(Bloomberg) -- Wells Fargo's top managers and board members are set to face investors Tuesday, and the conspicuous absence of a CEO has damped expectations that the bank will say anything new about how to emerge from the shadow of customer-abuse scandals or revive a lagging stock price.

The annual shareholder meeting in Dallas comes after CEO Tim Sloan resigned last month, prompting executives to backtrack on earlier guidance for expenses and regulatory relief.

With the board still conducting an external search for a CEO, the strategy for fixing past problems and returning to revenue growth remains in flux.

“Without a permanent CEO in place, the shareholder meeting seems less relevant,” Keefe, Bruyette & Woods Inc. analyst Brian Kleinhanzl said in an email.

“The future of the company is largely CEO-dependent.”

The scandals erupted in September 2016 on the revelation that employees opened perhaps millions of fake accounts to meet sales goals.

It was the first of many issues to emerge across a range of business lines and regulators have indicated the bank hasn’t done enough to fix itself.

Wells Fargo still has 14 outstanding consent orders and more than a dozen ongoing investigations.

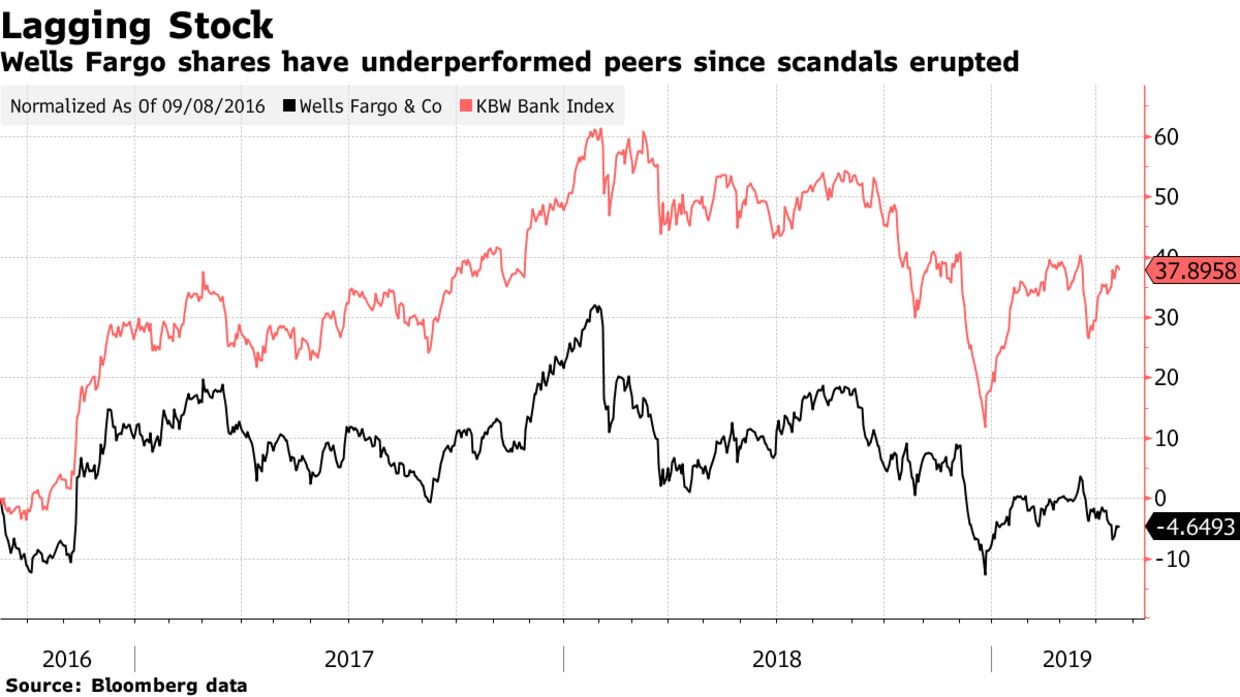

Investors are spooked: Shares of San Francisco-based Wells Fargo have fallen 3.1% since Sloan’s announcement, compared with a 6.5% gain for the KBW Bank Index. Worse, the stock has declined more than 4% since the first scandal was revealed, while the 24-company index has soared 38 percent.

Marty Mosby, an analyst with Vining Sparks, said bank officials will probably emphasize financial stability and higher customer satisfaction on Tuesday while providing updates on the CEO search. Such topics probably won’t reassure investors, he said.

“There’s not a lot they can talk about,” Mosby said in a phone interview.

Read more: Wells Fargo CEO stumble puts bank in familiar state of disarray

The only constants at Wells Fargo’s recent shareholder meetings have been protests.

Two years ago, the meeting was so raucous that it went into recess. Confrontations have been tense and sometimes loud as activists press the bank on topics ranging from consumer mistreatment to social and environmental concerns.

While protests are likely to recur, institutional pressure is easing. Advisory firms Glass Lewis and Institutional Shareholder Services Inc. are both recommending that investors vote in favor of all board members. Just two years ago, advisers were urging votes against two-thirds of the board. Six of the 11 independent director nominees this year joined the board since late 2016.

“Shareholder action against directors on the basis of failing to prevent or respond to the scandal is no longer warranted,” Glass Lewis wrote in a report. \“The board has demonstrated a commitment to enhancing its governance and risk oversight.”

Investors will also vote on two shareholder proposals for reports -- on incentive compensation and median gender-pay equity. The board and Glass Lewis recommend voting against both, while ISS say the proposals deserve support.