(Morningstar) Investors remain concerned as they weigh four key developments: 1) an inflationary squeeze, 2) rising interest rates, 3) recessionary conditions, and 4) tightening corporate profit margins.

Of the four developments, the primary driver continues to be inflation and the consequential reset in investor expectations. However, corporate earnings and a recession are increasingly coming into focus, with headwinds evident as economic vulnerabilities fester.

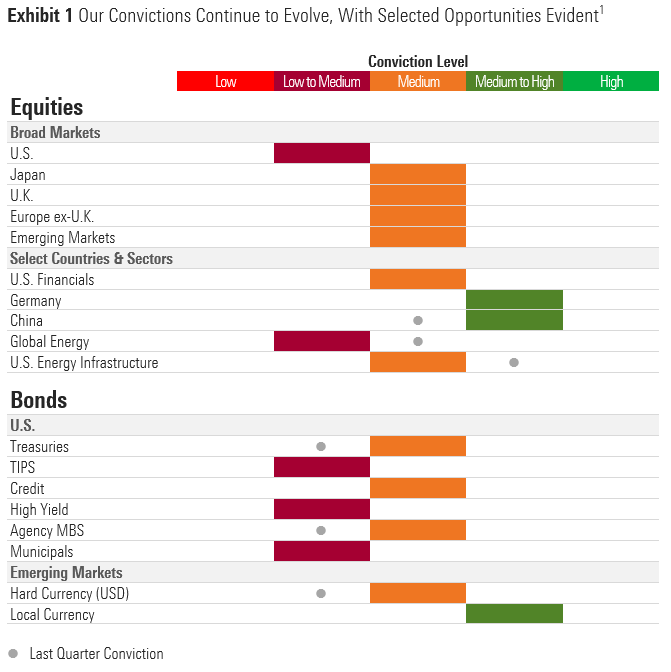

With a contrarian mindset, this has seen our convictions move in a positive direction, especially in selected fixed-income assets, although we remain broadly balanced in our long-term views.

[1] Source: Morningstar Investment Management LLC. Views as of July 15th, 2022 and subject to change. For illustrative purposes only.

Key Portfolio Positioning Points

There’s no use sugarcoating how badly the first half of 2022 has played out for most investors. For investors with goals in mind (which is the majority), it may feel like two steps forward and one step back. And as the second half of the year takes shape, attention is likely to continue surrounding the inflation threat and a potential economic recession. Behaviorally, this is an important time to remain grounded principally.

Equities continue to flirt around “official” bear market levels, yet it remains a fragmented story. At the sector level, energy stocks have been a standout performer, while defensive value-oriented areas of the market have lived up to their reputation and held up relatively well during the downdraft. Among the laggards, the dominant trend continues to be the fall of growth stocks.

Of relevance for investors, corporate earnings have remained robust so far, but profit margins are under pressure from rising costs and revenue growth is in doubt as consumers rethink their spending plans. High commodity prices are also proving problematic for inflation, although key commodities including energy, wheat, and copper have declined, perhaps as a sign of demand-led concerns surrounding the economy.

Looking to emerging markets, we’ve seen continued weakness, although many emerging countries have held up better than their developed peers. China has been one of the few bright spots, following a period of meaningful weakness.

Turning to fixed income, bonds of all kinds have struggled. Long-term bonds took a heavy punch thanks to their vulnerability to rising interest rates, although they’re now on better footing. Bond investors are also worried that higher rates have tipped the economy into recession, which is causing a selloff in credit-sensitive bonds. This has become more pronounced as consumer confidence deteriorates, with higher-quality bonds seeing a recent revival.

Looking ahead, we continue to believe stocks and bonds will play a key role in helping investors reach their goals, especially following the healthy rebound in yields. Stocks and bonds are diverse and can offer different mechanics, performing differently in various market environments, creating a pool of opportunity and ideal core assets for the majority of investors. Further, following recent losses, the valuations for both stocks and bonds have improved, which is a broad positive that will help investors in the next chapter of their investment journey.

U.S. Equities Outlook - Low to Medium Conviction

U.S. stocks have underperformed many global peers in 2022, with the froth in the market coming off. In particular, we have observed an unwinding in the more speculative pockets of the equity market, with one of these categories being “innovative” companies that often grab the financial headlines and garner attention from investors looking to own the next big winner.

