(Bloomberg) - While this week’s bank-stock drama blindsided most of the market, at least one corner of Wall Street spied trouble ahead.

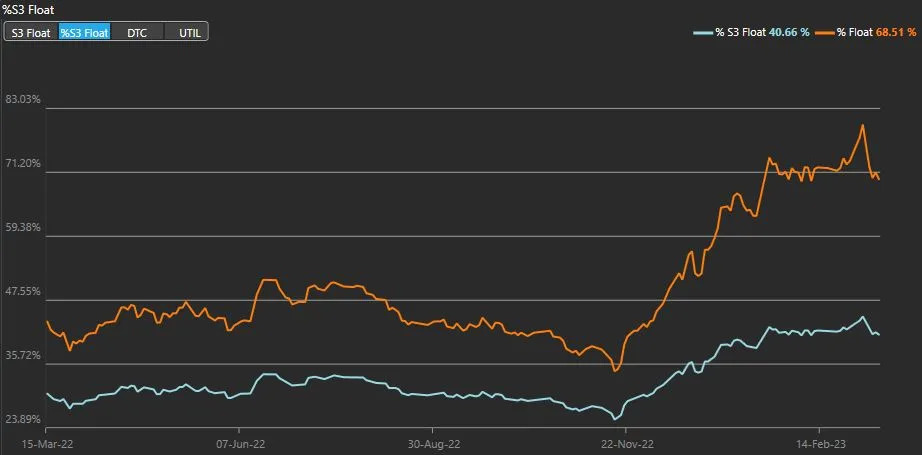

Short sellers pushed bearish interest in the $2.2 billion SPDR S&P Regional Banking ETF (ticker KRE) gradually higher for weeks before it peaked at about 78% of shares outstanding on March 3, according to data from analytics firm S3 Partners. That was the highest level in at least a year.

Bets against regional banks have been winners as concerns about balance sheets started rippling through the financial system. The fund, the largest ETF tracking regional banks, has dropped almost 15% in the past week — Thursday’s slide was its worst since June 2020 — after Silicon Valley-based SVB Financial Group was forced to unload bonds to raise cash.

But while those bets show at least some smart-money investors were out front of the selloff, it’s also clear much of Wall Street was taken by surprise. Shares of regional banks were up more than 8% on the year as recently as a week ago even as evidence built that surging money rates were pressuring bank deposits and the bonds that back them.

Data compiled by Bloomberg show aggregate share-price forecasts for all manner of financial institutions envision upside of more than 20%, and 2023 earnings estimates for the group are among the strongest in the S&P 500. Mutual fund managers have been flocking to them.

“I don’t think investors had given much thought to the degree that bank balance sheets can be a mess as the result of the moves in rates,” said Steve Sosnick, chief strategist at Interactive Brokers. “We all know that bank balance sheets are chock full of illiquid assets. That’s their business model. It was stunning to see how much of a haircut they had to take on their liquid assets.”

Bad news from SVB Financial and another small American bank, Silvergate Capital Corp., sparked the rout. First, Silvergate announced plans to wind down operations and liquidate after it was caught in the crypto industry meltdown. Then SVB said it needed to shore-up its liquidity, catching the market off-guard and causing Thursday’s panic.

“While banks are quite resilient, given regulatory changes since the GFC, the market is starting to sniff out that banks will have to really hike rates on deposits, which has the potential to crimp earnings,” said Steve Chiavarone, senior portfolio manager and head of multi-asset solutions at Federated Hermes.

On the other hand, the reason few on Wall Street highlighted bank stress as a key equity risk may be simply that the risk is a long shot. Extrapolating SVB’s woes to the broader financial system strikes some as dubious considering how little it resembles most other banks. The investment portfolio it’s selling off, for instance, had risen to 57% of its total assets. No other competitor among 74 major US banks had more than 42%.

Regulators, at least, saw the potential for some trouble for banks. The risk depositors would seek greener pastures as money rates jumped was highlighted in a November blog post by Carl White, an official at the Federal Reserve Bank of St. Louis. While higher rates often aid lenders by buttressing interest income, he noted, some institutions were by then already seeing deposits decline as customers took out funds to cover expenses or seek higher yields elsewhere.

“The industry’s lack of recent experience with rising and more volatile interest rates, coupled with material levels of market uncertainty, presents challenges for all banks, regardless of size or complexity,” he wrote.

KRE fell 2.6% as of 10:58 a.m. in New York. First Republic Bank sank more than 15% at the open before it was halted, leading declines among S&P 500-listed lenders. JPMorgan Chase & Co. edged higher, while losses at other major Wall Street banks were muted.

Short interest in the ETF has retreated slightly as the price has dropped, though bearish traders continue to bet against the fund. Thursday data showed the fund’s put-call ratio by volume — a measure of how many bearish options are trading versus bullish ones — leaped to the highest among US ETFs.

“The short interest jumps and put/call ratios reflect anxiety and panic,” said Todd Sohn, ETF strategist at Strategas Securities. “We can pick out catalysts: inverted curves (recession fear), deposit competition with short-term rates at 5%, and I tend to also wonder if there was crypto contagion fear also. It seems those are all manifesting themselves right now.”

By Sam Potter and Isabelle Lee