(Morningstar Managed Portfolios) Recoveries, by definition, are transitory. This is true whether we’re talking about an economic recovery, a stock market recovery or an injury recovery. They consist of a period of time following a setback, with an opportunity to see faster improvements than during a normal expansionary phase. This is not guaranteed, of course, as any athlete with hamstring problems can attest. Or if you grew up in 1990s Japan, where the “recovery” is arguably still going, beset with countless setbacks.

But they do eventually end, by definition. At some point, it stops being a recovery and it becomes the start of a new expansionary phase, at least until the next setback occurs. Yet, recoveries do represent an outstanding period of time for investors, with a desirable blend of positive data flow, fast growing earnings and the return of once fearful investors. It can be a period where all ships rise as the tide changes, creating a cyclical upswing.

Turning to today, most of the cyclical upswing may now be behind us, although we continue to see positives. The key now is to stay a step ahead of the pack, knowing what may come as the recovery matures, ultimately positioning portfolios in a way that reflects forward-looking realities.

Our Take on Today’s Recovery

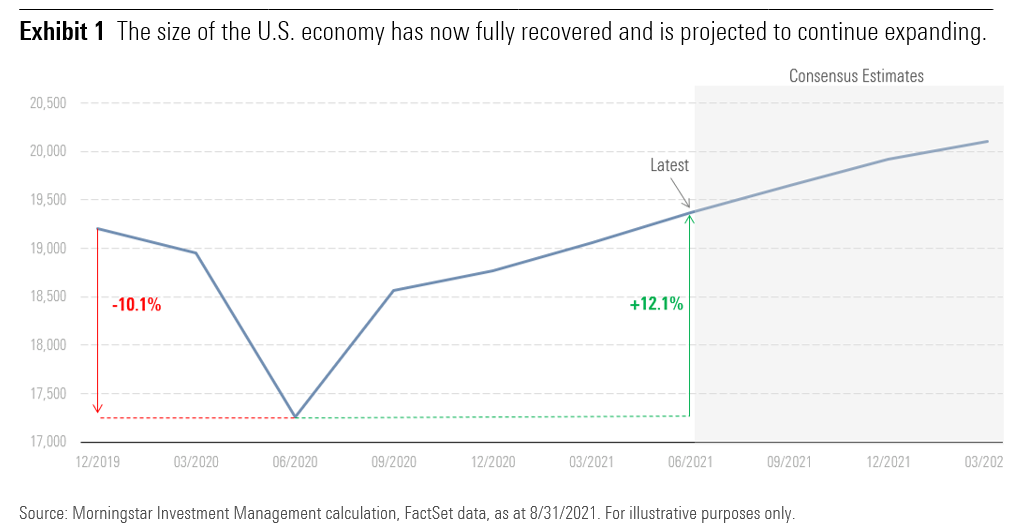

The economic recovery has been unique and powerful. The supportive environment is evolving quickly since the economy bottomed in Q2 2020, with a stellar recovery in both the economy and markets. Perhaps so strong that it is no longer valid to call it a recovery. We’ve seen economic activity in the U.S. exceed pre-pandemic levels, unemployment is back near 5% (from 14.8%)1, and wage inflation is rising.

From an investor’s perspective, we saw the classic recovery plot, with equity investors front-running the economic recovery (the forward price-to-earnings ratio expanded from under 15 times to over 22 times)2 before corporate earnings picked up and took the driver’s seat (as earnings accelerated, the P/E ratio deflated). In our multi-asset portfolios, we were thankful to see some valuation opportunities early and took advantage of the cyclical upswing.

In a forward-looking sense, many market participants are still encouraged by the economic recovery, with strong corporate earnings and cheap interest rates, so continue investing full throttle. Others are beginning to question the durability of the recovery. We’d just comment that this type of bifurcation among market participants is very normal at this stage of a recovery, as economic maturity increases, and the positive dataflow somewhat softens. In this regard, we are broadly positioned for a continuation of the economic recovery, even as we've paired back some of the cyclical positioning.

What are the Key Positions in Our Portfolios?

The key question we ask ourselves is what positions will best help investors reach their goals? This is the task (and opportunity) faced by our investment team. To summarize a few major positioning points:

- We are relatively balanced in our broader risk assessment, taking a modestly protective stance, acknowledging the strong run in markets and some fundamental risks ahead. We are offsetting some of our cyclical risk with exposure to defensive sectors like consumer staples and a minor equity underweight overall, based on our valuation work.