This started with a contraction in valuations—with price/earnings ratios coming back toward normal levels—but markets have since turned their focus toward the trajectory of future earnings. In this regard, corporate profits appear vulnerable, with aggregate earnings turning downward from record highs at a point where the economy is at risk from recessionary pressures. We would note that financial conditions, by many observations, remain fairly robust.

Looking ahead, valuations have improved, and valuation spreads—the disparity in valuation levels between sectors—has narrowed.

More pointedly, in this environment, we see fewer opportunities to be granular and target pockets of the market. In 2020–21, we identified opportunities clustered in more cyclical (or economically sensitive) areas of the market, including energy and financials. However, these have both held up comparatively well recently—energy, in particular, until very recently. So, we have seen opportunities of late to take some profits and perhaps allocate toward other, more comparatively attractive sectors or broad-market exposure. Specifically, regarding energy stocks: our valuation approach incorporates a reversion framework for energy prices longer term, which leads us to conclude that energy producers, in particular, have become fairly valued. But, we acknowledge that a prolonged period of structurally higher commodity prices is not priced into these shares and also that companies have shown fairly strong capital discipline even as pricing has firmed, which is a significant, positive departure from previous cycles. Energy infrastructure shares remain relatively appealing within the energy sector. On financials, our research leads us to believe that large U.S. banks are still relatively attractive. The last area on our radar is defensive sectors, most notably healthcare, which have improved in our relative rankings and could help offset equity risk as it is not highly correlated with economic cycles. Regarding technology stocks, we don’t assess these stocks with a broad brush, though our own sentiment index would suggest the extreme popularity has subsided. That said, valuation challenges persist beyond the recent declines, so care is required in this space, especially with interest-rate rises.

All this is to say—a long-term perspective remains a critical ingredient for investor success. This is perhaps even more relevant during periods of market turbulence. Our long-term, patient, valuation-driven, fundamentally informed, risk-aware, and wisely contrarian approach to investing keeps us focused on identifying opportunity in the midst of turbulence.

Europe ex.-U.K. Equities- Medium Conviction

European stocks are challenged, with supply-side issues evident and a difficult inflation backdrop stemming from the Ukraine/Russia war. The euro has also deteriorated meaningfully against the U.S. dollar, coming back to parity, which hurts importers but improves the attractiveness of exporters.

While we generally like European stocks, we find attractive opportunities when we dig into country and sector differentials. For example, we’ve reaffirmed our attraction to German stocks, which remain an appealing area despite the impact of the Russian conflict. In aggregate, we find German stocks offer solid balance sheets and potential upside to earnings—without eye-popping valuations. At a sector level, our positive view on European integrated-energy companies has moderated following recent strength, as it no longer offers the same valuation appeal. European banks, on the other hand, look more attractive in our analysis.

U.K. Equities - Medium Conviction

The United Kingdom has a relatively large exposure to energy and financial stocks, especially in the large-cap space, which has supported the market in recent times.

This comes despite the general consensus that the U.K. economy is vulnerable, with political change following the reluctant resignation of Boris Johnson as Prime Minister. We note the composition of U.K. stocks are buffered from domestic issues, given their international business models with the majority of revenues derived offshore. Of note, we’ve seen the largest 100 stocks (FTSE 100) significantly outperform the companies below it.

Our overall conviction score for the U.K. remains at Medium. While relative valuations remain at Medium to High, absolute valuations have fallen to Low to Medium reflecting recent performance.

This means our long-standing belief that investors were being well compensated for the risk of investing in U.K. stocks has softened, coming more in line with international peers. That said, they remain a strong dividend play, where we have seen many companies reinstate their dividends, although most are targeting more conservative payout policies going forward. While revenue is cyclical, given the underlying key sectors of financials, energy and materials, we believe it is stable. Both operating and financial leverage are also stable. From a fundamental standpoint, we note that most U.K. corporates are high-quality businesses, although certain scenarios pose a risk to corporate profitability.

Australian Equities - Low to Medium Conviction

Australian shares have given back some of their gains, with inflation and interest-rate expectations rising. High commodity-based exposure has generally supported the market, although investor sentiment remains on the weak side, especially for smaller companies that have fallen significantly.

