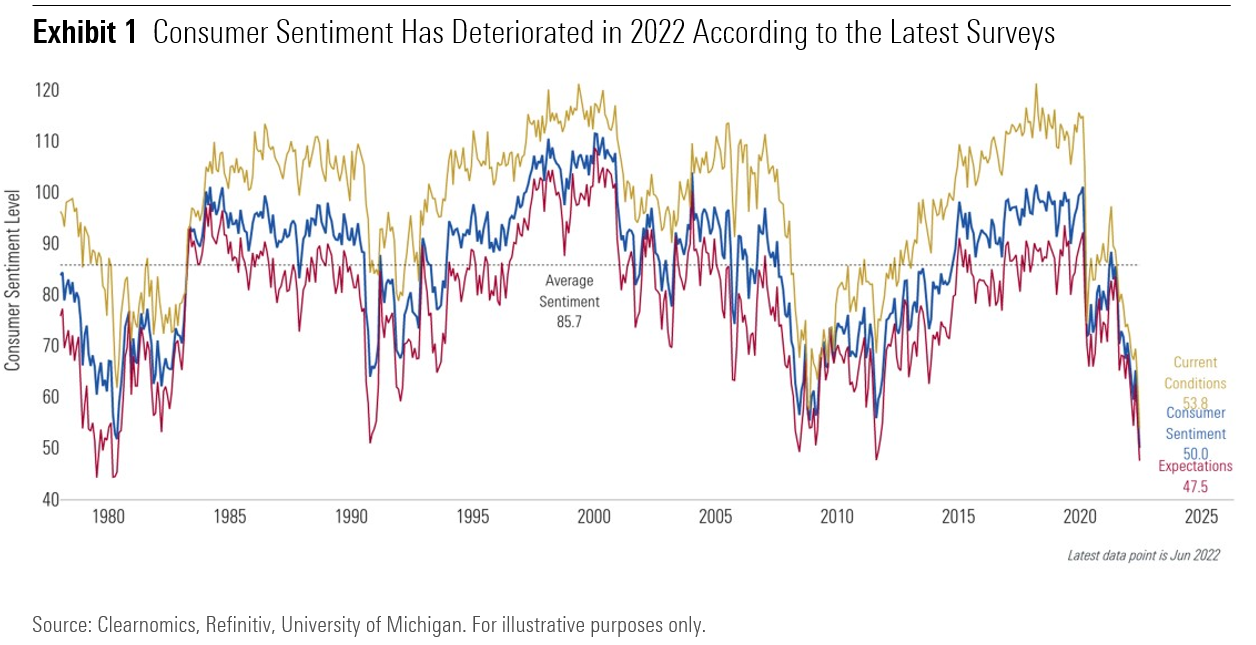

(Morningstar) Politics, war, and a cost-of-living crisis are all pressing on the moral conscience. Retirees are particularly scared, with inflation pinching budgets at the same time as portfolio values struggle. Additionally, the uncertainty created by the political upheavals in western democracies, together with the longer-term impact of the COVID pandemic and the war in Ukraine, have eclipsed the financial characteristics of the investments that people own and directed their attention towards politics and security. The impact is confidence-sapping.

