(OMFIF) - In a Project Syndicate piece published in August 2021, my friend and former US Treasury colleague Nouriel ‘Dr Doom’ Roubini, lucidly wrote that ‘The stagflation threat is real’.

Roubini’s point was that those who believe US inflation pressures and growth challenges are largely due to temporary supply bottlenecks are optimists headed for disappointment. He makes well-founded points and may be proven right. But my bet for the 2020s is on stagnation, not stagflation.

Before the pandemic, I tackled the global economic outlook for the 2020s in an OMFIF commentary. I envisioned a poor outlook, bordering on stagnation. Japan and Europe would remain in low-growth and deflationary doldrums; the US might perk up slightly but potential growth would be below 2%; and Chinese growth would sink sharply amid demographic trends, the fight against leverage and shifts to a consumer and services-orientated society away from its inefficient investment-intensive model. Emerging markets, often relying on strong global growth to power commodity prices and exports, would face difficulties.

But does the pandemic mean the world will experience stagflation rather than stagnation in the rest of the 2020s?

‘Stag’ remains well anchored. The pandemic hit economies hard. They are recovering at varying speeds. Despite considerable macroeconomic stimulus, many are unlikely to soon revert to pre-pandemic trends, let alone recoup 2020 losses. The Delta Covid-19 variant will complicate recovery. Policy-makers will soon shift to less forthcoming macroeconomic stances. China is witnessing financial stresses amid President Xi Jinping’s crackdown on the private sector and the fight against excess leverage. The financial troubles of Chinese property giant Evergrande are a symptom of this. The EM outlook will only toughen given weakened commodity prices, limited fiscal space, modest global growth and reduced monetary accommodation. Debt stresses abound.

But could the pandemic accelerate digitalisation, artificial intelligence and climate investments, boosting productivity and putting the world on a higher growth trajectory? Pandemic-induced technological shifts will change the future of work, but lasting productivity boosts require strong demand. In the post-pandemic environment, employers will produce more with fewer workers and reward capital at the expense of labour. New technologies require time to filter into daily economic life. The rhetoric around climate vastly exceeds action – humanity, alas, may well be losing the race against time.

What about ‘flation’? Here, the crystal ball is murkier.

Roubini’s piece sees supply chain disruptions lasting longer than many think. That may well be right, especially for the next two years or so. But supply chain disruptions should begin working themselves out thereafter. New chip plants may take time to be built, but they will be built. Consumer demand will likely further shift from consumer durables and production goods to services.

Many analysts point to de-globalisation due to trade tensions and supply chain disruptions. But pre-pandemic US/China tensions were not causing a de-anchoring of inflation expectations. Supply chains were already on the move with production often shifting, for example to Vietnam, closer to home and even some reshoring.

In light of the US’ strong fiscal stimulus, aggregate demand is outstripping aggregate supply and spending backed by excess savings may underpin cyclical growth for a while. But fiscal support will decline considerably and excess saving will be drawn down.

Inflation will remain elevated relative to inflation targets over 2022. The US debate continues to rage about whether elevated prices are ‘transitory’ or ‘persistent’. The labels may not be helpful – even if ‘transitory’, how long will elevated prices last and where will inflation settle? Outliers – such as used car prices – are coming down, but America’s questions still surround ‘sticky’ prices, such as housing costs.

That said, 5- and 10-year breakevens remain solidly around 2.5%. The Federal Reserve Bank of Atlanta’s August headline ‘sticky’ price index is currently around 2.5%, while core is closer to 2%. The Dallas Fed 12-month trimmed personal consumption expenditure mean stands at 2%. Further, the Fed has been crystal clear: if inflation rises well above 2% and long-term expectations are not anchored around 2%, it will act. And frankly, if inflation settled at 3%, that might be beneficial for monetary authorities and would hardly be as dramatic as the inflation of the 1970s.

Meanwhile, Japanese deflation remains entrenched. In the euro area, where all are atwitter about inflation temporarily reaching a whopping 3% year-over-year, the European Central Bank sees prices scantly over 2% this year and falling to the 1.5% to 1.75% range in the next two years after having undershot its target for a decade. Annual inflation in China is under 1%.

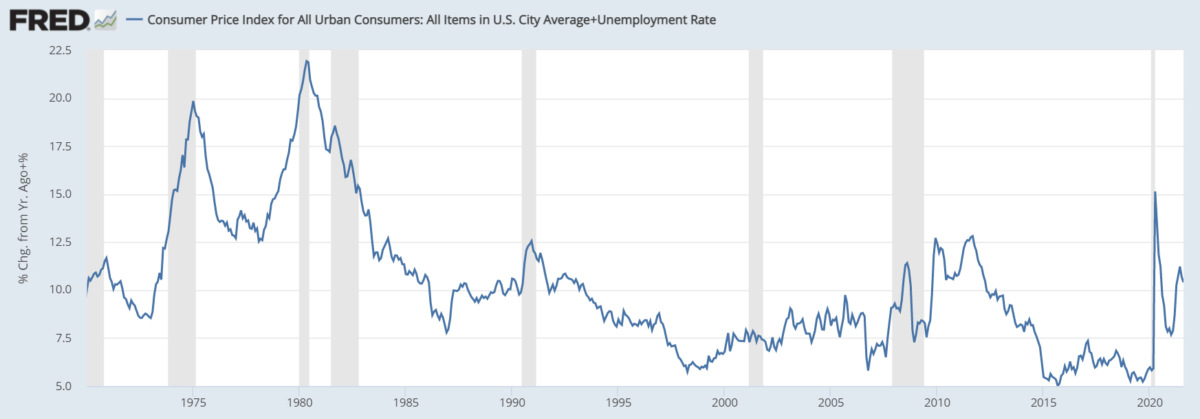

The US Misery Index in the 1970s often stood around 15%, plus or minus, with substantially higher inflation than at present. Now, it stands at around 10% and almost all estimates project it is headed lower. The medium-term US outlook, according to the Congressional Budget Office, is for unemployment moving back to 4% and PCE inflation around 2% (consumer price index a bit higher); combining the two yields a prospective Misery Index in the 6% to 7% range.

Figure 1. US average consumer price index combined with unemployment rate, %

Roubini and others may well be right that supply chain disruptions will raise inflation, and for longer than expected. But analogies with ‘stagflation’, conjuring up images of the 1970s, hardly seem apt. My bet is on stagnation, not stagflation.

By Mark Sobel

21 September 2021