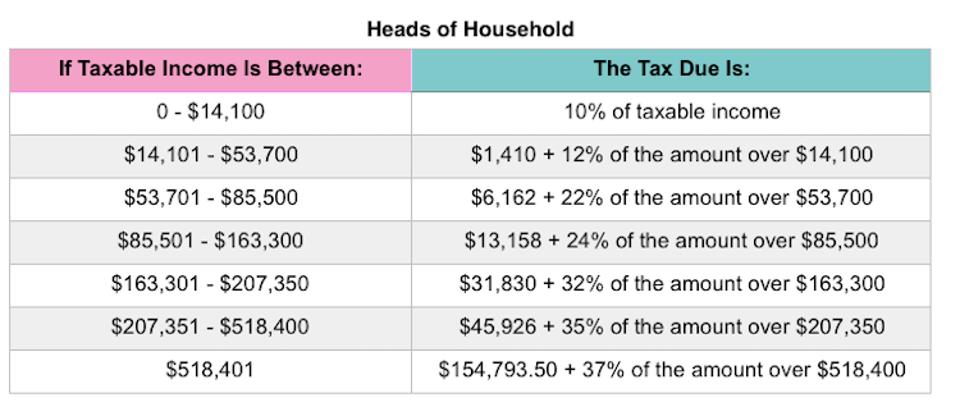

Tax Brackets

Here are what the rates are expected to look like in 2020:

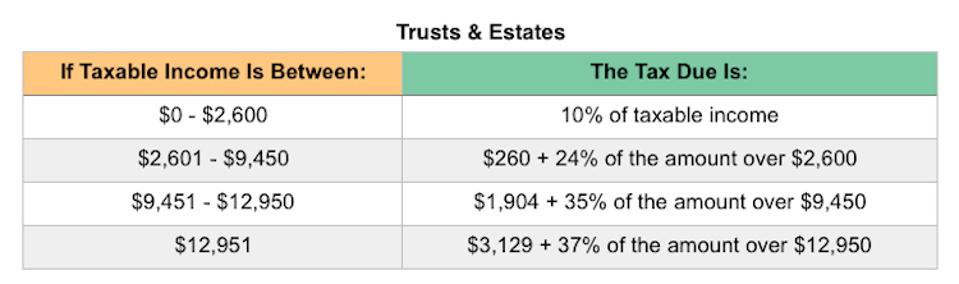

KPE

KPE

KPE

KPE

KPE

KPE

KPE

KPE

KPE

KPE

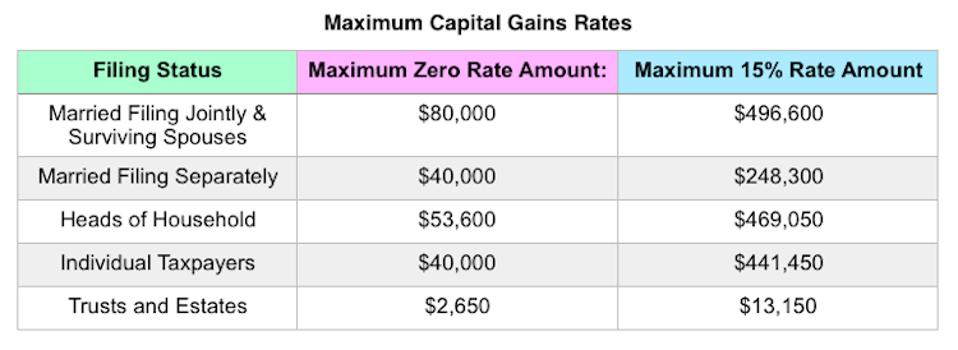

Capital Gains

Capital gains rates will not change for 2020, but the brackets for the rates will change. Most taxpayers pay a maximum 15% rate, but a 20% tax rate applies to the extent that taxable income exceeds the thresholds set for the 37% ordinary tax rate. Exceptions also apply for art, collectibles and section 1250 gain (related to depreciation).

Bloomberg Tax anticipates that the maximum zero rate amounts and maximum 15% rate amounts will break down as follows:

KPE

KPE

Personal Exemption Amounts

As part of the TCJA, there are no personal exemption amounts for 2020. Personal exemptions used to decrease your taxable income before you determined the tax due. You were generally allowed one exemption for yourself (unless you could be claimed as a dependent by another taxpayer), one exemption for your spouse if you filed a joint return and one personal exemption for each of your dependents—but that's no longer the case. (For more on what’s changed under the TCJA, click here.)

For purposes of the definition of a qualifying relative, the exemption amount is projected to be $4,250 ($4,300). The first amount, $4,250, is the amount that Bloomberg Tax believes is the literal application of the applicable IRC provision, but the amount in parentheses is the amount they expect the IRS to publish. (For more on IRS guidelines on qualifying relatives for purposes of the expanded child tax credit, click here.)

