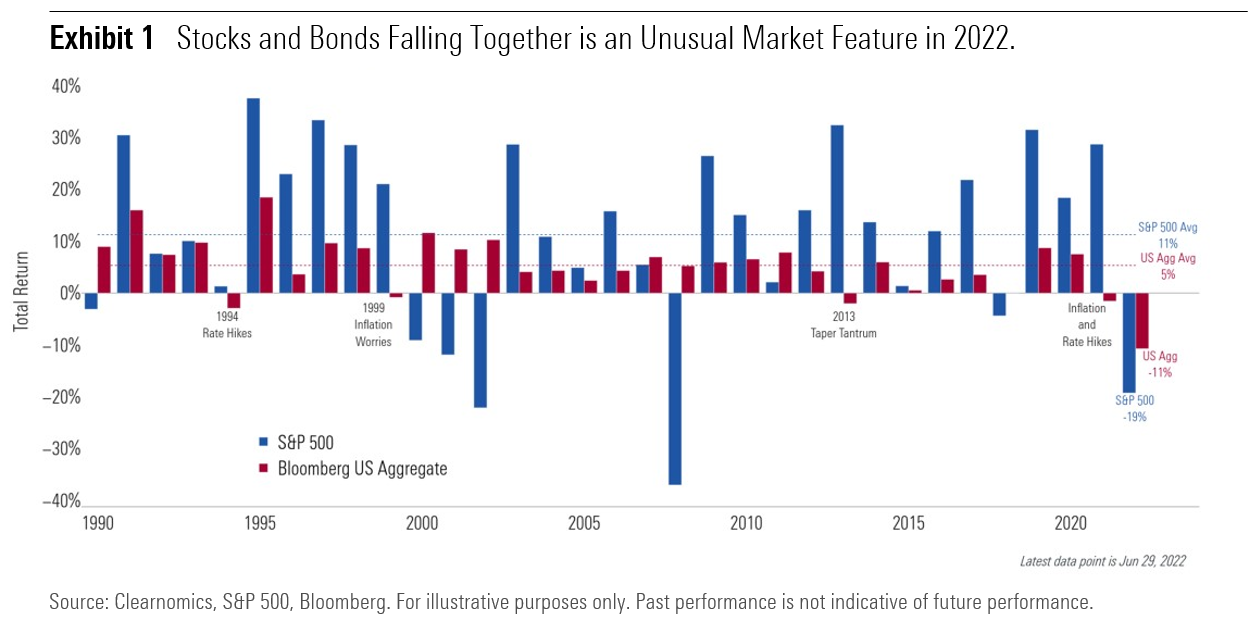

(Morningstar Managed Portfolios) Stocks and bonds fell at the same time, creating an uncomfortable period with few places to hide. In this environment, it is tempting to throw the baby out with the bathwater and source the scarce winners, but we still see the best portfolio mix maintaining a healthy level of stocks and bonds.

Moreover, the merits of stocks and bonds have improved, with higher yields and a better foundation for future return potential. It has also demonstrated the benefits of taking a valuation-driven approach, allowing us to protect capital at an important time. That's not to boldly declare we've reached a bottom, as that will only be clear in hindsight, but it does build the case to stick with a portfolio that includes an appropriate core exposure to stocks and bonds.

Explainer: Why Stocks and Bonds Should be Considered Core Assets?

If you are worried about your portfolio mix, it is worth taking a step back to appreciate the role stocks and bonds have on a portfolio. For example, stocks represent a share in a company, which tend to thrive if that company grows. Bonds are quite different in that they are a loan to a company or government, offering a steady income stream and generally lower risk. Together, they create a great combination of offense and defense.

That's not to say that other assets can't support a portfolio. Cash and alternatives (such as hedge-fund like strategies) are two commonly held assets in the portfolios we manage. Other assets include commodities and real estate, which can also be effective. Yet, stocks and bonds are two of the more reliable assets one can hold for the long term. For one, they comprise an enormous portion of public markets, allowing for diversification from within. For example, Treasuries behave differently than corporate bonds or emerging-markets debt. Similarly, financial stocks, energy stocks, and technology stocks can respond differently to different market environments. Plus, they are much more liquid than other assets that can comprise a meaningful part of someone's wealth. (You can sell a slice of your shareholding, but you can't sell a bedroom!) Moreover, relative to commodities, they offer cashflows that allow us to utilize proven valuation models, so we have a better idea of what these assets are intrinsically worth. These are some of the attractive characteristics that make stocks and bonds fabulous core assets.1