- In equities, we have broadened out our value-oriented holdings with key positions in energy and financial companies, which makes sense to us for most economic pathways. That said, exposure to value stocks remains among the largest relative driver of our portfolios at the current time. In our multi-asset portfolios, we carry a non-U.S. equity overweight too. This includes exposure to Japan, the UK, and emerging markets. On the growth side, we made a minor reduction to the significant US "big tech" underweight as value rallied in 4Q20 and 1Q21.

- For portfolios with healthy fixed income exposure, we favor emerging market debt in local currency and retain some inflation protection, although we have trimmed the latter position as inflation expectations increased recently. Elsewhere, our analysis still shows that many fixed income markets are expensive, especially so in high yield bonds, where we have shifted to an underweight position. In fixed income, we are balancing defensive characteristics against low absolute yields. We are also using alternative assets exposure to deal with the risk in fixed income at this yield level.

- Our underlying currency positioning depends on the portfolio in question. For more conservative portfolios, we are overweight the US dollar, but as we get into portfolios with more equity, we carry less US dollar exposure (partially explained by our preference for non-US equities) alongside a range of currency exposures, including the Japanese Yen, which tends to behave as a safe haven currency in periods of broad market stress. Broadly, we continue to lean on the protective characteristics of the US dollar where it makes sense to do so and have recently boosted this exposure.

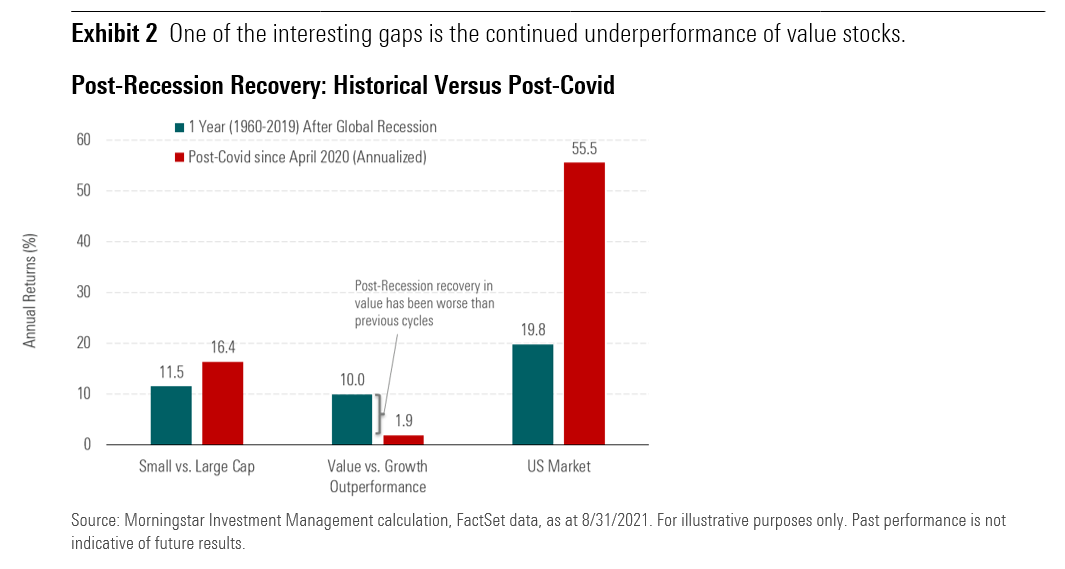

To capitalize on the broader recovery story, it is important to play through the probable economic pathways from here to determine how our positioning might fare. The first, and perhaps most likely scenario, is that the economic recovery is set to morph into a new economic expansion, despite some obvious headwinds.

If such a scenario transpired, our analysis suggests that in previous recoveries from global recessions, value outperformed growth more significantly. This might suggest there is still room for value stocks to outperform, as depicted in Exhibit 3.