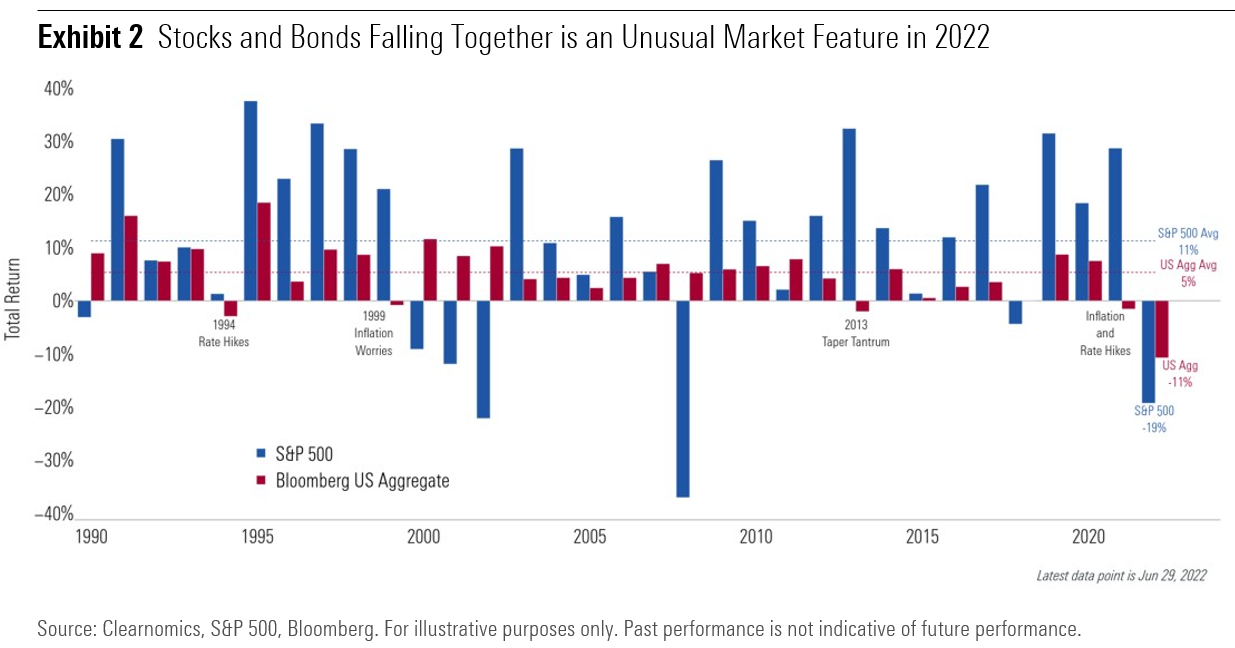

This can be seen in the returns to investors over the year-to-date and is especially evident in two assets. The first is government bonds, which are typically held for their defensive characteristics and as a source of diversification when investor sentiment is less positive. The second is the share price movement in U.S. companies that were expected to grow rapidly—including technology stocks—which have been the main engine of returns to investors over the last few years.

Unusual Features of Today

Unusually, government bonds have not played a defensive role in 2022, but have instead fallen in price alongside equities. While this synchronized decline will have a limited impact on more adventurous investors, who typically hold few bonds in their portfolios and are familiar with the ups and downs of being a shareholder, it is likely to be of far greater concern to cautious investors who typically hold a much greater proportion of their portfolio in bonds and are used to a more stable return.

