Biden is on fire.

After the $1.9 trillion stimulus bill blitz, he’s set his sights on rebuilding “crumbling” America. His plan is to splash out a massive $2.25 trillion to fix America’s rundown infrastructure, “green up” the economy, and invest in next-gen technologies.

“It is a once-in-a-generation investment in America unlike anything we’ve seen or done since we built the interstate highway system and the space race decades ago,” Biden said during the announcement.

That’s quite an undertaking that Biden’s hoping to push through Congress by July 4. If passed as-is, it will be one of America’s biggest buildouts. Its scope could even match the New Deal (the set of programs meant to pull America out of the Great Depression in the 1930s.)

What’s in the plan

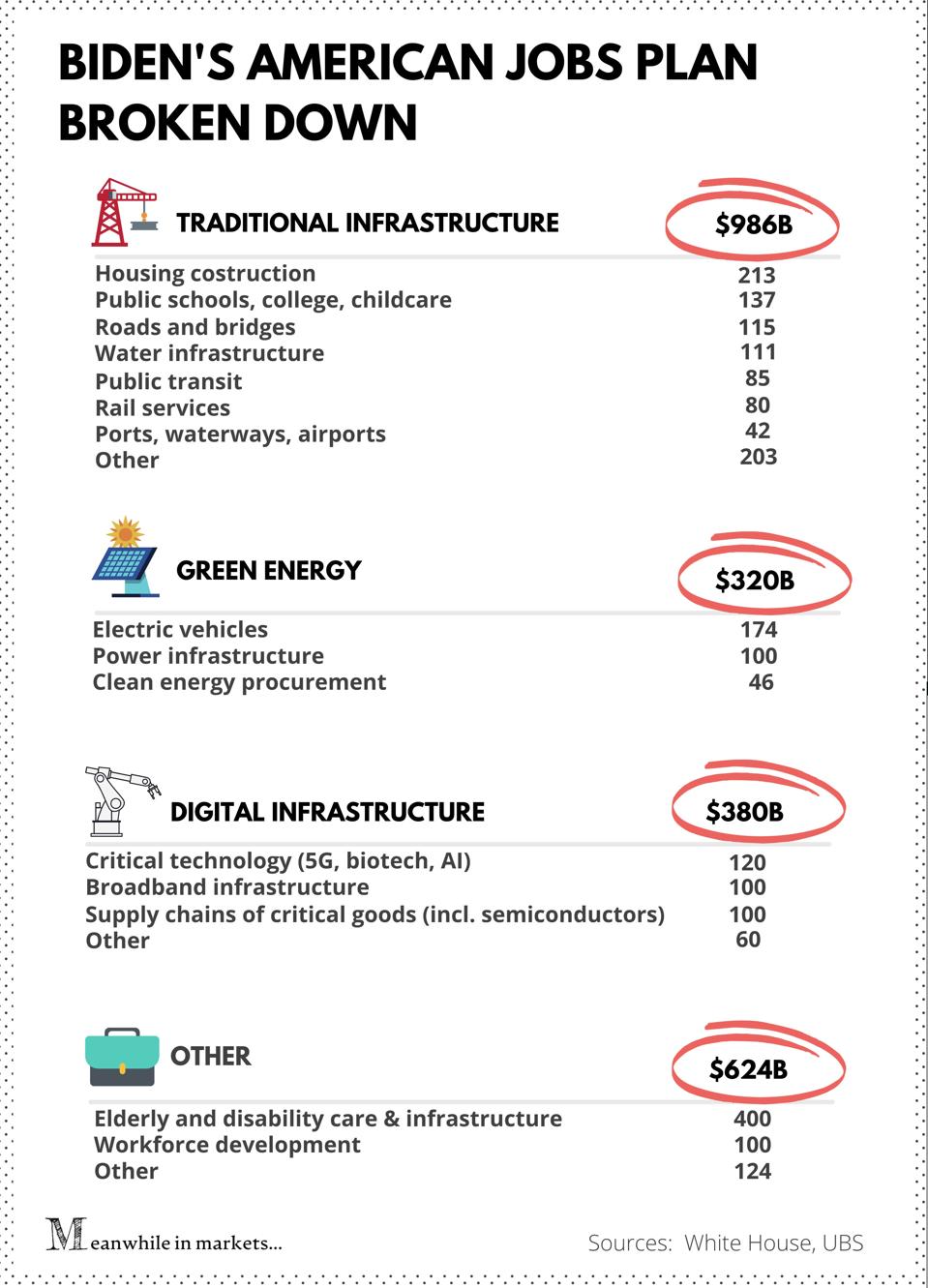

Biden’s team is still carving out the details, but the tentative plan dubbed "American Jobs Plan" is to shove a couple trillion dollars into four areas:

