(Morningstar Investment Management) As the saying goes, what a year this week has been. So far in 2022, it’s been a lot. Inflation, for the first time in 40 years, has dramatically accelerated—whether it’s the monthly consumer price index or long- term expectations embedded in the US Treasury market. War, with its attendant human costs as well as worries over the global supply chain, asserted itself on the global psyche. Interest rates, at least partly in response to inflation and the expected trajectory of policy rates in the U.S. and elsewhere, have risen sharply. Fears over slowing economic growth heightened speculation of the dreaded stagflation. A bear market in equities and fixed income spared few investors as many common volatility measures skyrocketed.

For illustrative purposes only

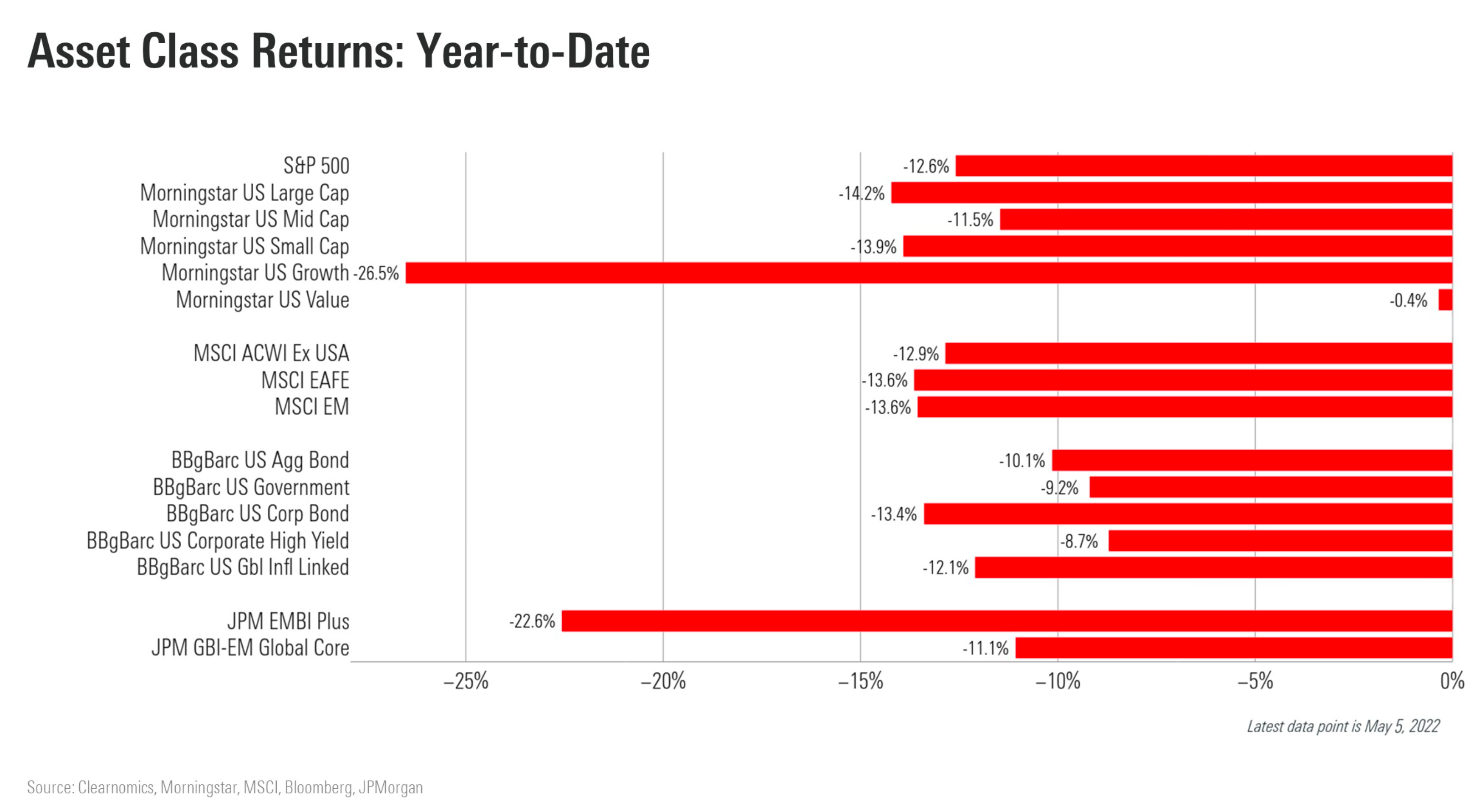

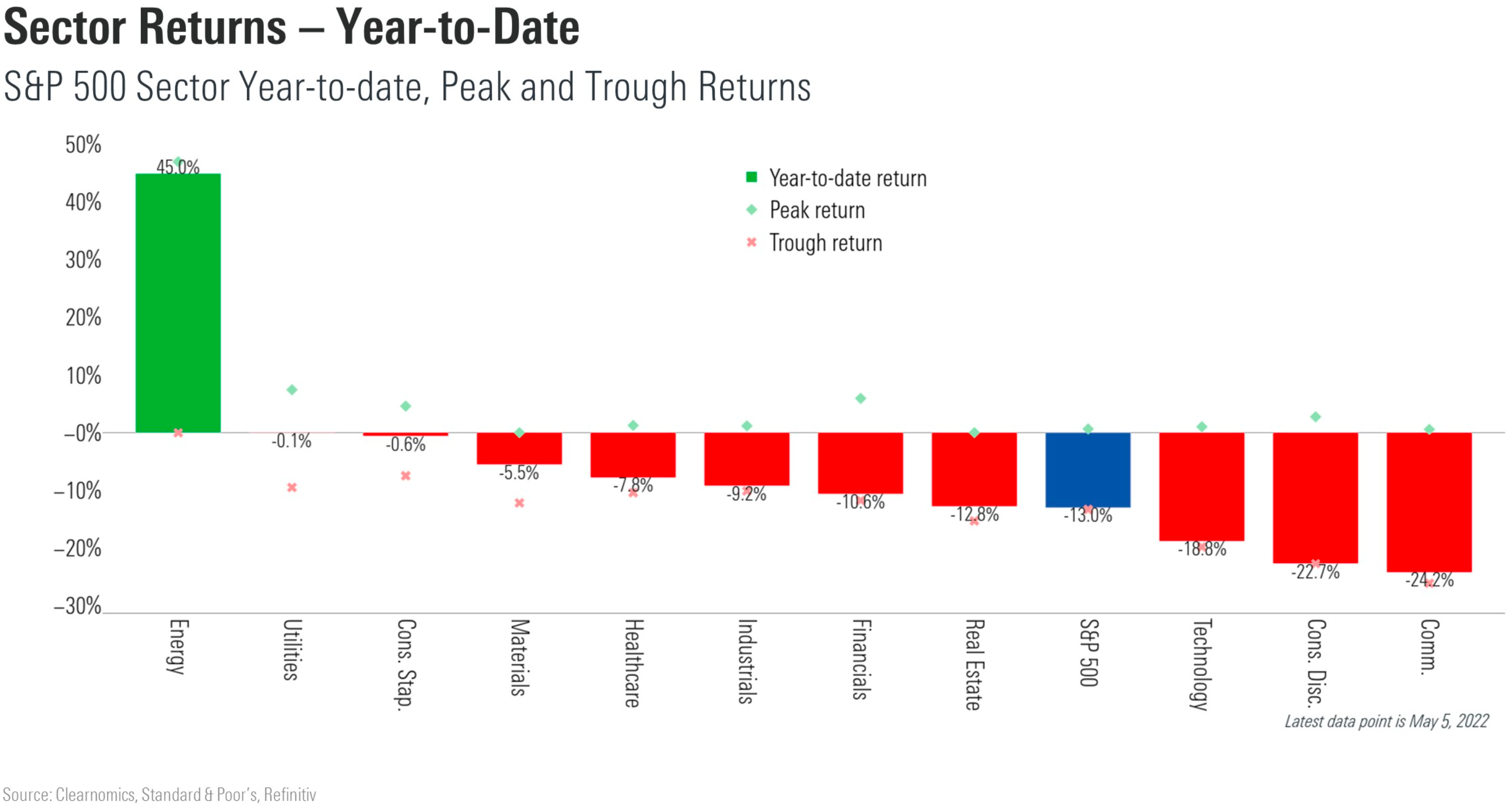

Digging further into the market backdrop thus far in 2022, most broad-equity and fixed-income markets declined year to date, as markets grappled with the reality of higher interest rates and the potential knock-on effect on economic growth. The notable exception from the selloff, energy stocks—a key overweight position across many of our portfolios—benefitted from rising oil prices amid the post- pandemic economic recovery and the Ukraine-Russia conflict.

