The mass affluent population represents an opportunity and a puzzle for the wealth advisor. Profiling this population, which accounts for about 15% of all retail investors, is the first step to meeting its unique needs.

The challenge for the wealth advisor lies in the fact that while the mass affluent population, defined here as investors with between $250K and $1 MM in investable assets, has distinct traits and characteristics and traits, there's no “average” mass affluent investor.

Client product and servicing requirements will invariably evolve over time and are strongly colored by factors such as age, employment, wealth, and family situation.

Advice dependence levels can vary widely.

Some clients will look to their advisor for every decision, others will want validation of their instincts, and others will be largely self-directed.

Clearly, a “one size fits all” approach will not fit at all.

Sizing the Market

The 76-million baby boomers (born between 1946 and 1964) have long dominated the mass affluent investor population.

Trusting and steady in temperament, they are willing to pay for the counsel of an advisor.

Technology will play a relatively minor role in their interactions and decision process.

They are also far less likely than younger clients to look to social media for financial or other advice.

In recent years, implications for servicing models at the mass affluent level have evolved with the emergence of millennial and other next generation clients.

The distinct behavioral characteristics and consumption patterns of these “digital natives” include skepticism, self-reliance and a disinclination to sit down with an advisor.

Born between 1982 and 2000, these children of the post war baby boomer generation will be the recipients of the largest intergenerational wealth transfer in history.

Lifestyle-oriented and intellectually curious, they are in many ways they are the future of the mass affluent segment.

Their financial prospects outpace those of their older siblings, the so-called Generation X’ers (born 1965-1982), many of whose careers stalled during by the 2007-2009 financial crisis.

Debt and uneven wealth accumulation levels suggest that many GenX investors will be stuck in mass market purgatory for far longer than previous generations.

Commonly described as “digital adopters”, Gen X investors are less tech-savvy than Millennials but still live much of their lives online.

They, like their Millennial siblings, will receptive to online financial education to keep them abreast of changes to laws and tax requirements.

Technology Rules

Wealth advisors long have appreciated the threat posed by low cost technology based service models, such as online brokerage, and more recently, the robo-advisor.

At the same time, they have been slow to appreciate the potential of technology for reaching underserved clients, in particular those unprofitable to serve, via face-to-face delivery.

While technology offers opportunities to scale and engage clients in the form of digital tools and enterprise platforms, advisors want guidance on how to integrate self-service into conventional models.

Over the past few years, the range of remote and self-servicing options available to advisors, e.g. video, tablet and chat, has surged.

The positive impact on cost is one reason firms have invested so heavily in these new tools and platforms.

At the same time, the embrace of front-office digital technology been underpinned by expectations of clients, who are increasingly tech-savvy and likely to live at a distance from their advisors.

Where in-person meetings are needed, however, ‘desktop-on-the-go” functionality is a must.

As such, wealth advisors are investing in mobile (and particularly tablet) platforms that enable them to prospect and onboard clients, as well as deliver solutions and insight.

Advisor portals with drill-down capabilities (i.e. the ability to view data at multiple levels, and various levels of complexity) provide instant access to client, market and portfolio performance data, for example.

Getting Nimble

Advisors now seek to harness this kind of data in direct support of on-the-go decision making and execution.

At the same time, as aggregators like Envestnet-owned Yodlee, Quovo, and even Mint.com have shown, data has become a strategic asset.

The result is a virtuous cycle in which the increased importance and flow of data via the desktop is accelerating its development and implementation.

Progress will not stop there, of course.

Technology (and the advisor) must keep pace as data capture extends to social media, customer sentiment, and other actionable information for analysis.

To succeed, advisors need to view technology as an enabler of progress, rather than an objective in itself.

This progress will be realized in the form of an improved user experience for both client and advisor, one defined by greater access to information and deeper relationships.

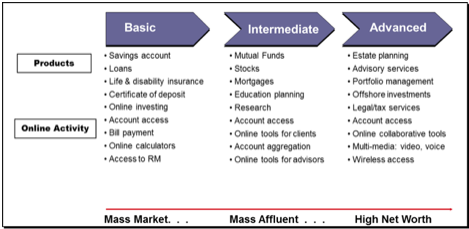

Transparency around fees and services will be another core benefit, particularly as client needs evolve from basic savings and transaction oriented products towards more integrated solutions.

Lastly, gains in efficiency should take place in the context of a broader de-risking strategy that comprises compliance and the elimination of errors through automation.