Rareview Capital founder Neil Azous wrote this just for you. It's the top story of the month for Wall Street and undoubtedly top of mind for many of your clients, whether or not they're living in a 60/40 portfolio world.

At Rareview Capital, we seek to bring a ‘rare view’ to investment challenges. We place value on being able to see across asset classes, discover new opportunities, identify hidden risks, and spot impending danger. We call this perspective Sight Beyond Sight®.

In our latest investment commentary we argued that investment-grade credit should have minimal weight in a portfolio. We were concerned because credit spreads were very tight, and even the slightest hint of inflation would lead to higher interest rates. So far, our Sight Beyond Sight® is proving correct. This year, as measured by the primary benchmark, investment-grade credit is -3.40%. For an asset with an average annual drawdown of 4.71%, this is a meaningful negative performance in a short period.

The Next Sight Beyond Sight®

Markets are a forward discounting mechanism, typically pricing outcomes at least six months in advance. Therefore, with the vaccination a fait accompli, it is prudent to begin thinking about macro themes beyond the pandemic’s evolution.

With that in mind, we believe the Sight Beyond Sight® is that higher 10-year real U.S. interest rates pose the most impending danger to current portfolio construction.

How can we see that? Last week, investors received critical macro information from the bond market.

Three Critical Signals

The nominal interest rate is the difference between real yields and breakevens. The breakeven rate is the difference in yield between inflation-protected and nominal debt.

Below is the U.S. Government bond market performance since February 10, 2021 close-of-business broken down by real, breakeven, and nominal interest rates.

As you can see, real interest rates exploded and breakevens declined modestly.

Note, a one-standard-deviation move in 10-year real U.S. interest rates over six days is 10 basis points. Since February 10th, real yields rose from -1.07% to -0.82% or 2.5-standard-deviations. Technically, real yields broke out of their multi-month range and crossed above the 200-day moving average for the first time since January 2019.

At a minimum, there are two potential key takeaways:

- A floor in real interest rates has been solidified.

- Real yields are unlikely to decline further.

Next, while the degree of the absolute sell-off in real interest rates and the reversal in breakevens are proof-enough of regime change, at Rareview Capital, we seek an additional confirmation from hard-to-see places. One area that provides strong signaling power is yield curvature. For example, the nominal yield curve had a noticeable change in leadership regarding the recent steepening bias.

Until last week, the steepening was led by the yield curve’s 5/30-year slope, driven by inflation expectations in the long-end. Now, the 2/5-year slope is leading, powered by Federal Reserve expectations in the belly of the curve. Combining the two slopes into a 2/5/30-year butterfly best encapsulates the phase shift underway. Last Tuesday, the “butterfly” had its largest one-day move in yield since the 2016 U.S. Presidential Election.

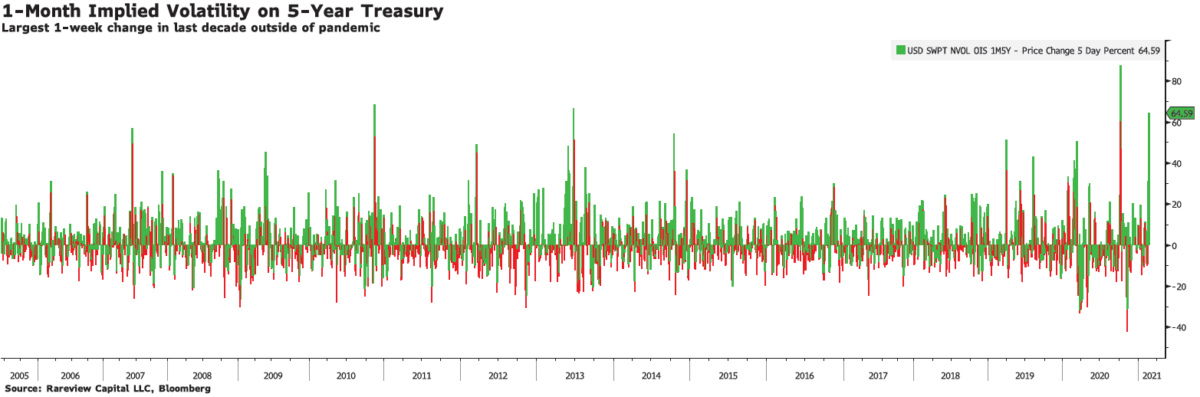

Finally, our long history in credit and equity derivatives allows us to look at volatility in multiple dimensions. We see that bond volatility flashed a critical signal that mirrors the messaging received from real rates and the nominal yield curve. For example, last week’s relative change of implied volatility of a one-month option on the 5-year U.S. Treasury rose by 3-standard deviations. In absolute terms, it was the largest move higher in a decade, outside of the pandemic, and close to the highs of the last 15 years.