For illustrative purposes only

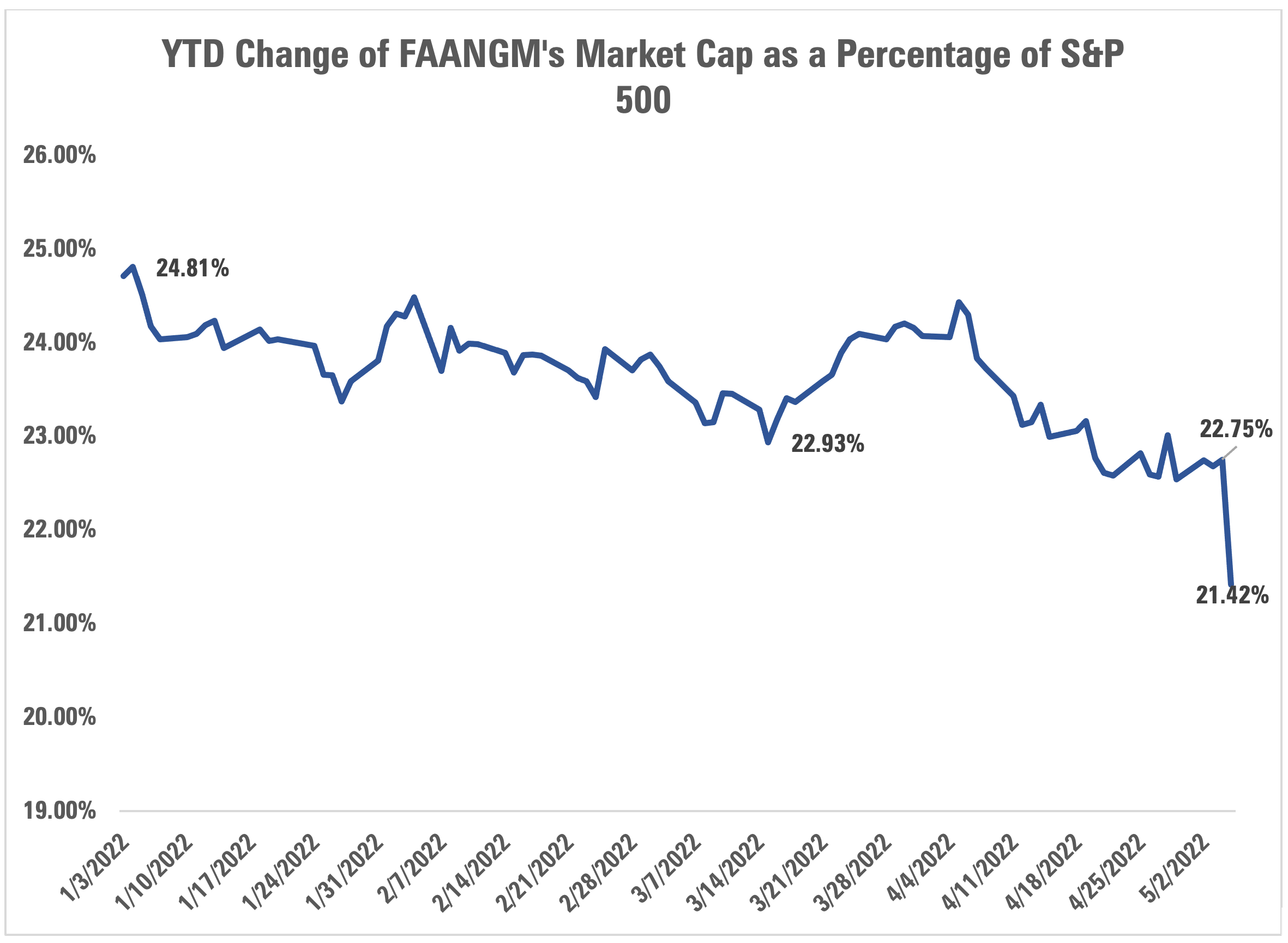

Large-capitalization technology shares (Big Tech stocks), which have dominated market performance for the past decade, have been at the epicenter of the market selloff as a double-whammy of rising borrowing costs and the prospect of slower growth disproportionally impacted assets whose cash flows are far out in the future. The S&P 500 Communication Services Index, which includes stocks such as Alphabet, Meta, and Netflix, has given up 24.2% so far in 2022. We have previously cautioned investors about the potential valuation and market concentration risk posed by these stocks and have generally been underweight Big Tech going into this downturn.

FAANGM market share has steadily declined throughout 2022: Market Cap Share of FAANGM stocks as a percentage of the S&P 500.

Source: FactSet, Morningstar Investment Management calculation as of May 5th, 2022. For illustrative purposes only.

