I was talking to a friend the other day. He shoved his phone in my face and said, “Look!” and pointed to an S&P 500 chart hitting 3,900.

“Is the game on? Is the stock market in another 10-year (or so) rally?”

I wish there were a simple yes or no answer. Truth is, I don’t know. No one does. Even Nobel-winning economists and pro analysts are terrible at predicting this stuff. And it doesn’t help that we don’t have much benefit of hindsight.

Think about it. Today’s market behavior is so unusual—and has so little precedent—that Hollywood is already shooting four movies about it.

So, instead of playing prophet, today I’ll look at the reasons analysts are justifying stocks at these lofty prices. Then you can decide whether their reasoning fits in with your investment ideology or not.

This recovery doesn’t follow the pattern of a typical market cycle

The last time stocks went into a Covid-crash-like freefall was in September of 2008. That month, the housing collapse came to a head when one of America’s largest investment banks, Lehman Brothers, filed for bankruptcy.

Stocks were already headed downhill. But the sight of hundreds of Wall Street suits leaving their offices with boxes in hand sowed panic. And the stock market plunged into one of the worst bear markets in history.

The crash spooked a lot of investors and kept them off stocks for years to come. It took ~1,500 days for the S&P 500 to recover its losses—even though corporate profits bounced back to pre-crash levels long before that.

Which is how market cycles are supposed to work.

Something bad happens and fear spreads. Investors flee to bonds and other safer investments for shelter. Meanwhile, stocks crash and investors become more skittish. For a while, they pay less for a dollar in earnings and stock valuations go down.

Eventually, things pick up, and so does investors’ faith in stocks. Risk appetite grows. Investors pay more and more for a dollar in earnings until something bad happens again. And the cycle repeats.

This recovery is different.

After the crash last March, it took just 126 days for the S&P to blast past its previous record. That’s the fastest recovery in history. Not only that, today investors pay more for a dollar in earnings than they have in the past 20 years.

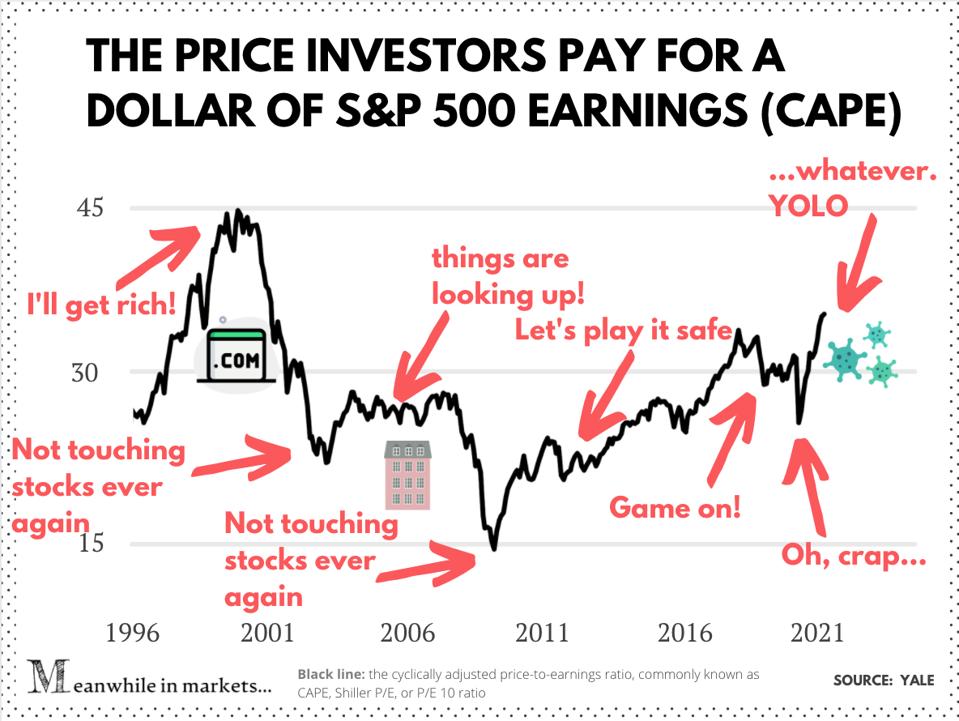

Compare that to the recoveries after the dot-com crash and the housing collapse (infographic from my recent Meanwhile in Markets newsletter):

