(Morningstar ) This document has been created to highlight the most important issues facing investors, share insights from our current research, and help you make better investment decisions as we enter 2022. It has been compiled by our investment leaders and draws on the work of our global team.

Globally, Morningstar now runs over 150 portfolios, which are all united by our investment principles and a common methodology. As we look ahead, it is important to remember that the future holds a wide range of possible outcomes and is characterized by unyielding complexity that continually defeats those who seek to make confident forecasts. Fortunately, our role as investors is not to forecast the future, but rather to construct portfolios that empower people to reach their goals whatever the economic and market conditions.

Let’s not forget about the entire purpose of investing, which is to let our money work for us. It is an active decision to put money aside (delayed gratification) to boost our purchasing power and/or fund our desired future lifestyle. Ultimately, it is to help you achieve your goals.

Therefore, we start with the objectives of investors. We have identified four key objectives that are especially relevant as we enter 2022 and sorted them into a 2 x 2 grid. Each of these objectives are addressed in a separate section of this document to cover the current challenges facing investors. We offer practical insights drawn from our own research and expressed in the portfolios that we manage. This enables investors to focus on the objective and solutions that are most pertinent to them.

Underlying this outlook is the understanding that returns to investors will be determined by both the cashflows generated by the assets in which we invest and the price paid to acquire those assets. A fundamentally attractive asset can become an unattractive investment when purchased at a high price and, equally, a fundamentally weak asset can provide the most attractive returns when bought at a sufficiently low price. The importance of this dual focus when undertaking investment analysis tends to be lost in markets characterized by excessive optimism or pessimism. As investors become increasingly focused on the future path of prices, confident of either a continuation of the past or a sharp reversal, many forget that most paths lie between these two outcomes.

It is for this reason that we adopt a granular, fundamental and valuation-driven approach to investing, acknowledging that expensive markets can provide opportunities, and cheap markets may be a source of threats. In every situation, the right approach is to view the future probabilistically and think long term.

Part 1:

Growing a Client’s Portfolio with High-Conviction Positioning

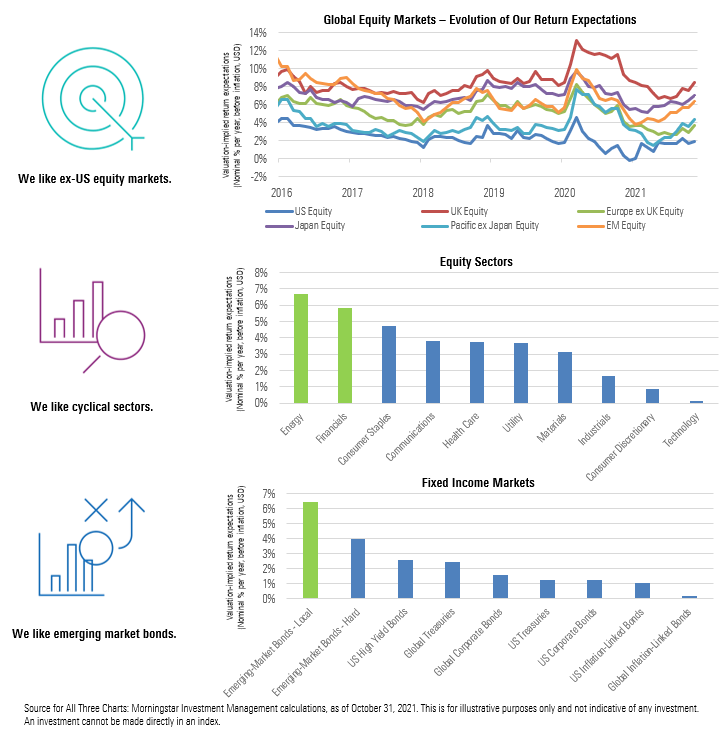

Investors are entering 2022 with stocks at or near all-time highs—up over 100% from the market bottom in the U.S., for example. Kickstarted by an unprecedented fiscal and monetary stimulus and sustained by rising investor exuberance—e.g., special purpose acquisition company (SPACs), IPOs, and meme stocks—sharp gains across risk assets such as equity and credit have left investors with only a small number of investment opportunities. That requires an increasingly focused approach to portfolio construction.

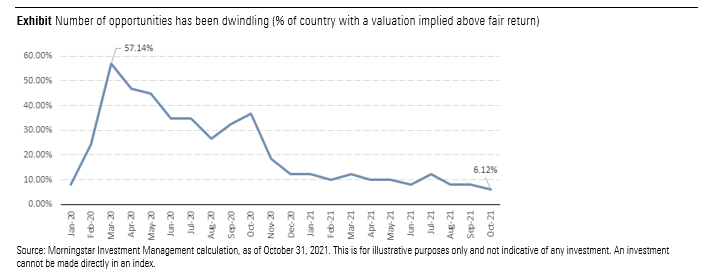

When assessing the number of attractive asset-class opportunities, we tend to look at the percentage of assets that trade above their fair return, which is the return we expect to realize when the asset is trading at fair value.