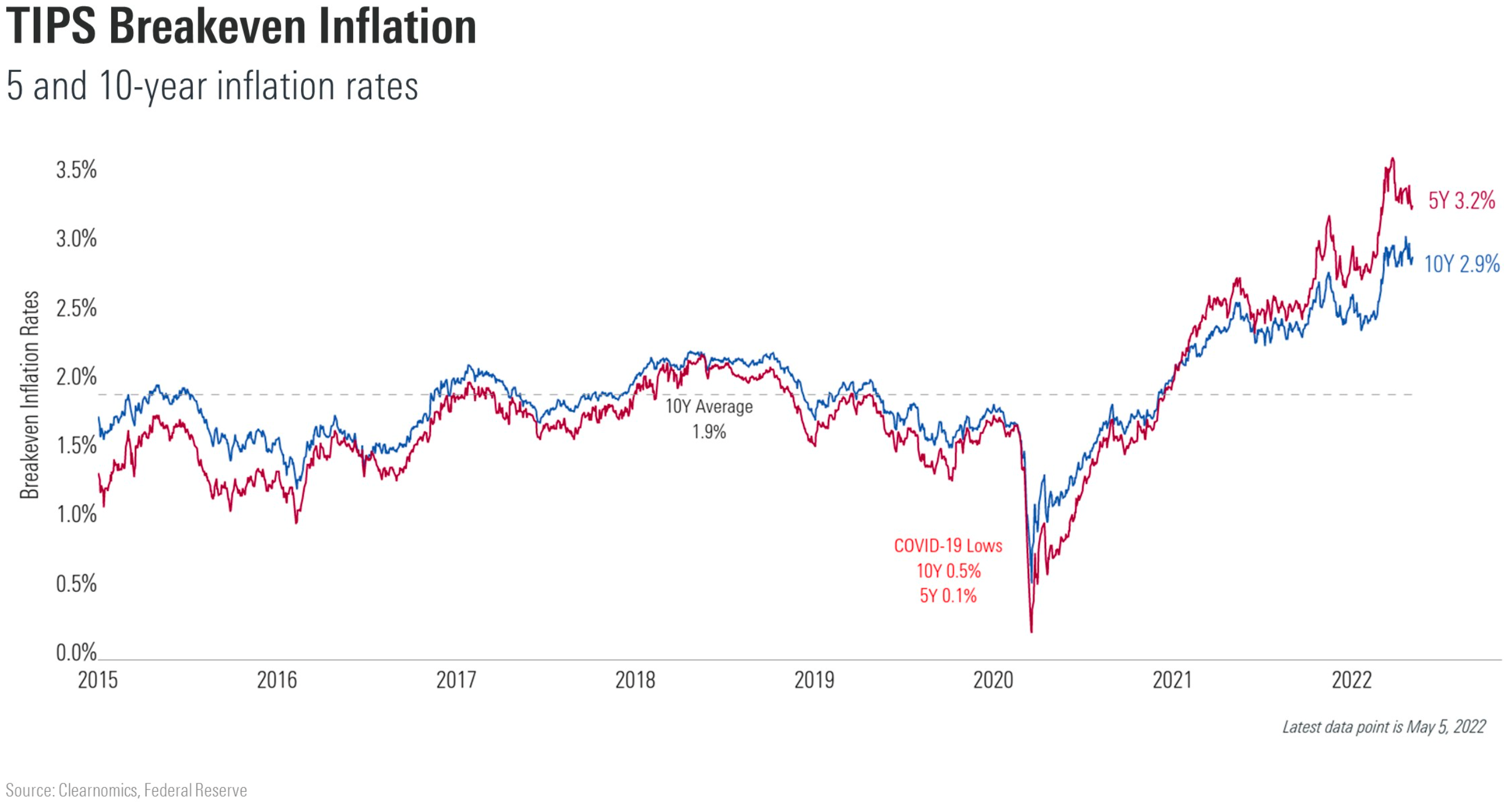

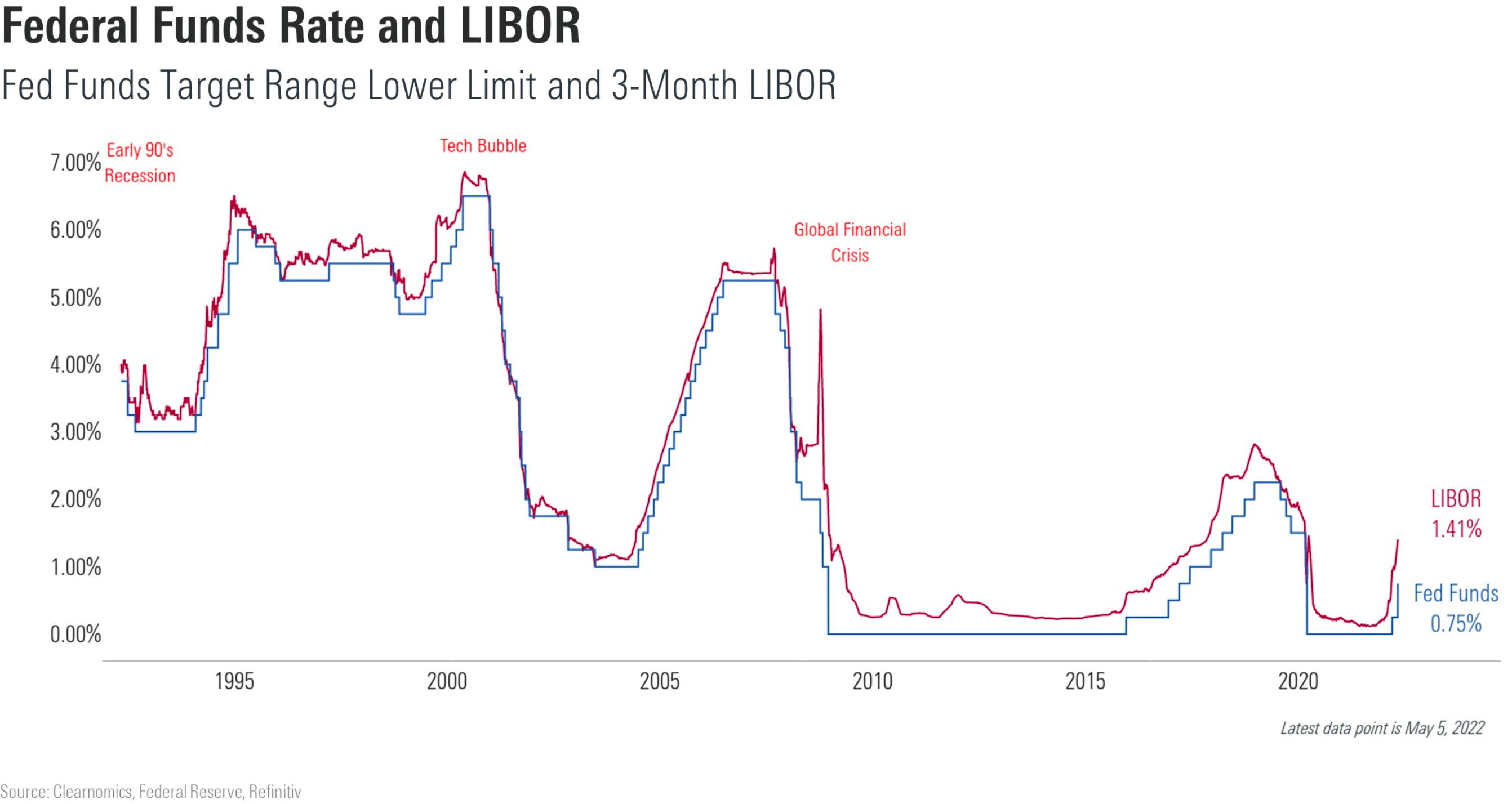

Also notable during 2022 has been the lack of defensiveness of U.S. Treasury bonds, particularly those with extended maturities. Investors had come to expect that treasuries would be a source of portfolio ballast during periods of equity market uncertainty—and this was certainly the case during the significant equity market selloff in response to the advent of the COVID-19 pandemic early in 2020. With the benefit of hindsight, it has become clear that the regime, or backdrop of policy-rate accommodation, significantly aided treasury returns during that time frame. With the prospect of rising treasury rates in anticipation of higher policy rates as central banks grapple with inflationary pressures, the regime has shifted from one of prevailing tailwinds to one of prevailing headwinds, at least for the moment.

Long-term inflation expectations have risen beyond the Fed's 2% inflation target

For illustrative purposes only.

Financial Conditions have tightened, with the Fed increasing the Funds Rate to 75bps and the market expecting more rate hikes 2022

For illustrative purposes only.

