For a stock market to crash, prices must fall. That is obvious. But what if stocks rise and the value of money falls? Is that a crash? If the value of money drops 30% but the market rises a little, is that a bull market?

Not many people would argue against the premise that it is the Federal Reserve’s liquidity actions that have levitated the U.S. stock market. Sadly, in an attempt to keep the whole economy from imploding it has inflated stock asset values to ridiculous levels. Jay Powell, the Fed Chairman, made it clear in a recent interview that they were committed to supporting the U.S. economy and to protecting it from the effects of anti-Covid measures, for as long as necessary and for as much as needed, and clearly indicated that would be for a long time.

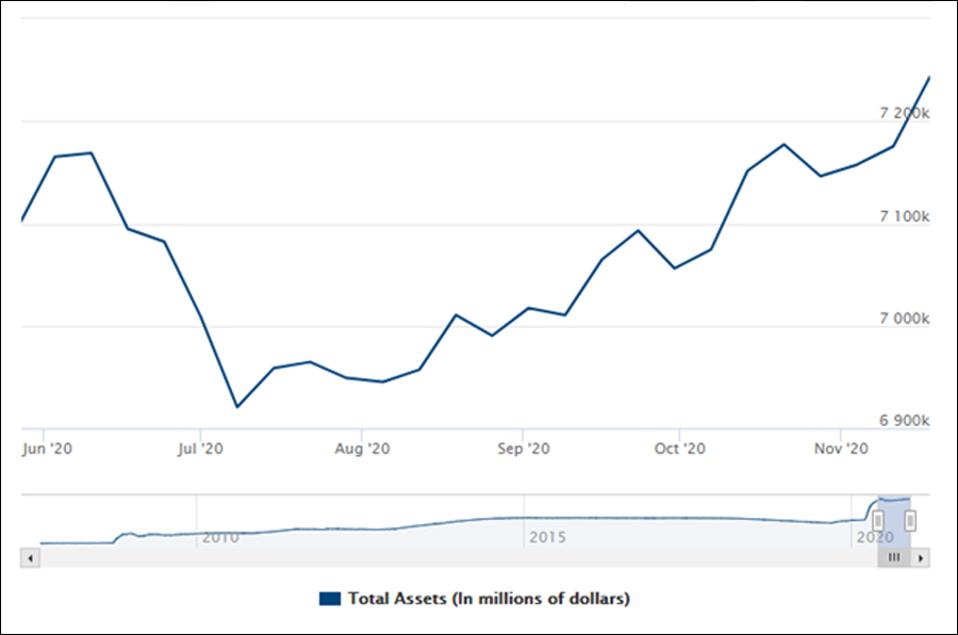

This is the trend of that Federal Reserve support:

(Chart courtesy of the Federal Reserve’s website)

This QE or however you want to brand this liquidity provision (liquidity equals cash, provision equals printing assets that turn into money) is clearly going to run and run for a long time because every time the Fed slackens its swapping of fresh government-backed quality assets for other people’s sketchier assets, down flops the stock market and then up pops more QE to keep the market from crashing Hindenburg-like in flames.

When the Fed tapered in 2019, down went the market and crash went peripheral global economies as U.S. dollars were sucked from the global economic plumbing. The U.S. and the world economy is hooked on the Federal Reserve’s money printing. By swapping golden government debt for other parties’ riskier, perhaps very risky, debt the Fed yanks the world’s dodgy assets holders out of the mire by their hair, thus avoiding a spiral of insolvency. The potential damage of that terrifying comeuppance is what sparks all bailouts, allowing broken companies and economies to stagger on, most likely towards even greater fragility.

The weird thing is this: If these liquidity operations keep going on, the Federal Reserve will in effect own all its citizens’ homes and all its creditworthy (and not so creditworthy) corporate debt and thus have liens on most of the economic assets of its citizens and producers. It will have in effect nationalized, though probably by accident, the country, having bought it with government paper. However, if it brings this process to a halt the market will crash and everyone will instantly be a lot poorer, while if it carries on at some point it will glut the market for its paper, up will go interest rates and down will go the value of bonds and the reality of a much poorer economy will bite.

However, it seems that the Federal Reserve is not going to let the stock market crash whatever the outcome.

But if a dollar in 2023 or 2024 buys significantly less and the market hasn’t rocketed accordingly, you are getting your reset in a chronic way rather than through an acute event of a 30% retrenchment on your portfolio. This will be the aim, once again to smooth the process by spreading it out over a decade or two rather than take the pain in an awful three or so years of restructuring.

Yet make no mistake, the U.S. stock market is a house of cards, and as the Malaysians discovered when they propped up the price of tin, there is a finite nature to keeping a market away from its natural equilibrium and you must spend increasing amounts to do it. At some point you run out of credit and down goes the market to its correct level. How long the U.S. can continue to debase its credit while maintaining its credibility is the key question in this ongoing drama and every country in its time has gone beyond that point and sunk into crisis. If the U.S. chooses to corner its markets, that time will approach rapidly. With continued QE the system will become more fragile still so to the catalyst needed to breach that fixed market corner will get smaller and smaller until the slightest of nudges will break the spell.

Inflation solves all these problems as it gives the flexibility for economic activity to rebalance as few can keep up with all the different developing prices. It creates impetus for people to get their money moving and crushes debt with negative real interest rates and also stealthily rebalances the actual value of those debts. Switching inflation on and off is a known, even though central banks ludicrously claim otherwise.

But will the stock market crash now? Hearing Jay Powell speak it appears they are prepared to die on the hill of QE. So the market will not be allowed to take its natural course. This means the market will crash but only when and if there is a downfall moment. There has to be a readjustment for a global economy that has lost at least 10% of its output with still more damage to come.

Some governments will aim for a chronic economic development while some will go for an acute one if they can shift its blame onto someone or something else.

As such, investors should pray that the new incoming U.S. administration doesn’t find a neat scapegoat to blame a reset on, to get that out of the way early in their term.

For anyone who is not a diehard buy and holder, the near future must be one where an investor’s fingers should stay hovering near that sell button because the tightrope walk the Fed is walking for the sake of the U.S. and world economy is going to be a precarious one.

This article originally appeared on Forbes.