The number of assets that are fairly valued based on our valuation models has declined since last year. For instance, in March 2020, 57% of all country-equity markets that we track traded at a discount to their intrinsic value, and that has fallen to only 6% of all country markets as of the end of October.

In this context, it is prudent to recall Warren Buffet’s guidance: “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” During the height of the pandemic-induced sell-off last March, we were in an environment where opportunities were plentiful, and a very targeted approach wasn’t required. Today, the situation is different. Investors ought to take a more measured approach to constructing their portfolios: i.e., put out the thimble, and save the proverbial bucket for a period with heavier rain.

Because of the scarcity in opportunity out there, the work that our global investment team does to uncover the opportunities presenting the best potential reward for risk becomes more critical. Looking ahead to 2022, we are highlighting three investment ideas for investors to consider in their portfolios.

1) The Recovery Play: Relative Value in Energy and Financials

While there are a number of headwinds on the horizon, not least uncertainty about inflation and the emergence of a resistant COVID-19 variant, the global economy is poised to continue its recovery, fueled by the normalization of economic activity globally.

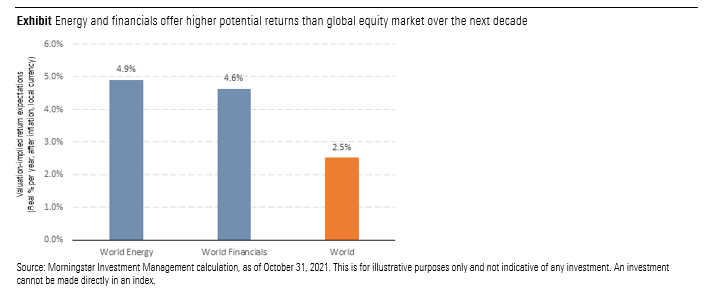

At current prices, global equities look expensive overall, according to our analysis, both in absolute terms and relative to international markets. However, there are pockets where we continue to see opportunity. These opportunities tend to cluster in more cyclical (or economically sensitive) areas of the market—including energy and financials, which have both done exceptionally well recently.

- Energy Stocks: Despite recent strength, we continue to believe integrated energy companies with diversified business models and strong balance sheets provide significant potential upside for investors. The global energy sector has survived its darkest days, which saw a negative oil price at one point. Additionally, the longer-term transition towards cleaner energy remains broadly on track despite some concerns about the profitability of clean energy. This development is particularly interesting when we consider climate-change risk, with European energy companies making a meaningful pivot toward renewables.

- Banks: Our research also leads us to believe that banks are still relatively attractive. Lower-than-expected loan losses and a potential acceleration of loan growth as we enter 2022 provide a favorable medium-term backdrop for the sector. For banks, we believe risks are skewed to the upside in the next year or two, driven by fundamental improvements that include solid economic growth, low loan losses, and a higher capital return. Our valuation models suggest that energy and financial stocks have the potential to outpace the broad global equity market by more than 2% over the next decade.

Energy stocks and financials also have attractive inflation-fighting properties, given their ability to pass on price increases to their clients. Inflation tends to boost interest rates and a steeper yield curve, which benefits banks. Oil is a commodity, and any price increases are passed on to consumers. In the event of a continued rise in inflation, energy and banks stand to benefit.

2) Growth Companies at a Lower Price: The Case for China Tech

Investors have been bidding up prices of so-called “big tech” in recent years amid scarce growth elsewhere and falling interest rates, propelling an increase in stocks with the prospect of long-term growth. This run-up in prices, in addition to the risk of stretched valuations, has also increased concentration of the U.S. equity market in a handful of technology companies. As of September, Meta Platforms (Facebook), Amazon, Apple, Netflix, Google (Alphabet) and Microsoft made up approximately 24% of the U.S. market, creating a need for U.S. investors to diversify away from single stocks.

A sell-off in Chinese equities over the course of 2021, which was triggered by a regulatory crackdown, presents investors with an opportunity to purchase shares of big-tech companies at low valuations. At current prices, China offers better absolute and relative value than any other major market, even after accounting for the potential impact that the regulatory crackdown may have on growth and profitability. Chinese stocks have an attractive growth profile and the major tech names have low financial leverage, which provides diversification against some of the cyclical stocks that are also trading cheap. Therefore, we think there is a growing case for investing in China.