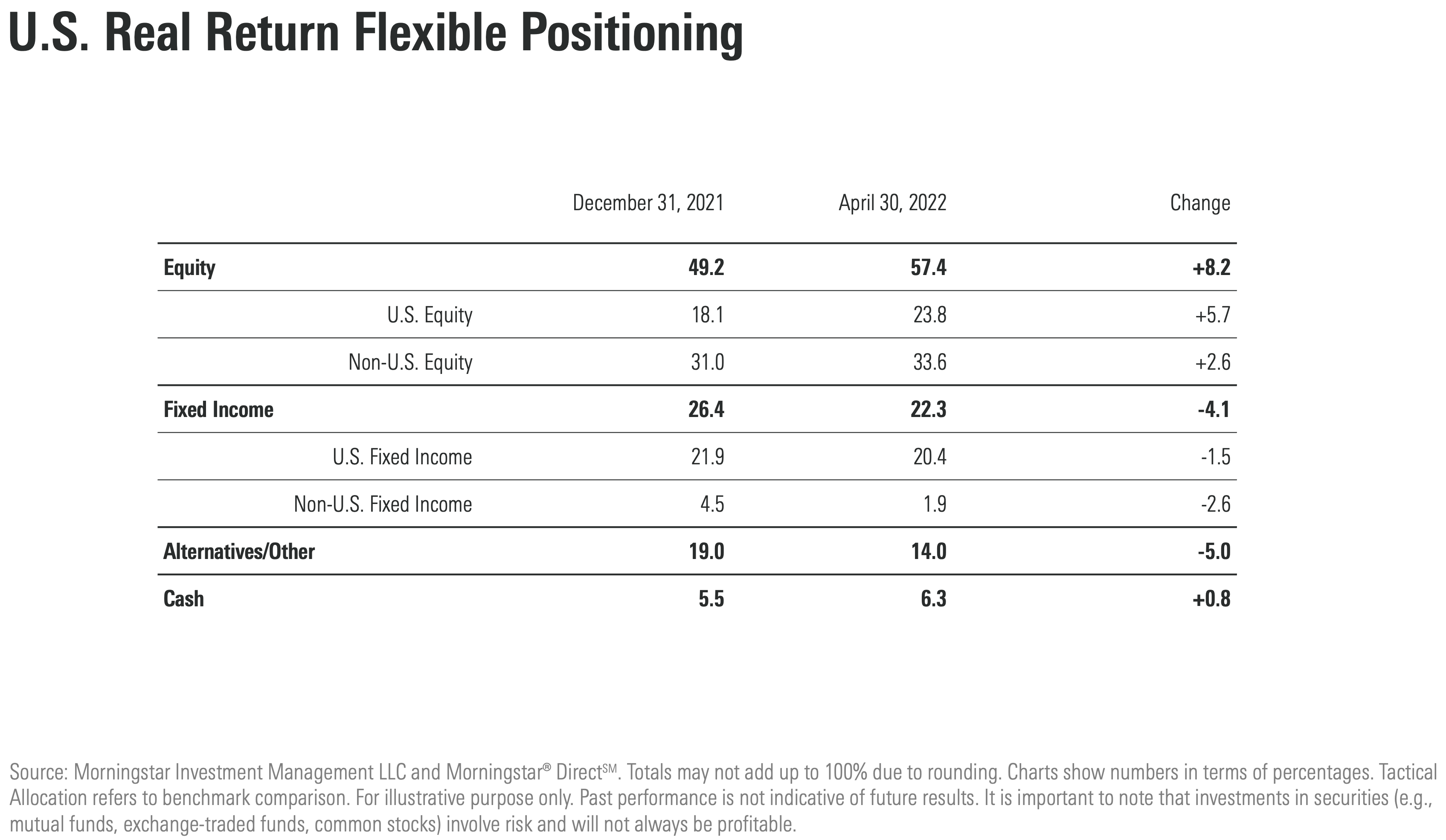

Positioning: Then and Now

Heading into 2022, we had three concerns, two of which were interrelated. First, as valuation-conscious investors, the sky-high—at least in our estimation—price tags of U.S. stocks were worrisome. This was particularly true among the FAANGM stocks (Facebook/Meta, Apple, Amazon, Netflix, Google/Alphabet, and Microsoft), which had dominated the market for several years and had a particularly strong stretch during pandemic lockdowns.