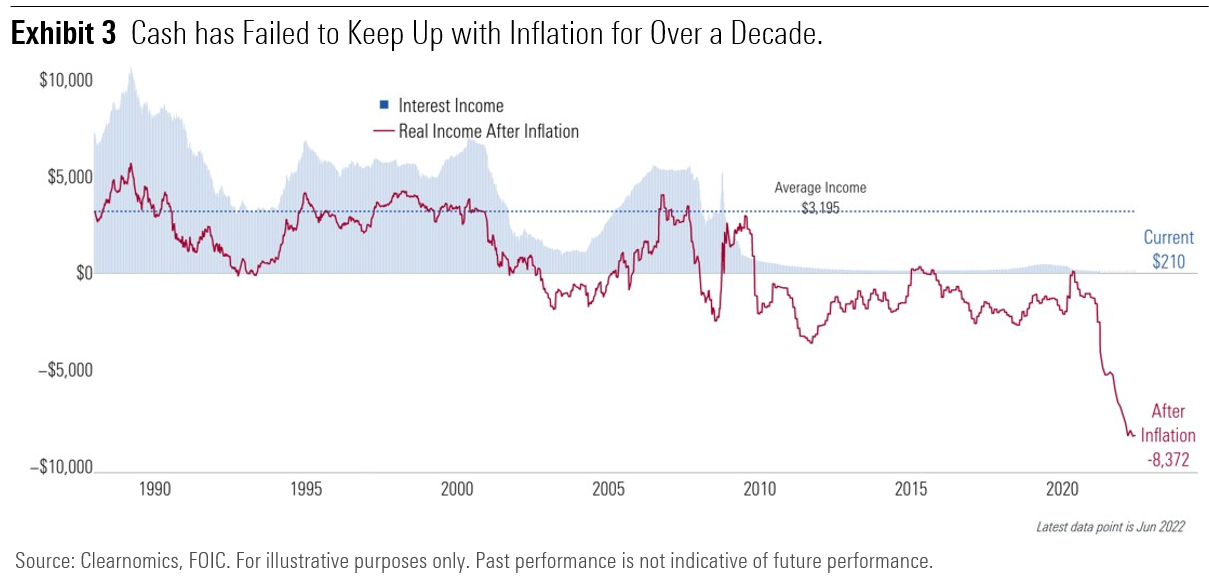

The combination of unusually poor returns and a troubling geopolitical backdrop is a perilous one for investors as it can promote behavior that may permanently damage an investors’ ability to reach their financial goals. We understand the allure of cash-reigns-supreme at times such as these (the so-called "cash is king" mentality), but it is important to remember that cash has a terrible track record of keeping up with inflation, so is a near-guaranteed way to lose purchasing power.

Given the above developments, we have three points we'd like to convey to help guide clients through this challenging period.

1. Keep Returns in Context

As humans, we have a tendency to concentrate on our most recent and vivid experiences and extrapolate those experiences forward. This leads us to be more adventurous when we have recently experienced gains and more cautious when we have experienced losses. It also explains the habitual problem of investors buying high and selling low.