3) Emerging-Market Debt in Local Currency: The Only Place for Positive Real Return in Fixed Income

With negative yields on government bonds (after adjusting for inflation) across developed government-bond markets and corporate credit spreads at multi-year lows, the fixed-income universe is looking at paltry returns over the next decade. Emerging-market debt in local currency (which we prefer over hard currency) continues to offer positive real yields and is a notable exception. Our view remains that emerging markets’ sovereign fundamentals are broadly stronger than in the past. Improved current-account balances, enhanced reserves, movement to orthodox monetary policy, and a build-out of a local investor base allow for a shift to local-currency funding, though there are ongoing concerns surrounding an increase in debt levels and a lack of fiscal discipline in some countries.

In aggregate, emerging markets (EM) were slower out of the blocks in opening up their economy than developed markets (DM) were. That said, the majority of EM central banks have started increasing central-policy rates as inflation remains elevated. In addition, an aggregated view of EM currencies also looks undervalued and should be a tailwind over time. The area can be volatile, yet even allowing for some pessimistic assumptions, our research suggests that investors could earn a decent premium over similar-duration U.S. Treasuries if they’re willing to risk short-term loss. Stated differently, we think investors are likely to be compensated for the risk of investing in emerging-markets bonds over time, especially for local-currency bonds.

Part 2:

Protecting a Client’s Portfolio from Drawdown

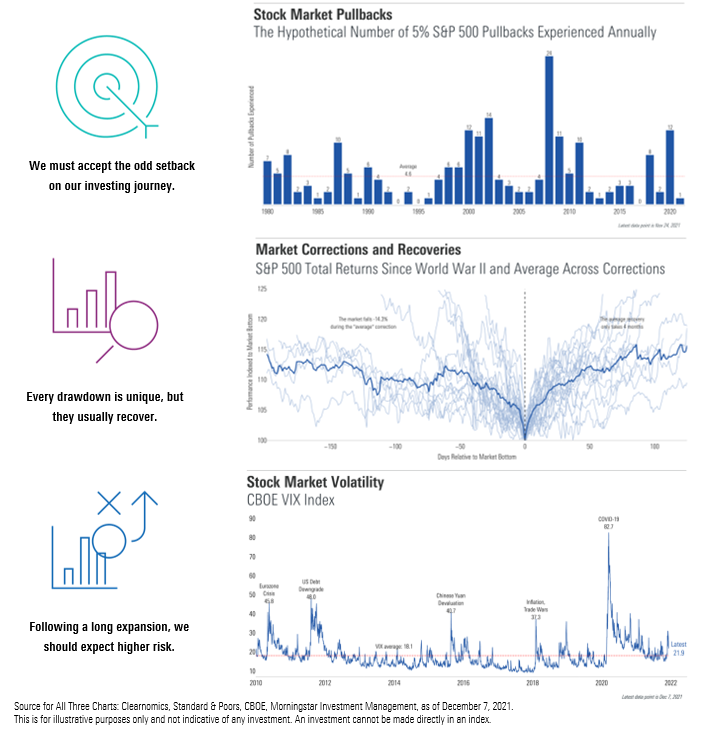

Investing is all about taking risk. To achieve our investment objectives and enable investors to meet their goals, we need to assess the investment environment and take what we deem appropriate risks. Sometimes the opportunity set will be rich, and we will be able to build robust portfolios that should comfortably meet an investor’s investment objectives. Other times, that’s not the case. Our analysis hints that the path ahead could be a little rocky at times, but we must accept some risk to achieve goals.

“Risk is the Price You Pay for Good Returns”

Calling drawdowns good or bad is somewhat flippant. Of course, no drawdown is good for an investor. This is especially the case for investors with shorter time horizons.

In fact, risk aversion can be a rational response, as people often fail to appreciate the danger of negative compounding. The common message is that compounding is a beautiful thing, however it is more powerful on the downside than the upside. Consider various scenarios. If the market were to sell off by 20% tomorrow, you need to make 25% to get back to square. If it falls by 50%, you need to earn 100%. Avoiding losses matters because losing less means you require less to bounce back.

That said, failing to take calculated risks is a risk itself. Or, said simply: we must ensure that we take enough risk to meet our objectives. This side of the coin is just as important, as goal attainment is the key reason most people invest. This is also the main focus of our investment approach—we need to ensure we are being rewarded for the risks we take.

Tomorrow versus Yesterday

In the last decade it has been a relatively simple task to invest in a very risk-focused way and still achieve healthy returns above the inflation rate. Even in the extreme market event in March 2020, we were afforded the opportunity to buy assets at prices that could deliver exceptional long-term returns—enabling us to be confident that we could deliver on our promises to investors.

However, the opportunity set has clearly narrowed. Equity markets have become more expensive on almost every measure, with some parts of the market moving to what we’d consider quite extreme levels. The same can be said for traditionally defensive assets, with bonds trading at levels that could lead to significant capital losses, especially with economic growth remaining a tailwind and inflation at levels not seen for many years.