Some of the political uncertainty has subsided, with Anthony Albanese taking the helm as Prime Minister, although economic vulnerabilities remain. Corporate profits could also be sensitive to an economic downturn, with profit margins near cyclical highs (especially among the miners) and aggregate earnings slipping from record highs.

Australian shares still look on the unattractive side of normal. This observation is true both in an absolute sense, with low expected long-term returns, as well as relative to many global peers. While opportunities do exist at a more granular level—especially for those willing to invest differently to the index—we continue to prefer global exposure, including Germany, China, Japan, and select emerging markets. We are conscious that the wave of high commodity prices and cyclically high profit margins could turn south, which could cause an earnings decline. It would take a further decline in prices before we see outright attraction in this asset class.

Japanese Equities - Medium Conviction

The recent assassination of former Prime Minister Shinzo Abe is a devastating blow, yet Japanese companies will benefit from his pro-business policies for years to come. With a staggered reopening from COVID that has only recently allowed entry to foreigners, Japanese stocks have had a unique experience, often moving out of lockstep with the rest of the global equity market. They continue to offer a diversified revenue source, especially for unhedged exposure, with the Japanese yen showing incredible value (near multi-decade deviations against other developed market currencies).

We continue to see merit in Japanese holdings. For the most part, our conviction in Japanese stocks is built on some major structural change taking place at a corporate level. While much of this structural tailwind is now behind us, we still see scope for a continuation of improving shareholder interests, rising dividend payouts, and board independence. Japanese stocks also carry attractive diversifying properties that can help in market downturns.

While acknowledging the industry adage, “You can’t eat relative performance,” we do believe that providing some downside protection should ultimately benefit our clients. Therefore, Japanese equities are still among our preferred major equity markets. With this in mind, we maintain a preference for domestic-facing companies, most notably financials. Sentiment toward Japanese financials had been hindered by the Bank of Japan’s prolonged quantitative-easing program, making it difficult for banks to make money (and lowering investment income for insurers). While this is likely to remain a challenge, the upside is meaningful if and when the normalization takes hold.

Emerging-Markets Equities - Medium Conviction

Emerging-markets stocks have enjoyed a better period, with China a key outperformer in recent times, although the broad basket remains challenged by high inflation, higher funding costs, and volatile local currencies. As usual, investors in emerging markets must also price in regulatory and geopolitical risk, with Russia prominently bringing such risks back in focus. We note that inflation has also become a major challenge in emerging markets, with the rate-hiking cycle generally ahead of developed-market peers, and a strong U.S. dollar is causing nervousness.

We consider emerging-markets equities to be among our preferred equity regions (alongside selected European and Japanese equities). As part of this, we need to remember that emerging markets are heterogeneous. Investors tend to bucket emerging markets as one, but often the real opportunities present themselves at a country, sector, or regional level. For example, China continues to offer better absolute and relative value, with the Chinese government providing regulatory relief for various industries and reopening after COVID spikes hit major metropolitan areas. Fundamental risks are on the higher side, but we see a contrarian opportunity in China, especially in the technology space, which has suffered from negative sentiment.

Global Sectors

At a sector level, we’ve seen significant divergence as inflation and high commodity prices influence investors. Perhaps the most notable is the prolonged run for energy companies, which have significantly outpaced other sectors, albeit from a low base following a decade of underperformance. At the other end, technology is still struggling, which is perhaps not surprising given the long-duration nature and the unwinding of monetary stimulus. Defensive sectors have played an important role for investors, helping offset volatility and providing the protective characteristics that people seek in a downturn.

The opportunity to add value via sector positioning has narrowed. That said, we continue to see opportunities for portfolio exposure, especially at the defensive end.

Let’s start with energy stocks, given their extraordinary run. This sector was among our highest-ranking opportunities last year and has enjoyed a period of elevated commodity prices. However, this opportunity has narrowed, and we’ve taken the opportunity to pocket some profits.

Financial companies are another area that we saw attractive relative valuations versus the broader equity market, particularly in the U.S. market. For banks, we note they have reduced their balance sheets and improved the quality of the asset composition by reducing more risky securities. In addition, higher-quality funding (deposits) has increased meaningfully, making banks more resilient in an economic downturn. We’ve observed lower financial leverage, and though we may have been too optimistic on the extent of banks’ ability to diversify their revenues and structurally improve cost-to-income ratios, we have seen some cost-cutting to repair their operating model and improve profitability. On balance, systematic risks are lower than they were at the turn of the decade.

