(Proactive Investors) - “What’s this crash about a big crash coming… and should I move to a lower risk level on my ISA?”

This was a Whatsapp message from one of my family recently.

“There should be a shift back towards active investment. Passive has gone too far.”

These two conversations are sort of connected, as my family member, like many investors under 50, has his main savings accounts held with a robo-adviser that uses passive investment funds to keep costs down while providing wide market access.

The Whatsapp message is probably the sort of question that gets asked a lot of anyone who works in any finance related job, including journalism.

So let’s try and unpack it all.

Passive versus active

Passive investing is most commonly an exchange-traded fund (ETF) that tracks an index of company shares, or could be an exchange-traded product (ETP) tracking a group of bonds, commodities or currencies, or sometimes a single commodity or currency.

This is in contract to actively managed funds, where a fund manager works to an investment strategy, picking shares or other securities to add to the portfolio and then choosing when to sell them too.

Wood via her ARK funds has also championed active ETFs, where the funds trade on an exchange but the underlying securities are chosen by the manager rather than tracking an index.

Active ETFs have become popular in the US and are a newer phenomenon in Europe.

Last year active strategies represented about 10% of global ETF net inflows, according to the recent Brown Brothers Harriman report, with 78% of respondents expecting to increase their exposure to actively managed ETFs from 65% a year ago.

What’s it got to do with robo-advisers?

Robo investment advisers use artificial intelligence to pick the right mix of ETFs for a customer based on questionnaire answers based on their earnings, financial plans and comfort with risk.

UK examples include Nutmeg, Wealthify, Moneyfarm, Investengine, Moneybox, and evestor.

On the one hand, investors such as my family member like them for the ease of use and, on the other, users are shuttled into a handful of portfolios based on some general questions.

Some offer you the chance to change your risk profile, with Nutmeg allowing you to move from levels 10, where the portfolio bucket is made up entirely of equities, down to lower levels where the proportions of government and corporate bond ETFs and cash increases, down to level 1 where there is less than 9% equities (mainly via a FTSE 100 and a S&P 500 tracker), with UK government bond ETFs and money market.

Moneyfarm offers seven risk portfolios and Wealthify five, while evestor and Moneybox seem to offer three and it’s not clear how easy it is to change them.

Why does Musk think “passive has gone too far”

In classic Reply Guy fashion Musk was looking to bend a conversation to his own thoughts as he jumped onto a long Twitter discussion originally sparked by Marc Andreessen (co-founder of Netscape and now a Silicon Valley investor) noting the prescience of a 1977 academic paper on the "The Professional-Managerial Class".

As the conversation moved round to ESG and the pressure being applied to companies by fund managers, the Tesla and Spacex boss (and perhaps soon also of Twitter) jumped in, tweeting: “Exactly, decisions are being made on behalf of actual shareholders that are contrary to their interests! Major problem with index/passive funds.”

Another user replied that a “deeper problem” is that according to modern portfolio theory, “the most rational investment strategy is to buy the market. But the reason why the market reflects the fundamentals of companies is because arbitrageurs (active investors) make it so. So what happens when everyone is passive?”

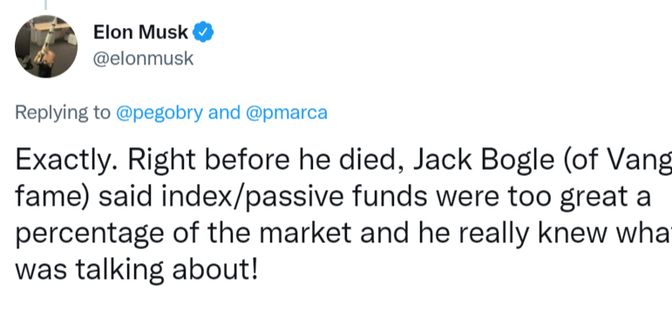

This led Musk to tweet that Jack Bogle, who founded passive fund colossus Vanguard Group, Bogle wrote that if index funds owned more than half of the stock market it would not “serve the national interest”.

This may partly to do with ETF giants like Blackrock holding over 5% of Tesla, with 28 Vanguard products also holding the carmaker.

BlackRock, the world's largest money manager, has become a prominent force in pushing environmental, social and governance (ESG) issues in the past couple of years, with boss Larry Fink warning company bosses that “climate risk is investment risk”.

Cathie Wood joins in

Ark’s Wood joined the conversation, saying that investors who held S&P 500 trackers missed out on Tesla’s rise from a US$1.6bn company at IPO in June 2010 to the US$650bn when it entered the S&P 500 in December 2020.

She also noted that ARK's research shows “most broad-based passive funds are ‘short’ disruptive innovation at a time when the global economy is undergoing the largest technological transformation in history”.

Any investors in ARK’s flagship fund early in 2020 would have near tripled their money that year but any who put their money in during the early months of 2021 would have lost more than two-thirds of their money by now, with the share price back to where it was three years ago.

“In my view, history will deem the accelerated shift toward passive funds during the last 20 years as a massive misallocation of capital,” Wood added.

By Oliver Haill

May 10, 2022