Faced with these risks, the key is to assess a portfolio relative to the corresponding goals and risk tolerance of the investor, whilst also acknowledging the investing environment we operate in. Regarding the investment environment, we foresee a wide range of potential outcomes, expecting the next year (and decade) to look quite different from the last.

This is both an opportunity and a threat—it presents an opportunity for us to add value for investors by navigating the series of setbacks ahead, but it’ll require a different approach from that taken over the last decade. We are heading into a time when broad market exposure (passive investing) could easily fall short of historical averages and may fail to meet absolute return objectives, making it difficult for investors to achieve their goals. In this sense, we don’t expect an easy ride for the average investor.

Defending in a Low Interest Rate Environment

Perhaps the biggest dilemma for risk-sensitive investors resides in traditional fixed income. Holdings in “defensive assets” such as bonds offer poor return prospects, in our analysis, creating a true challenge for risk management.

We don’t paint with a broad brush here, still selectively investing in pockets of the bond market for their defensive characteristics and/or return potential. However, many fixed income markets are expensive (especially so in corporate high-yield bonds, where we carry an underweight position). This is quite different from the last 30 years, where bonds have played the dual role of return generator and diversifier in portfolios. We are therefore balancing what is left of their defensive characteristics against low absolute yields while also looking for more defensive characteristics from the growth holdings in our portfolios.

The Goal Must Still be to Avoid Permanent Loss of Capital

Importantly not all drawdowns are equal. Volatility provides investment opportunities—the ability to get set in assets with significant upside. As investing great Bill Miller says, “volatility is the price you pay for returns” and accepting volatility will be necessary for most investors. The way we approach risk is to consider the potential for two types of drawdowns: 1) valuation-induced drawdowns, and 2) volatility-induced drawdowns. We embrace volatility, within reason, but want to avoid valuation-induced sell-offs.

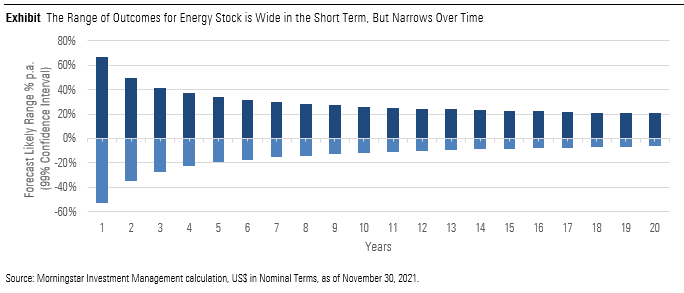

When you look at the exposure in our multi-asset portfolios, this difference between volatility and valuation becomes evident. We have a decent tolerance for holding assets with economically sensitive cashflows, even if these assets tend to have higher core volatility. Our exposure to energy stocks is a good example. They present reasonably high core volatility, but that can usually be recouped with time. See the chart below for the volatility of the global energy sector, where the range of outcomes really starts to skew to the upside over long timeframes—this is a “good” volatility tradeoff in our view.

Valuation-based drawdowns (paying too much for an asset) can be more enduring and may not be fully recouped—even over the long term. Equities that go bankrupt or bonds that default are extreme examples. These are the drawdowns our process seeks to avoid where capital can be permanently impaired.

So, how can an investor both protect and earn? We believe the best pathway is to identify the assets with the greatest reward-for-risk and size them appropriately to manage total portfolio risk. Today, the most attractive holdings are concentrated in cyclical areas of the market, despite their higher volatility, so we employ portfolio construction techniques to offset or temper the cyclical risk, including defensive sector exposures.

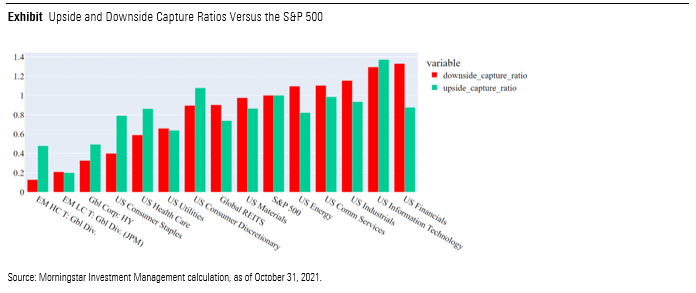

Our analysis has shown some of the most attractive assets include emerging-markets debt, consumer-staples stocks, healthcare, and utilities companies. These are all attractive as replacements for growth assets in an array of different environments we might face, especially where the opportunity set is diminished and the potential for a risk event is elevated. Analysis we have recently carried out shows that each of the asset classes named above have inviting downside- and upside-capture ratios against the S&P 500, presenting particularly attractive asymmetry between the two in the significant market scenarios we have run.