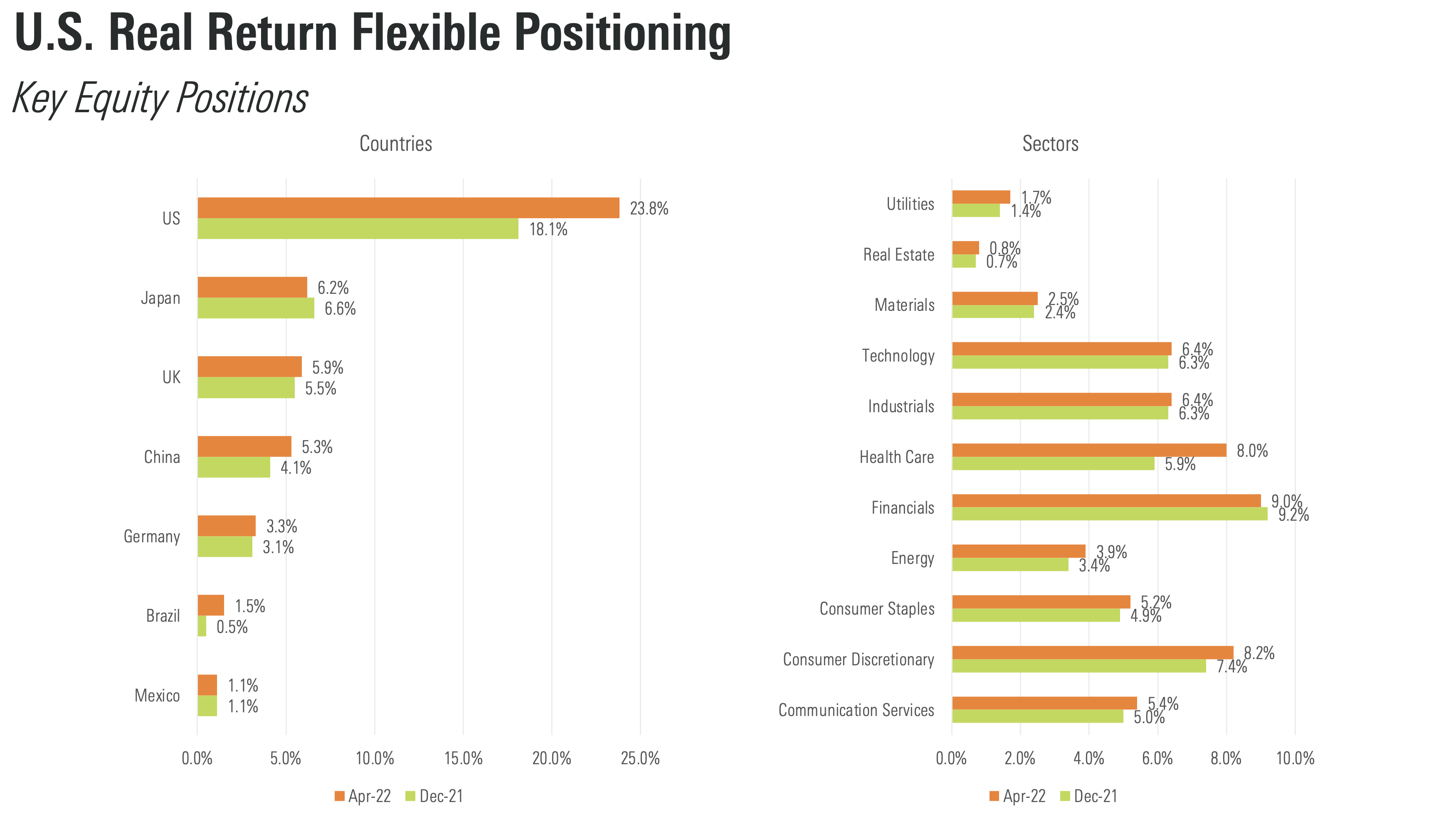

Meanwhile, stocks outside the U.S., while not cheap on an absolute basis, looked attractive relative to the U.S. market. This view led us to opt for non-U.S. stocks over U.S. stocks and value segments of the U.S. market (energy and financials) over U.S. Big Tech. Areas of particular interest within the non-U.S. equity market included the U.K., European financials, Brazil, Mexico, and China.

In addition to valuation concerns, we were leery of the macroeconomic environment. We don’t spend much time forecasting inflation or interest rates—few investors, if any, have proven prescient in those estimations—but given fiscal and monetary policy, supply bottlenecks, and the unprecedented global stop/start of health policies, the range of outcomes for inflation seemed particularly wide. The follow-on, of course, was the impact on interest rates and how the Federal Reserve might respond to persistently high inflation. This was particularly worrisome to us, given the low yields across fixed income, which seemed vulnerable to negative surprises.

Inflation and interest-rate concerns reinforced our preference for value-oriented equities over their growthier counterparts. While the driving appeal of value stocks is their price relative to fundamental value—and often a higher yield, either through dividends, buybacks, or both—growth stocks excite investors because of their high forecasted earnings streams. Because investors value these stocks by discounting those earnings into the present with interest rates, higher interest rates can undercut their appeal.