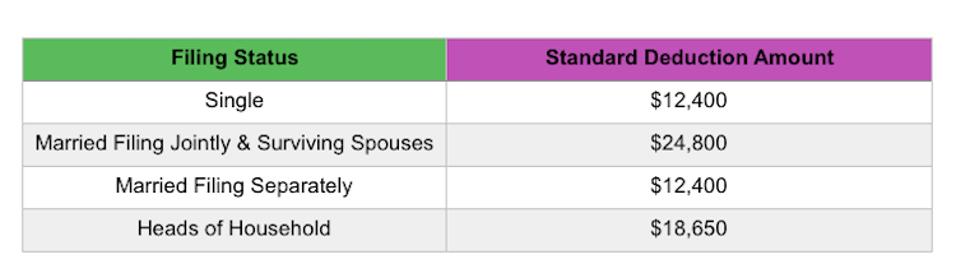

Standard Deduction

As part of the TCJA, the amount of the standard deduction doubled for most taxpayers in 2018. With inflation, those amounts remain the same for most taxpayers next year. Here are the projected standard deduction amounts for 2020:

KPE

KPE

Also, for 2020, it’s predicted that the standard deduction for an individual who may be claimed as a dependent by another taxpayer will not be more than:

- $1,100, or

- the sum of $350 plus the individual’s earned income.

The additional standard deduction amount for the aged or the blind will be $1,350. The additional standard deduction amount will increase to $1,650 if the individual is also unmarried and not a surviving spouse.

For those high-income taxpayers who itemize their deductions, the Pease limitations, named after former Representative Don Pease (D-OH) used to cap or phase out certain deductions. However, as a result of the TCJA, there are no Pease limitations in 2020 (though there are rumblings in Congress about changing that—click here for more).

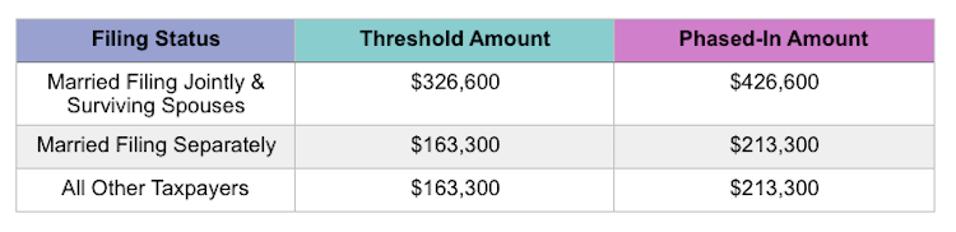

Section 199A deduction (also called the pass-through deduction)

As part of the TCJA, sole proprietors and owners of pass-through businesses are eligible for a deduction of up to 20% to bring the tax rate lower for qualified business income. The deduction is subject to threshold and phased-in amounts. For 2020, those amounts will look like this:

KPE

KPE

(For more on the pass-through deduction, click here.)

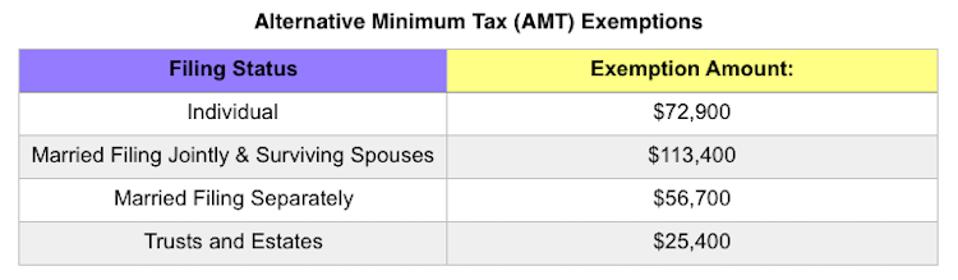

Alternative Minimum Tax (AMT)

The AMT exemption rate is also subject to inflation. Bloomberg Tax anticipates that the exemption amounts will look like this in 2020:

KPE

KPE

Kiddie Tax

For 2020, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,100 or the sum of $350 and the individual’s earned income (not to exceed the regular standard deduction amount).

Under the TCJA, your child must pay taxes on their unearned income, but if that amount is more than $1,100, but less than $11,000, you may be able to elect to include that income on your return rather than file a separate return for your child.

(For more on the kiddie tax, click here.)

Federal Estate Tax Exclusion

The federal estate tax exclusion for decedents dying will increase to $11.58 million per person or $23.16 million per married couple.

Gift Tax Exclusion

The annual exclusion for federal gift tax purposes will remain at $15,000 in 2020. That means that you can gift $15,000 per person to as many people as you want with no federal gift tax consequences in 2019; if you split gifts with your spouse, that total is $30,000 per person.

—

This should be enough to get you started for 2020 tax planning. You may need to do a withholding checkup to make sure that you’re on track before the new year.

Remember that these are just projections. The Internal Revenue Service (IRS) will publish the official tax brackets and other tax numbers for 2020 later this year, likely in October.