Defensive value-oriented areas of the market continue to live up to their reputation and have held up relatively well during the downdraft. Sectors include healthcare, utilities, and consumer staples, all of which provide services that are required in both good and bad times. Generally, stocks in these categories are less volatile and less affected by the ups and downs of long-term market cycles. This could be important if we see a broad-based decline in corporate earnings.

Developed-Markets Sovereign

- U.S. - Medium Conviction

- Europe - Low Conviction

- Japan - Medium Conviction

Locally and globally, government bonds remain volatile. We note the large uptick in yields for short-term bonds as investors reset their interest-rate expectations. In the U.S., this has caused the yield curve to “invert” once again (where investors get a higher yield for short-term bonds than longer-term bonds), which is often seen as a recessionary signal.

That said, there are some signs that longer-term government bonds are finally showing their defensive characteristics again, following a rough start to 2022. The synchronized declines were of great concern to cautious investors who typically hold a higher proportion of their portfolio in bonds and are used to a more stable return.

The material increase in bond yields has improved the forward-looking prospects, which applies positively to the U.S., U.K., and Australia. Europe is also rising from a very low base, although the absolute yields remain broadly unattractive. In all cases, yields fail to cover inflation, but that ought to be expected given the environment.

Going slightly deeper, the ability to add income to portfolios through risk-free assets while mitigating duration/default risk looks attractive to us currently. Rising government bonds are a positive for future return generation, and we expect this asset class to continue playing a role in a total portfolio context. That said, overall, we feel that managing duration risk makes sense in most portfolio scenarios. We are cognizant of the rather sizeable drawdown in government bonds year to date, and adding materially to duration might make sense at some point, but our response should be measured and deliberate, given the fast-changing response from central banks.

In this sense, government bonds are in an odd spot. On the one hand, the global macro environment is widely uncertain with a range of outcomes. The domestic economy is challenged with slowing growth abroad and surging inflation that has the potential to reduce aggregate demand. To complicate matters, central banks have been late to make decisions to address inflation that could ultimately lead them to a tough bridge—fight inflation aggressively or do what you can to maintain the economic recovery. Unfortunately, at this stage, these decisions seem to be mutually exclusive. Further, given the delicate nature of both the domestic and global economy, long-term sovereign bonds seem appropriate to hedge against risks to the downside, whether that is aggressive central bank action, a weakening of demand, or both.

Investment-Grade Credit

- U.S. - Medium Conviction

- Europe - Low to Medium Conviction

We’ve seen a meaningful shift in corporate bonds. The initial uptick in yields was primarily a shift in the risk-free rate (mirroring the rise in government bond yields), but we’ve since seen credit spreads widen, which is a sign of corporate vulnerabilities and recessionary nerves. From a duration standpoint, corporate bonds have shared a similar experience to government bonds, where longer-dated bonds have underperformed in this environment. Shorter-dated bonds have held up, relatively speaking.

Both locally and globally, the higher yields have improved return expectations over the long run, albeit from a low base. A key element is credit spreads—the difference between corporate-bond yields and government-bond yields—which have moved closer to fair value in our analysis, although not enough to be deemed attractive. Said another way, the margin for error remains low and opens the door to a greater permanent loss of capital if credit downgrades were to occur. In this regard, one should be aware of the historically high percentage of BBB-rated issuers (the lowest level still considered investment-grade) in this space. This credit-quality development needs to be monitored carefully, as a heightened default cycle can’t be ruled out. From a fundamental standpoint, the Federal Reserve’s increased involvement in this asset class had provided a backstop, although withdrawal of that support, increasing leverage ratios, and the possibility of higher yields are a cause for concern over the medium to long term.

In summary, this space has improved, but the inherent appeal remains muted. We see some attraction as a middle ground—providing some extra yield versus government bonds and a duration profile that can help in portfolio construction.

High-Yield Credit

- U.S. - Low to Medium Conviction

- Europe - Medium Conviction

High-yield credit has offered a tempestuous ride in recent years, with yields increasing quite meaningfully. Headline yields now look very tempting, oscillating in the 7%–9% range, which we haven’t seen since the COVID panic and before that in early 2016.