One exception to this preference in our portfolios were Chinese stocks, particularly within Big Tech. A host of concerns had weighed on these stocks over the past year, including an unpredictable regulatory environment. As a result of the negative sentiment, China Big Tech valuations looked far more reasonable to us, and we had initiated small positions in the country.

Within fixed income, we had reduced our exposure to core bonds in favor of hedged alternative strategies that historically generated consistent, moderate returns in a somewhat fixed-income–like fashion, but without the embedded vulnerability to rising interest rates.

While this positioning hasn’t mitigated all loss of the year-to-date period, it certainly has helped our relative results, particularly given the sell-off within U.S. Big Tech. That said, China tech has been a pain point as geopolitical tension and renewed COVID lockdowns have added to investors’ concerns. Ditto with European stocks more closely tied the Russia/Ukraine war, including Germany and European financials.

As markets have sold off, we have continuously reassessed positioning, taking stock of valuations and weighing the potential for a range of different outcomes. From a valuation perspective, China looks even more attractive, and we’ve increased our exposure—but only up to a limit, given the tremendous regulatory and geopolitical uncertainty that we cannot handicap. We’ve also edged into U.S. stocks broadly as the market has continued to fall, though valuations remain high, in our estimation.

Our fixed-income positioning remains largely intact, with significant stakes in alternatives, though we continuously reassess valuations in Treasury and corporate markets as well. To date, they remain stretched in our minds; our allocations today help offset recession risk.

Source: Morningstar Investment Management LLC and Morningstar® DirectSM. Totals may not add up to 100% due to rounding. Charts show numbers in terms of percentages. Tactical Allocation refers to benchmark comparison. For illustrative purpose only. Past performance is not indicative of future results. It is important to note that investments in securities (e.g., mutual funds, exchange-traded funds, common stocks) involve risk and will not always be profitable.

Our Guiding Principles

This conversation naturally leads into a discussion of how we manage portfolios through uncertainty, which, while always present, feels particularly high today. Will inflation grind higher or moderate of its own accord? Will the Federal Reserve be able to thread the needle, attacking inflation but leaving growth untouched, thereby avoiding a recession? And if that’s not enough, how will China navigate COVID, and what will be the long-term outcome of the Russian/Ukrainian war?

At Morningstar Investment Management, we adhere to a few principles that we believe will help us accomplish our overall objective of satisfactory long-term investment results on behalf of our clients. First, we believe that in any investment climate, but most importantly during periods of uncertainty, you need to stay true to your process. For us at Morningstar Investment Management, this means sticking with our long-term, valuation-driven, independent-minded, behaviorally aware approach towards investing. Our decision process requires time, thought and thoroughness, and this means we won’t capture every short-term trading move but should, over time, be able to identify and capture suitable long-term opportunities during periods of uncertainty.

Second, we believe it is a prudent strategy to recognize uncertainty for what it is. A hallmark of our process is the emphasis on planning over prediction. We do not consider it to be a core competency to be able to predict market movements, but we can build out scenarios in our analysis and test investments to understand their behavior under different conditions. As well, our valuation-driven approach seeks to build in a margin of safety in our analysis in order to account for uncertainty.

Third, we believe it is vitally important to remain focused on fundamentals—and how periods of uncertainty impact those fundamentals. We are constantly researching sectors, countries, and asset classes that are impacted by these uncertainties, with the goal of reviewing and refining the assumptions underpinning the long-term fair values that inform our view of expected returns.

Fourth, we believe it is important to utilize periods of uncertainty to consider implications for portfolio positioning. As we think about the portfolios we build on behalf of our clients, the concept of robustness is highly emphasized in that thought process. What we mean by robustness is the ability of a portfolio to deliver a return stream that is competitive when markets are accommodative and holds value comparatively well during periods of turbulence. Delivering robust portfolios is especially important during periods of uncertainty, as a critical element of our approach is to help keep our investors in the game—to stay invested. With this in mind, from a portfolio perspective, we utilize periods of uncertainty to monitor and review portfolios to ensure that our response to changes in valuation levels is measured and thoughtful.

Overall, while periods of uncertainty are certainly not pleasant, they do often unearth potential opportunities. By sticking with our process—recognizing uncertainty for what it is, keeping our focus on fundamentals, and always being mindful of our portfolio positioning—we believe that our chances of identifying and profiting from these opportunities are greatly improved.