(MarketWatch) There may be some limitations to the U.S. government’s borrowing after all.

An anticipated surge of U.S. borrowing in the global debt markets in the second half of this year is starting to create concern as Treasury is expected to ramp up its issuance of bills, notes and bonds to fund a soaring $1 trillion budget deficit.

The U.S. government’s budget gap has widened 27% compared to the first 10 months of fiscal 2018, as spending has risen 8% and receipts have grown by 3%. The federal fiscal year runs October through September. The Trump administration recently forecast a $1 trillion full-year shortfall, while the Congressional Budget Office is slightly more conservative, putting it at $896 billion.

Last month the U.S. Treasury laid out its plans to borrow $814 billion between July and December, after the Trump administration and Congress agreed to a two-year postponement of the U.S. debt ceiling, ensuring no government shutdown or a federal default.

Not only does the Treasury needs to borrow to cover the fiscal deficit created by Trump’s 2017 tax cuts and the inability of Congress to agree on spending cuts, but Treasury needs to rebuild its cash balance which was run down to pay the governments bills when the debt ceiling was hit in May.

The coming deluge of Treasury issuance has stoked worries on Wall Street about whether there is enough liquidity in the system in the short term to meet the supply without pushing up short-term borrowing costs and inverting the yield curve even further.

U.S. dollar liquidity is deteriorating and “is reaching a point where it may require drastic action if measures aren’t taken to address it soon,” warned Gaurav Saroliya, director of macro strategy at Oxford Economics, in a note on Wednesday.

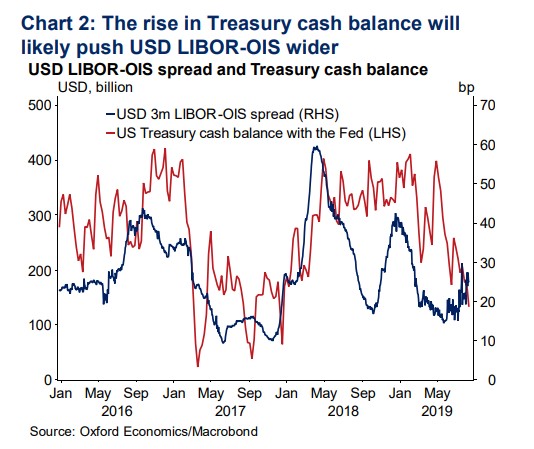

To illustrate the concern, Saroliya pointed to the higher costs already faced by London-based banks lending to one other overnight in dollars, the popular dollar Libor-OIS spread, which has climbed in anticipation of the Treasury glut hitting markets.

This chart shows the rise of the 3-month dollar Libor-OIS spread since May, even as U.S. Treasury cash balances at the Federal Reserve have dropped from about $400 billion to closer to $150 billion.

As the Treasury restores its cash balance with the coming supply, Saroliya expects liquidity woes to worsen, particularly in a scenario where long-term Treasury notes are yielding less than shorter-dated debt.

“With Treasury issuance set to surge in the wake of the recent debt-ceiling deal, an inverted yield curve could create a significant issuance indigestion in the market,” Saroliya wrote.

On Wednesday, the U.S. Treasury 10-year note yield briefly fell below the 2-year note yield, an inversion of the funding curve that has foretold past economic slowdowns.

Meanwhile fears of an economic recession rattled U.S. stocks Wednesday, with the Dow Jones Industrial Average DJIA+0.39% closing down 800 points, its biggest one day fall this year, before some recovery on Thursday morning in the benchmark S&P 500 index.

Amid the stock market rout, the chances of a half percentage point cut in the federal funds rate in September rose to 30.4%. Markets are pricing in a 69.6% chance of a quarter-point interest rate cut next month.

Despite the rising Treasury debt issuance, investors globally have been buying U.S. government debt, pushing the 30-year U.S. bond to a record low around 2.0% this week, as yields on many other developed country bonds are even lower with about $15 trillion worth of debt now offering negative yields.

Slowing global economic growth due to the U.S. - China trade war is resulting in central banks easing monetary policy, and an array of geopolitical risks from Brexit, to Italian political instability, the U.S. sanctions on Iran, and violent protests in Hong Kong are encouraging investors into the safe haven of U.S. debt.

But in the short-term money markets, the coming flood of U.S. Treasury debt issuance may cause some indigestion.

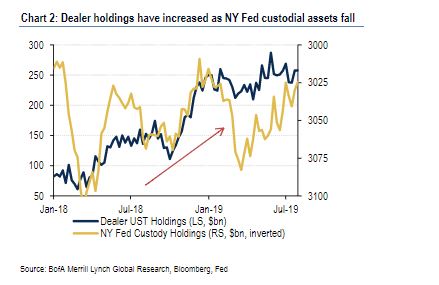

Bond dealers who underwrite the Treasury’s debt sales in the weekly auctions are already holding record amounts of U.S. Treasurys on their books as the fiscal deficit has increased. Now their need to borrow more cash in short-term money markets, using Treasuries as collateral, to buy even more government debt is pushing up short term rates.

A key risk barometer, the U.S. “repo” market, where cash is borrowed overnight using Treasurys for collateral, has signaled that liquidity is tightening.

Repo rates have climbed recently in relation to what the Federal Reserve pay banks to hold excess reserves. The rate that lenders have charged for cash in the market for Treasury repurchase agreements was 2.22% on Tuesday, compared with the 2.1% that the Federal Reserve pays banks to hold excess reserves, known as the IOER rate.

Liquidity may also be tightening in the market for short term borrowing of U.S. dollars internationally, known as the “foreign repo pool” where non-U.S. investors keep cash balances with the Federal Reserve, and the rising costs of currency hedging given the strength of the U.S. dollar may make investing in U.S. Treasury debt less appealing, Saroliya noted.

China and Japan were by far the largest foreign holders of Treasury securities, as of July 16, in the most recent report of holders.

For Saroliya, it all boils down to the Federal Reserve needing to act to preserve liquidity, perhaps by cutting benchmark U.S. rates by another 50 to 100 basis points or through another round of quantitative easing or bond buying.

“And that needs to be immediate!” Saroliya urged.

Earlier this month, Bank of America Merrill Lynch analyst Mark Cabana also warned that the historically high levels of Treasury securities held by dealers could pose problems when it come to issuing more debt.

This chart shows dealer holdings of Treasury debt rising between January and July, at the same time custody holdings at the New York Fed have declined.

“We are concerned that the U.S. banking system is nearing reserve scarcity,” Cabana wrote in a note to clients. Ultimately, he said opening the Treasury “floodgates” would likely “force the Fed to start expanding its balance sheet by year-end.”

To be sure, not everyone sees doom in the U.S. adding to the already $22.4 trillion national debt.

“A lot of Street commentators have highlighted the fact that there is going to be a huge amount of supply in the Treasury market, and how that is going to affect rates,” said Robert Sabatino, global head of liquidity at UBS Asset Management, in an interview with MarketWatch.

“When you look at the space though this is a market that most people want to own at some point, especially given the fact that there are $15 trillion of bonds in negative yields,” he said. “It makes the U.S. look really attractive.”