Somewhat counterintuitively, it is therefore likely that average “through-the-cycle” portfolio growth exposure ought to be higher than last decade—to the point where it may make sense to gain exposure to more volatility assets to achieve investment objectives. This is a good example of using smart diversification techniques, smoothing the ride via carefully selected growth holdings instead of relying on expensive traditional defensive exposures. Still, there is a potential for more volatility in portfolio returns and temporary drawdowns are there.

Currency exposure is another available tool that may be highly underrated by many investors. For example, the U.S. dollar and the Japanese yen tend to behave as so-called “safe-haven” currencies in periods of broad market stress. By allocating smartly across the currency universe, we can lean on the protective characteristics of the dollar and the yen where it makes sense to do so and have recently boosted this exposure.

Key Takeaways for Risk Management

The hardest, yet most effective, approach when protecting against loss is to distinguish between volatility-induced setbacks and valuation-induced losses. Periods of volatility will come and go, which are scary at the time, but they rarely impact goal attainment.

As advocates of great investing, we must collectively resist impulsive actions and understand that the road won’t be straight. Accepting some volatility is a pre-requisite for good returns in any market, but today’s market arguably requires greater care than usual. In our view, this necessitates us to target the best assets to protect and earn, with careful sizing and smart diversification.

A final thought on downside protection: we should be happy to forego some of the gains in strong upwards markets, acknowledging that we won't participate in losses to the same extent as others if we maintain a risk-focused approach. Ideally, if we can limit losses by investing in a risk-focused way, we are less likely to trigger an irrational response from investors, meaning we are more likely to help them stay invested, giving them a better chance of achieving their goals over time.

Part 3:

Protecting a Client’s Portfolio from Inflation

When it comes to the most insidious risks facing investors, inflation may well top the list. Its impact on portfolios doesn’t appear until investors compare gains to the climbing cost of living. To achieve any meaningful progress toward financial goals, investors need to clear the inflation hurdle.

Beating Inflation is Investing 101

For many years, clearing the inflation hurdle hasn’t been difficult. With a stable supply-and-demand balance, the cost of living has broadly risen at a predictable, modest pace. Meanwhile, falling rates, expanding valuations, and individual company successes have fueled broad-market gains at a rate well above historical norms.

But when inflation does materialize, particularly at higher levels, its impact can be widespread devastation. Investors with shorter time horizons, who typically have greater exposure to bonds, are particularly vulnerable. A significant portion of the total return generated from bonds comes from income, which, for most bonds, is predetermined (hence the term “fixed” income). As inflation rises, the “fixed” income delivered by the bond is worth less. In response, investors may sell bonds, driving prices down and further hurting returns.

Among investors with shorter-term horizons are retirees, who no longer generate wages that could potentially rise to inflation-adjusted levels.

But it’s not just the bond investor who faces risk during periods of inflation. While equity markets aren’t subject to the same “fixed”-income conundrum, their total return can also be in jeopardy; their dividend payments are worth less, and their earnings can suffer from higher input costs, particularly if they are not in a position to pass along higher prices to their consumers. As earnings come under pressure, so can their ability to generate inflation-beating returns.

Even high-flying growth stocks aren’t immune to inflation. In fact, growth stocks have historically shown greater vulnerability to inflation than their value brethren. The explanation involves the expectations around earnings: as inflation rises, so do interest rates, which means investors expecting higher earnings from growth companies discount them back to present day with a more penalizing level of interest rates.

This leaves us with two questions as we enter 2022:

- If inflation is inconsistent—and unpredictable—how do you protect your portfolio from it?

- If you could predict it, given that both bonds and stocks are vulnerable to it, is there anything you can do to protect against it anyway, even if you could see it coming?

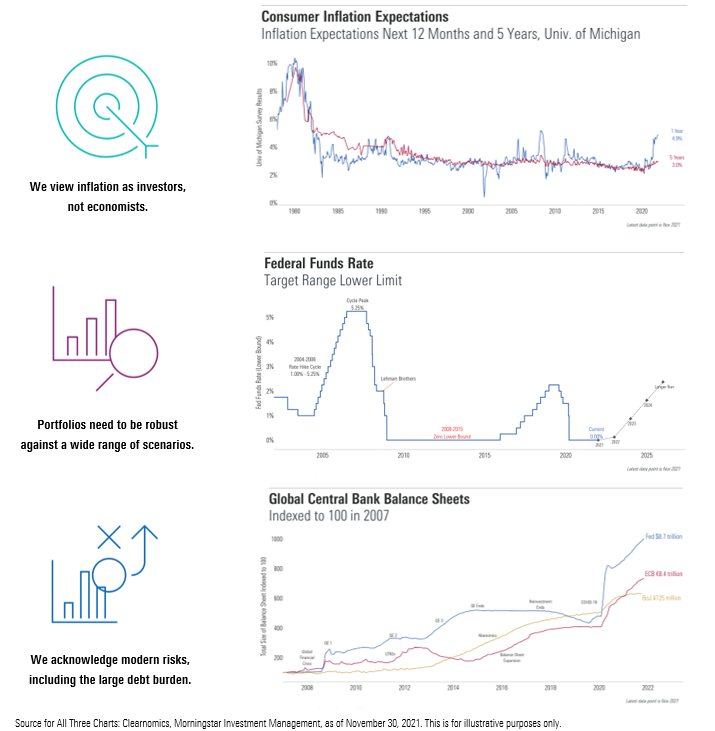

On the first point, you don’t need to know with certainty that inflation is coming. We view portfolio construction as an exercise of probability, weighing one market environment against another. We build portfolios for a range of environments and rarely make binary calls on particular outcomes.