Our View of Stocks and Bonds Today

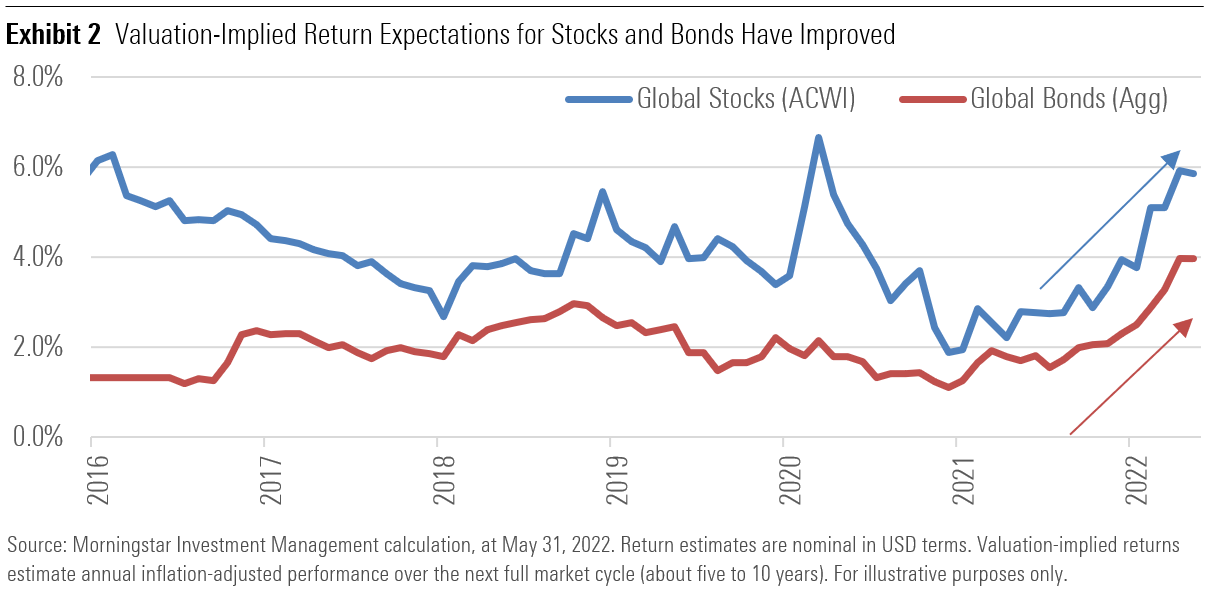

Turning to the current situation, we need to balance return potential and risk. With questions around a regime change of higher inflation and rates, one way to help us monitor the situation is to reassess our return and risk expectations over time. We like to use "valuation-implied returns," which wrap up several methods of valuation analysis into a consistent output, allowing us to monitor a collective pulse on market conditions. Using this analysis, we can see the return prospects for both stocks and bonds are improving significantly. The below returns are annual estimates over the next decade.