We note this type of volatility isn’t unusual for high-yield bonds, which sit at the riskier end of the bond market—often moving more with equity markets than with other bonds. This was certainly the case during the height of the COVID-19 crisis, with high-yield bond prices seesawing in line with broader equity market sentiment. Again, it is seemingly happening now with the added complication of rising rates.

The case for investing in this asset class has improved, but it is not (yet) a glaringly positive opportunity. While headline default risks are still deemed to be low, this could change with central banks tightening conditions and recessionary conditions festering.

Valuations have improved, though, with our conviction reflecting this change. A shorter duration profile relative to other bonds is also a potential positive in a rising-rate environment.

Emerging-Markets Bonds

- Local Currency - Medium to High Conviction

- Hard Currency - Low to Medium Conviction

Emerging-markets bonds have experienced dispersion, with challenging fundamentals and currency moves major components of weaker performance.

Like high-yield bonds, the headline yields are rising to enticing levels, as high as 8%+. This reflects the reality that many emerging-markets central banks have had to raise interest rates to combat inflation pressures and to bolster currencies.

Emerging-markets debt in local currency (which we still prefer over hard currency) offers healthy absolute yields, accounting for the added risk. Our view remains that many emerging-markets sovereigns, though with notable exceptions, have improved their fundamental strength compared to history. This includes improved current account balances, enhanced reserves, movement to orthodox monetary policy, and a build-out of local investor base allowing for a shift to local currency funding. In addition, the aggregation of emerging-markets currencies also looks undervalued overall and could offer a tailwind over time.

The area can be volatile, yet even allowing for some pessimistic assumptions, our research suggests that investors could earn a decent return if they’re willing to risk short-term volatility. In other words, we think investors can expect to be compensated for this risk over time, especially for local-currency bonds.

U.S Agency MBS - Low to Medium Conviction

U.S. mortgage-backed securities (MBS) have experienced a sizeable drawdown year to date as a sharp rally in interest rates led to meaningful extension in duration. Fundamentally, the housing market is beginning to slow as a result of higher interest rates and home prices. The MBS market is also pricing in the tightening of monetary stimulus.

Overall, considerable weakness has been experienced year to date while fundamentals remain solid and technicals look much more attractive today. Looking forward, the asset class could benefit from positive asset flows as many asset managers were underweight MBS given tight valuations and rock-bottom mortgage rates in 2021.

Given the sharp rally in mortgage rates and significant duration extension, the attractiveness of this asset class has improved. Heading into the second half of 2022, investors will be keen on watching inflation and the result it has on overall consumer demand. The idea of slowing economic activity should bode well for AAA assets, such as Agency MBS, as there is little inherent default risk. That said, further spread widening may take place before it turns in investors favor.

Global Inflation-Linked Bonds - Low to Medium Conviction

In the midst of inflationary pressures not seen for over four decades, inflation-linked bonds have done what investors have needed them to do and then some. This is exacerbated by continuing supply bottlenecks under the umbrella of huge fiscal and monetary support.

That said, we’ve seen the breakeven rate (the difference between nominal government bonds and inflation-protected bonds) fall back after a recent spike.

Inflation-linked bonds continue to offer protection against an inflation shock, but at prices that are akin to an expensive insurance policy.

Within that context, a key consideration in a multi-asset portfolio is whether inflation-linked bonds can help us diversify our risk drivers. Keep in mind that with inflation-linked bonds, such as Treasury Inflation-Protected Securities (TIPS), the value of the principal rises (or falls) with changes in inflation expectations rather than the actual inflation rate. Inflation expectations are notoriously difficult to forecast, so this can be a key benefit.

Of course, inflationary pressures are proving quite sticky at the moment, yet it wouldn’t take much for markets to reprice inflation should something give. One important consideration is duration risk, where inflation-linked bonds are often longer-dated securities with meaningful interest-rate sensitivity. Interest rates can often move higher (meaning bond prices fall) at the same time as inflation, and this can, at times, undermine the benefits from the inflation protection.

U.S. Municipal Bonds - Low to Medium Conviction

Municipal bonds have also experienced recent setbacks against a backdrop of rich valuations and increasing yields. High-yield municipal bonds have been among the most volatile during this environment.

Yields on high-quality municipal bonds remain on the low side, despite the rise in yields. On this basis, we continue to expect municipal bonds’ absolute after-tax returns to be subdued but perhaps higher than the after-tax returns from other U.S. fixed-income investment-grade bonds.

