Donald Trump said so many things on "Meet The Press" last weekend that one of the biggest bombshells went practically uncommented in our world. It turns out he's taking credit for the Fed's unusually abrupt pivot from tightening rates in 2018 to a long pause and then cuts in 2019.

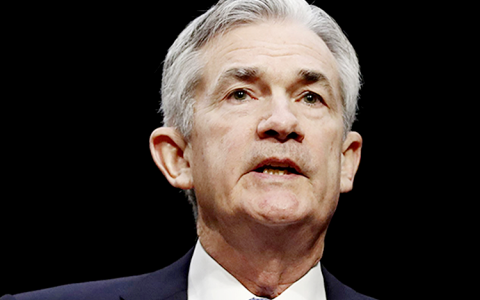

In other words, someone from the White House is claiming to have pushed the theoretically isolated and independent Fed around . . . and that Jay Powell in particular backed down.

Here's the quote:

Well you know that I put a lot of pressure on him. It was outside pressure, because nobody knows whether or not you can really do that, but I did, because I thought his interest rates were too high. And he ultimately dropped his interest rates. The same gentleman, as you know. And — but it was a lot of pressure. I mean, I was very active on that. Right now, interest rates are very high. They’re too high. People can’t buy homes. They can’t do anything. I mean, they can’t borrow money. The banks don’t have the money. The banks aren’t lending the money. The banks — by the way, Chase Manhattan Bank, Bank of America, they discriminate against conservatives. It’s a disgrace, and they shouldn’t be allowed to, and I’m going to do something about that. But you take a look at banks throughout the country. And I think because of the regulators — but you take a look at Bank of America and Chase, they discriminate against conservatives and Republicans.

You know the word jawboning? I did a lot of jawboning against him, and he ultimately lowered interest rates. We had low interest rates. We had the best housing market ever. We had people buying homes.

Either the man is misremembering or he's telling the truth. If he's claiming to have dictated rate policy, the biggest problem is that people will believe the Fed is for sale if you figure out which arm to twist.

And yes, that's a problem. Central banks are most effective when they can work without fear of crossing paths with the politicians, much less the rest of us. If Jamie Dimon or any banker could manipulate the yield curve in his own favor, he'd be thrilled.

Powell and company bask in the protective coverage of their neutrality. They see themselves as scientists, independent observers in the service of the economy itself.

They pay a lot for that neutrality. A lot of etiquette has evolved around making sure the Fed abstains from even the illusion of helping or harming any political entity.

There's usually an informal rate moratorium around the presidential election, for example. And when you ask Powell to comment on what's going on in the government, he'll say you need to ask the government.

And there will be people who believe that the White House called the tune and the Fed rolled over. The reputation of the institution and its decisions is called into question.

Maybe Trump jawboned Powell. Maybe not. After generations building the story that the Fed can't and shouldn't be swayed by any outside consideration, people now need to legitimately wonder what really happened in 2018-9.

We now need to second guess every statement and every press conference. Yes, Powell is up there talking. But is there a secondary narrative going on behind the boilerplate, some secret agenda?

Is he . . . lying? Making all this up as he goes?

That's a much bigger problem for the Fed. Even if Trump is misremembering the relationship, simply raising the possibility makes it harder to trust the narrative.

And once you stop trusting the narrative, every decision becomes political. Is the Fed keeping rates high to penalize one party going into an election, starving the economy to move votes? Are they cutting rates to serve another?

Can the Fed be leveraged to throw an election? How does a democracy avoid that?

I asked the people at the Fed to comment. They're busy but seem serenely dismissive: "Thanks for reaching out but we don't have anything new to share on this at the moment."

To my ear, the whole claim sounds ridiculous to them. That's nice. But sometimes, as every advisor knows all too well, every client desperately needs to be reassured that there is no news, that the rumor they've been hearing is as false as it gets.

After all, we weren't in the room. Trump might be telling the truth or spinning it to put himself at the center of the universe.

But if you can remember back 4-5 years, it felt very strange at the time to see a Fed that said it was comfortable with inflation and unemployment in June to suddenly reverse its posture in July.

The elephant in the room, ironically, was that inflation was running a little too cold for comfort even with the funds rate on the low side of neutral. And the trade war was still a big wild card.

Powell flipped from hawk to dove, even after holding the line through the "mini bear market" of late 2018. The rest of rate committee swung in line almost seamlessly.

And so rates started coming back down again after the only meaningful tightening cycle since the 2008 crash. The subtext behind every press conference was simple, really just a shrug: until inflation takes off, there's no harm in keeping money as cheap as possible.

Rates kept edging lower through 2019 as inflation remained dormant. Then they crashed in the pandemic when the Fed pushed all the buttons at once to keep money moving through the lockdowns.

It felt weird. It was a weird moment going into an even stranger couple of years, and it was probably an extremely hard time to preserve even the illusion of the Fed and the White House operating in different worlds.

Looking at the transcripts and the minutes again, it looks like Powell simply changed his mind when the economy gave him the wiggle room. The arguments may be esoteric, but at least we can watch them play out in the rear view.

But the fact that we now need to ask is sad. Maybe someone in DC will ask Powell to address it today. We'll all laugh it off.