From Marta Norton, Chief Investment Officer, Morningstar Investment Management LLC.

Morgan Stanley, E-Trade, and Eaton Vance. Charles Schwab and TD Ameritrade. Franklin Templeton and Legg Mason. Asset management consolidation grabbed headlines in 2020, with many analysts pointing to a drive toward lower fees and greater product breadth likely to motivate more marriages in 2021 and years to come.

Meanwhile in the financial advisor space, Cetera Financial Group announced plans to acquire Voya Financial’s retail brokerage business in February 2021, which followed a number of similar announcements in 2020, including LPL’s decision to buy Waddell & Reed’s wealth management business and Advisor Group’s acquisition of Ladenburg Thalmann.

What’s driving all this desire to build large financial advisory operations? One reason may be increasingly costly technology services—digital workflows, for example, or tech improvements that stem from greater regulatory and compliance burdens. In a post-COVID world in which all advisor/client interactions have grown more accustomed to virtual engagement, this trend seems unstoppable.

Indeed, whether through financial advisory consolidation or technological platforms available to firms of all sizes, we believe advisors who survive into the future will have access to scale.

Perhaps surprisingly, this emphasis on economies of scale still allows for customized portfolios. That’s critical: Research by Morningstar Investment Management’s Ryan Murphy, head of decision sciences, suggests that clients value the interpersonal elements of the financial advisor/client relationship the most.1

Of course, personalization today doesn’t look like it did even 10 or 20 years ago. Today, technology has brought improvements to product offerings that offer advisors not only personalization but also scale. Rather than advisors creating one-of-a-kind portfolios of individually selected stocks, bonds, or mutual funds, today’s personalization comes from managed portfolios, unified managed accounts (UMAs), and model marketplaces, which allow even smaller RIAs access to low-cost, customizable portfolios while someone else handles the middle- and back-office work.

But is there something insincere about personalization through scale? Can portfolios really be customized for the unique needs of each client if you rely on model portfolios?

It may not come as a surprise, but we would argue yes. The reality is that, while the nuances are different, the broad outlines of client needs tend to fall along a known spectrum across near-, intermediate-, and long-term investment horizons. Moreover, market outcomes are not infinite, so for the vast majority of people, tailored stock or mutual fund selection won’t likely make a meaningful difference in the final analysis.

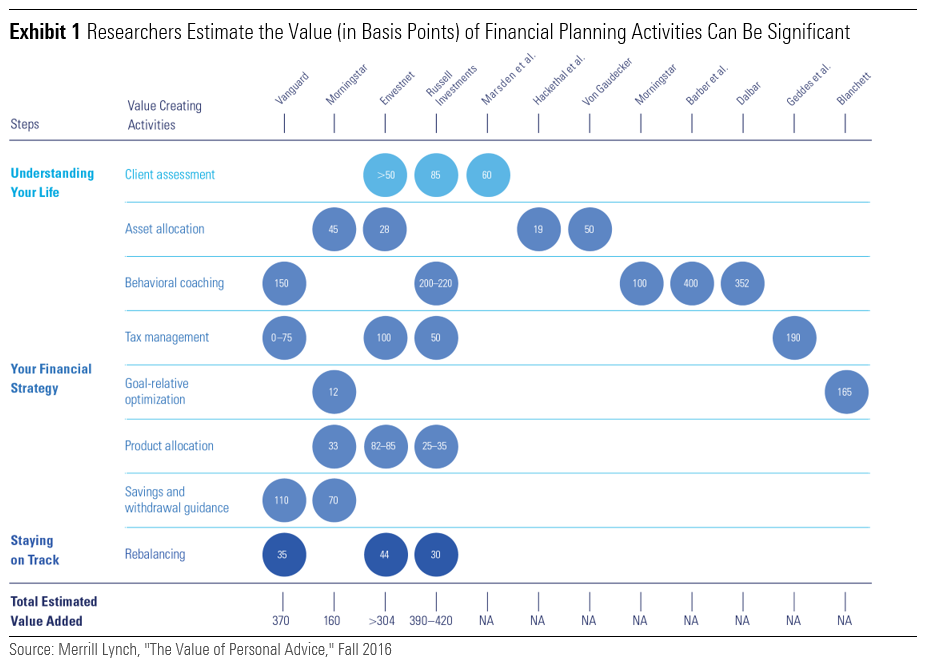

Where customization is meaningful and can vary relates to the details of the financial plan and the behavioral coaching that aims to help clients stay the course. Consider the many nuances of issues like taxes, estate planning, required minimum withdrawals, retirement expectations, or insurance. And while behavioral pitfalls are often fairly similar across investors, even the institutional types, the most impactful delivery is often personal. For the advisor who takes the time to invest in this effort, clients often stay the course. Morningstar researchers Blanchett and Kaplan found as much in 2013 and 2017 in their studies2 of the impact of financial planning (see Exhibit 1).