Fortunately, our research suggests that many of the assets best suited for inflation protection are also relatively well priced. These assets include:

- Short-duration bonds or cash (fixed payments have very short durations and thus can reset as rates rise)

- Equities that are positively correlated to inflation, such as energy stocks

- High-quality companies with high degrees of pricing power that can pass along rising input costs

However, there are also sources of protection we don’t like. For example, inflation-protected bonds (including Treasury Inflation-Protected Securities or TIPS) are a common go-to source; however, these are less attractively priced, in our view. The same applies to high-yield bonds and floating-rate bonds, both of which benefit from improving credit profiles during inflationary periods but are also unattractively priced. As a result, we have limited exposure to these asset classes, despite their inflation-protection properties.

Key Takeaways Regarding Inflation

Inflation is a well-known risk facing investors and we take it seriously. In 2022, as always, we believe inflation is worth protecting against, but we caution investors away from trying to predict inflation outcomes with precision.

The key is to understand how each asset may help in different inflation outcomes, assessing the total portfolio impact and whether it will deliver on its objective. It’s worth noting that some assets that have been in vogue for the past few years—especially U.S. growth stocks—strike us as not only overpriced but also as vulnerable in an inflation shock.

Those considerations above aside, over the past several decades inflation has been more a specter in investors’ minds than an actual reality they need to face, and today’s market could very well prove to be more of the same. It’s for that very reason that we think along the lines of probability rather than forecasts and account for a range of market environments. In the end, if inflation once again fails to materialize as a real threat, we do not believe our portfolios will be at a disadvantage; the driving thrust of their positioning is valuations, not inflation.

Part 4:

Letting Your Money Work for You into Later Life

One of the primary motives of investing is to fund a comfortable retirement, with a 2020 Morningstar Behavioral Research survey showing that this remains the number-one goal among individuals. So, while retirement planning remains a foundational pillar of the financial advice industry, we’d broaden it out as making your money work for you. This is a timely and relevant topic, as it is no secret that income generation is getting harder, with several trade-offs and potential pathways to navigate.

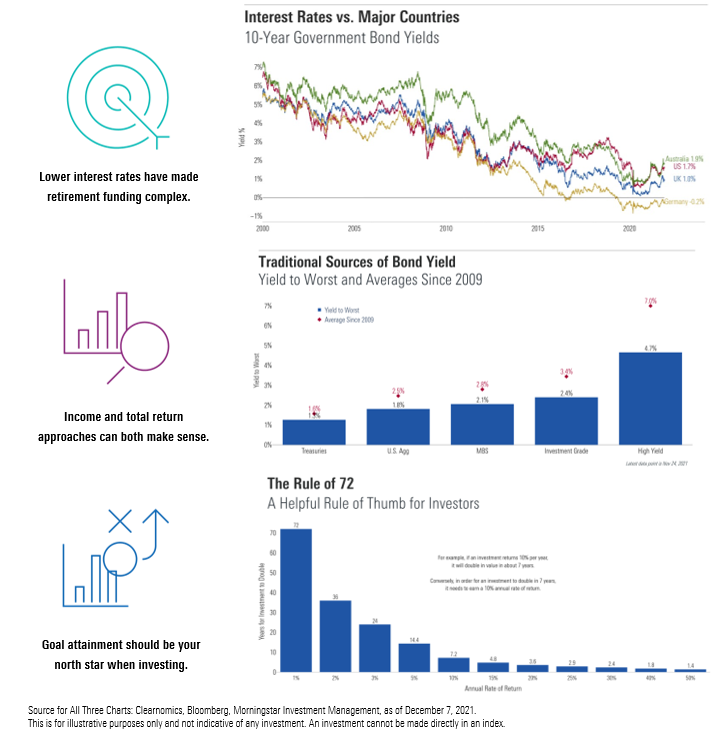

The Modern Dilemma for Retirees & Income Generators

The last decade has been a good one for investors of all types and sizes, with record-low volatility and record-high prices for most asset classes. For retirees, though, it has been a period of declining cash rates, declining bond yields, and declining dividend yields. This remains one of the great challenges for investors trying to live off their assets in 2022, as income is so much harder to attain.