Collectively, we believe the bond market signaled that the current economic scenario of growth and reflation optimism would soon lead to a step-change in the Federal Reserve outlook. That is, a tightening stance, away from pandemic-led easing. Note, this is the phase before an interest rate hiking cycle begins.

Regime Shift

Below is a regime matrix for real yields and breakevens. Based on the three critical signals received last week, we believe the bond market shifted from Regime 2 to Regime 3.

As we advance, we expect a more gradual rise in real yields and breakevens to move sideways in response to robust economic data over the coming months. Note, the last time we were in Regime 3 in 2013, Federal Reserve messaging drove the regime change, which led to the “taper tantrum.” Recognizing this distinction is critical.

Higher real yields are typically associated with a stronger U.S. dollar and lower gold prices. They are usually a headwind for equities, especially if the upward move is fast and steep. However, we are not at the point where the U.S. dollar will be universally stronger, or that risky assets and commodities will broadly fall because of higher real interest rates. Why? Because that occurs during the transition from Regime 3 to Regime 4 when the Federal Reserve telegraphs a hiking cycle when they begin tapering asset purchases.

Impact on Asset Classes

Based on the transition from Regime 2 to 3 with the Federal Reserve caveat, below is our Sight Beyond Sight® for various asset classes.

US Equities: The S&P 500 typically falls 1.5-2.0% following a 2-standard deviation move higher in real yields in one month. That said, we are less worried about the stock market if:

- The speed and degree of the next real yield move is incremental.

- The absolute level of the real yield is still negative.

- Earnings growth remains strong.

Commodities: Gold is the commodity most inversely correlated to higher real yields. The yellow metal fell 2.80% last week. There was also a key bearish technical development. That is, a “Death Cross” formed where the 50-day fell below the 200-day moving average. The last five times that happened since 2010, gold fell ~13% on average. Above other assets, gold is the most apparent casualty currently and should continue to trade soft, especially as cryptocurrencies continue to take inflows away from it.

US Dollar: The US dollar has yet to universally strengthen, especially against cyclical or emerging market currency crosses because government bond yields in the rest of the world have been rising at a faster pace than US Treasuries in February. That will change when/if messaging leads to front-end rates repricing meaningfully as shorter-dated yields matter most for exchange rates. For now, investors are slowly rotating to other low-yielding funding currencies – the euro exchange rate (EUR), Japanese yen (JPY), and Swiss franc (CHF). This funding switch argues that if you are a US-based investor holding European or Japanese equities, it is prudent to move into the currency-hedged versions of those products. Three ETF examples include HEDJ, DXJ, and AXJ.

Emerging Markets: One asset class that should be singled-out for impending danger is emerging markets. Both equities and local currency debt are extremely sensitive to a stronger U.S. dollar and higher real interest rates. There is also growing fear that China is tightening policy after weathering the pandemic better than other G7 countries. Recently, a key reflation metric for the world – their fiscal impulse – turned down. A continuation in the “world’s factory” would signal that the manufacturing-over-services trade is complete. If you are overweight, the traffic light just turned to yellow for a downgrade to neutral from overweight.

Treasury Inflation-Protected Securities (TIPS): The industry’s dominant portfolio – the 60/40 stock-bond allocation – has undergone a structural change since last summer. For months, institutional investment managers, including us, have advocated replacing the 40% nominal bond allocation with inflation-linked bonds and commodities. As a result of that rotation, the current valuation of TIPS discounts the outcome of above-trend inflation. Said differently, TIPS are fully valued, and there is little room for error. The regime shift by the Federal Reserve has negative implications for TIPS securities. As real yields increasingly discount a tighter policy path from the Federal Reserve, the price of TIPS declines. Moreover, if the market continues to price a faster tightening path because of an increase in inflation, the expected offset to inflation pressures cannot be TIPS. Why? Because TIPS may become a detriment when accounting for the low absolute negative real yield.

A Final Warning

One final crucial risk warning is warranted. Regarding risk management, we are often asked what keeps us up at night? The answer is a twin-move of higher real interest rates and lower crude oil prices. Fundamentally, we are currently very constructive on the barrel – its high roll-yield is hard to ignore. However, on March 31, OPEC+ is expected to curtail their production cuts. Also, the WTI oil strip is nearing levels that may entice US shale producers to focus on Free Cash Flow (FCF) instead of CAPEX discipline. We are watching this risk profile above all else because it typically leads to credit spread widening, and credit spreads are at/near all-time tight levels. Also, there is no hedge to this scenario except higher cash balances before it happens. If this scenario materializes, the ripple effect will be felt hard across risk assets.

As a boutique firm, we can help you navigate these potential critical changes in the market by providing direct access to our investment professionals and library of tools. At Rareview Capital, our goal is to become a trusted resource and the first call for your questions.