Although fundamentals of state and local governments held up better than expected in the wake of the pandemic, uncertainty around additional fiscal aid leaves room for volatility. It’s also worth noting that the sharp rise in rates could cause an outflow cycle, which could hinder the asset class’s performance.

Global Infrastructure - Low to Medium Conviction

- U.S. Energy Infra & MLPs - Medium Conviction

Infrastructure assets are a diverse basket, with airports, rail, and energy-related holdings all carrying differing performance drivers. Of particular note, energy-related investments have staged an incredible run, and while the path ahead remains uncertain, valuations have become less attractive. We’ve also seen takeover activity by unlisted and/or private investors increase for listed transportation infrastructure assets, mainly in the airport and toll road sub-sectors. This is being driven by these assets being more highly valued in the unlisted market.

While infrastructure has generally become more attractively priced over the last quarter, due to rising interest rate and recession concerns (the latter mainly negatively impacting railroads and airports), we continue to see better value in other areas of the equities market.

Oil prices are significantly higher, and energy infrastructure equity prices have rebounded strongly—which has served, at the margin, to mute our historically positive view of this asset class. That said, we continue to see some appeal given the relatively high dividend yields and continued demand recovery. We also cite further governance and capital-allocation discipline. Specifically, our expectation is for a meaningful reduction in capital expenditures by energy infrastructure companies on growth projects, with overall spend being reduced toward maintenance or steady-state levels.

Headwinds remain amid the push to address climate change, but the transition to renewable energy is likely to be a long path, potentially allowing for an extended period of robust free cash flow generation for the industry—which we anticipate will be used to strengthen balance sheets and return cash to shareholders.

Listed Property - Low to Medium

Global real estate investment trusts (GREITs) have had a unique run since the COVID crisis started, with solid gains before a more recent setback. Recent underperformance has come about due to concerns on a number of fronts: rising interest rates negatively impacting upon valuations and expected debt funding costs, recessionary concerns negatively impacting rental outlooks, and rising construction costs posing potential profit margin downside for companies with property development businesses.

While moves to reopen global economies have broadly progressed, we believe that earnings risks remain elevated. Investors in office REITs face a more depressed rental-growth outlook over the short term and an uncertain outlook over the medium to long term. Time will tell if the trends toward accelerating online sales and working from home persists. However, from a valuation perspective, global-listed property assets remain relatively expensive. We continue to see superior opportunities elsewhere.

Alternatives

Alternatives have offered some protection during the downturn, though, in many cases they haven’t offered the outright diversification investors were hoping for.

Of course, this depends on the strategy being adopted. For this reason, investment selection remains critical, with our preference for genuinely diversifying assets with a focus on reasonable cost and liquidity. More specifically, with rising bond yields implicating both stocks and bonds in similar ways, alternative assets can appeal given that returns from this asset class tend to have a lower direct relationship with the performance of traditional asset classes such as equities and bonds.

Currency

While currencies are notoriously volatile, we tend to think of currency positioning via the lens of portfolio robustness (targeting defensive characteristics where sensible), but also as a potential source of return at extremes.

Recently, the U.S. dollar has strengthened meaningfully, even hitting parity with the euro, which is a major consideration for many portfolio holdings. The Japanese Yen has also experienced considerable weakness.

Looking ahead, we see merit in diversifying currency exposure away from the U.S. dollar, despite the oft-referenced safe-haven status. The yen has the potential to provide diversification qualities and help preserve capital in times of extreme economic and market stress, as well as provide potential upside.

Cash

In today’s inflation environment, holding cash is a near-guaranteed way to lose purchasing power.

However, we balance this view, as the market vulnerabilities are worth protecting against. Specifically, our research still points to some meaningful dispersion across asset classes, which presents an opportunity for investors. The key is to selectively allocate to the most attractive asset classes to deliver a robust total portfolio outcome.

More pointedly, we see our cash reserves serving three purposes. First, cash helps reduce the sensitivity to interest-rate rises, especially relative to long-dated bonds, which is still an important risk to manage. Second, cash should help buffer the portfolio from any future volatility resulting from a fall in equity markets. And third, cash provides us with ample liquidity to take advantage of investment opportunities as they arise.