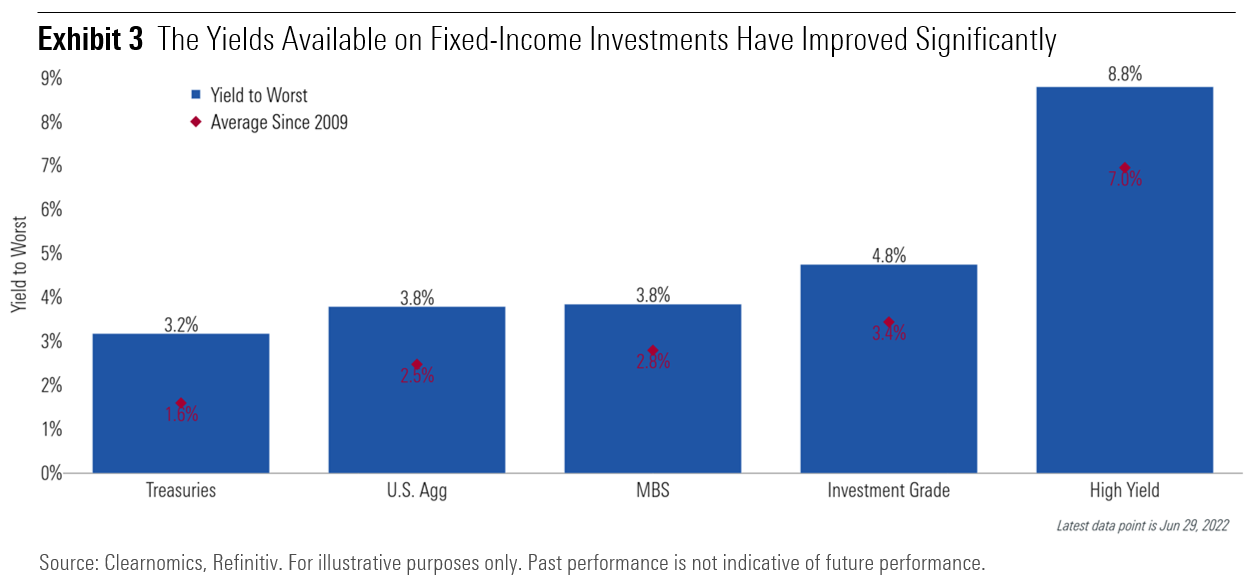

Driving this observation, dividend and bond yields are growing from a low base, which is primarily thanks to the recent price falls and interest rate hikes. Perversely, this change could be considered a relief, especially for income-sensitive investors such as retirees. It marks a major change from 18 months ago, where we noted significant valuation pressures, especially in assets with duration risk (such as growth stocks and long-dated bonds, where a lot of the expected cashflows are discounted from the future).2

Now we're seeing the valuation premium slashed, making both stocks and bonds much better value. Of note, these market adjustments are often justified for rational and calculated reasons, but higher yields and lower valuations are a net positive for future return generation. In this sense, we continue to believe stocks and bonds are fantastic assets for wealth creation and preservation. Furthermore, stocks and bonds have a long history of being negatively correlated, so when one goes down, the other tends to go up. That isn't happening right now due to rising inflation and interest rates, but it is a relationship we expect to take hold again in most market scenarios.

But it's not just about staying invested in stocks and bonds—it's also about understanding the right stocks and bonds to invest in. Some bonds fare better than others in rising-rate environments. For example, we note that short-term bonds, which carry less duration (or interest-rate sensitivity), tend to outperform the broad bond market during rising rates. Therefore, holding more in short-term bonds can offer the potential to minimize losses should rates move meaningfully higher while continuing to provide capital preservation properties that high-quality bonds tend to offer during volatile market conditions.

When working through these opportunities, it is also important to acknowledge the inability to predict the path or timing of normalization. Many people declared the death of bonds back in 2009, only to see them miss out on spectacular returns in the decade that followed. The danger here is trying to time the market by exiting bonds in an attempt to re-enter when interest rates have "normalized", wherever that point may lie.

Rising Rates Can Ultimately be Good for Long-Term Investors

It's important to remember that rising interest rates means borrowers will pay investors more to hold their capital. As rates move higher, short-term debt rolls over to higher rates and investors can ultimately get paid more—but only if they are still invested.

At Morningstar Investment Management, we've sought to manage interest-rate risks in our portfolios while preserving return potential. But the larger issue may be a behavioral one, as it often is. Specifically, it's easy to fear rising rates and rashly trade out of stocks and bonds. This would be a mistake, in our opinion, as the future looks much brighter for these core asset classes, where we have a greater return cushion from the higher yield.

Underpinning all of the above is the most important rule of investing—to think probabilistically. Although the future appears to be more uncertain of late, the nature of the future is that it is always uncertain. We must therefore always consider a broad range of potential outcomes and create portfolios that are robust across that range. We do this by assigning probabilities to a range of potential outcomes and stress-testing portfolios using both historic and hypothetical scenarios.

Practically speaking, the path to higher interest rates is anything but certain, with stocks and bonds playing an important role in most market environments. A portfolio created in this way will not be perfectly aligned to any single outcome and so is unlikely to be at the top of the short-term performance tables. However, it is equally unlikely to breach the risk guidelines which have been set to align the portfolio with the risk tolerance of the investor. It is therefore a more dependable vehicle to help investors reach their goals—helping you deliver returns and sleep at night.

Final Thoughts

Coming into the 2022 downturn, we had warned about the risks of overvalued stocks and bonds. We generally carried lower bond exposure and had less exposure to longer-dated assets, which helped us navigate through a difficult period. This stemmed from our valuation-driven investment process, which is our compass to help clients reach their goals.

Looking ahead, we continue to believe stocks and bonds are fabulous assets to help people reach their goals. Stocks and bonds offer different mechanics, performing differently in various market environments. They are time-tested, liquid, and functional. They offer a steady stream of cashflow and are also relatively easy to value—compared to assets with no cashflows—making them ideal core assets for the majority of investors. Further, following recent losses, the return expectations for both stocks and bonds have improved. This is a broad positive that will help investors in the next chapter of their investment journey. Often, the time to get excited is when people are fearful.