This might be about to change, with some expecting interest rates to rise. We note that we aren’t in the business of predicting interest rates, although the general consensus is that the most likely direction for interest rates is up. Our expertise is to build portfolios that can handle different possibilities, which is really a matter of portfolio robustness. In this regard, higher interest rates would have obvious implications for asset prices, with retirees particularly sensitive given their typically higher weighting to bonds. This is a double-edged sword, however, as higher rates would cause bond price losses in the near term, but it could make income generation easier in a forward-looking context.

The harsh reality is that we are presented with a perfect storm against retirees—an environment that is low yielding and generally unattractive, with rising inflation reducing their purchasing power. This requires a selective approach to empower investor success and presents a modern dilemma to solve.

What Approach is Best for 2022?

Many timeless questions carry special weight in 2022. For instance, are retirees better positioned by focusing on a selective-income approach or a total-return approach in an environment of low current yields and higher risk? We did some interesting research on this in early 2021 and found that both approaches can still be effective, although both carry risks, too. The same learnings are applicable in 2022, though starting yields are slightly lower again and risks slightly higher.

- With a total-return approach in 2022, you would seek to accumulate further gains, then sell part of the portfolio periodically to meet the withdrawal needs. The obvious risk is that markets are expensive, so if you sell down assets that aren’t rising (or worse, falling), you’ll have a higher likelihood of running out of money. This is a risk many would like to avoid, especially those exposed to sequencing risk (the risk of a big decline early in your retirement wiping out a big part of your nest egg). Ordinarily, this would incline many towards an income approach, but the common mantra remains that “there is no alternative” (TINA).

- The income approach requires a selective approach in 2022, as a focus on cash-flow generation requires you to typically tilt portfolios toward asset classes with higher current income, such as high-dividend stocks and emerging-markets debt. However, some of the popular income assets can carry meaningful downside risk, and some exhibit no growth in income (a risk in the face of rising inflation). For example, we don’t believe longer-dated bonds are an area that will serve income-hungry investors in 2022. We think yield chasing is a cardinal sin when it is taken to the extreme, moving up the risk curve without a thorough understanding of what you own and why you own it. Patience is key, as 4%+ yields are difficult, if not impossible, to obtain in 2022 without accepting meaningful risk.

Natural Sources of Cashflow in 2022

Some assets naturally lend themselves to stable income generation, and we see some attraction in these asset classes heading into 2022. The aim is for:

- Income growth,

- Some capital growth to keep up with inflation,

- Durability. Dividend cuts are an issue to avoid and technological obsolescence must be considered. ESG (environmental, social, governance) risks must also be assessed.

Key Takeaways for Living Off Your Assets

As was the case in recent years, 2022 is likely to be a difficult environment for passive-income generation, with low rates and expensive assets a common challenge. Arguably, this year’s environment is even worse, with higher inflation eroding the purchasing power of your income.

This requires careful navigation. On one hand, your primary role is to maintain your purchasing power with an inflation-beating portfolio that is robust and can handle different environments. On another, it makes sense to capture natural income sources, helping you with the three measures of retirement success: 1) cashflow stability, 2) source of withdrawals, and 3) likely ending account value.

We seek to do all of the above in the portfolios we manage, including some that are specifically targeted with inflation-beating or income-targeted objectives.

