Former President Donald Trump's corporate tax cuts may have a longer life than his successor promised, to the benefit of U.S. corporate bottom lines.

Reversing the 2017 cuts was such a priority for candidate Joe Biden that he said he would do it on his first day in office, leading to predictions of hits to corporate earnings by as much as 9%.

But in light of the worsening pandemic and narrow partisan split in Washington, economists and analysts believe that President Joe Biden may not get around to corporate tax increases in the first 100 days or even the first year of the new presidency.

"There's just a bunch of other, bigger problems to deal with," said Mark Mazur, director of the Urban-Brookings Tax Policy Center.

U.S. equity analysts have taken note.

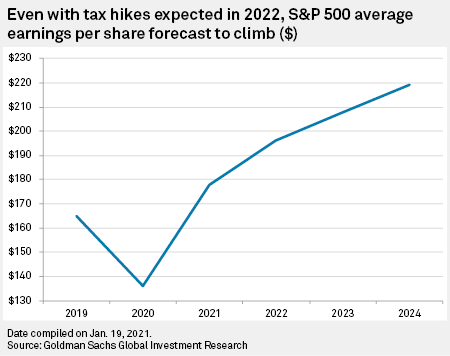

Goldman Sachs strategists in a Jan. 8 forecast said they expect S&P 500 EPS to grow by 31% in 2021 after falling by 17% in 2020. The 2021 forecast was 2 percentage points higher than they projected before Democrats took control of the Senate in the Jan. 5 runoff elections. S&P 500 EPS would grow in this projection by an additional 10% in 2022, when Goldman sees tax increases going into effect, 2 percentage points lower than Goldman previously estimated for the year.

Goldman estimates S&P 500 EPS to grow by 6% in 2023 and 5% in 2024, unchanged from its previous forecast.

New priorities emerge

During his campaign, Biden proposed raising the corporate tax rate from 21% to 28%. The rate was lowered from 35% to 21% in the 2017 tax law.

But the incoming administration will be focused first on work to boost coronavirus vaccine distribution and then on efforts to help the pandemic-battered economy recover. Corporate tax reform may not even be on the agenda before the 2022 mid-term elections.

In addition, while the runoff election in Georgia gave Democrats control of Congress, the advantage is razor-thin and likely not enough for sweeping changes to corporate tax policy in the midst of a pandemic.

"That margin in the Senate doesn't give you a huge mandate to do things," Mazur said. "A tax increase is a big lift."

When he unveiled his $1.9 trillion economic relief package on Jan. 14, Biden stressed that he planned to fund it through raised taxes, calling on corporations to pay their "fair share" in taxes.

"We can do it without punishing a single person by closing tax loopholes for companies that ship jobs overseas, or allow American companies, 90 of the top Fortune 500 to pay zero federal income taxes," Biden said.

But during her Senate confirmation hearing on Jan. 19, Janet Yellen, Biden's pick to head the Treasury Department, indicated that changes to the 2017 tax cuts were still a long way off.

Biden "has said that eventually, as part of a larger package that would include significant spending and investment proposals — not now while the pandemic is really depressing the economy — that he would want to repeal parts of the 2017 tax cuts that benefited the highest-income Americans and large companies," Yellen said.

Partial changes

Biden wants to reverse incentives in the 2017 cuts for offshore operations and profits but does not support a complete repeal of the law, Yellen said.

Any change to tax policy will likely be put off "until the worst of the pandemic is behind us," said Daniel Grosvenor, director of equity strategy with Oxford Economics.

"However, the heightened risk of these policies, coupled with the likelihood of a stricter regulatory environment in the US, is likely to weigh on US equities relative to the rest of the world," Grosvenor said.

Democrats could pass tax increases later this year to take effect in 2022, David Kostin, Goldman Sachs' chief U.S. equity strategist, speculated in a client note. Rather than an increase to 28%, as Biden pledged, Democrats are more likely to settle on an increase to about 25% to appease the party's more fiscally conservative members in order to assure passage in the Senate, Kostin said.

But other policy changes, chiefly Biden's stimulus proposal and other spending plans, could offset the impacts of a corporate tax increase on U.S. companies, he said.

In addition, companies that may face higher corporate taxes could benefit from other Biden policy priorities, including a forthcoming infrastructure plan which Biden had proposed would carry a $2 trillion price tag.

"If the administration is going forward with an infrastructure plan and you're a company that makes road grading equipment, that's going to overcome higher taxes," said John Stoltzfus, chief investment strategist and managing director at Oppenheimer Asset Management.

Corporate tax hikes, if passed by Congress, could cause S&P 500 EPS to drop by 5% to 9%, said Tom Essaye, founder of the stock analysis firm the Sevens Report, but the impact would be uneven.

"Sectors that would likely get hit the most would be tech and industrials, due in part to their high earnings and also because of offshore profits that would potentially subject to corporate tax," he said.

However, he added that any tax policy changes would likely be put off until late 2021 at the earliest since "tax uncertainty will be an additional headwind on the economic recovery."