Mallouk versus Cuban reveals the way the industry pendulum is swinging as professional investing takes more cues from professional wrestling every day and the white gloves come off.

Peter Mallouk has no reason to pick a fight in public. He built a firm that runs $55 billion through partnering with high-profile brand evangelists like Tony Robbins.

So it’s a little shocking to see him calling out TV billionaire Mark Cuban by name in his social media and official channels for being a bad market forecaster.

“Mark Cuban: A Case Study In Worthless Predictions” doesn’t hold anything back.

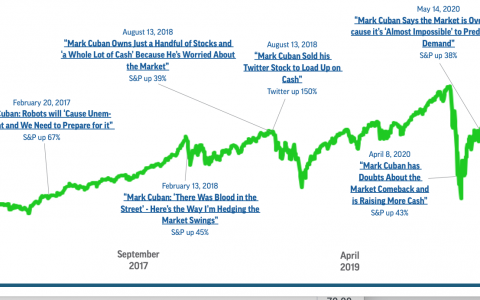

Mallouk went back five years and charted a few of the Shark Tank star’s more outrageous and inaccurate market calls against the S&P 500.

It’s not a great track record. Cuban touted gold in 2016, fretted about robots derailing the consumer economy in 2017, got bearish in 2018 and has more recently been warning every outlet within earshot that the market is overextended.

Someone who followed each of these opinions as an investment recommendation probably would have missed a lot of the market’s upside while rotating into lagging assets at the worst possible time.

As Mallouk points out, the market media loves it when a big name says something outrageous. The clicks add up. People get paid.

There’s always been an aura of vaudeville around Wall Street. With so much “consensus” commentary around, people feel like they need to take contrarian postures in order to get noticed.

These positions rarely materialize, and in the meantime the sheer effort of simplifying a complex argument for sound bite interviews tends to force extreme appeals to either greed or fear. Everything is either perfect or it’s the end of the world.

Fame And Other Assets

Cuban knows the game, of course. Starting in the hype-heavy dot-com era, his biggest successes as an entrepreneur have been in the media industry. He’s all about branding and demand generation.

Significantly, he isn’t a financial advisor. He doesn’t manage anyone else’s money. While he might weigh in on broad strategy, I doubt he even actively manages his own venture capital portfolio much less the more liquid assets.

He definitely isn’t directly competing with people like Peter Mallouk except in the sense that his forecasts get in the way of the professionals.

Retail investors who watch a lot of CNBC are naturally going to be at least susceptible to that kind of messaging. But they probably aren’t your ideal clients, either.

They’re probably lone wolves, Robinhood types. Even if you’re their advisor, they’re constantly absorbing “hot tips” from elsewhere and will push back against all your best-supported projections of what the portfolio should do.

The fact that Peter Mallouk is feeling that pushback right now is significant. He’s usually fairly unflappable, even professionally serene.

Something got under his skin. This isn’t a marketing move designed to get him in front of millions of mass-affluent investors eager to deploy thousands of dollars. In that scenario, he would be on TV picking fights and chasing controversy.

This is a retention tactic. He wants to calm his people down and keep them around in volatile market conditions.

It’s a call to clarity. Like many of us, he’s trying to differentiate between “real pros” who are here with clients for the long haul and “high-profile prognosticators” who come and go between commercial breaks.

Cuban never has to answer to the SEC or FINRA when a client complains. Neither do the networks. They operate in a theoretical vacuum, “financial entertainment.”

They want to capture an audience on an hour-by-hour basis. High-profile guests and shocking headlines make that happen.

In the advisory world, the dynamics are very different.

Capture The Client, Hang On Forever

It’s always been challenging to attract accounts. I’ve been telling people for decades that I hate gathering the assets because it’s hard work.

You need to invest personal resources into building a strong public persona. And you need to be out there in front of prospects all the time. You need to catch their attention.

Some people love that. Cuban loves promoting things. He knows what sells and how to sell it.

I have no idea how good he really is at evaluating investments or juggling risk. A lot of his portfolio companies seem to be all sizzle and no steak, which is all right if you’re in the sizzle business.

And I suspect a lot of the people who follow him are in it for the sizzle. They like a cartoon world dominated by greed and punctuated with fear to keep things interesting.

It’s a fantasy of wealth. When these people accumulate actual wealth, they’re fickle and the wealth is often fleeting too. We say they have money to “play” with.

Chase these people with conventional SEC-approved wealth management promotional messaging and you’ll only catch empty air in the long run. They’ll come in, make a mess and ultimately wander off when something shiny catches their attention.

Occasionally real money will gravitate toward sizzle messaging as well, but people like Mark Cuban don’t really have a structure in place to accept the funds and nurture the clients.

Maybe someday celebrity portfolios will become hot stuff and that situation will change. However, I don’t think the pundits really want the headache or the responsibility.

Should Peter Mallouk call any of the pundits out for being more entertainer than serious economist? There’s no wrong answer. He can do what he wants and if he finds this useful or amusing, that’s what counts.

Is it interesting that he finds it useful to throw cold water on the hot air now? Definitely. He’s talking to his clients and friends. I doubt he even expected it to go viral.

That’s probably how to do it. Keep it clean unless you have to get dirty. Don’t tear down competitors unless they become an existential threat.

Maybe the industry is changing. Loudmouths may win in the long haul. But unless that’s the industry you enjoy, there’s no reason to pick a lot of melodramatic fights just to boost your SEO.

If you’re in it for the fame, you already know how SEO works. Why start making waves now?

That said, long-term value propositions are hard to sell without a long-term strategy. People really don’t see the point of “staying the course” until the market cycles a few times.

By then, it’s too late for the fast money to do anything but learn a hard lesson. You might get a few of these people after they follow a few too many bad TV bets.

But they need to come to you. There’s no sense in going to them, unless of course you're desperate.

And Peter Mallouk is not.