The CAPE of the S&P 500

MEANWHILE IN MARKETSAnd yet, the S&P 500’s earnings haven’t even reached pre-Covid levels. So why are investors getting ahead of themselves this time?

Investors are paying lofty prices in advance

There are two main reasons investors are so into stocks in this recession.

First, the Fed has denied investors the chance to take refuge in government bonds. They are holding rates near zero and buying hundreds of billions of dollars in Treasuries every month. This increases demand for the bonds and weighs down their yields.

The result: all Treasuries—even 30-year bonds—earn a real negative yield (adjusted for inflation).

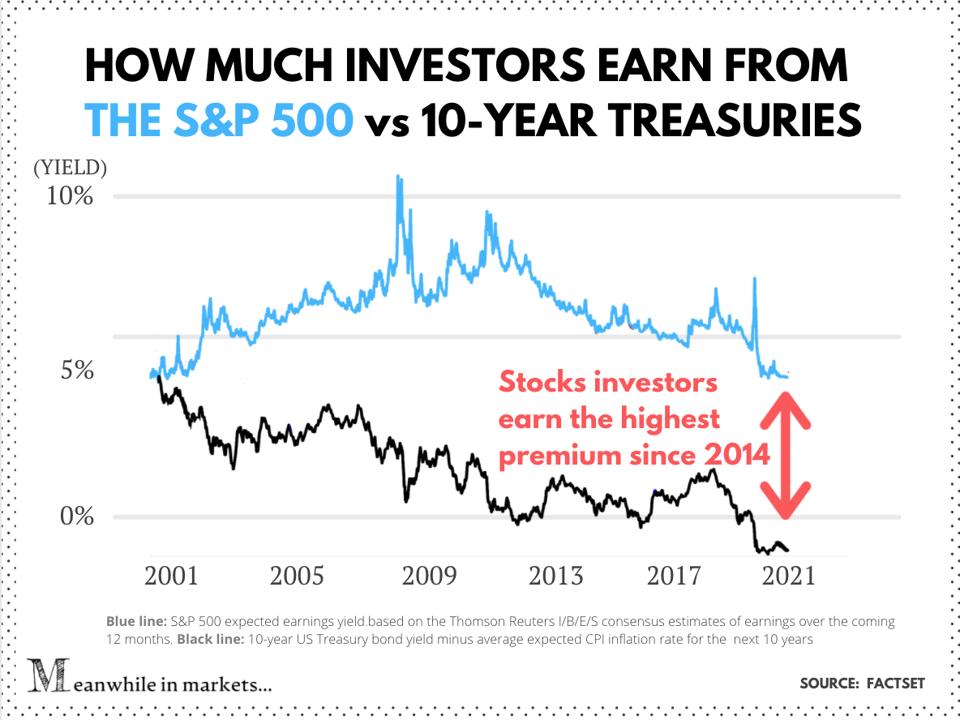

Meanwhile, lofty stocks still earn more in terms of earnings yield relative to Treasuries. So investors choose expensive stocks over loss-making Treasuries as the lesser evil. (I talk about this at great length here.)

In short, this relationship between stocks and Treasuries is called “equity risk premium.” It tells how much more you earn by investing in stocks vs. supposedly risk-free government bonds. And in the S&P 500’s case, the premium today is the most attractive since 2014:

The S&P 500 earnings yield vs. 10-year Treasury real yield

MEANWHILE IN MARKETSSecond, this recession is different because all the recent bell-tightening wasn’t by choice. A lot of people simply can’t go out and spend their money. And most analysts think that earnings will eventually catch up to the lofty valuations after Covid.