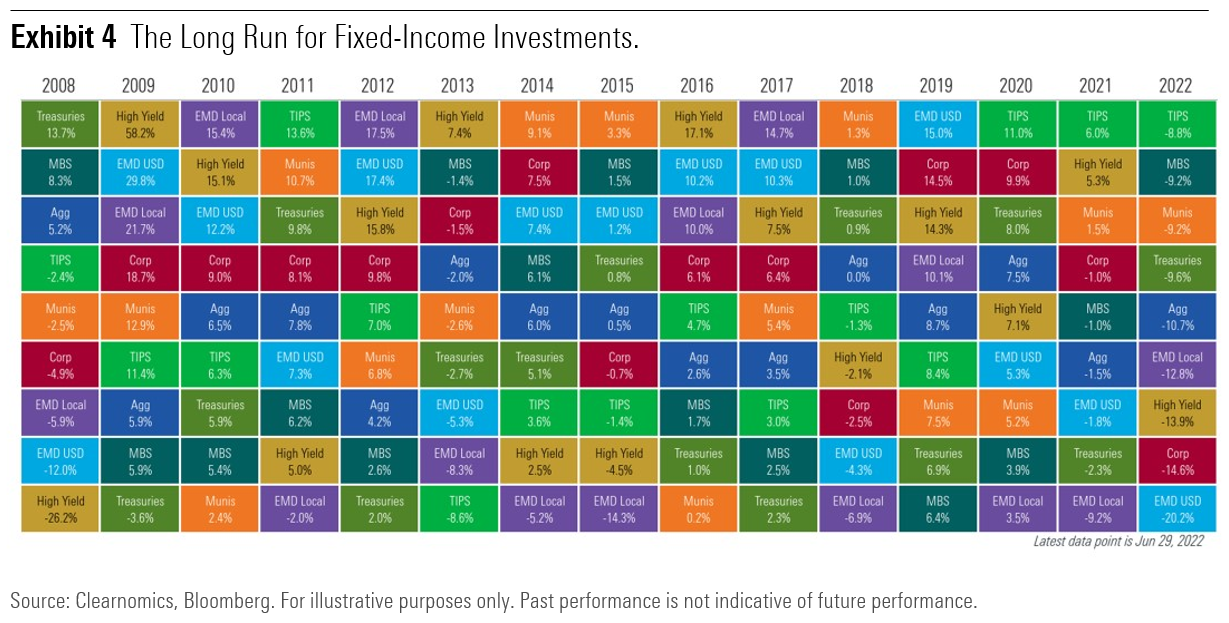

One way of combatting this tendency is to contextualize recent returns as part of a longer-term journey towards an investors goal. For instance, the returns to cautious investors have been very healthy over the last few years (higher than long-term norms), supported by relentless stimulus from central banks that propelled both bonds and stocks. As a result, cautious investors are likely to be far closer to their original goals than they might expect to be at this point, notwithstanding the recent falls.

Cautious portfolios are still in good shape for the future, too. The change in the market in 2022 has seen yields increase across the board, which sows the seeds to future cashflows and returns. This is especially true for bond markets, which are an effective holding for cautious investors from today's position. We are deliberately targeting assets that offer healthy and stable investment profiles, which should give you confidence. If you have a decent investment horizon, there is reason for optimism.

2. Take Back Control, but Do So Effectively

The loss of control that one feels when asset prices are falling can be anxiety-inducing. Yet it is important to acknowledge uncertainty for what it is. Uncertainty is everywhere, given geopolitical events that are both unpredictable and impactful, such as political division, a cost-of-living squeeze, and the threat of war.

The desire to control is a natural response, but it is perhaps better diverting that focus to matters that are likely to improve your situation. Budgeting is one such example that is worthy of revisiting in today's environment, as it has likely changed. With inflation impacting some parts of your budget more than others, it is a good idea to work through your spending patterns and identifying actions that can improve your financial situation and provide reassurance.

We are similarly looking at the impact of inflation on different investments, with some sectors and countries more impacted than others. Adapting to change while controlling the controllable is a sound approach to decision making. But trying to control the uncontrollable leads to destructive actions. As Warren Buffett famously said: "Only when the tide goes out do you discover who's been swimming naked." Understanding uncertainty, robustness, and control are key concepts we take seriously as investors.

3. Reaffirm Your Goals

Progress towards one’s goals is only relevant if the goal is well articulated and sticky. That is, we want to get to the heart of your ambitions and maintain our focus over time. And while many are thoughtful about this process, we often hear that clients' goals change amid uncertainty. Even worse, those without goals are far more likely to be focused on recent returns and therefore more prone to the mistakes that such a focus encourages. Equally, it is challenging to reassure that you are financially secure if you do not share a definition of what financially secure means.

In order to help, we encourage you to work through a process that we call "mining for goals." This process was developed by our Behavioral Insights team and involves three steps; 1) writing down your top medium- to long-term goals off the top of your head, 2) reading a list of the most common goals among similar people, 3) reassessing which goals are most important to you. Our research found that over 70% of people changed at least one of their top three goals as a result of step 2, helping them understand what is most important and helping create a stickier foundation for success.

Of course, if your goals have changed, this may require a rethink of your financial plan. It may also impact the investments that are most appropriate for your circumstances. If this applies to you, it should be worked through with your financial advisor.

Our Message to Cautious Investors

From an investment perspective, the principles of good investing still apply, and we feel positive about our ability to help clients' reach their goals despite the market backdrop. As part of this, we continue to manage risks carefully, understanding the impact of inflation and recessionary conditions on each investment we hold. Today's conditions bring about new challenges, but our north star hasn't budged—with our clients' goals top of mind. The silver lining is that our return expectations have improved following recent market weakness, which should hold investors in good stead over the longer term while we seek robustness at the total portfolio level to manage against headwinds.

While periods such as the one we are experiencing are undoubtedly challenging for cautious investors, we want you to know that we are thinking carefully about your journey as investors and as humans. As ever, we are here to support you in any way that we can.