For those new to the concept of impact investment, the field and available information and data often raise more questions than answers. This is largely attributed to insufficient data on past impact investment performance.

According to impact investment researcher and advisor, Rachel Browning, "Only a handful of impact-focussed funds have exited their investments, making it difficult to model the return landscape of such investments." Still, impact curious families, family offices and those considering this type of investing for the first time need concrete information to go on.

This is the second article in a four-part series written with those new to impact investing in mind. The first article investigated both theoretical and practical answers to the common question, "Does impact investing always come at a price?" Building on that, this piece examines why impact investing may be profitable and explores how performance is currently benchmarked.

Benchmarks in impact investing

Benchmarks are standards or measures used to analyze the allocation, risk, and return of an investment or portfolio. They are considered an essential part of meaningful performance analysis and are especially useful when weighing a fund's claims.

When it comes to assessing impact investments, while there has been some development in constructing an industry benchmark, there is still some way to go. Nevertheless, three initiatives exist, each with unique insights on impact investment performance evaluation.

The Impact Investing Benchmark

In 2015 Cambridge Associates, in collaboration with Global Impact Investment Network (GIIN), introduced the Impact Investing Benchmarks. Together they produce quarterly reports that specifically capture the performance of private equity and venture capital funds that target risk-adjusted market-rate returns in the impact investing space (as opposed to funds that target concessionary returns that are perceived to be below market rate).

The benchmark covered 51 funds at launch, but with strong growth in the number of developed market impact funds, 85 funds qualified for the benchmark by late 2019. Cambridge Associates believes that as the industry grows, "Credible data on risk and return can help both existing and future impact investors better identify strategies that best suit their desired social, environmental, and financial criteria."

Browning points out that their research has revealed several interesting insights. One such example is that there used to be a size premium when it came to impact funds, with smaller ones outperforming their larger counterparts. For the past 10 years, however, impact funds exceeding $100 million have outperformed the smaller ones.

It is also interesting to note how well some of the PE impact funds within this benchmark have performed. However, Browning cautions that as with conventional finance, manager selection and fund due diligence are essential for long term out-performance.

Impact Alpha

The Impact Investing Benchmark data demonstrates that impact investments perform in-line with traditional investments. It does not, however, describe the role of impact in achieving those returns. This begs the question, "What are the underlying characteristics or mechanisms common to companies achieving impact and strong returns?"

A 2017 meeting of general partners (GPs) of impact-focused VCs and private equity funds, at Harvard business school, revealed a consistent pain point - having to make the case to investors that investing with impact did not necessarily require a trade-off in financial returns. Many of the GPs agreed that impact is often an advantage.

When impact investing forms part of the strategic focus rather than affecting financial returns negatively, it adds value to a portfolio and enhances investment performance. This concept is referred to as "impact alpha".

In the past, impact alpha has mostly been described anecdotally in ways unique to individual managers. However, Tideline and Impact Capital Managers produced a report that attempted to identify, consolidate and describe ten distinct drivers of impact alpha.

"The Alpha in impact" whitepaper published in December 2018, describes impact alpha as the ways in which operating with an impact objective enhance investment management can add financial value for investors, fund managers, and their investees. The paper provides valuable impact fund manager insights to those interested in impact investing that facilitate a deeper understanding of value creation mechanisms. This information can also be used as a foundational approach to due diligence and manager selection of impact-driven funds. The best performing impact fund managers should be able to demonstrate how their access to opportunities, market insights and additional operational rigor helps them to achieve strong results.

The Annual GIIN survey

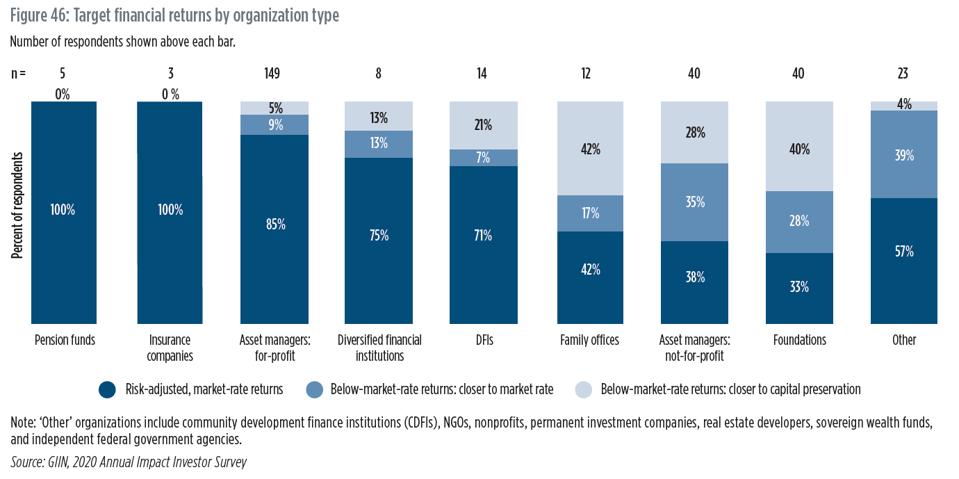

Profitability of course depends on the impact investing approach. With family offices and foundations frequently targeting below market-rate strategies as described by the results of the recently published GIIN 2020 survey.

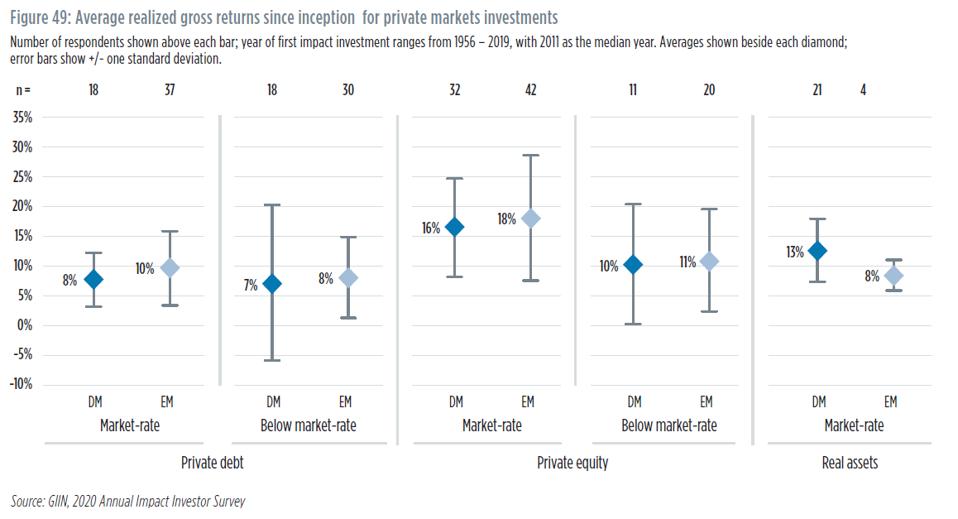

The survey also revealed the average gross returns of private impact investments. This describes the historical effect of having an emerging markets (EM) or developed market (DM) focus and compares the returns of a below-market-rate approach with a market-rate approach.

Experts agree that further research is required in the impact space, however, those considering impact investing for the first time are not without guidelines when it comes to benchmarking these activities.

While the profitability of impact investments is very much dependent on objectives and the approach employed, implementing performance measurements along with relevant and comparable benchmarks is getting easier.

This article originally appeared on Forbes.