(Insurance NewsNet) - “Slow and steady wins the race” is not just the takeaway from an insurance executive’s favorite fable, it’s been a winning strategy throughout COVID-19, according to AM Best.

The industry overall did well overall, with a 30% increase in operating results in 2021 over 2020, according to AM Best’s report, "Limited COVID-19 Impact on U.S. L/A Operating Performance Metrics.” But the companies that have favored slow, steady growth with little volatility were the ones that earned an end zone victory dance.

Not that the last few years have been easy. Although there have been some doubts expressed about COVID death tallies, there is no argument that death claims have soared.

The life insurance industry usually paid out about $80 billion in claims per quarter before the first quarter of 2020. Those claims leapt each quarter about $100 billion in the last quarter of 2021, a 28% jump since the end of 2017.

The companies that navigated best were the ones that have not surged and lagged in net premiums between quarters. The carriers that race off the line tend to lose their wind in the longer contest.

“Growing a book of business successfully takes time and capital,” according to the report. “Those insurers that do grow rapidly may be offering more client-friendly features, commissions, and crediting rates, but they may not translate into profitability. High growth is unsustainable.”

The companies that AM Best assessed as the strongest over time had more stable trends and diversification across product lines, leading to consistent top-line growth. These companies tend to hold higher levels of surplus, which they can use with their economies of scale to reduce operating expenses. The lower expense ratios also allow the companies to offer more competitive rates.

“Volatile earnings generate uncertainty and can result in an irregular accumulation of capital,” the analysts wrote. “Over the last 20 years, companies with an operating performance assessment of Very Strong did not report an operating loss at all, compared to 5.9% of the time for Strong companies and over 35% of the time for Marginal companies.”

The losses as a share of capital and surplus were also less severe.

Although the AM Best report shows that slow and steady operations tend to reflect slow and steady growth, careful companies did have a heck of 2021, according to another report.

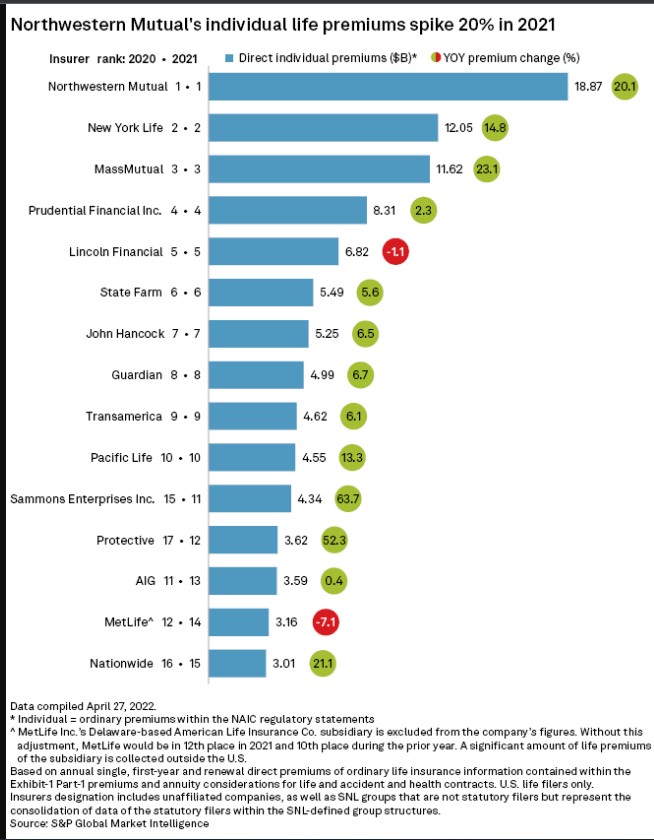

A recent S&P report showed that usually staid mutual companies did exceedingly well. Northwestern Mutual was the top of the individual life chart with a 20% gain year over year.

Whole life products, the province of mutual companies, had an uncharacteristic surge, with a 27% increase in the fourth quarter of 2021, representing the strongest quarterly premium growth for that product line in 30 years, according to LIMRA. Eight of the top 10 whole life carriers saw double-digit growth.

LIMRA expects whole life growth to slow this year but maintain a strong 10% premium growth.

Variable product sales, which tend to track current equity market performance, did breathtakingly well, with a 65% jump in sales in the last quarter of 2021. Protection-focused VUL sales increased 33%, but accumulation-focused VUL sales more than doubled.

Variable universal life has not had such a strong performance since 2008, when the equity market collapse brought VULs down with them. Since then, slower and steadier fixed products have been winning the race.

By Steven A. Morelli

May 17, 2022