(Side note: economists still debate whether it’s a new economic cycle or just an expansion of the one that started in 2009.)

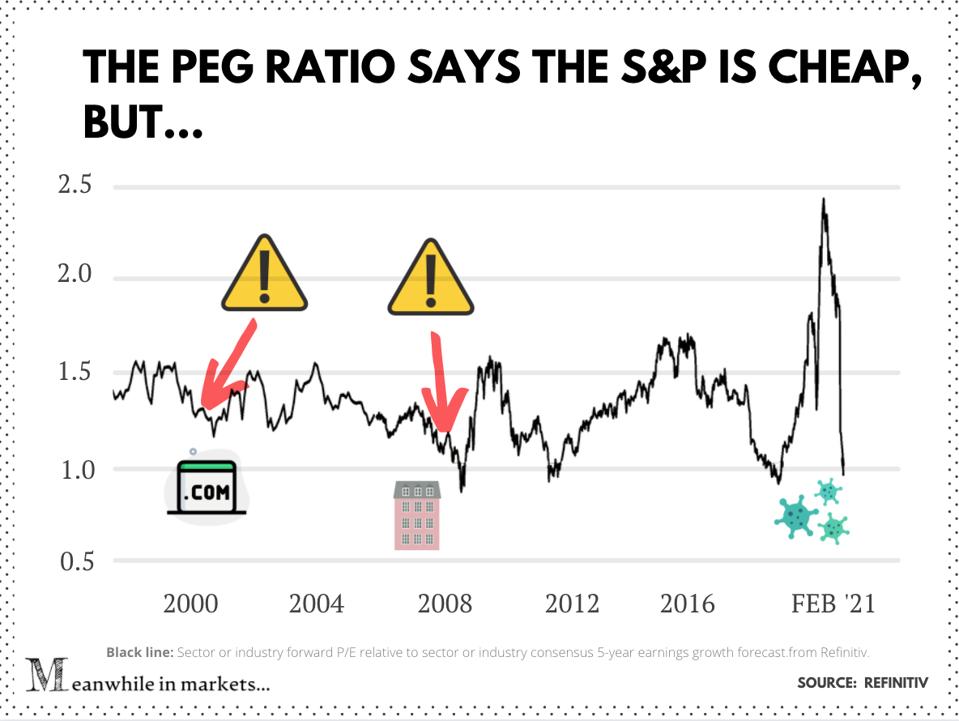

Take a look at the chart below. It shows the PEG ratio of the S&P 500. In this case, the measure adjusts the S&P’s P/E ratio based on its expected earnings growth over the next five years. In other words, the higher the projected growth, the lower the P/E ratio.

Based on this measure, the S&P valuation is the lowest since 2018, as you can see here:

The PEG ratio of the S&P 500

MEANWHILE IN MARKETSJust take this with a big grain of salt. If there’s one constant about Wall Street’s earnings estimates, it’s that in bull markets they overshoot most of the time. (See how “cheap” stocks have become leading up to the dot-com and 2008 crashes based on this measure.)

A bubble or not, valuations are still more attractive overseas

The stock market recovery might give you a sense of assurance that everything is back to normal. It’s false. The economy is a long way from where stock prices suggest it should be (at least under normal conditions). And there’s a lot of hope and expectation baked into those prices.

So be conscious of that. And if you are heavily invested in US stocks—which are the most expensive in the world and have the highest concentration of “anti-recovery” tech stocks—consider moving some of your eggs overseas.

JPMorgan JPM JPM strategists think that stocks in Europe (especially the UK), Japan, and emerging markets offer some of the most attractive valuations today. And if you are investing in the internet, you may want to dip your toes in China.

China’s internet stocks are already up 16% since our discussion a few weeks ago—and still sell at bargain valuations compared to the US names.

This article originally appeared on Forbes.