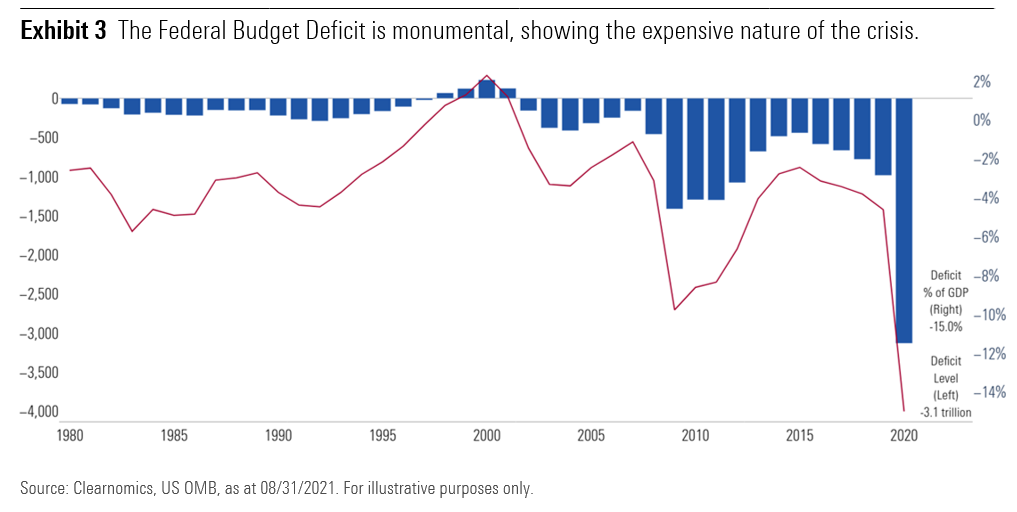

Others pathway that we must face up to include fundamental risks that are unique to this recovery. Prominently, a key risk is that this recovery was an expensive one. With both federal government and central bank support in the trillions, we averted a major economic crisis, yet the policy exit is fraught with danger.

We further acknowledge some other key downside risks, including:

- Inflation,

- Covid variants,

- Corporate capital supply. The ease by which companies can access capital via equity raisings is a potentially worrying development (from venture capital to SPACs and IPOs).

- High valuations: The COVID sell-off was short-lived, and the market was arguably overpriced going into the correction.

Some of these points have garnered mainstream coverage already, and we’re not breaking new ground on these topics in this piece. Suffice to say there are “known unknowables”, with each development having widespread probabilities attached to it. It is for this exact reason we continue to diversify the risk drivers in our portfolios, so we are positioned for investor success in many outcomes, not just one.

Moving Ahead

Investors ought to be happy right now. For the vast majority of investors, we’ve experienced a tailwind of strong absolute performance related to the economic recovery. We should all be thankful for that, in what is proving to be a complex environment.

However, looking backwards isn’t overly helpful for portfolio construction, whether that be in a multi-asset context or managing a direct equity basket. So, across the 70+ portfolios we manage, we continue to spend the majority of our time living in the future—understanding fundamental risks, finding opportunities, then packaging it together into portfolio solutions that help investors reach their goals.

We won't get everything right, as no one carries a 100% strike rate, but investors can take comfort when our positioning reflects our best research. So, even when this economic recovery ends, which it will by definition, we are still well equipped to empower investor success.

1 Sourced from the Federal Reserve as at 09/15/2021.

2 Sourced from Clearnomics, Refinitiv as at 09/15/2021.

Opinions expressed are as of the current date; such opinions are subject to change without notice. Morningstar Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Morningstar Investment Management does not guarantee that the results of their advice, recommendations or objectives of a strategy will be achieved. This commentary contains certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. Past performance does not guarantee future results. Morningstar® Managed PortfoliosSM are offered by the entities within Morningstar’s Investment Management group, which includes subsidiaries of Morningstar, Inc. that are authorized in the appropriate jurisdiction to provide consulting or advisory services in North America, Europe, Asia, Australia, and Africa. In the United States, Morningstar Managed Portfolios are offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC, both registered investment advisers, as part of various advisory services offered on a discretionary or non-discretionary basis. Portfolio construction and on-going monitoring and maintenance of the portfolios within the program is provided on Morningstar Investment Services behalf by Morningstar Investment Management LLC. Morningstar Managed Portfolios offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC are intended for citizens or legal residents of the United States or its territories and can only be offered by a registered investment adviser or investment adviser representative. Investing in international securities involve additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Morningstar Investment Management cannot guarantee its accuracy, completeness or reliability. Index Information Individual index performance is provided as a reference only. Each index is unmanaged and is not available for direct investment. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, we cannot guarantee its accuracy, completeness or reliability. Index data sources are as follows. S&P 500 Index—An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. The S&P 500 is a market value weighted index. MSCI EAFE Index (Europe, Australasia, Far East)—A free float-adjusted market capitalization index designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. Bloomberg Barclays U.S. Aggregate Index—A market value weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets