Another tweet sent the markets into upheaval. This time it was the announcement from President Donald Trump that his side will end negotiations on fiscal stimulus. Granted, it wasn’t clear that idea ever had much support in the Republican-controlled U.S. Senate in the first place. The Dow Jones Industrial Average ended 375 points lower on Tuesday, and the Nasdaq Composite dropped to 7% below its record close.

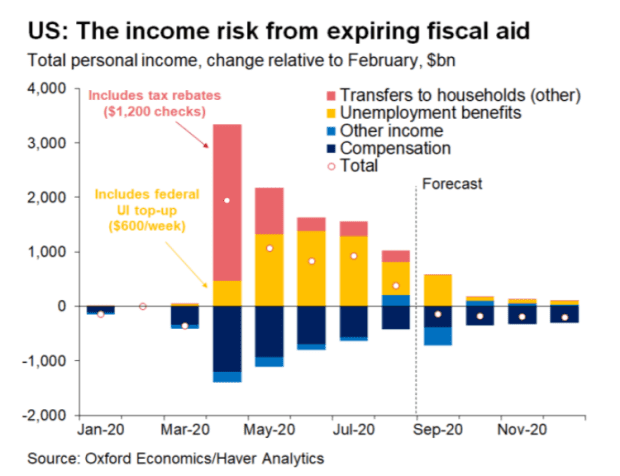

Gregory Daco, chief U.S. economist at Oxford Economics, said the move could be a watershed moment for the world’s largest economy. Yes, consumer spending held up after the expiration of the $600 weekly federal unemployment benefits at the end of July. But that is because of the savings that had been built up during the spring and summer, thanks in part to those benefits, as well as the inability to go out to shops and spend.

The end of the five-week Lost Wages Supplemental Payment Assistance program — that’s Trump’s executive order giving $300 a week in extra aid, when states match it with $100 — will create an income “cliff” valued at roughly $600 billion annualized, Daco says.

“Without faster job growth — unlikely at this stage of the recovery — or increased fiscal aid, households, businesses and state and local governments will be increasingly susceptible to a deterioration of the health situation,” he says. The drag to gross domestic product, when coupled with the lack of support to businesses, and state and local governments, will be 1.5%, with the fourth quarter approaching “stall speed,” he says. That is perilous on the eve of flu and election season.

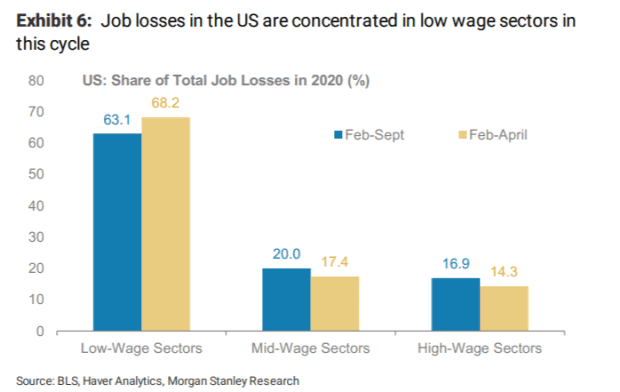

Morgan Stanley’s global economics team is more upbeat, saying the world economic recovery will continue, if moderate, through the winter. The team bluntly notes the unemployment during the pandemic has been focused on low-wage industries. At the peak in April, 68% of all employment losses were concentrated in low-wage industries, which accounted for only 43% of pre-COVID payrolls in February.

It also says that the hit from the pandemic to state and local government finances hasn’t been as severe as anticipated. “States have not shifted into full-on austerity mode for now because they are able to use reserve funds, and they are still deploying federal aid that was provided under the [Coronavirus Aid, Relief, and Economic Security Act],” the Morgan Stanley team notes.

What does that mean for the market? Julian Emanuel, chief equity and derivatives strategist at BTIG, said Tuesday’s events open up the potential for downside to the S&P 500’s 200-day moving average of 3,113 (which would be a 7% drop).

“While weakness between now and Inauguration Day (1/20/21) is likely a buying opportunity — with low rates, eventual further stimulus and medical progress on the virus supportive elements for 2021 — we are reminded that in a period of elevated volatility and uncertainty that the long run is made up of a series of short runs which are frequently gut-wrenching,” he said.

This article originally appeared on MarketWatch.