Products That Can Personalize

Even so, we acknowledge that at times, personalization needs to go beyond financial planning and behavioral coaching. Whether it’s a truly unique need or a matter of perception, advisors must be prepared to offer something different to certain clients. And as technology is driving the trend toward consolidation, it’s also enabling new investment vehicles that can deliver both scale and customization.

Those vehicles are unified managed accounts, or UMAs, and direct indexing. Let’s look at them in turn.

UMAs typically offer all of the scale of managed portfolios, with the added benefit of customization and whole-portfolio transparency and analysis. Before UMAs, advisors had to either treat accounts separately or spend time and resources bringing accounts together to analyze. UMAs deliver this reporting as part of the service.

The customization potential is limited only by the options offered on a platform. An advisor might dial risk up or down on a core multi-asset portfolio by pairing it with an equity or fixed-income separately managed account, or SMA. Or, higher-net-worth clients maybe prefer to build a portfolio of SMAs.

Note that these combinations are not created equally, nor should they be taken lightly. We have suggested advisors follow three main guidelines when combining portfolios in a UMA: Blend portfolios only to meet a specific need or known preference (low costs, for example); ensure each strategy plays a unique role in a combined portfolio (i.e., don’t combine two risk-based multi-asset portfolios with a myriad of overlapping holdings); and look for differentiated results from the combined portfolio (a notably different risk profile, for example, or increased exposure to non-U.S. markets).

Another exciting product development is the accessibility of direct indexing. It’s no secret that money has poured into ETFs by the billions in recent years, as investors have sought to lower costs and improve liquidity over mutual funds. With zero-commission trades now the norm, investors can move in and out of ETFs quickly and cheaply. But if there’s one investment vehicle that’s not personalized, it’s the ETF, which dutifully tracks its index with no exceptions.

But what if a client doesn’t want to hold every security in an ETF? This may be for a number of reasons, but in a world where interest grows every day in environmental, social, and governance (ESG) investing, that number has grown. Direct investing allows an investor to cheaply replicate the risk/return profile of an index while directly holding all, or a portion of the underlying stocks—enabling one to vote one’s shares—or, in some cases, customizing the exposure by not holding certain index constituents. In addition to the transparency and security benefits of direct ownership, direct indexing also allows for tax-loss harvesting, which can be a real boon to wealthier investors.

Technology gains allow for scale for advisors of all sizes on a level not previously seen. But for many, that means not going it alone, and tapping into the economies of model portfolios. Models—and related technologies—enable advisors to focus on services where they can add the most value, while still empowering their ability to create personalized portfolios for clients. While consolidation and scale so often imply doing more with less, we think this is an example where advisors can do more with more. These are exciting times to be a financial advisor.

[1] Murphy, R., Sin, R., & Lamas, S. 2019. "The Value of Advice: What Investors Think, What Advisors Think, and How Everyone Can Get on the Same Page." Morningstar White Paper. https://www.morningstar.com/lp...

[2] Blanchett, D. & Kaplan, P. 2013. "Alpha, Beta, and Now … Gamma," The Journal of Retirement, Vol. 1, No. 2, P. 29.

Opinions expressed are as of the current date; such opinions are subject to change without notice. Morningstar Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Morningstar Investment Management does not guarantee that the results of their advice, recommendations or objectives of a strategy will be achieved. This commentary contains certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. Past performance does not guarantee future results. Morningstar® Managed PortfoliosSM are offered by the entities within Morningstar’s Investment Management group, which includes subsidiaries of Morningstar, Inc. that are authorized in the appropriate jurisdiction to provide consulting or advisory services in North America, Europe, Asia, Australia, and Africa. In the United States, Morningstar Managed Portfolios are offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC, both registered investment advisers, as part of various advisory services offered on a discretionary or non-discretionary basis. Portfolio construction and on-going monitoring and maintenance of the portfolios within the program is provided on Morningstar Investment Services behalf by Morningstar Investment Management LLC. Morningstar Managed Portfolios offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC are intended for citizens or legal residents of the United States or its territories and can only be offered by a registered investment adviser or investment adviser representative. Investing in international securities involve additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Morningstar Investment Management cannot guarantee its accuracy, completeness or reliability.