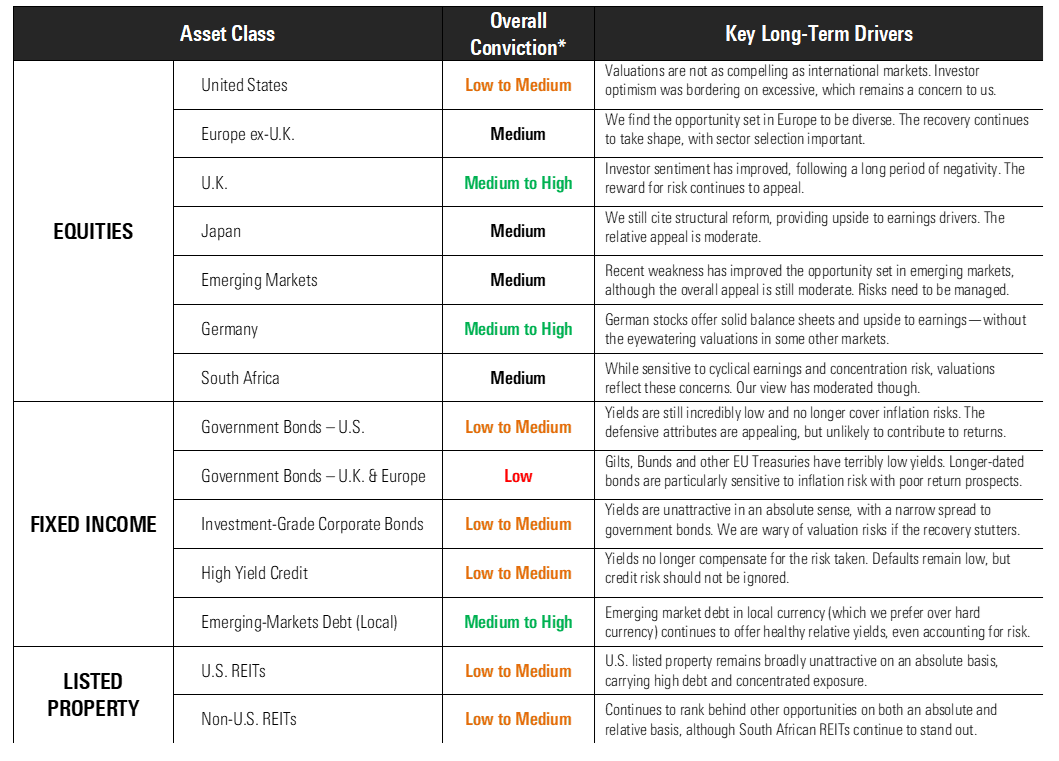

Summary of Our Asset-Allocation Views

2022 looks set to be a fascinating year. We have some new dynamics to deal with, including high inflation and the prospect of rising rates, coupled with already expensive markets. We don’t expect it to be a smooth ride, but we continue to emphasize portfolio robustness and find pockets of relative opportunity, with our convictions detailed below. We note these convictions are long-term in nature, perhaps better considered over the course of a decade, which we believe will continue to empower investor success.

Source: Morningstar Investment Management, conviction levels confirmed at November 12, 2021.

*Overall conviction is a long-term judgement built on a five-point scale from “Low” to “High”. Typically judged on a 10-year horizon, a “Low” means that reward-for-risk is likely to be subdued, whereas a “High” means reward-for-risk is appealing. This incorporates our four pillars of conviction, including 1) absolute valuations, 2) relative valuations, 3) fundamental risk and 4) a contrarian scorecard.

The Overall Conviction level and Key Long-Term Drivers reflect the opinion of Morningstar Investment Management. These opinions are as of the date written, are subject to change without notice, do not constitute investment advice, and are provided solely for informational purposes. Morningstar Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses, or opinions, or their use. This document contains certain forward-looking statements. We use words such as expects, anticipates, believes, estimates, forecasts, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause the actual results to differ materially and/or substantially from any future results, performance, or achievements expressed or implied by those projected in the forward-looking statements for any reason. Investments in securities (e.g., mutual funds, exchange-traded funds, common stocks) are subject to investment risk, including possible loss of principal, and will not always be profitable. Prices of securities may fluctuate from time to time and may even become valueless. Securities in this report are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. There can be no assurance any financial strategy will be successful. Diversification and asset allocation are methods used to help manage risk; they do not ensure a profit or protect against a loss. Morningstar® Managed PortfoliosSM are offered by the entities within Morningstar’s Investment Management group, which includes subsidiaries of Morningstar, Inc. that are authorized in the appropriate jurisdiction to provide consulting or advisory services in North America, Europe, Asia, Australia, and Africa. In the United States, Morningstar Managed Portfolios are offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC, both registered investment advisers, as part of various advisory services offered on a discretionary or nondiscretionary basis. Portfolio construction and ongoing monitoring and maintenance of the portfolios within the program is provided on Morningstar Investment Services’ behalf by Morningstar Investment Management LLC. Morningstar Managed Portfolios offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC are intended for citizens or legal residents of the United States or its territories and can only be offered by a registered investment adviser or investment adviser representative. Investing in international securities involve additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may carry these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. Investment research is produced and issued by Morningstar, Inc. or subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. The terms “we,” “us,” and “our” throughout this document refer to Morningstar Investment Management LLC. The term “Morningstar” refers to Morningstar’s Equity Research Group. The information, data, analyses, and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete, or accurate. The information contained herein is the proprietary property of Morningstar Investment Management and Morningstar Investment Services and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar Investment Management or Morningstar Investment Services. The opinions expressed herein are those of Morningstar Investment Management and Morningstar Investment Services, are as of the date written and are subject to change without notice, do not constitute investment advice, and are provided solely for informational purposes. Morningstar Investment Management and Morningstar Investment Services shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses, or opinions, or their use. Morningstar Investment Management and Morningstar Investment Services do not guarantee that the results of their advice, recommendations, or the objectives of your portfolio will be achieved. There is no guarantee that negative returns can or will be avoided in any of the portfolios. An investment made in a security may differ substantially from its historical performance and as a result, you may incur a loss. Past performance is not a guarantee of future results. The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Morningstar Investment Management and Morningstar Investment Services cannot guarantee its accuracy, completeness, or reliability.