- Upgrade traditional infrastructure — fix 20,000 miles of roads, 10,000 bridges, replace water pipes, upgrade public transportation (buses/rail cars and stations/ports/airports), childcare facilities, colleges, public schools, and produce 2M+ affordable places to live

- Invest in digital infrastructure — provide 100% coverage of high-speed internet, invest in new tech (AI, 5G, biotech), and support the production of semiconductors, which is a national security thing

- Invest in green energy — support American-made EVs (tax credits, 500,000 EV charging stations), and build out an electric power grid designed for renewables

- Support underserved groups —provide affordable care for the elderly and job training programs for underserved communities

Here’s a breakdown of the plan by proposed budget:

Infographic: American Jobs Plan broken down

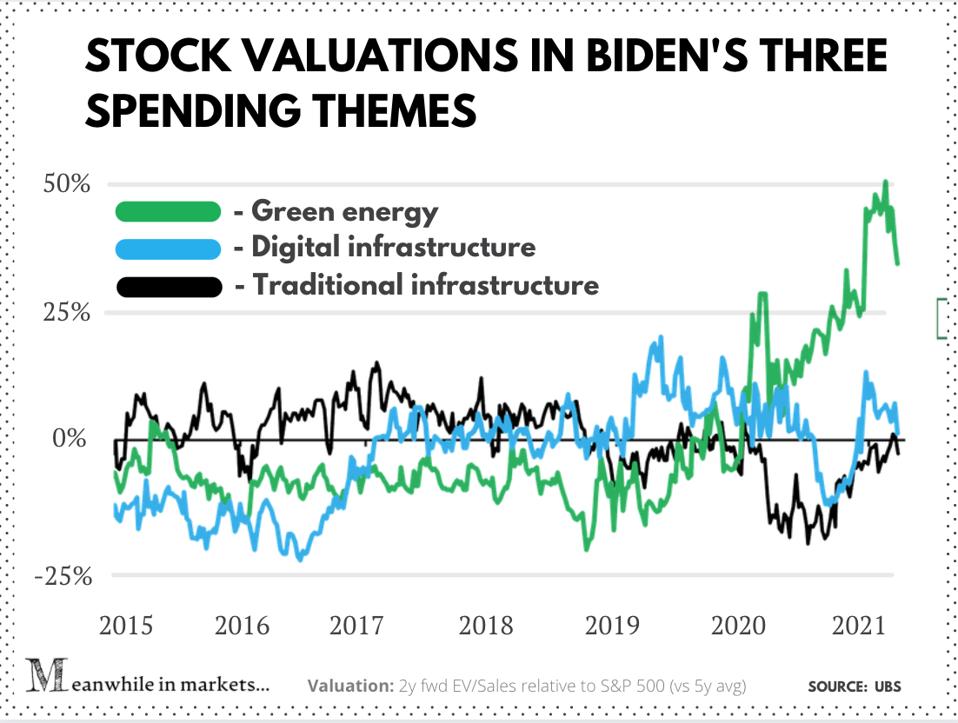

Meanwhile in MarketsGreen energy is hands-down the most hyped-up theme here. And when the “American Jobs Plan” came out, stocks tied to green energy like Tesla TSLA +0.6% jumped the most. But while green investments are the future, they may not be the best way to bet on Uncle Sam’s historic spending spree.

