Eliminating AMT headaches and the federal estate tax is nice, but wealthy investors only want to hear three words: “capital gains rates.”

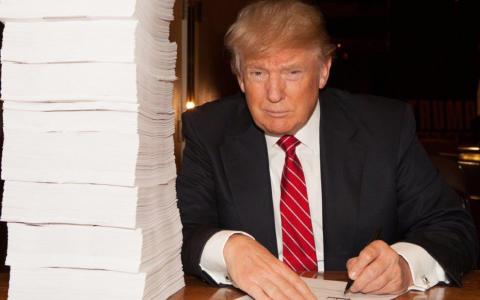

We spent months waiting for details on how the Trump administration plans to follow through on promises to cut taxes for corporations and individuals alike.

Proposal after proposal floated and then fizzled behind the scenes while wealthy households put big decisions on hold. Now we have nine pages of clarity at last.

It isn’t exactly ambitious. And until a lot of blanks get filled, there’s actually a chance that those who deferred taxable events into 2018 are going to feel a little cheated.

The good . . .

Start the overtly client-friendly aspects of today’s “framework.” If this passes, repealing the federal estate tax will give paper millionaires and land-rich farmers alike dynastic relief.

Advisors won’t need to work so hard reducing the drag on multi-generational asset transfers. Trusts and similar vehicles recede to more peripheral roles in the planning landscape. Philanthropy shifts toward year-to-year donations that capture the annual charitable deduction instead of one big estate-slimming end-of-life transaction.

(The charitable deduction survives, by the way. So does the mortgage interest deduction, in some form. Keep that in mind for when we talk about the AMT.)

In general, earned income probably gets a little cheaper on a post-tax basis, although frustrating question marks remain around whether a rumored “surcharge on the rich” means the top income rate won’t drop much after all.

Still, if you were paying 39.6% and now get the chance to claw back 4.6% next year, a married couple bringing down a $500,000 joint salary or a widower like Warren Buffett might save a whopping $1,000 in income tax. That’s real money. Naturally, the higher the salary, the bigger the break that marginal 4.6% represents.

Jamie Dimon, for example, can theoretically save up to $277,000 a year under the revised bracket system, assuming his base and bonus remain locked in at $6.5 million. Top-ranked hedge fund managers do proportionally better.

Of course Buffett, Dimon and company accumulate the bulk of their wealth on investment income, not from hard labor. There wasn’t a word on capital gains, interest and dividend treatment today. Those who live on passive income are just as deep in the dark as ever.

That’s not a great thing for the truly wealthy who’ve been dragging their feet on recognizing long-term gains and losses until we know how — or if — the rates will change.

. . . the corporate . . .

What is clear is that the corporations that they invest in can throw off more cash for shareholders or reinvest it in the business. Even if corporate taxes aren’t going all the way to 15% as initially hoped, capping the maximum rate at 20% still boosts after-tax profit by 5%-15% depending on the sector.

That cash flow can turn into dividends and buybacks. It can also unlock massive asset purchases, provided of course that the 100% first-year depreciation offer actually happens.

We saw something similar back in the 2008 crash, when accelerated GDP gave management teams on the brink of panic an incentive to let go of a little cash. It was an emergency stimulus measure then. This time, it’s pitched as a way to feed a boom.

The rule of thumb a decade ago was that every $1 in immediate write-offs counteracted $0.27 in real GDP deterioration. Depending on how fully management takes advantage, we could get stronger growth.

Beckoning about $2.8 trillion in stranded overseas capital back home will also help. That money’s got to go somewhere. Even if it’s just to reward shareholders and acquire competitors, once-stagnant capital can move again. That’s a good thing.

Move down the food chain and small business can also take advantage of the depreciation break. Trump’s very happy that pass-through entities will have their taxes capped at 25%. Other wealthy people who funnel income through a family business or other closely held structure will also rejoice.

. . . and the vague

We didn’t hear anything about carried interest, though. Depending on the final rules, hedge funds and other private equity vehicles may need to shuffle the assets to get the best deal here. It probably won’t affect many of your clients, but those who care will really need to know.

Beyond these points, most of what’s currently on the table is actually geared toward the true middle class and below. Doubling the standard deduction won’t add up to more than a rounding error in a true HNW household’s finances. Eliminating most common itemized deductions beyond mortgage interest and charity initially looks like a net drag.

But think a little more deeply about those deductions. While Trump’s also happy to eliminate the AMT once and for all, eliminating most of the write-offs at the same time simplifies the accounting without making much of a fiscal impact for most families who pay AMT now.

If anything, AMT offered the possibility of paying a slightly lower maximum rate on slightly larger taxable income. The new consolidated process could end up the worst of both worlds for those who managed to harvest the right deductions from year to year.

Ultimately wealth will flow where the numbers are most attractive. Right now, small businesses look like they’ll make at least a little more sense as a place to park capital and get it working.

We may not get a better chance to harvest and apply tax losses in a long time. And trusts may not make quite as much sense as an estate planning vehicle — estate planning as we know it may be in for big changes, unless for some reason fans of the death tax make a compelling case to keep it on the books.

Otherwise, everyone from the municipal bond market to H&R Block are still holding their breath. We’re a step toward clarity but there’s a long way to go.