And that has to do with what’s “baked” into their price.

Biden’s spending themes as investments—from cheapest to most expensive

The stock market does not reflect the present. It’s a function of all the fears, hopes, and beliefs of what will happen in the future. And most of what could happen is “baked” into stock prices way before it happens.

In fact, sometimes investors bid up stocks ahead of time so much that when things do happen the stocks barely budge—or go in the opposite direction. That’s even more true with highly scrutinized political agendas.

In other words, picking the best investments to play Biden’s spending spree is not just about sorting out the stocks that Uncle Sam will shower with most money. It’s also about finding those that haven’t been hyped up in advance.

As a good starting point, here’s a handy chart (hat tip to UBS) that plots the valuations of stocks tied to Biden’s three spending themes since 2015:

Valuations of stocks tied to Biden's spending themes

Meanwhile in MarketsAs you can see, green energy stocks are selling ~30% above their historical average. And while stocks tied to traditional and digital infrastructure have had a great run since the election (obviously in anticipation of this bill), they are still in line with historical norms.

Two ways to invest in Biden’s agenda

Now regardless of which themes you pick, there are two ways to put them in your portfolio.

The first option is to go broad and invest in an ETF tied to Biden’s agenda. The broadest such ETF would be iShares U.S. Infrastructure ETF (IFRA). It holds a basket of 155 stocks that benefit from infrastructure spending.

You could also look into ETFs that track sectors that would play a part in the buildout. Good examples would be the sectors of basic materials (stuff like cement that goes into construction) and industrials (earth-moving machines and all that).

Or if you are more into digital, you may consider the semiconductor sector, which has become a matter of national security. The largest ETF tracking US stocks in this industry is iShares PHLX Semiconductor ETF (SOXX) SOXX +1%

Another way is to pick out your own roster of stocks. And if you feel like getting in the weeds, consider a couple of things for your research.

First, look at how much of the company’s revenue comes from the areas Biden’s plan is targeting. For good reference, here’s what revenue sources UBS’s lead US equity strategist, Keith Parker, looks for in stocks:

"Traditional infrastructure: We identify companies which have revenue exposure to related areas such as transport infrastructure, building/energy/utility construction, machinery equipment, waste management, building & construction materials.

Clean energy: We identify companies which have revenue exposure to segments such as renewable energy manufacturing, pollution control equipment, renewable energy generation.

Broadband and digital: We identify companies which have revenue exposure to the theme such as communication infrastructure and network equipment, infrastructure software and semiconductors."

Second, check how much revenue the company is earning from government contracts. If the company gets a great deal of orders from Uncle Sam, an explosion in its spending will have a more immediate and direct impact on the company.

And last, weigh the stock’s valuation against its long-term average and valuation before the election. That’s because the higher the valuation, the more likely the news is “baked” into the stock price. Or put another way, there’s less upside left for you.

Bidenomics is going into full swing

Biden’s $1.9 trillion stimulus and “American Jobs Plan” are more than spending bills. They are a sign of a U-turn in America’s policy.

The nation is shifting from so-called Trumponomics (a deregulated economy driven by tax cuts with the hope that big corp profits will trickle down to the rest of the economy) to Bidenomics (a more regulated economy driven by large-scale public investment paid by taxing big corp).

Or, as Robert Reich, a former US secretary of labor, neatly put it, “Bidenomics is… give cash to the bottom two-thirds and their purchasing power will drive growth for everyone.”

This 180 will have an effect on stocks for years to come. And it’s already shifting the order of winners and losers in the markets. In other words, what worked under Trump is not going to work under Biden. And that’s something we’ll discuss more in the coming articles.

Now, the big question is how many of his whims can Biden pass through Congress. A thin Democratic majority is in his favor. But not all Democrats are crazy about Biden’s grand plans.

Time will tell.

This article originally appeared on Forbes.